Separately Managed Account

Jun 09, 2025|ByLincoln Fleming, CPA/PFS, CFP

The bottom line

- Although investors may feel anxious about stock market volatility, tax might be a silver lining.

- Investors, working with their tax professional, can take advantage of these tax planning opportunities to improve long-term, after-tax wealth outcome potential.

- Optimal tax planning strategies will vary based on the goals and circumstances of the investor.

In April, investors were rattled by elevated stock market volatility. Although market turbulence can be unsettling and uncertainty remains high, tax savvy investors may seek to take advantage of short-term planning opportunities to boost long-term wealth outcomes.

In such an environment, certain strategies may become more impactful for tax conscious investors. Although optimal strategies will vary based on individual facts and circumstances, highlighted below are 6 tax strategies to consider during a volatile market:

- Tax-loss harvest

- Do Roth conversions

- Make gifts

- Fund Grantor Retained Annuity Trusts (GRATs)

- Immunize existing GRATs

- Transition to tax efficient strategies

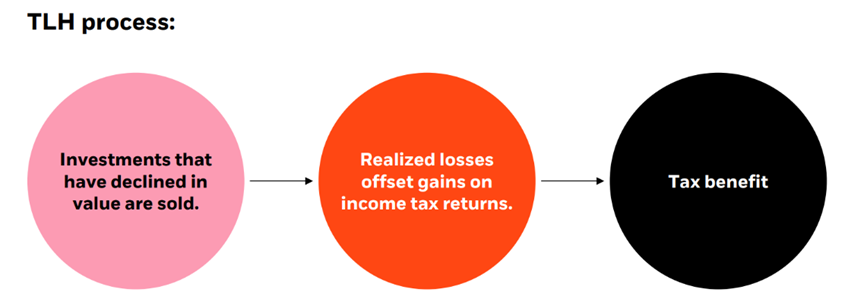

Many investors may reduce their overall tax burden by selling securities that have declined in value. Such losses can be used to offset capital gains realized elsewhere and to accomplish other important goals, such as reducing concentrated positions or repositioning a portfolio. Such a realization of losses, also known as “tax-loss harvesting,” takes advantage of market volatility to help boost after-tax returns.

Investors may be able to increase overall loss harvesting opportunities by methodically realizing capital losses throughout the year and employing active tax management solutions such as direct indexing or tax managed long/short strategies.

2. Do Roth conversions

A Roth conversion involves moving assets from a pre-tax retirement account, such as a traditional IRA or 401(k), into a Roth IRA. Potential advantages of doing a Roth conversion include no required minimum distributions during life, tax-free withdrawals, enhanced tax flexibility in retirement, and for very wealthy investors, a lower taxable estate.

For investors contemplating a Roth conversion, market declines may provide attractive opportunities to do so at a reduced tax cost, and any future recovery or asset growth may escape taxation, provided that certain requirements are met.

Investors and their advisors should consider many important factors when contemplating a Roth conversion, such as the investor’s current vs future estimated marginal tax rate, time horizon for needing to access the Roth funds, the availability of funds to pay the taxes generated by the conversion, and the investor’s estate planning goals.

3. Make gifts

During down markets, wealthy investors can gift assets at temporarily discounted valuations, using up less of their lifetime gift tax exemption to accomplish their wealth transfer planning goals.

Gifting reduces the value of the donor’s taxable estate, and any future rebound or appreciation in value of these assets would also accumulate outside of the donor’s estate.

4. Fund GRATs

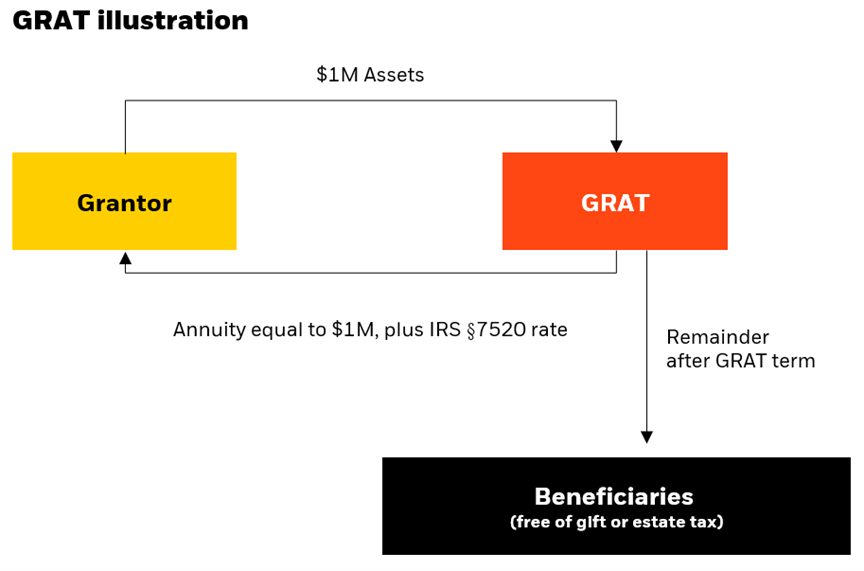

Grantor Retained Annuity Trusts, or GRATs, attempt to freeze the value of a taxpayer’s estate and transfer any income and appreciation in excess of the Section 7520 hurdle rate to trust beneficiaries free of gift and estate taxes. They offer high upside potential (gift/estate tax savings) with very little downside risk (minimal administrative costs). They tend to perform best when funded with volatile assets.

In order to prevent “winners” (assets that outperform the hurdle rate) from being diluted by “losers” (assets that underperform the hurdle rate), it may be advantageous to fund multiple GRATs, each with highly volatile but different assets. In an attempt to capture pockets of volatility and market upswings, investors may wish to use GRAT annuity payments to fund new GRATs, a strategy known as “rolling GRATs.”

5. Immunize existing GRATs

GRAT “immunization” refers to a strategy where highly volatile assets in a GRAT are swapped out for less volatile assets, such as bonds or cash. For example, if GRAT assets have significantly outperformed the Section 7520 hurdle rate, a grantor may wish to “lock-in” existing transfer tax gains and protect the successful GRAT from future losses.

Conversely, if GRAT assets have significantly underperformed the Section 7520 hurdle rate and the “out of the money” GRAT is deemed likely to fail, a grantor may wish to substitute out and “re-GRAT” (transfer to a new GRAT) the immunized assets if it is believed that the new GRAT is more likely to succeed.

6. Transition to tax efficient strategies

Investors interested in transitioning appreciated legacy holdings to more tax efficient strategies, such as swapping out of a mutual fund and into an SMA, may be able to take advantage of market volatility to do so at a reduced tax cost.

Furthermore, pairing such a strategy with systematic tax-loss harvesting may allow an investor to offset some or all the capital gains generated during the transition.

Never let a good crisis go to waste

Although market volatility can be stressful and uncertainty remains high, powerful planning opportunities exist for tax-minded investors. Advisors can help clients utilize tax strategies that best work for their goals and improve long-term, after-tax wealth outcomes by taking advantage of these tax silver linings, as appropriate.