Capital at risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested.

MAKING INVESTING EASIER

Introducing iShares Portfolio ETFs

iSHARES PORTFOLIO ETFs EXPLAINED

Everyone deserves to experience financial wellbeing: the confidence to meet today’s expenses while saving for retirement and being prepared for all of life’s moments in between.

That’s why we built iShares Portfolio ETFs – a simple range designed to help you invest to build wealth that will serve you throughout your lifetime. Pick the ready-made ETF that suits your goals and the level of risk you’re happy to take.

If you want to start your investing journey, chances are you want it to be simple and convenient.

So let’s talk about iShares Portfolio ETFs.

An Exchange Traded Fund, or “ETF”, is an assortment of investment securities, usually stocks or bonds packaged up as one fund.

A portfolio ETF is made up of several ETFs that invest in thousands of stocks and bonds across a wide range of companies and governments.

But what does that mean for you?

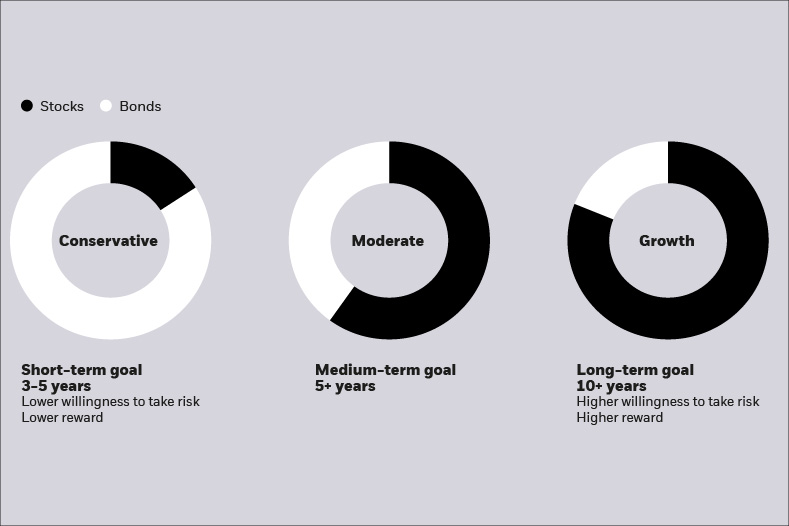

iShares Portfolio ETFs are simple. You pick from our three risk profiles: ‘Conservative’, ‘Moderate’ and ‘Growth’.

iShares Portfolio ETFs are low-cost. Investing could help your savings beat inflation, so we use ETFs and index funds to keep costs down. This helps more people get started investing for their future.

iShares Portfolio ETFs are diversified. We pick a variety of asset types to help investments endure falls in stock market prices during periods of volatility.

As a leading global index provider, MSCI understands the opportunity to gain exposure to a range of different markets around the world and MSCI indexes track these global markets. Multi-asset portfolio managers often use MSCI-linked financial products that provide transparent, rules-based exposure to global, regional, country and sector equity markets. Diversified investments can help investors spread risk.

Lastly, iShares Portfolio ETFs are managed by… us! BlackRock is a global asset manager… …with local know-how. In other words, your money is in safe hands.

Or… wings. Because that’s an owl.

And that’s why iShares Portfolio ETFs could be a great way to get started.

Risk Warnings

Investors should refer to the prospectus or offering documentation for the funds full list of risks.

Capital at risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested.

Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy.

Changes in the rates of exchange between currencies may cause the value of investments to diminish or increase. Fluctuation may be particularly marked in the case of a higher volatility fund and the value of an investment may fall suddenly and substantially. Levels and basis of taxation may change from time to time and depend on personal individual circumstances.

Fund-specific risks

iShares Conservative Portfolio UCITS ETF

Counterparty Risk, Credit Risk, Liquidity Risk

iShares Moderate Portfolio UCITS ETF

Counterparty Risk, Credit Risk, Equity Risk, Liquidity Risk

iShares Growth Portfolio UCITS ETF

Counterparty Risk, Credit Risk, Equity Risk, Liquidity Risk

Description of Fund Risks

Counterparty Risk

The insolvency of any institutions providing services such as safekeeping of assets or acting as counterparty to derivatives or other instruments, may expose the Fund to financial loss.

Credit Risk

The issuer of a financial asset held within the Fund may not pay income or repay capital to the Fund when due.

Equity Risk

The value of equities and equity-related securities can be affected by daily stock market movements. Other influential factors include political, economic news, company earnings and significant corporate events.

Liquidity Risk

The Fund's investments may have low liquidity which often causes the value of these investments to be less predictable. In extreme cases, the Fund may not be able to realise the investment at the latest market price or at a price considered fair.

Important Information

In the UK and Non-European Economic Area (EEA) countries: this is issued by BlackRock Investment Management (UK) Limited, authorised and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL. Tel: + 44 (0)20 7743 3000. Registered in England and Wales No. 02020394. For your protection telephone calls are usually recorded. Please refer to the Financial Conduct Authority website for a list of authorised activities conducted by BlackRock.

BlackRock has not considered the suitability of this investment against your individual needs and risk tolerance. To ensure you understand whether our product is suitable, please read the fund specific risks in the Key Investor Document (KID) which gives more information about the risk profile of the investment. The KID and other documentation are available on the relevant product pages at www.blackrock.co.uk/its. We recommend you seek independent professional advice prior to investing.

Any research in this document has been procured and may have been acted on by BlackRock for its own purpose. The results of such research are being made available only incidentally. The views expressed do not constitute investment or any other advice and are subject to change. They do not necessarily reflect the views of any company in the BlackRock Group or any part thereof and no assurances are made as to their accuracy.

This document is for information purposes only and does not constitute an offer or invitation to anyone to invest in any BlackRock funds and has not been prepared in connection with any such offer.

© 2025 BlackRock, Inc. All Rights reserved. BLACKROCK, BLACKROCK SOLUTIONS and iSHARES are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

WHAT ARE PORTFOLIO ETFs?

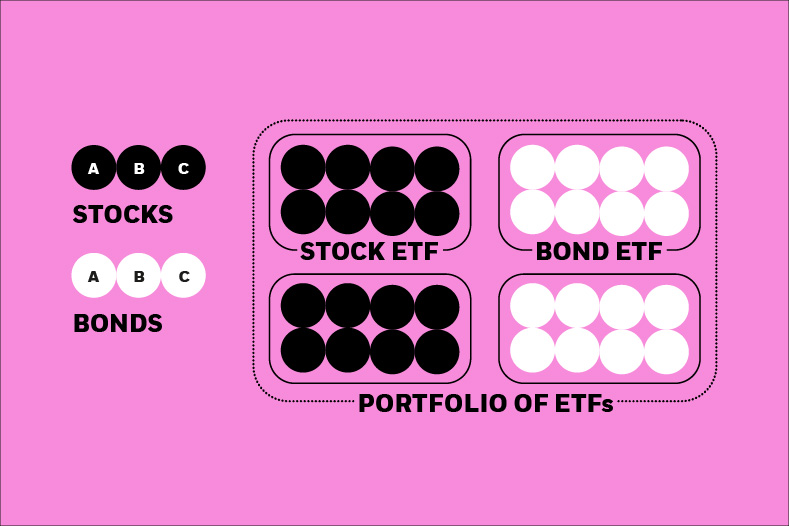

- An Exchange Traded Fund (ETF) is a pool of investment securities, usually stocks or bonds, wrapped into one vehicle, a ‘fund’. ETFs provide access to a diversified selection of stocks or bonds, usually at a lower cost than purchasing the individual stocks or bonds yourself.

- A portfolio ETF is made up of several single ETFs that invest in individual stocks and bonds across a wide range of companies and governments to create a truly diversified portfolio.

- iShares Portfolio ETFs typically hold 15-25 ETFs giving you exposure to over 8,000 individual stocks and bonds.*

*Source: BlackRock as of July 31, 2025.

Risk: Diversification and asset allocation may not fully protect you from market risk.

For illustrative purpose only and subject to change.

Bonds are a way for governments or companies to borrow money from investors, in exchange for income, which is paid out on a regular basis.

Bonds play an important role in building a diversified portfolio and provide investors with 3 potential benefits:

- A stream of income generally higher than cash.1

- A method to counterbalance the fluctuations in stock prices that investors may encounter when holding stocks.2

- A preserver of capital (i.e. your savings) while potentially providing more yield than idle cash. Yield refers to the income earned on an investment over a specific period, typically expressed as a percentage of the investment's value.

1With bonds, there is a greater level of risk to your money because they can go up and down in value, but this can potentially lead to higher returns. Additionally, in a high inflation environment, the cash held in bank current accounts or deposit savings are at risk of losing value as inflation will reduce the buying power of your money over time.

2Bonds generally exhibit lower price volatility compared to stocks. Bond prices are primarily influenced by changes in interest rates and the issuer credit profile, which tend to be less volatile than the factors affecting stock prices, such as earnings reports, market sentiment, and economic indicators. Historically, investors used bonds to diversify their investments and reduce the impact of market volatility.

WHY ARE BONDS IMPORTANT FOR PORTFOLIO DIVERSIFICATION?

Many investors begin their journey by investing in ETFs composed of stocks, often those tracking an index such as MSCI All Country World (ACWI) or S&P 500 index. Introducing bonds, a different type of investment to stocks, to your investment portfolio may bring added portfolio diversification benefits. A truly diversified portfolio will have exposure to a mixture of different types of investments, including stocks and bonds.

Risk: Diversification and asset allocation may not fully protect you from market risk.

WHY iSHARES PORTFOLIO ETFs

Expertise

Trust is important - iShares is part of BlackRock, one of the world’s largest asset managers, with global insights and local expertise. So, you can be confident your money is in safe hands. Source: Bloomberg, July 2025.

Diversification

We're on your side - the more you spread your investments the more you spread risk. That’s what iShares Portfolio ETFs do, they diversify across a variety of assets, making sure all your eggs aren’t in one basket.

Affordable

It doesn’t have to be expensive - investing can protect your savings by helping beat inflation. It doesn’t take much to start, using ETFs we keep costs low and help more people invest for their future.

Simple

The hard work is done - you simply pick the ready-made fund that suits your investment risk preference: Conservative, Moderate or Growth. It’s easy to get started and then the experts will take it from there.

CHOOSING THE RIGHT RISK PROFILE

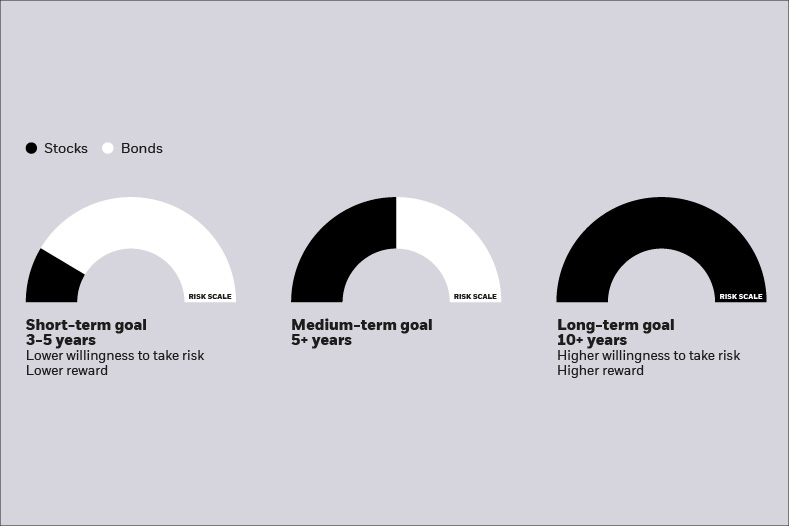

- The mix of stocks and bonds held in your portfolio can have a big impact on your long-term returns. Stocks could help you achieve higher returns than bonds but are considered riskier.

- A conservative portfolio will typically have a higher allocation to bonds than stocks while a growth portfolio will have a higher allocation to stocks than bonds.

- Over the long-term the day-to-day ups and downs associated with stocks can be less of a problem, but it all depends on how long you want to invest for. The longer you plan to keep your money invested, the more risk you may be willing to take.

DISCOVER iSHARES PORTFOLIO ETFs

iShares Portfolio ETFs are designed to help you manage risk while growing your savings. Compare these three ETFs and pick the one that fits your goals, time horizon, and risk appetite.

INVEST IN iSHARES PORTFOLIO ETFs WITHIN YOUR ETF SAVINGS PLAN

With an ETF savings plan you can invest a flexible amount in ETFs every month, starting from just £1. This offers you flexibility, especially if you prefer to invest regularly rather than a set amount once.

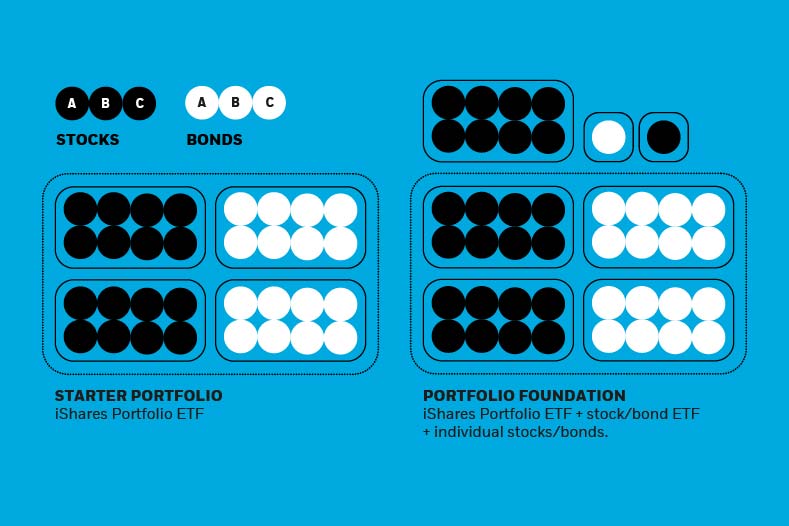

iShares Portfolio ETFs are available in many ETF savings plans and there are different ways to think about investing:

- Getting started – For those who are just beginning their investment journey, use iShares Portfolio ETFs to start investing knowing the experts are taking care of managing your money.

- A foundation to build on – For those wanting more choice across multiple investments, use iShares Portfolio ETFs as the core foundation of your portfolio and complement this base with other ETFs you wish to invest in.

The beauty of the savings plan, once you have chosen the ETFs that are right for you, all you have to do is decide how much you want to invest and how often.