Private Market

Jan 07, 2026|ByIsabelle Rucart, CFA, PRM

BlackRock’s 2026 Private Markets Outlook builds on many of the themes explored last year, and one message for U.S. wealth investors is clear: private markets are moving from niche allocations to essential components of resilient portfolios. Against a backdrop of higher-for-longer rates, structural inflation, and greater dispersion, private assets are increasingly essential.

“In 2026, private markets are set to transform how societies build infrastructure, how businesses finance growth, and how investors achieve diversification in their portfolios.”

BlackRock, Private Markets Outlook 2026

Private credit: income you can underwrite

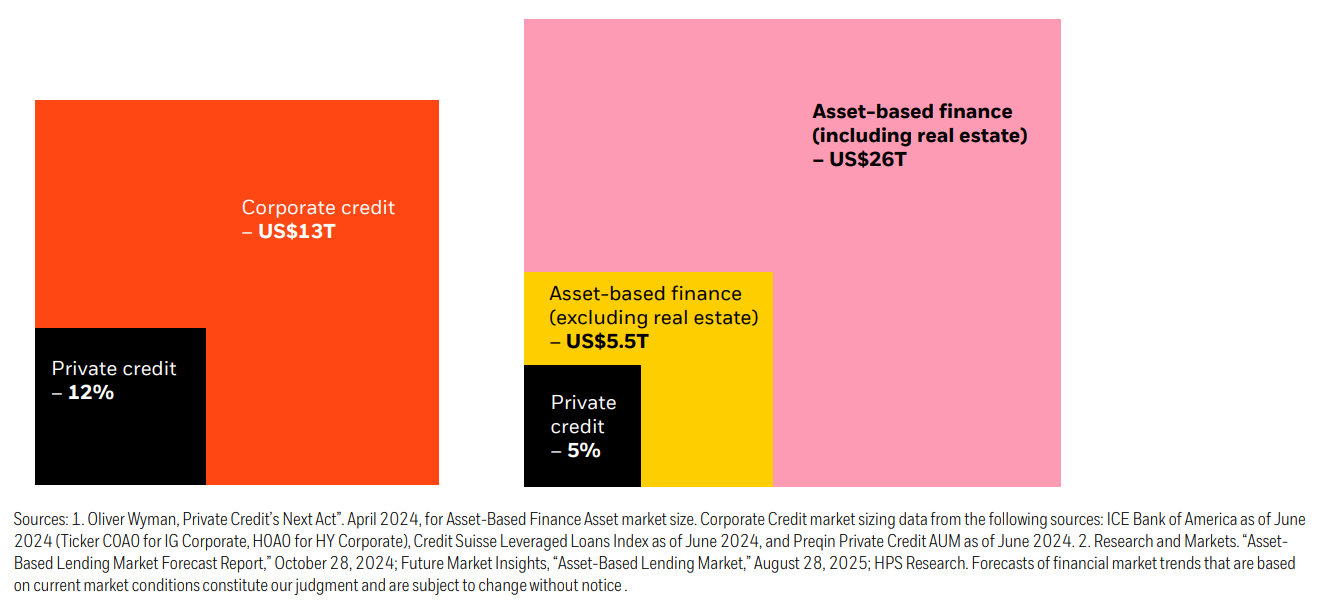

Private credit has become a dominant channel for corporate financing, as banks remain selective. In 2026, yield opportunities persist, but the focus is on structure, documentation, and alignment. Direct lending and asset-based finance can now provide institutional-quality income streams that advisors can underwrite with confidence. Floating-rate coupons add inflation protection and enhance portfolio stability. For wealth clients, the takeaway is clear: this is not about chasing yield, but about building a durable, high-conviction income engine anchored in strong covenants and sponsor support.

Private credit’s room for expansion

Infrastructure: the AI–energy nexus

Infrastructure investment has entered a new phase. The rise of artificial intelligence, cloud computing, and electrification are fuelling massive demand for data centers, power generation, and grid modernization. These are not cyclical themes, but structural shifts backed by policy and long-dated contracts. For investors, the combination of visibility, inflation linkage, and essential demand makes infrastructure a core allocation rather than an alternative.

Within portfolios, infrastructure can balance duration risk, complement fixed income, and provide exposure to energy transition and digital connectivity. The asset class has effectively become the bridge between sustainability goals and returns.

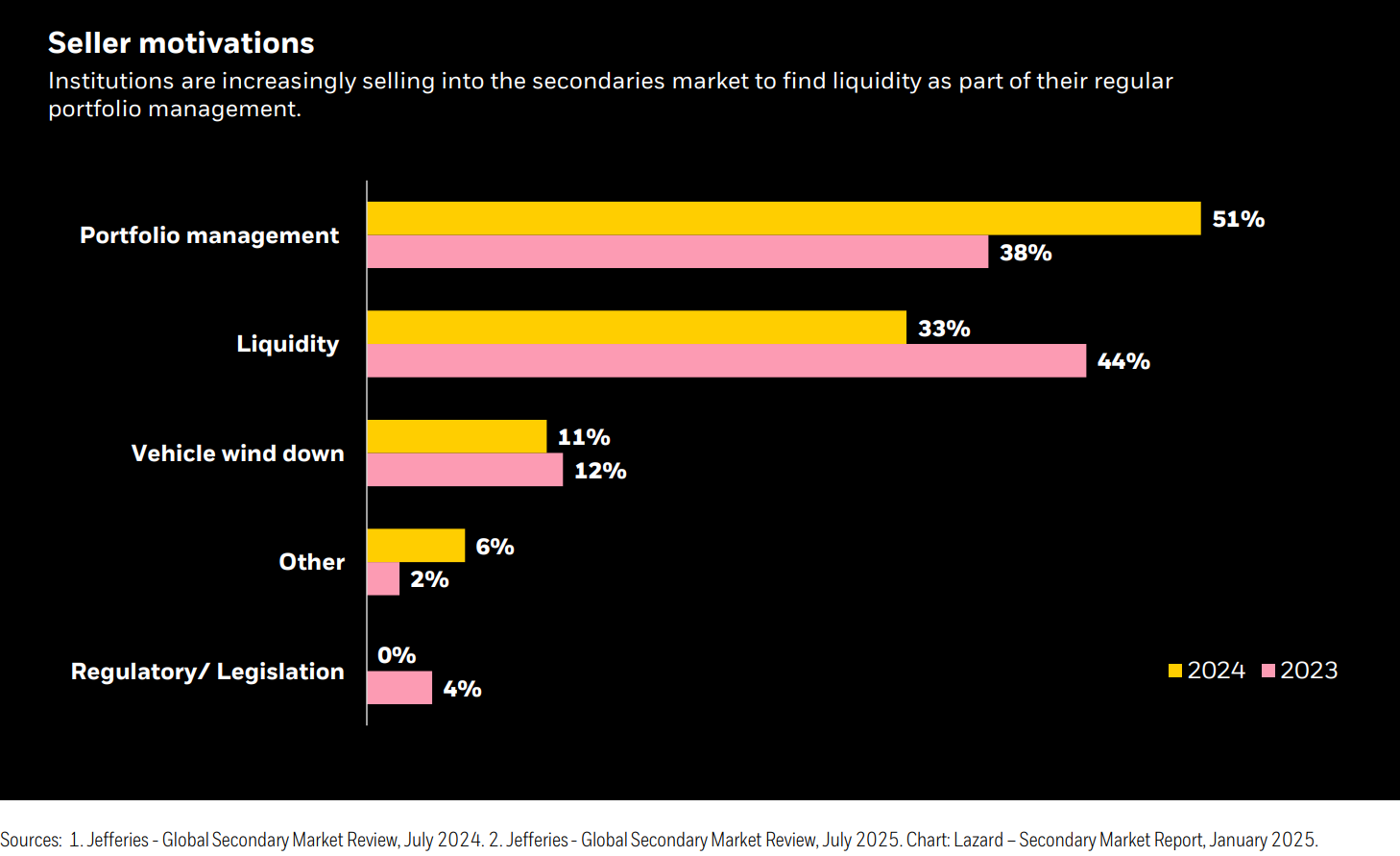

Private equity: liquidity through secondaries

Private equity continues to offer differentiated growth, but the way investors access it has evolved. Secondaries and GP-led continuation vehicles now give investors the ability to manage liquidity more proactively, re-underwriting seasoned assets rather than exiting under pressure. For advisors, this marks a turning point: private equity exposure can now be structured with clearer pacing, shorter duration, and greater flexibility.

Selective co-investments add further upside while keeping fees in check. The key is disciplined selection: focusing on sectors where fundamentals remain robust and operational value creation drives returns rather than multiple expansion.

Real estate: focus where fundamentals lead

The real estate landscape has reset. Legacy office exposure continues to face headwinds, but other segments — residential, industrial, logistics, and specialized assets like data centers and life-science facilities — are well supported by long-term demand and constrained supply. For wealth portfolios, the opportunity lies in targeted allocations to these high-conviction areas, emphasizing operational improvement over passive beta.

