Re-think your bonds: broaden your mix

Now that yields are back in fixed income, it’s time to reassess your portfolio. As you re-up your bond weights, it’s a great time to re-think your bond mix. Do what the pros do - anchor your portfolio with low-cost bond ETFs and then allocate your fee budget to flexible funds and private credit.

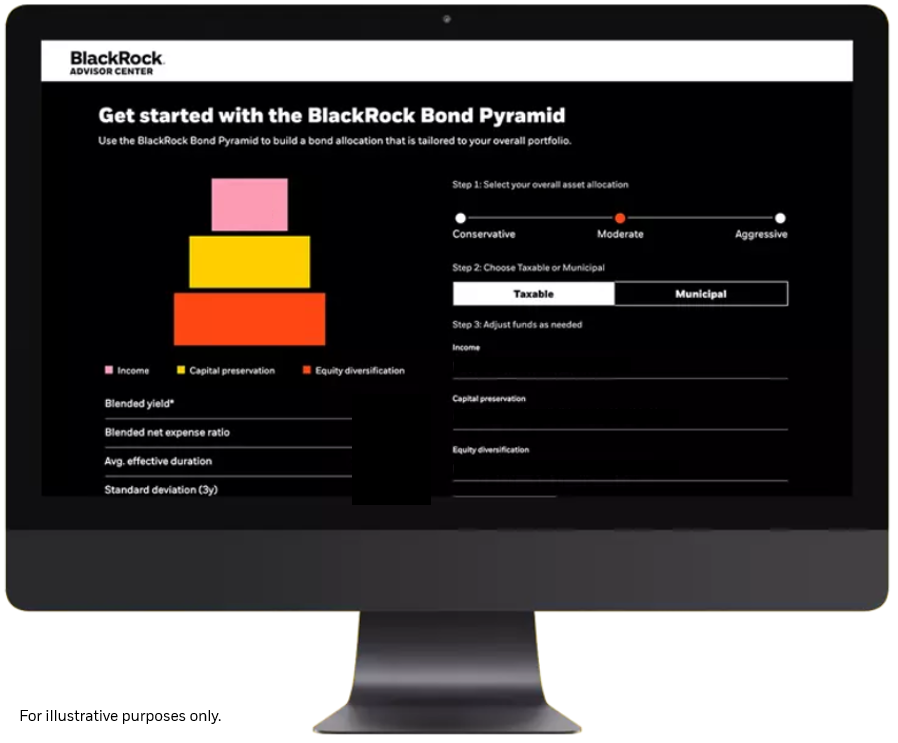

For illustrative purposes only.

Optimize your bond portfolio

The BlackRock Bond Pyramid is an interactive tool that showcases ways to blend active funds with bond ETFs to help meet portfolio goals or prepare for changing markets.

Explore ideas to get started

More articles loaded. Use Shift+Tab keys to browse.

Total articles: