Multi-Asset

A go-anywhere income solution

Improve your income potential with a tactical, unconstrained strategy that sources opportunities across geographies and asset classes. BlackRock Multi-Asset Income Fund takes a risk-first approach while seeking to deliver a consistently attractive yield.

Performance update

- The fund (Institutional share class) returned 50bps in December, compared with 52bps for the benchmark.

*The fund introduced a performance benchmark of 33.34% MSCI World High Yield Dividend Index (Net), 33.33% Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index and 33.33% Bloomberg U.S. Aggregate Bond Index on April 30th, 2025. This benchmark is in addition to the existing risk benchmark comprised of 50% MSCI World Index and 50% Bloomberg U.S. Aggregate Bond Index.

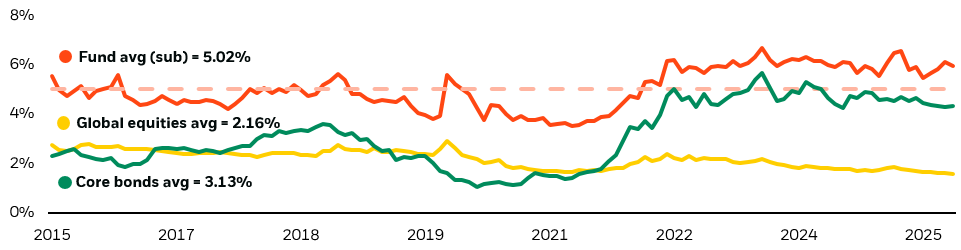

Over the last 10 years, the fund has provided a consistent and compelling level of monthly income.

Source: Morningstar and Bloomberg. Fund yield is 30-day SEC yield (subsidized), Institutional share class. Core bonds: Bloomberg U.S. Aggregate Bond Index. Global equities: MSCI World Index.

As of 12/31/25

Subscribe to Multi-Asset Income insights

Get timely market outlooks and portfolio positioning insights delivered to your inbox each month.

Please try again

Related resources

More articles loaded. Use Shift+Tab keys to browse.

Total articles:

Access exclusive tools and insights

Explore My Hub, your new personalized dashboard, for portfolio tools, market insights, and practice resources.

Performance data quoted represents past performance and is no guarantee of future results. Investment returns and principal values may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. All returns assume reinvestment of dividends and capital gains. Current performance may be lower or higher than that shown. Refer to blackrock.com for most recent month-end performance.

To obtain more information on the fund, including the standardized average annual total returns as of the most recent calendar quarter and current month-end, please visit Multi-Asset Income Fund.