Introduction to options

The volume of options trading in the US has doubled in the last few years driven by greater investor access and awareness.1 Many investors associate options with speculative use cases like buying calls on “meme” stocks, but institutional investors have used options for decades to manage risk, customize investment outcomes, and more.

Options Myth Busting

|

Myths |

Reality |

|

“Options are just for speculating” |

While some strategies can be used for speculating, other options may be used as a wealth-management tool to help reduce risk in alignment with clients’ goals. |

|

“Options are complex” |

Professionally managed strategies supported by interactive tools help take the complexity out of options, allowing you to focus on the client outcomes they achieve. |

|

“Options are time-consuming” |

Access to professional managers, education, and resources can make it easier than ever to incorporate options into an advisory practice. |

|

“Quality option strategies are hard to find” |

Outcome ETFs and Option Overlay SMAs are two of the fastest-growing areas in the U.S. wealth market. BlackRock is investing in its ETF and SMA platform to help democratize high-quality, customizable option solutions. |

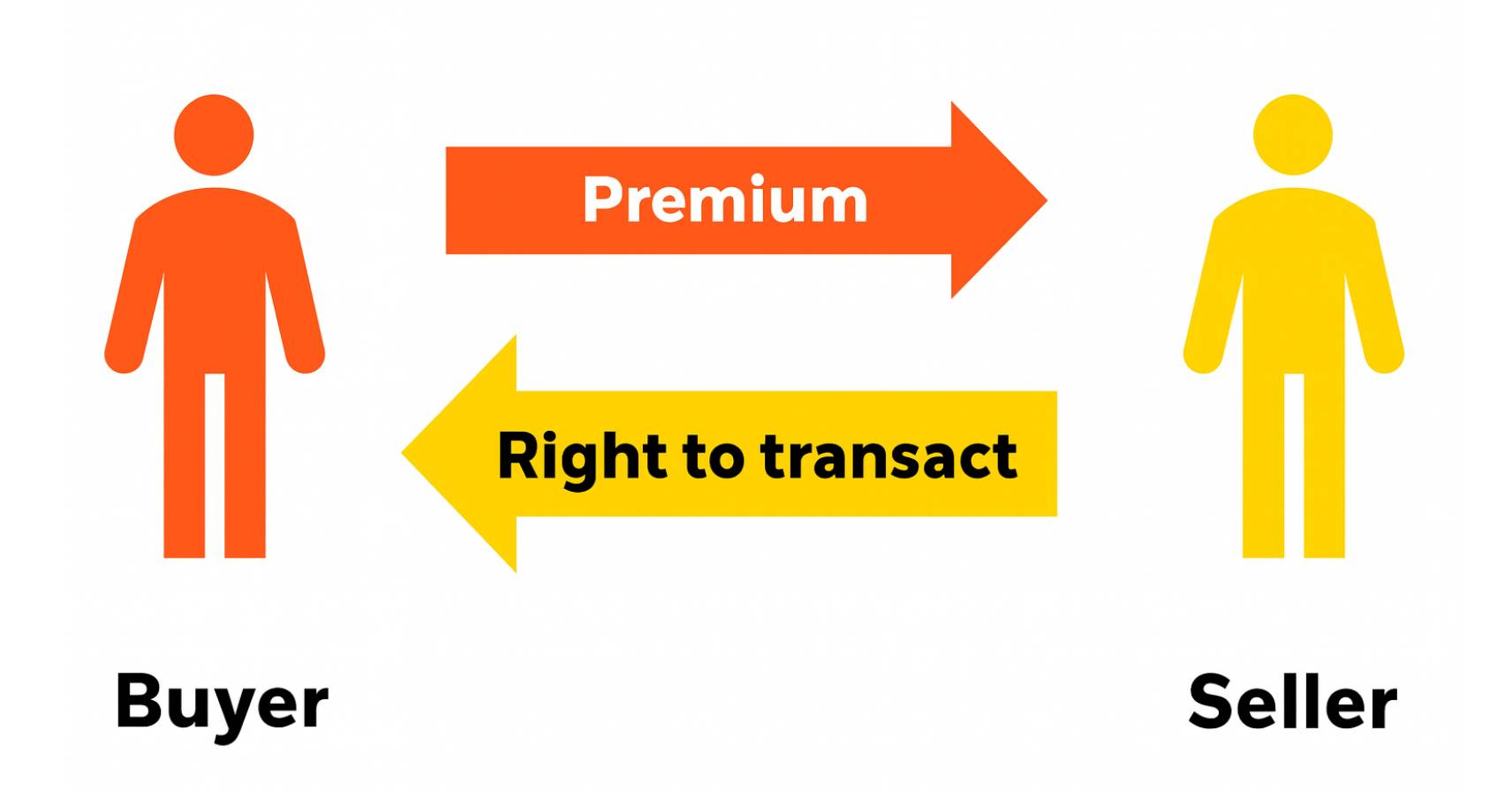

Every option has a buyer and a seller

The buyer pays a small fee (or premium) for the right to transact at a specific price, and the seller receives that fee in return for the commitment to honor the right to the transaction.

How options generate return

Owning options does not mean you have to “transact” in the underlying. Options, like other securities, can move up or down in price. They can expire or be bought and sold prior to expiration. Their value is linked to the underlying reference security.

|

Role |

Make Money |

Lose Money |

|

Option Buyer |

Option price appreciates / increases |

Option price decreases / expires “worthless” |

|

Option Seller |

Option price decreases / expires “worthless” |

Option price appreciates / increases |

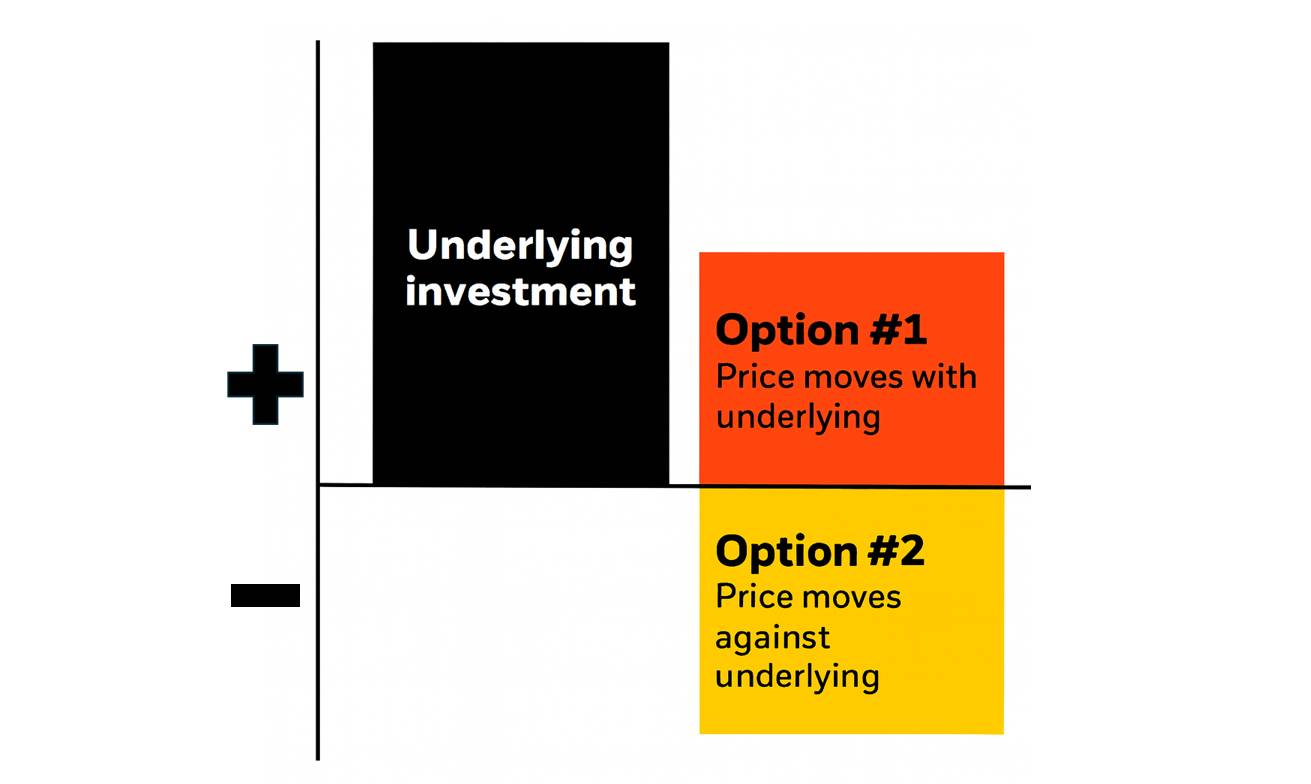

Options move with or against an investment

There are:

- Those that move with an underlying asset, helping investors gain exposure and add risk.

- Those that move against an underlying asset, helping investors reduce exposure and hedge risk.

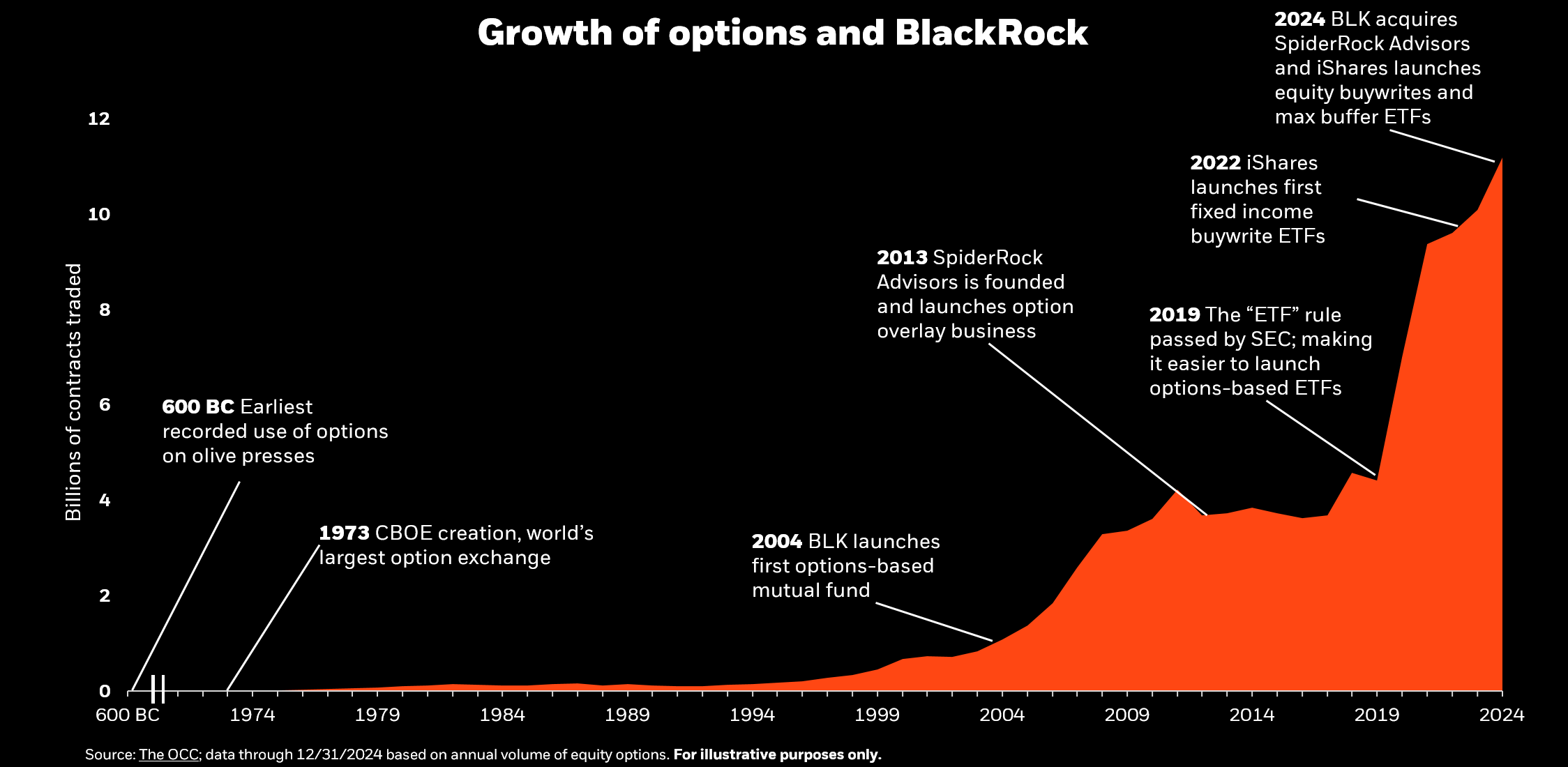

Options are growing, so is our platform

While options are not new, advancements in technology have made option products more accessible to a wider audience. As investors look for guidance in this evolving space, BlackRock builds on its long history of risk management and product innovation to deliver its option platform.

Important options definitions

Calls: Gives the option buyer the right to buy an underlying asset at a specified price within a specific time period.

Puts: Gives the option buyer the right to sell an underlying asset at a specified price within a specific time period.

Premium: The price of the option contract. The seller (writer) of the contract receives the premium (income) from the buyer at the time the contract is agreed.

Strike price: The price established in the option contract at which the option can be exercised.

Expiration: The date that the option contract ends.

Want to learn more about options basics?

Explore our ‘options refresh’ to learn more about the fundamentals of options and their role in portfolios.

Options Insights

More articles loaded. Use Shift+Tab keys to browse.

Total articles: