Expected Return Range:

The expected return range represents a projected range of annualized returns, calculated using BlackRock’s 10-year Capital Market Assumptions, the asset class exposure of the user-defined portfolio and the volatility of the user-defined portfolio.

In order to estimate a portfolio’s expected return, BlackRock maps each underlying fund to an asset class that is selected by BlackRock based on the fund’s Morningstar Category. Asset classes are typically mapped to market index(es). All funds in any given Morningstar Category are represented by the same asset class, with the exception of funds that are deemed to have Private Market exposure. BlackRock identifies funds with Private Credit or Private Equity exposure and assigns these funds to Private Credit or Private Equity asset classes, separate from their Morningstar Category. Individual equity securities included in the portfolio are mapped to asset classes based on their GICS sector.

BlackRock’s Capital Market Assumptions are then applied to the asset classes to calculate the portfolio’s expected return. Please refer to the Capital Market Assumptions discussion below for the expected return figures for a set of sample indexes that are broadly representative of the market.

The engine used to calculate the range of expected returns (median, low and high) is a closed form solution and uses a methodology that is statistical and probabilistic. In addition to the Capital Market Assumptions, the engine takes into account the current risk (volatility) of the holdings of the portfolio. The low range represents the 25th percentile, and the high range represents the 75th percentile.

Projections are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. No representation is made that an investor will achieve results similar to those shown. Actual portfolio returns could be higher or lower based upon a number of factors and circumstances not addressed herein.

Capital Market Assumptions (As of September 30, 2024):

Capital market assumptions refer to BlackRock's return, risk and correlation expectations for each asset class. (Correlation measures how asset classes move in relation to each other.) These assumptions are based on historical asset class returns (as reflected by certain indices), proprietary models, BlackRock’s subjective assessment of the current market environment and forecasts as to the likelihood of future events.

|

|

Index |

10 Year Annualized |

10 Year Annualized Expected Risk |

|

|

MSCI USA Index |

6.17% |

17.75% |

|

|

MSCI World ex USA Index (unhedged) |

7.98% |

17.00% |

|

|

Bloomberg U.S. Government Index |

3.44% |

4.99% |

|

|

Bloomberg Global Aggregate Treasury Index ex U.S. (unhedged) |

4.31% |

7.91% |

|

|

Bloomberg U.S. Credit Index |

3.65% |

6.13% |

BlackRock typically reviews the assumptions quarterly. Actual calculations may include more recent risk and return information.

Capital market assumptions contain forward-looking information that is not purely historical in nature. They should not be construed as guarantees of future returns. The projections are based on BlackRock’s proprietary capital markets assumptions for risk and geometric return and correlations between major asset classes. These asset class assumptions are passive only and do not consider the impact of active management. The assumptions are presented for illustrative purposes only and should not be used, or relied upon, to make investment decisions. The assumptions are not meant to be a representation of, nor should they be interpreted as BlackRock’s investment recommendations. Allocations, assumptions, and expected returns are not meant to represent BlackRock performance. Long-term capital markets assumptions are subject to high levels of uncertainty regarding future economic and market factors that may affect actual future performance. Ultimately, the value of these assumptions is not in their accuracy as estimates of future returns, but in their ability to capture relevant relationships and changes in those relationships as a function of economic and market influences. Because of the inherent limitations associated with the use of illustrative asset allocations based on capital markets assumptions, potential investors should not rely exclusively on the portfolios shown in the tool when making an investment decision. The illustrative portfolios shown in the tool cannot account for the impact that economic, market, and other factors may have on an actual investment. Unlike actual investments, the portfolios shown in the tool do not reflect actual trading, liquidity constraints, all applicable fees and expenses, taxes, and other factors that could impact an investor’s realized future returns Please note all information shown is based on assumptions, therefore, exclusive reliance on these assumptions is incomplete and not advised. The individual asset class assumptions are not a promise of future performance. Indexes are unmanaged and used for illustrative purposes only and are not intended to be indicative of any fund’s performance. It is not possible to invest directly in an index.

Private Market Blended Capital Market Assumptions:

There are two Private Market asset classes available; Private Credit and Private Equity. Funds that are deemed to have Private Market exposure are mapped to these asset classes. These funds typically have a combination of both Private Market holdings and Public holdings. Therefore, the expected return values used for these asset classes reflect a blend of the Private Credit/Private Equity Capital Market Assumptions with other Capital Market Assumptions (for example, US Large Cap Equities & US Credit Bonds). The Capital Market Assumptions and weights included in these blends are determined by BlackRock in reviewing the average exposure of all funds mapped to the asset class on an annual basis.

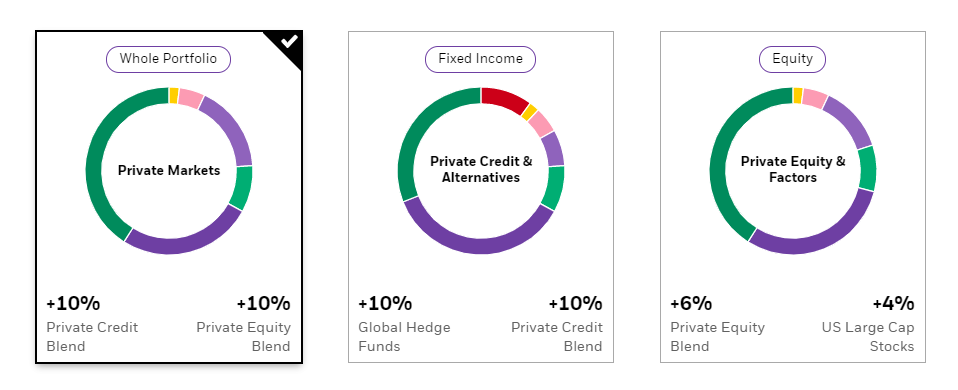

Alternate Portfolios:

In Step 2 of the tool, up to three hypothetical portfolios are provided that include asset classes that a user can introduce (or increase) in their loaded portfolio. The hypothetical portfolios are generated by a rules-based engine that has two inputs; the goal the user selected (increase income, enhance returns, reduce risk) and the asset classes held in the loaded portfolio.

Illustrative Example:

These hypothetical alternate portfolios add varying asset classes to the original portfolio and ‘source from’ existing asset classes. The alternate portfolios are identified by whether they are sourced from the Equity sleeve of the portfolio, the Fixed Income sleeve of the portfolio, or both Equity & Fixed Income. Suggestions will illustrate a 20% allocation to the asset classes presented, provided the portfolio has sufficient initial exposure to the asset classes to ‘source from’, otherwise a reduced allocation is presented. These added asset classes & sourcing are determined by BlackRock. Within the decision tree, asset classes are chosen that offer greater potential to deliver the given goal (relative to their funding source). The BlackRock Capital Market Assumptions are the primary driver of the assessment of ‘potential to deliver the given goal’, and consideration is also given to additional aspects including investment style (e.g., income-oriented or sustainable) and current risk.

Behind every added asset class is a representative investment that is determined by BlackRock. Details of the investments can be found in Step 3 of the tool. The universe of investments considered by the tool is limited to BlackRock mutual funds and iShares exchange-traded funds (“ETFs”). The flagship BlackRock or iShares product associated with the asset class or investment style is illustrated (typically the largest offering, based on AUM). Other investments not available in the tool may have characteristics similar or superior to those that are included. It is important to note that each fund is shown for promotional purposes only, and the financial professional should determine whether any specific fund is an appropriate fit for a given portfolio. The asset classes and funds are not customized for any specific client portfolio and are based solely on the criteria identified above. Certain asset classes and corresponding representative investments within the hypothetical alternate portfolios may not contribute positively to the investment goal selected in the tool in all instances.

iCRMH0125U/S-4087449

iCRMH0225U/S-4197712