About this investment trust

Capital at risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested.

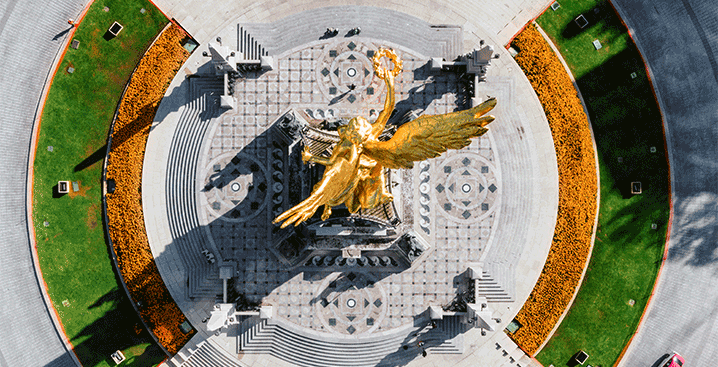

The Company aims to secure long-term capital growth and an attractive total return primarily through investing in quoted securities in Latin America.

Why choose it?

Latin American countries hold a wealth of opportunities for long-term investors keen to participate in the region's growth and diversity. Our experienced team draws on its extensive network in the region to uncover the most compelling opportunities across a variety of countries and sectors.

Diversification and asset allocation may not fully protect you from market risk.

Suited to…

Investors with a long-term horizon who want to include Latin American shares in their portfolio and are able to tolerate periods of market volatility in pursuit of capital growth. This means shares prices may rise and fall more frequently.

What are the risks?

- Capital at risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested.

- Overseas investment will be affected by movements in currency exchange rates.

- Emerging market investments are usually associated with higher investment risk than developed market investments. Therefore the value of these investments may be unpredictable and subject to greater variation.

- Investment strategies, such as borrowing, used by the Trust can result in even larger losses suffered when the value of the underlying investments fall.

Useful information

Capital at risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested.

Fees & Charges

Annual Expenses as at Date: 31/12/2023

Ongoing Charge (including any Performance Fee): 1.28%

Management Fee Summary: The management fee is 0.80% per annum of the Company's NAV.

-

ISIN: GB0005058408

Sedol: 0505840

Bloomberg: BRLA LN

Reuters: BRLA.L

LSE code: BRLA

-

Name of Company: BlackRock Fund Managers Limited

Telephone: 020 7743 3000

Email: cosec@blackrock.com

Website: www.blackrock.com/uk

Correspondence Address: Investor Services

BlackRock Investment Management (UK) Limited

12 Throgmorton Avenue

London

EC2N 2DLName of Registrar: Computershare PLC

Registered Office: 12 Throgmorton Avenue

London

EC2N 2DLRegistrar Telephone: +44 (0)370 707 1112

Place of Registration: England

Registered Number: 2479975

-

Year End: 31 December

Results Announced: March (final)

AGM: May

Dividends Paid: February, May, August and November

Latest company announcements

Capital at risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested.

Filter by type:

Filter by date period:

Sign up for Regulatory News Service alerts

To receive email alert notifications once an update to the Trust occurs, please sign up and select the updates you would like to receive via The Association of Investment Companies website here.

The Board's approach to ESG

Capital at risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested.

Environmental, social and governance (ESG) issues can present both opportunities and threats to long-term investment performance. The securities within the Company’s investment remit are typically large producers of vital food, timber, minerals and oil supplies, and consequently face many ESG challenges and headwinds as they grapple with the impact of their operations on the environment and resources. The Board is also aware that there is significant room for improvement in terms of disclosure and adherence to global best practices for corporates throughout the Latin American region, which lags global peers when it comes to ESG best practice. These ESG issues faced by companies in the Latin American investment universe are a key focus of the Board, and it is committed to a diligent oversight of the activities of the Manager in these areas. Whilst the Company does not exclude investment in stocks on ESG criteria, ESG analytics are integrated into the investment process when weighing up the risk and reward benefits of investment decisions and the Board believes that communication and engagement with portfolio companies is important and can lead to better outcomes for shareholders and the environment than merely excluding investment in certain areas.

More information on BlackRock’s global approach to ESG integration, as well as activity specific to the BlackRock Latin American Investment Trust plc portfolio, is set out below. BlackRock has defined ESG integration as the practice of incorporating material ESG information and consideration of sustainability risks into investment decisions in order to enhance risk-adjusted returns. ESG integration does not change the Company’s investment objective. More information on sustainability risks may be found in the AIFMD Fund Disclosures document of the Company available on the Company’s website at https://www.blackrock.com/uk/individual/literature/policies/itc-disclosure-blackrock-latin-america-trust-plc.pdf.

BlackRock Latin American Investment Trust plc - engagement with portfolio companies in 2021

Given the Board’s belief in the importance of engagement and communication with portfolio companies, it receives regular reports from the Manager in respect of activity undertaken for the year under review. The Board reviews these closely and asks for further updates and progress reports from the Portfolio Managers in respect of evolving ESG issues and the action being taken where appropriate. The Board notes that over the year to 31 December 2021, 61 total company engagements were held with the management teams of 23 portfolio companies representing 76% of the portfolio by value at 31 December 2021. Additional information is set out in the tables that follow.

| BlackRock Latin American Investment Trust plc year ended 31 December 2021 | |

|---|---|

| Number of engagements held1 | 61 |

| Number of companies met1 | 23 |

| % of equity investments covered2 | 76% |

| Shareholder meetings voted at1 | 77 |

| Number of proposals voted on1 | 770 |

| Number of votes against management1 | 84 |

| % of total votes represented by votes against management | 10.91% |

1 Source: BlackRock and Institutional Shareholder Services as at 31 December 2021.

2 Source: BlackRock. Company valuation as included in the portfolio at 31 December 2021 as a percentage of the total portfolio value.

| Engagement Themes *1 | Engagement Themes *1 |

|---|---|

| Governance | 61 |

| Environmental | 57 |

| Social | 39 |

| Engagement Topics *1 | Engagement Topics *1 |

|---|---|

| Climate risk management | 35 |

| Operational sustainability | 56 |

| Social risks and opportunities | 34 |

| Business oversight/risk management | 45 |

| Executive management | 34 |

| Remuneration | 20 |

| Environmental impact management | 38 |

| Human capital management | 25 |

| Board composition and effectiveness | 44 |

| Corporate strategy | 43 |

| Governance structure | 42 |

*Engagements include multiple company meetings during the year with the same company. Most engagement conversations cover multiple topics and are based on BlackRock vote guidelines and BlackRock’s engagement priorities can be found at: https://www.blackrock.com/corporate/about-us/investment-stewardship#engagement-priorities. The numbers in the tables above reflect the number of meetings at which a particular topic is discussed.

1 Sources: ISS Proxy Exchange and BlackRock Investment Stewardship.

BlackRock’s approach to ESG integration

BlackRock believes that sustainability risk – and climate risk in particular - now equates to investment risk, and this will drive a profound reassessment of risk and asset values as investors seek to react to the impact of climate policy changes. This in turn, in BlackRock's view, is likely to drive a significant reallocation of capital away from traditional carbon intensive industries over the next decade. BlackRock believes that carbon-intensive companies will play an integral role in unlocking the full potential of the energy transition, and to do this, they must be prepared to adapt, innovate and pivot their strategies towards to a low carbon economy.

As part of BlackRock’s structured investment process, ESG risks and opportunities (including sustainability/climate risk) are considered within the portfolio management team’s fundamental analysis of companies and industries and the Company’s portfolio managers work closely with BlackRock Investment Stewardship Team to assess the governance quality of companies and investigate any potential issues, risks or opportunities.

As part of their approach to ESG integration, the portfolio managers use ESG information when conducting research and due diligence on new investments and again when monitoring investments in the portfolio. In particular, portfolio managers at BlackRock now have access to 1,200 key ESG performance indicators in Aladdin (BlackRock's proprietary trading system) from third-party data providers. BlackRock’s internal sustainability research framework scoring is also available alongside third-party ESG scores in core portfolio management tools. BlackRock’s access to company management allows it to engage on issues that are identified through questioning management teams and conducting site visits. In conjunction with the portfolio management team, BlackRock Investment Stewardship Team meets with boards of companies frequently to evaluate how they are strategically managing their longer-term issues, including those surrounding ESG and the potential impact these may have on company financials. BlackRock's and the portfolio management team’s understanding of ESG issues is further supported by BlackRock’s Sustainable Investment Team (BSI). BSI look to advance ESG research and integration, active engagement and the development of sustainable investment solutions across the firm. ESG integration does not change the Company's investment objective, or constrain the Investment Manager’s investable universe, and does not mean that an ESG or impact focused investment strategy or any exclusionary screens have been or will be adopted by the Company. Similarly, ESG integration does not determine the extent to which the Company may be impacted by sustainability risks.

Investment Stewardship

As a fiduciary to its clients, BlackRock has built its business to protect and grow the value of clients’ assets. As part of this fiduciary duty to its clients, BlackRock is committed to promoting sound corporate governance through engagement with investee companies, development of proxy voting policies that support best governance practices and also through wider engagement on public policy issues.

Global Principles

BlackRock’s approach to corporate governance and stewardship is explained in its Global Principles. These high-level Principles are the framework for BlackRock’s more detailed, market-specific voting guidelines, all of which are published on the BlackRock website. The Principles describe BlackRock’s philosophy on stewardship (including how it monitors and engages with companies), its policy on voting, its integrated approach to stewardship matters and how it deals with conflicts of interest. These apply across relevant asset classes and products as permitted by investment strategies. BlackRock reviews its Global Principles annually and updates them as necessary to reflect in market standards, evolving governance practice and insights gained from engagement over the prior year. BlackRock’s Global Principles are available on its website at https://www.blackrock.com/corporate/literature/fact-sheet/blk-responsible-investment-engprinciples-global.pdf.

Market-specific proxy voting guidelines

BlackRock’s voting guidelines are intended to help clients and companies understand its thinking on key governance matters. They are the benchmark against which it assesses a company’s approach to corporate governance and the items on the agenda to be voted on at the shareholder meeting. BlackRock applies its guidelines pragmatically, taking into account a company’s unique circumstances where relevant. BlackRock informs voting decisions through research and engage as necessary. BlackRock reviews its voting guidelines annually and updates them as necessary to reflect changes in market standards, evolving governance practice and insights gained from engagement over the prior year.BlackRock’s market-specific voting guidelines are available on its website at https://www.blackrock.com/corporate/about-us/investment-stewardship#principles-and-guidelines.

In 2021, BlackRock explicitly asked that all companies disclose a business plan aligned with the goal of limiting global warming to well below 2ºC, consistent with achieving net zero global greenhouse gas (GHG) emissions by 2050. BlackRock viewed these disclosures as essential to helping investors assess a company’s ability to transition its business to a low carbon world and to capture value-creation opportunities created by the climate transition. BlackRock also asked that companies align their disclosures to the Task Force on Climate-related Financial Disclosures (TCFD) framework and the SASB standards. For 2022, BlackRock is evolving its perspective on sustainability reporting to recognise that companies may use standards other than that of the SASB and reiterates its ask for metrics that are industry - or company - specific. BlackRock is also encouraging companies to demonstrate that their plans are resilient under likely decarbonisation pathways, and the global aspiration to limit warming to 1.5°C. BlackRock is also asking companies to disclose how considerations related to having a reliable energy supply and just transition affect their plans. More information in respect of BlackRock’s investment stewardship approach to sustainable investing can be found at https://www.blackrock.com/corporate/literature/publication/blk-commentary-climate-risk-and-energy-transition.pdf.

BlackRock has been a member of Climate Action 100+ since 2020 and has aligned its engagement and stewardship priorities to UN Sustainable Development Goals (including Gender Equality and Affordable and Clean Energy). A map of how BlackRock Investment Stewardship's engagement priorities align to the UN Sustainable Development Goals (SDGs) can be found at https://www.blackrock.com/corporate/literature/publication/blk-engagement-priorities-aligned-to-sdgs.pdf.

BlackRock is committed to transparency in terms of disclosure on its engagement with companies and voting rationales and is committed to voting against management to the extent that they have not demonstrated sufficient progress on ESG issues. This year, BlackRock voted against or withheld votes from 6,560 directors globally at 3,400 different companies driven by concerns regarding director independence, executive compensation, insufficient progress on board diversity, and overcommitted directors, reflecting our intensified focus on sustainability risks. In the 2020-21 proxy year, BlackRock voted against 255 directors and against 319 companies for climate-related concerns that could negatively affect long-term shareholder value. More detail in respect of BlackRock's engagement and voting history can be found at https://www.blackrock.com/corporate/literature/publication/2022-investment-stewardship-voting-spotlight.pdf.

BlackRock also publishes voting bulletins explaining its vote decision, and the engagement and analysis underpinning it, on certain high-profile proposals at company shareholder meetings. Vote bulletins for 2021 can be found at https://www.blackrock.com/corporate/about-us/investment-stewardship#vote-bulletins.

BlackRock's reporting and disclosures

In terms of its own reporting, BlackRock believes that the SASB provides a clear set of standards for reporting sustainability information across a wide range of issues, from labour practices to data privacy to business ethics. For evaluating and reporting climate-related risks, as well as the related governance issues that are essential to managing them, the TCFD provides a valuable framework. BlackRock recognises that reporting to these standards requires significant time, analysis, and effort. BlackRock's 2023 TCFD report can be found at https://www.blackrock.com/corporate/literature/continuous-disclosure-and-important-information/tcfd-report-2023-blkinc.pdf.

