Equity

Mar 27, 2025|ByIgor Zamkovsky, CFA

Discover what is behind the growth of outcome ETFs and why they can be a powerful tool within your practice.

Key takeaways

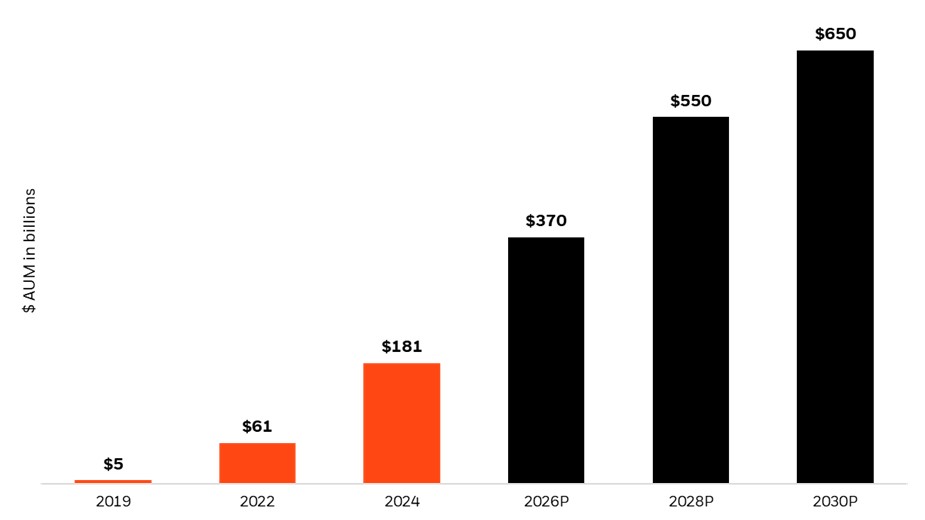

- BlackRock projects that U.S. outcome ETFs assets under management will surge to $650 billion by 2030 — more than three times its current size.1

- Outcome ETFs help investors achieve specific goals like income, targeted downside protection, and enhanced growth, while providing a cost-effective and convenient way to access options-based strategies.

- Outcome ETFs help empower investors to tackle macro uncertainty, offering features such as the potential for income or downside protection within a certain range, and can serve as a core building block to help address complex portfolio challenges.

The changing market landscape

The markets have changed a lot in the last few years and so too are the ways investors look to implement strategies that align with their goals. As more and more clients are looking for specific investment outcomes, innovation has made it easy to incorporate these types of strategies within ETFs.

Outcome-oriented strategies

The two main ingredients of Outcome ETFs are exposure to an underlying asset, such as an ETF that seeks to track an index and options on that underlying asset to help deliver the specific goals.

1. Enhanced income

Outcome ETFs known as buy-write ETFs, can generate additional income through options strategies, such as covered calls. This makes them an attractive option for income-focused investors.

2. Targeted downside protection

Outcome ETFs known as buffer ETFs, utilize options strategies to pursue specific investment goals like targeted downside protection. This helps investors mitigate losses during market downturns as represented by the Underlying ETF, while still allowing for some upside potential. 2

3. Growth

Outcome ETFs known as accelerated strategy ETFs, can target enhanced growth by using options to create unique payoff structures. These ETFs allow investors to participate in market gains up to a certain point, making them a powerful tool when markets experience periods of moderate growth as represented by the underlying ETF. 2

Rapid growth of outcome ETFs

As clients seek to implement these strategies, outcome ETF AUM has skyrocketed to $181 billion in 2024 from $5 billion in 2019.3 The category’s AUM was the fastest growing in 2024, expanding 58% from the prior year.4

Convenience and cost-effectiveness

While many investors may be familiar with options strategies, having them available inside the ETF wrapper provides a new, convenient and cost-effective avenue for investor access. Outcome ETFs are also designed to align with important investment goals, like generating income or targeted downside protection.

Future growth projections

Given their ability to provide investors with the potential for a specific outcome in a single ticker, we expect outcome ETFs to continue expanding and the category within the U.S. to more than triple to $650 billion by 2030.5

We expect U.S. outcome ETFs to reach $650 billion by 2030³

Source: BlackRock, Morningstar as of 12/31/2024. Estimates include scenario calculations based on proprietary research by BlackRock Global Product Solutions. Industry projections assume the continued evolution of the options ecosystem and market structure to support the growth of outcome ETFs at scale. These figures are for illustrative purpose only and there is no guarantee the projections will come to pass.

This expected growth comes at the intersection of product innovation, changing demographics and market dynamics.

Since 2019, nearly 500 outcome ETFs have been launched, and in 2024 alone represented 27% of all new ETF listings.6 This growth is driven by policy and macroeconomic uncertainty, higher market volatility, and demographic shifts, such as the increasing number of retirees globally.

Education and adoption

While outcome ETFs have grown rapidly in the last few years, nearly 90% of advisors don’t use them yet.7 We believe outcomes ETFs can play an important role in portfolio construction, but more education is needed so investors can best utilize these strategies. This paper aims to explore outcome ETFs and the options strategies within them, including how they can be used by investors seeking to achieve investment goals such as income, targeted protection, or enhanced growth.

iSHARES FUNDS

Explore a range of iShares ETFs to meet your clients’ investing goals.

Subscribe for the latest market insights and trends

Get the latest on markets from BlackRock thought leaders including our models strategist, delivered weekly.

Please try again

Related Resources

More articles loaded. Use Shift+Tab keys to browse.

Total articles:

Access exclusive tools and content

Obtain exclusive insights, CE courses, events, model allocations and portfolio analytics powered by Aladdin® technology.