Real estate can still deliver diversification and steady income, but success depends on being selective and forward-looking rather than index-based.

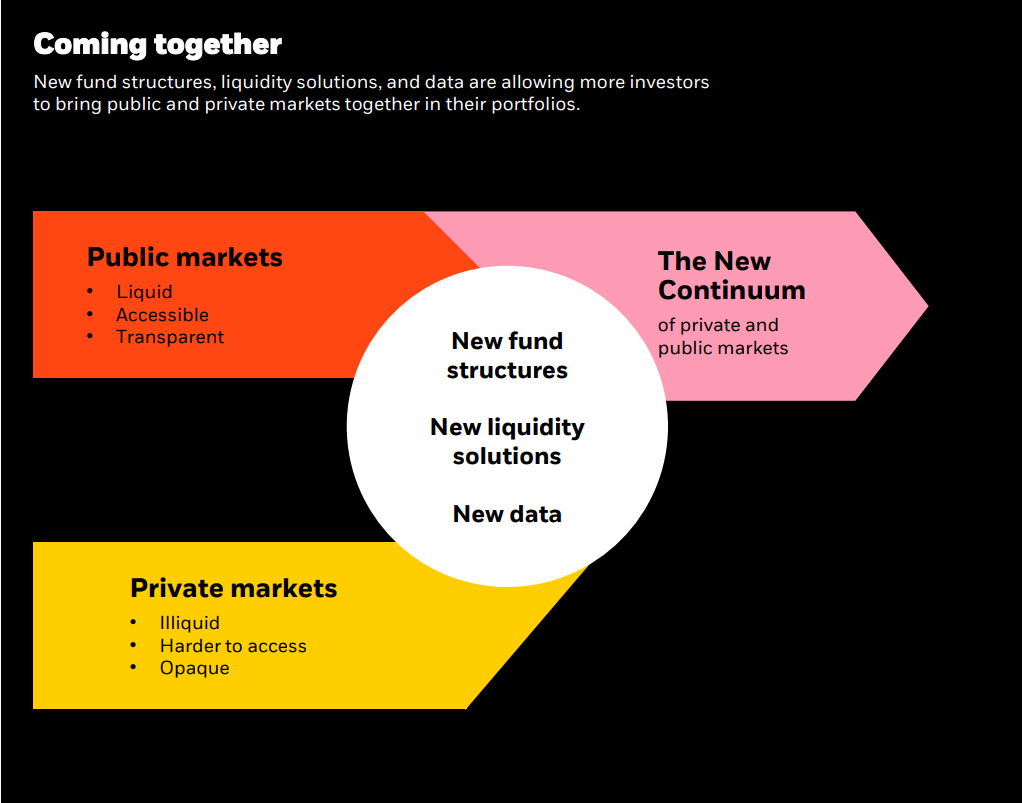

The new public–private continuum

One of the defining trends is the blurring of lines between public and private markets. Semi-liquid and evergreen structures, improved transparency, and better analytics are allowing advisors to integrate private exposures into the same portfolio frameworks used for publics. This evolution transforms private markets from a collection of standalone products into building blocks of holistic, outcome-oriented portfolios.

“The New Continuum Between Public and Private Markets” — liquidity spectrum from public to semi-liquid to drawdown structures.

What this means for portfolios

For income-oriented clients, private credit and core infrastructure can serve as foundational allocations that generate yield and hedge inflation. Balanced investors can layer in secondaries and selective real estate to capture growth while maintaining cash-flow visibility. For growth-oriented investors, combining digital and energy-transition infrastructure with targeted co-investments creates exposure to the economy’s most powerful long-term themes.

Across all profiles, pacing and liquidity management remain critical. As evidenced in our recent research paper, “Sizing Private Market Investments,” and our article “Private Markets in Wealth Portfolios,” advisors should sequence commitments, diversify vintages, and use secondaries as a proactive liquidity tool. With better data and semi-liquid options, private markets can now be managed with the same precision and accountability as traditional holdings.

Ultimately, 2026 marks a turning point. Private markets are no longer a separate universe — they are a natural extension of diversified, modern wealth portfolios. For advisors, the opportunity lies in integrating these exposures thoughtfully, aligning them to client outcomes, and positioning portfolios to benefit from the next phase of global transformation.1

Meet the author

More articles loaded. Use Shift+Tab keys to browse.

Total articles: