Multi-Asset

A flexible multi-asset strategy to seek better outcomes

It takes an experienced and well-resourced team to seek out the most attractive investment opportunities around the world while managing volatility. BlackRock Global Allocation Fund seeks returns competitive with global stocks over market cycles but with less risk.

Performance and positioning update

- The fund outperformed its benchmark in December 2025 with cyclical segments like Financials, Materials, and Industrials being the best performing sectors.

- Maintained modest equity overweight as large-cap companies deliver strong earnings and broad-based revenue growth.

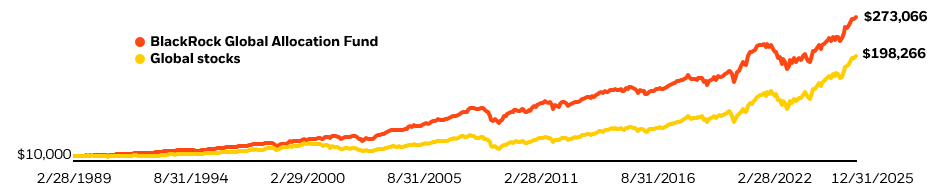

The fund has historically outperformed global stocks with less volatility*

Source: BlackRock, Bloomberg, as of 12/31/25. Performance is based on a hypothetical investment of $10,000 in the fund and the FTSE World Index made the first month post inception (2/3/89). *Volatility for the same period, is represented by annualized standard deviation of monthly returns for Institutional shares, all other share classes will vary. Standard deviation for the fund: 9.90% and for global stocks: 15.18%. Annualized returns for the fund (institutional shares): 9.35% and for global stocks: 8.45%. Index returns are for illustrative purposes only. Index performance returns do not reflect any management fees or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Subscribe to Global Allocation Fund insights

Get timely market outlooks and portfolio positioning insights delivered to your inbox each month.

Please try again

I’m up at 3:45 every morning. I want to know where all the markets are. I work out for an hour then the day really gets going.

I’m Rick Rieder, Chief Investment Officer of Global Fixed Income at BlackRock.

So my job is investing money for clients trying to generate returns using fixed income assets within portfolios. From being in this business for 35 years, you learn you got to be thoughtful, you got to innovate, you got to be different, and then apply that to the experience you have and the research that you’re doing.

Education for me is literally the foundation of everything. I’m chairman of the board of North Star Academy. It’s over 14 charter schools, serving 6,000 kids in the city of Newark. We started an internship program to bring high school kids in to help them with not just understanding markets, the economy, finance, but also understanding how you interface in business. We’re helping to change the future of thousands of underserved kids.

It gives you a real boost to see the difference you can make.

There’s a lot to do in a day, but when you start to see what you can get done, I think it’s safe to say that I won’t look back and wish I had slept more.

Meet Rick Rieder: Morningstar’s 2023 Outstanding Portfolio Manager

Rick Rieder, Chief Investment Officer of Global Fixed Income, has been awarded the 2023 Morningstar Award for Investing Excellence, Outstanding Portfolio Manager. Rick Rieder’s consistent approach to managing strategies like Strategic Income Opportunities, Total Return, Global Allocation and more have helped funds deliver long-term success.

Related resources

More articles loaded. Use Shift+Tab keys to browse.

Total articles:

Access exclusive tools and content

Obtain exclusive insights, CE courses, events, model allocations and portfolio analytics powered by Aladdin® technology.

Performance data quoted represents past performance and is no guarantee of future results. Investment returns and principal values may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. All returns assume reinvestment of dividends and capital gains. Current performance may be lower or higher than that shown. Refer to blackrock.com for most recent month-end performance.

To obtain more information on the fund, including the Morningstar time period ratings and standardized average annual total returns as of the most recent calendar quarter and current month-end, please visit Global Allocation Fund.

The Morningstar RatingTM for funds, or "star rating," is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and 10-year (if applicable) Morningstar Rating metrics. The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods.