BlackRock’s fixed income SMAs

Explore BlackRock’s full platform of fixed income SMAs to address your clients’ needs.

Advance Static Table-1,Paragraph-1

Advance Static Table-2,Paragraph-2

The table below shows portfolio characteristics for our sample portfolios. For actual strategy performance and characteristics, view the strategy fact sheet or GIPS Composite Report.

| Strategy | Avg. yield to worst-Gross (%) | Avg. tax-equivalent yield to worst-Gross (%) | Avg. coupon (%) | Avg. effective duration (yrs) | Fact Sheet | Sample Portfolio | GIPS Composite Report |

|---|---|---|---|---|---|---|---|

| Short-term Municipal | 2.36 | 3.99 | 5.00 | 2.83 | Fact Sheet | Sample Portfolio | GIPS Composite Report |

| Intermediate Municipal | 2.62 | 4.42 | 5.00 | 4.92 | Fact Sheet | Sample Portfolio | GIPS Composite Report |

| Long-Term Municipal | 3.39 | 5.72 | 4.93 | 8.12 | Fact Sheet | Sample Portfolio | GIPS Composite Report |

| Municipal Opportunities† | 3.68 | 5.97 | 4.92 | 6.09 | Fact Sheet | Sample Portfolio | GIPS Composite Report |

| Municipal Ladder 1-5 Year | 2.22 | 3.74 | 5.00 | 2.30 | Fact Sheet | Sample Portfolio | GIPS Composite Report |

| Municipal Ladder 1-10 Year | 2.54 | 4.29 | 5.00 | 4.11 | Fact Sheet | Sample Portfolio | GIPS Composite Report |

| Municipal Ladder 5-15 Year | 2.79 | 4.72 | 5.00 | 6.58 | Fact Sheet | Sample Portfolio | GIPS Composite Report |

| Municipal Ladder 10-20 Year | 3.29 | 5.57 | 5.00 | 8.62 | Fact Sheet | Sample Portfolio | GIPS Composite Report |

For illustrative purposes only. Portfolio characteristic data, including the yields shown above, do not reflect results of actual BlackRock accounts or strategies. The portfolio characteristics data shown is that of the respective hypothetical sample portfolio. Actual results may differ. The sample portfolios illustrate a hypothetical portfolio for the investment strategy identified above to illustrate the types of investments that may be purchased for a client selecting such investment strategy. The hypothetical portfolio is based on the current market environment and is not the result of actual trading. The holdings identified do not represent all of the securities purchased, sold or recommended for any particular advisory client and in the aggregate may represent only a small percentage of an actual client's portfolio holdings. The holdings do not constitute a recommendation or solicitation to buy or sell any particular security and you should not assume that an investment in any of the securities was or will be profitable. Actual client portfolios will differ for a variety of reasons including, but not limited to, account size, the timing of client investments, differences in in market conditions and in the number, types, availability and diversity of securities that can be purchased, liquidity considerations and client objectives and guidelines. This information is shown for illustrative purposes and is subject to change. The yields of the sample portfolios are shown gross of fees and do not reflect the deduction of all applicable fees and expenses. Refer to the total portfolio’s gross and net performance shown in the respective GIPS Reports for the overall effect of fees. The portfolio characteristics shown are the data points most requested by Financial Advisor clients. Please click on the sample portfolio link for more information. Data as of February 2, 2026.

† BlackRock Allocation Target Shares (BATS) mutual funds available for use within BlackRock Separately Managed Account Strategies.

The table below shows portfolio characteristics for our sample portfolios. For actual strategy performance and characteristics, view the strategy fact sheet or GIPS Composite Report.

| Strategy | Avg. yield to worst-Gross (%) | Avg. coupon (%) | Avg. effective duration (yrs) | Fact Sheet | Sample Portfolio | GIPS Composite Report |

|---|---|---|---|---|---|---|

| Short-Term Taxable | 3.71 | 4.27 | 1.90 | Fact Sheet | Sample Portfolio | GIPS Composite Report |

| Intermediate Taxable | 4.14 | 3.97 | 4.24 | Fact Sheet | Sample Portfolio | GIPS Composite Report |

| Fundamental Core Taxable | 4.41 | 3.92 | 5.89 | Fact Sheet | Sample Portfolio | GIPS Composite Report |

| Short Duration† | 3.86 | 3.86 | 1.81 | Fact Sheet | Sample Portfolio | GIPS Composite Report |

| Core Bond† | 4.32 | 3.79 | 5.85 | Fact Sheet | Sample Portfolio | GIPS Composite Report |

| Government/Corporate Taxable | 4.26 | 4.03 | 6.06 | Fact Sheet | Sample Portfolio | GIPS Composite Report |

| Corporate Ladder 1-5 year | 4.07 | 4.34 | 2.29 | Fact Sheet | Sample Portfolio | GIPS Composite Report |

| Corporate Ladder 1-10 year | 4.37 | 4.30 | 4.11 | Fact Sheet | Sample Portfolio | GIPS Composite Report |

For illustrative purposes only. Portfolio characteristic data, including the yields shown above, do not reflect results of actual BlackRock accounts or strategies. The portfolio characteristics data shown is that of the respective hypothetical sample portfolio. Actual results may differ. The sample portfolios illustrate a hypothetical portfolio for the investment strategy identified above to illustrate the types of investments that may be purchased for a client selecting such investment strategy. The hypothetical portfolio is based on the current market environment and is not the result of actual trading. The holdings identified do not represent all of the securities purchased, sold or recommended for any particular advisory client and in the aggregate may represent only a small percentage of an actual client's portfolio holdings. The holdings do not constitute a recommendation or solicitation to buy or sell any particular security and you should not assume that an investment in any of the securities was or will be profitable. Actual client portfolios will differ for a variety of reasons including, but not limited to, account size, the timing of client investments, differences in in market conditions and in the number, types, availability and diversity of securities that can be purchased, liquidity considerations and client objectives and guidelines. This information is shown for illustrative purposes and is subject to change. The yields of the sample portfolios are shown gross of fees and do not reflect the deduction of all applicable fees and expenses. Refer to the total portfolio’s gross and net performance shown in the respective GIPS Reports for the overall effect of fees. The portfolio characteristics shown are the data points most requested by Financial Advisor clients. Please click on the sample portfolio link for more information. Data as of February 2, 2026.

† BlackRock Allocation Target Shares (BATS) mutual funds available for use within BlackRock Separately Managed Account Strategies.

Subscribe to monthly updates on portfolio characteristics

Sign up to receive a monthly email when the portfolio characteristics for our suite of municipal and taxable fixed income SMA strategies are updated.

Please try again

Slide 1: Custom Cover Page

BlackRock has recently launched new proposal capabilities through My Managed Accounts, including personalized transition and risk scenario analyses. These proposals can be customized to every client and help tell the story of how BlackRock fixed income SMAs can help your clients in meeting their investing goals. In this video we will walk through some of the capabilities and features you can expect.

Slide 2: Transition Analysis

Let's start with the transition analysis. For advisors with portfolios funded with existing securities, we will develop a plan to tax-efficiently transition your clients’ bonds to a BlackRock SMA. Our transition analyses include a breakdown of current and proposed holdings, as well as buy and sell rationale to help explain changes in the portfolio. In this example the Portfolio Manager looks to optimize the curve expression to increase the portfolio’s yield and cash flow while maintaining a similar duration profile.

Slide 3: Risk Analysis

Now, let's explore our risk analysis capabilities. We leverage our Aladdin technology to create custom risk analyses to help you make informed decisions. From interest rate shocks to historical scenarios, we offer over fifty risk scenarios. In this video, we will be examining the fixed income scenario slide. In this analysis, we illustrate the portfolios impact based on an instantaneous shock to the 10yr treasury as well as effects from credit spread adjustments in both investment grade and high yield.

Conclusion

We are excited to continue expanding our resources and capabilities to better serve you and your clients. Please reach out to your BlackRock portfolio manager to request a custom proposal or learn more about our fixed income SMA platform.

Important Notes

Investing involves risk, including possible loss of principal. Asset allocation and diversification may not protect against market risk, loss of principal or volatility of returns. Actual investment outcomes may vary. There is no guarantee that these investment strategies will work under all market conditions or are suitable for all investors and each investor should evaluate their ability to invest long-term, especially during periods of downturn in the market. No representation is being made that any account, product, or strategy will or is likely to achieve profits. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. You should consult your tax or legal advisor regarding such matters. This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

BlackRock’s Aladdin platform is a financial technology platform designed for institutional client use only and is not intended for end investor use. Aladdin users undertake sole responsibility and liability for investment or other decisions related to the technology’s calculations and for compliance with applicable laws and regulations. The technology should not be viewed or construed by any Aladdin users, or their customers or clients, as providing investment advice or investment recommendations to any parties.

©2025 BlackRock, Inc. or its affiliates. All Rights Reserved. BLACKROCK is a trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

New Proposal Builder

Watch this video to learn more about BlackRock’s new fixed income SMA proposal capabilities, featuring personalized transition and risk scenario analyses powered by Aladdin. Contact your BlackRock representative for more information.

Why BlackRock for fixed income SMAS

BlackRock is a leader in the fixed income SMA industry, managing over $70B in client assets.1 Our platform offers a scalable process to help advisors build personalized bond portfolios for their clients.

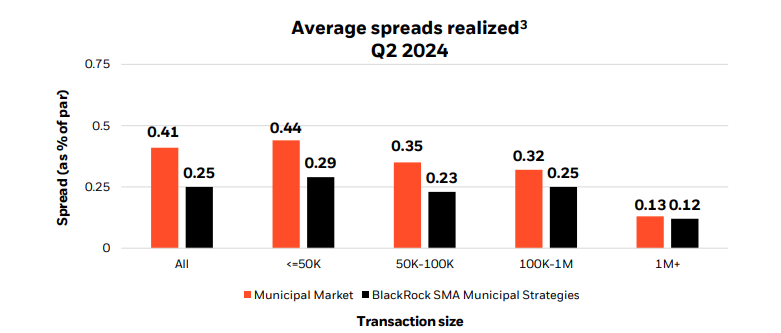

Scale matters when trading municipal bonds

BlackRock generally trades on the financial market to purchase bonds for clients at a larger scale, potentially benefiting investors with lower transaction costs and greater access to inventory.

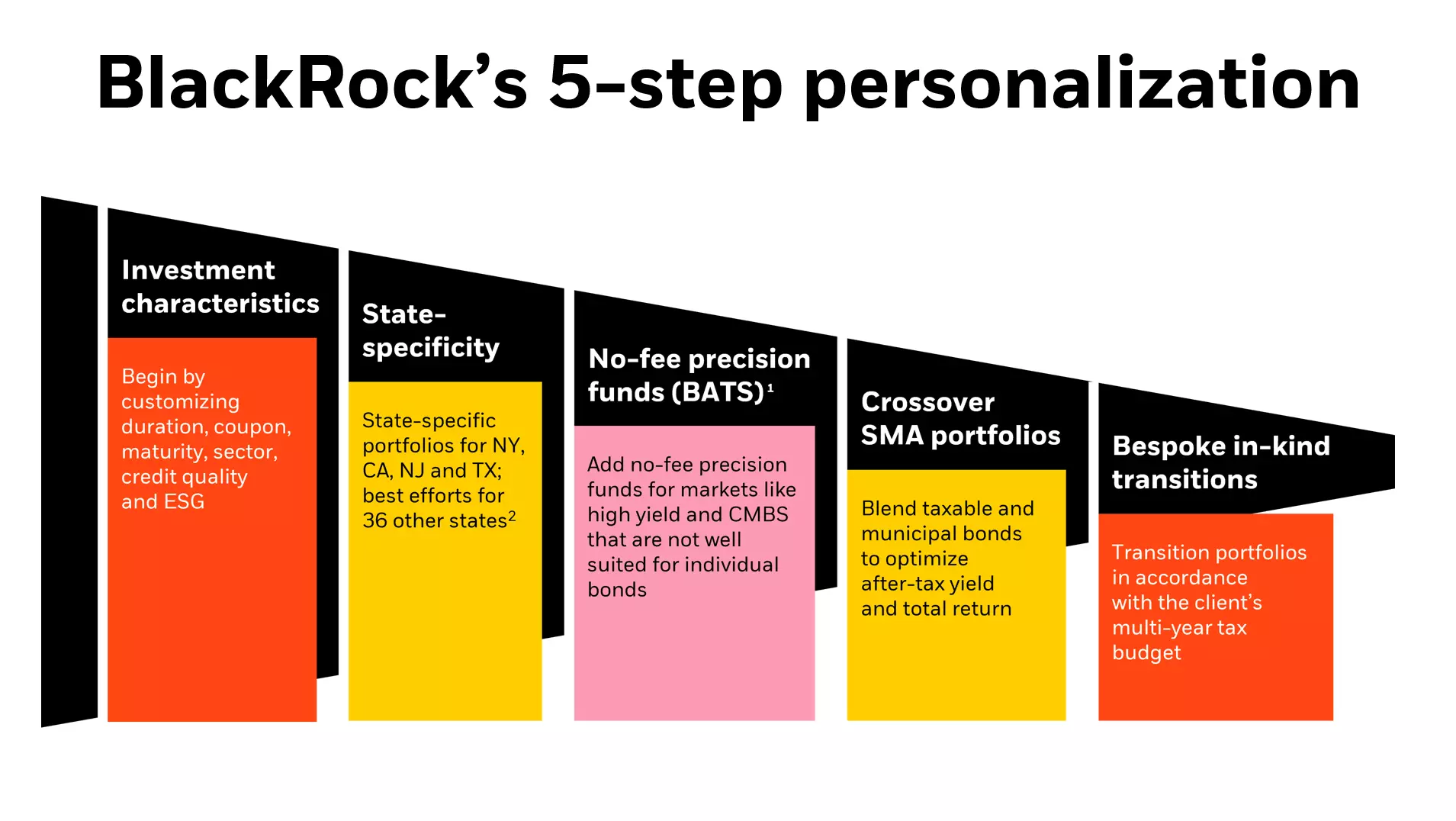

BlackRock customizes fixed income SMAs across five dimensions

BlackRock fixed income SMAs offer a range of enhanced customization capabilities seeking to deliver personalized solutions for advisors and their clients.

A discussion on fixed income SMAs: Hear from the experts

Kevin Staub, SMA Commercial Strategy and Duane Liedl, Senior Portfolio Manager discuss fixed income SMAs and how BlackRock is partnering with advisors to help deliver personalized solutions to their clients.

FAQ's

-

Not all bonds are created equal. Some of the key differences between municipal and taxable bonds include the issuer and type of projects that will be funded, risk profile, yields and tax implications. It is important to consider the potential benefits and risks of each when deciding the best option for your specific situation.

-

Taxes vary according to the type of bond you own. Tax-equivalent yield is the return calculation that puts a taxable and tax-exempt bond on equal footing. To calculate tax-equivalent yield, divide the municipal (tax-free) yield by 100% minus the investor’s tax bracket. This formula helps in comparing municipal and taxable bonds.

-

Bonds typically pay interest on a semiannual basis, or every 6-months.

- Equity

AI stocks, alternatives, and the new market playbook for 2026

In 2025, global stocks delivered strong returns despite periodic pullbacks, underscoring the value of staying invested in a diversified portfolio. Bonds once again acted as stabilizers, with Fed rate cuts boosting fixed income performance relative to cash. Looking ahead to 2026, many investors remain constructive on equities, while seeking balance through bonds, alternatives, and option-based strategies.