Fund manager commentary

29 February 2024

Comments from the Portfolio Managers

Please note that the commentary below includes historic information in respect of the performance of portfolio investments, index performance data and the Company’s NAV and share performance.

The figures shown relate to past performance. Past Performance is not a reliable indicator of current or future results.

The Company’s NAV fell -0.3% in February, underperforming the benchmark, MSCI EM Latin America Index, which returned 0.5% on a net basis over the same period. All performance figures are in sterling terms with dividends reinvested.1

Emerging markets more broadly almost fully recovered from January weakness, gaining +4.8% in February and broke their four-month streak to marginally outperform developed markets (+4.2%) by +0.6%. Latin American markets lagged the rest of emerging markets, finishing the month flat (-0.2%). Mexico (-2.8%) and Argentina (-2.8%) led declines, whilst Peru (+7.2%) and Chile (+5.6%) were at the top of the table. (All returns in this paragraph are on a US Dollar basis.)

At the portfolio level, our overweight and stock selection within the Consumer Staples space in Mexico was the key contributor to performance, alongside our Chilean Industrials exposure. On the other hand, stock selection in the Brazilian Financials sector hurt relative returns. Having no exposure to Peru was another drag over the period.

From a security lens, Chilean lithium producer, SQM, was the largest contributor over the month, reversing some of the January losses. Alpargatas, a Brazilian footwear manufacturer, was another strong performer after 4Q23 results indicate that their inventories continue to improve. An overweight position in Becle, a Mexican producer and supplier of alcoholic beverages most famously known for their high-end tequila brand Jose Cuervo, also helped returns. The company delivered strong 4Q results, beating consensus by 15%. The portfolio’s performance was also supported by an off-benchmark exposure in Argentina through steel pipe manufacturer, Tenaris. The stock rose following a 4Q (EBITDA) beat, where results had been helped by an increase in shipment to the Middle East and for offshore pipeline projects.

On the flipside, Banco Bradesco was the worst performing stock over the month. The stock sold off after an earnings miss amid high credit costs, and weaker 2024 guidance. While it has taken longer than expected, we continue to believe they will benefit from falling rates in Brazil. A lack of exposure to Peruvian bank, Credicorp, was another detractor as the company's FY24 guidance was better than consensus. While not having a holding in Brazilian electric equipment firm, WEG, was one of the top contributors in January, this hurt returns in February. The company reported better-than-expected results due to a one-off tax-gain. We maintain our cautious stance on the name as we see sequential margin deterioration going forward.

We made few changes to the portfolio in February. We continued to reduce our exposure to Mexican convenience store operator FEMSA, as our investment case has largely played out and as we see margin pressure at their core convenience store Oxxo. We traded against relative performance by trimming our exposure to Brazilian bank Itau and used the proceeds to top up our holding in Bradesco following poor results. We think the performance and valuation differential between the two banks is too large. We re-initiated a position in Brazilian investment management platform, XP Inc, as the company has strong operating leverage to falling interest rates.

Argentina continues to the be largest portfolio overweight, driven by two off-benchmark holdings (with no exposure to domestic Argentina). Panama appears as our second largest overweight, due to our off-benchmark holding in Copa Airlines. On the other hand, we remain underweight in Peru due to its political and economic uncertainty. The second largest portfolio underweight is Mexico.

Outlook

We remain optimistic about the outlook for Latin America. Central banks have been proactive in increasing interest rates to help control inflation, which has fallen significantly across the region. As such we have started to see central banks beginning to lower interest rates, which should support both economic activity and asset prices. In addition, the whole region is benefitting from being relatively isolated from global geopolitical conflicts. We believe that this will lead to both an increase in foreign direct investment and an increase in allocation from investors across the region.

Brazil is the showcase of this thesis - with the central bank cutting the policy rate considerably. We anticipate further reductions, particularly if the Federal Reserve ceases its own rate hikes. The government’s fiscal framework being more orthodox than market expectations has helped to reduce uncertainty regarding the fiscal outlook and was key for confidence. We expect further upside to the equity market in the next 12-18 months as local capital starts flowing into the market.

We remain positive on the outlook for the Mexican economy as it is a key beneficiary of the friend-shoring of global supply chains. Mexico remains defensive as both fiscal and the current accounts are in order. While our view remains positive, we have taken profits after a strong relative performance, solely because we see even more upside in other Latin American markets such as Brazil. We also note that the Mexican economy will be relatively more sensitive to a potential slowdown in economic activity in the United States.

We continue to closely monitor the political and economic situation in Argentina, after libertarian Javier Milei unexpectedly won the presidential elections in November. Milei is facing a very difficult situation, with inflation above 200% year-on-year, FX reserves depleted and multiple economic imbalances. To further gauge sentiment on the ground, we travelled to the country in January. The trip further instilled our cautious view on the economic outlook for the country, and we see no fundamental reasons as to why we would want to buy this market now.

Source: Unless otherwise stated all data is sourced from BlackRock as at 29 February 2024.

1Source: MSCI and BlackRock, as of 29 February 2024.

Any opinions or forecasts represent an assessment of the market environment at a specific time and are not intended to be a forecast of future events or a guarantee of future results.

This information should not be relied upon by the reader as research, investment advice or a recommendation.

Risk: Reference to the names of each company mentioned in this communication is merely for explaining the investment strategy, and should not be construed as investment advice or investment recommendation of those companies

Portfolio manager biographies

Capital at risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested.

Sam Vecht is lead manager of the BlackRock Latin American Investment Trust plc. He is Head of the Emerging Europe, Frontiers and LatAm team within the Fundamental Active Equity division of BlackRock's Active Equities Group and is responsible for managing long-only and long/short portfolios in both Emerging and Frontier markets. He is also co-manager of the BlackRock Frontiers Investment Trust plc. Sam joined BlackRock in 2000 in the Global Emerging Markets Team. He has a degree in International Relations and History.

Christoph Brinkmann is deputy manager of the BlackRock Latin American Investment Trust plc. He is Vice President in the Global Emerging Markets Equities Team who has covered multiple sectors and countries across the Latin American region. He joined BlackRock in 2015 after graduating from the University of Cologne with a Masters in Finance and a CEMS Masters in International Management.

Board of directors

Carolan Dobson (Chairman) was appointed as a Director on 1 January 2016 and as Chairman on 2 March 2017. She is the former Head of UK Equities at Abbey Asset Managers and former Head of Investment Trusts at Murray Johnstone and therefore brings a wealth of industry experience to the Board. She is currently Non-Executive Chairman of Brunner Investment Trust plc and Baillie Gifford UK Growth Fund plc.

Craig Cleland was appointed as a Director on 1 January 2019 and Chairman of the Audit Committee from 31 March 2019. He is Head of Corporate Development/Investment Trusts at CQS (UK) LLP, a multi-asset asset management firm in London with a focus on credit markets, where his responsibilities include advising and developing the closed-end fund business. He is also a Director of Invesco Perpetual Select Trust plc and the CC Japan Income & Growth Trust plc and was formerly a Director of Martin Currie Asia Unconstrained Trust plc. He was previously at JPMorgan Asset Management (UK) Limited, latterly as Managing Director, and led their technical groups in the investment trust business. Prior to that, he was a Director and Senior Company Secretary at Fleming Investment Trust Management, transferring to JPMorgan Asset Management after Chase Manhattan Bank acquired Robert Fleming Holdings Limited.

Laurie Meister was appointed as a Director on 1 February 2020. Ms Meister has 32 years of financial markets experience, both in New York and in London, with 28 years dedicated to having led and developed Latin American equity and capital markets businesses and other emerging markets. Her most recent position was as the Director of Latin American equity sales for European institutional clients for Deutsche Bank from 2008 to 2018. Prior to this she worked for J.P. Morgan Chase as a Director with responsibility for rebuilding the Cemea (Central and Eastern Europe, Middle East and Africa) equity business and then became the Senior European Equity Director for their Latin American equity business. Her initial experiences in the Latin American equity arena included the European start up in the early 1990s of the Merrill Lynch Latin American research sales operation. She then moved as a Managing Director to Robert Flemings in 1995 where she co-led the start-up of their Latin American trading sales and research operations across the region. Ms Meister has a B.A. from the University of Pennsylvania and an M.B.A. in Finance from the New York University Stern School.

Nigel Webber was appointed as a Director on 1 April 2017. Mr Webber’s broad investment experience has seen him lead the design of investment solutions for affluent and high-net-worth individuals across global markets and multiple asset classes. Most recently, he was Global Chief Investment Officer for HSBC Private Banking where he held global responsibility for all investment activity for Group Private Banking. During his time at HSBC, Mr Webber was also Chairman of the Global Investment Committee for Group Private Bank and Chairman for HSBC Alternative Investments Limited. Prior to this, he held a number of blue-chip executive positions around the world for investment and asset management businesses. He is also a qualified accountant.