Against a backdrop of volatility and regulatory change, a new generation of multi-asset funds has proven invaluable for financial advisers and their clients.

Capital at risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested.

The UK investment market has evolved over the past five years, with both independent financial advisers (IFAs) and self-directed retail investors increasingly adopting risk-managed multi-asset portfolios.

Global assets under management in the Investment Association Volatility Managed and Mixed Asset sectors grew from USD $200bn at the end of May 2019 to $295bn at the end of February this year.1

Alongside this, the new macro market regime we have entered – prompted by the Covid-19 pandemic, increased geopolitical tensions and the resulting inflationary environment – has led self-directed retail investors to reassess their portfolio allocations.

Many are keen to outsource portfolio management to asset management experts who are well placed to navigate this new environment. The popularity of multi-asset strategies has risen as a result – both for investors with an IFA and self-directed investors through digital platforms.

The latter category of service providers is flourishing. Digital investing is the fastest-growing wealth segment in the UK, with 9.5 million accounts open at the end of 2022 – up 39% since 2020.2 UK investors are increasingly demanding simple and accessible investment management that meets their financial needs, be that through self-directed or professionally advised investing.

Challenging times for IFAs

Financial advisers and wealth managers have endured an increasingly difficult backdrop in recent years. Economic pressures and the Consumer Duty rules, along with other legislation, have created additional compliance pressures and work for advisers. While professional indemnity premiums have soared and advisory businesses have also seen day-to-day operational costs rise.

To counteract some of these pressures, many IFAs have been looking for ways to free up time to play to their strengths. They want to focus on providing personalised customer support that differentiates them from digital offerings. Outsourcing investment management to a third party can help. Rather than spending time calculating optimum equity and fixed-income allocations, or fine-tuning economic forecasts, advisers can instead focus on wider concerns of financial planning.

Risk-based multi asset funds

Risk-based multi-asset funds enable clients to diversify their portfolios while staying within risk-tolerance levels. This characteristic is proving increasingly popular with clients and their advisors, says Douglas Kearney at Intelligent Pensions: “We want resilience in difficult markets – an investment solution that could be proactive to changes in the market.”

Risk: Diversification and asset allocation may not fully protect you from market risk.

Risk-based multi-asset funds give advisers access to a range of investment funds. Outsourcing investment management into these funds brings several benefits for advisers:

- Multi-asset diversification: investments are made across a broad range of asset classes, which could help in reducing overall portfolio risk.

- Cost effective: many funds are invested in value-for-money ETFs and index funds. This makes them significantly cheaper than other products managed by discretionary fund managers. Lower costs mean potential better net returns for clients.

- Tailored risk profiles: advisers can select funds according to clients’ risk profiles, goals and circumstances. These are then actively managed by fund managers to ensure consistent risk levels.

- Professional management: asset allocations can be adjusted to suit changing market conditions. This more active ‘hand on wheel’ approach could ensure the risk profile remains appropriate, in contrast to a ‘set-and-forget’ strategy.

Risk: There can be no guarantee that the investment strategy can be successful and the value of investments may go down as well as up.

Building a strong track record

BlackRock’s MyMap range of multi-asset funds have been designed to meet the needs of today’s advisers and wealth managers, and their diverse clients.

Ross Leckridge of IFA firm Aberdein Considine says MyMap keeps IFAs informed of changes to the funds. Even in opting for an active management style, he says that BlackRock helps them understand “the decisions that are being made and why they’re being made,” adding: “We understand the strategy. We believe in the strategy.”

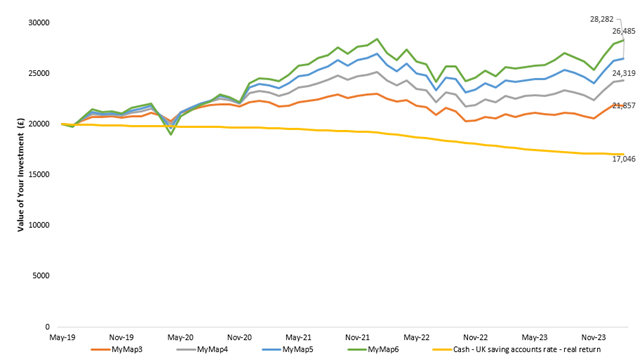

Five years of strong returns3, despite a challenging economic backdrop, demonstrate that this approach not only works in theory, but in practice, too. The graph below shows how £20,000 invested in various MyMap funds compares to £20,000 left as cash savings over a five-year period.

| YTD 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | Since Inception* | |

|---|---|---|---|---|---|---|---|

| (31-Dec 2023 to 31-March 2024) | (31-Dec 2022 to 31-Dec 2023) | (31-Dec 2021 to 31-Dec 2022) | (31-Dec 2020 to 31-Dec 2021) | (31-Dec 2019 to 31-Dec 2020) | (28-May 2019 to 31-Dec 2019) | ||

| MyMap 3 | 1.14% | 6.39% | -10.73% | 3.23% | 7.21% | 4.09% | 2.26% |

| MyMap 4 | 3.56% | 9.24% | -11.98% | 7.99% | 9.60% | 6.34% | 4.93% |

| MyMap 5 | 4.73% | 11.34% | -12.46% | 12.35% | 11.44% | 7.67% | 6.99% |

| MyMap 6 | 6.89% | 12.63% | -12.72% | 15.67% | 12.39% | 9.19% | 8.74% |

Even investors in the more conservatively managed MyMap 3 fund have seen their money grow in real terms, earning £4,859 more than the equivalent cash savings.

Those in the funds with a higher risk rating (e.g. MyMap 4, MyMap 5 and MyMap 6) are looking at significantly higher returns of around £10,000 on average, significantly boosting their progress toward longer-term financial goals.

| Graph 1: Returns on £20,000 investment. | ||||

| MyMap3 | MyMap3 | MyMap3 | MyMap3 | |

| How much more would you earn > Cash (£) | + £4,859 | + £ 7,599 | + £ 9,944 | + £ 11,995 |

The figures shown relate to past performance. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or a strategy.

Source: BlackRock, BoE database as of April 30th 2024. For MyMap 3, MyMap 4, MyMap 5 and MyMap6 : The data shows the growth of an initial GBP 20,000 investment.

This has been calculated by taking the monthly fund performance, which is calculated on an NAV basis, net of fees, in GBP, for the D share class. For the Real Cash UK Savings Account: The data shows the growth of an initial GBP 20,000 investment to a UK cash savings account. This has been calculated by taking the ‘Monthly interest rate of UK monetary financial institutions (excl. Central Bank) sterling instant access deposits excluding unconditional bonuses from households (in percent) not seasonally adjusted’ metric from the BoE database. The real return is calculated by adjusting this inflation by using the monthly U.K Consumer Price Index (CPI).

This data highlights not only the benefit of a multi-asset approach, but also the added-value delivered by BlackRock’s expert investment team.

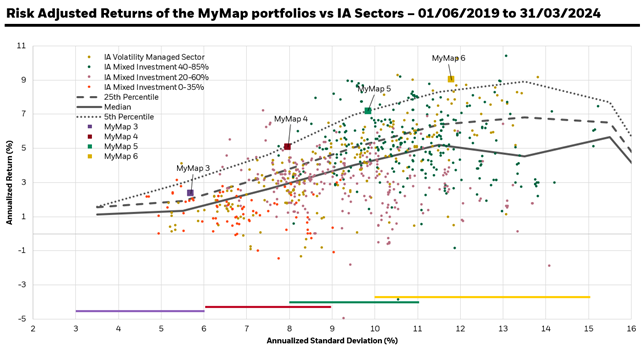

Performance versus peers

How has BlackRock achieved such returns on its MyMap funds? Much is due to the focus on risk management – particularly on rewarding risk across different funds. But it also comes down to deep expertise. As the world’s largest fund manager,4 BlackRock fund managers can draw on extensive research and expertise to inform allocation decisions.

Although BlackRock is the largest asset manager in the world, its investment solutions and MyMap’s actively managed by UK-based investment teams, are designed to provide the personalised, tailored services IFAs need.

Herbert and Webster’s Adam Herbert says: “The MyMap range brings together all of BlackRock’s best investment capabilities.” He notes that the range allows advisers to get on with their priorities: “We are helped by the performance of the portfolio, which allows us to spend more time speaking to clients.”

MyMap. Ready when you are.

In these times, multi-asset funds are becoming invaluable tools for advisers. Portfolios built from ETFs and assembled by expert fund managers offer a simple, affordable and robust solution for advisers, enabling them to focus on delivering a superior service for clients.

Ready-made funds can also give advisers peace of mind, allowing them to outsource the monitoring of regulatory requirements. In a persistently challenging environment, BlackRock’s MyMap range seeks to enable IFAs to give their clients the stability and growth they need to meet their financial goals.

Sources:

1 Morningstar 02/04/2024

2 Statista 02/04/2024

3 5 years’ performance data Source: BlackRock 10th June 2024

4 Business Insider, 10 Jan 2024