Multi-Asset Strategies and Solutions (MASS)

Why BlackRock for multi-asset solutions?

We utilize the full breadth and depth of BlackRock’s global investment platform, leveraging expertise across asset classes and geographies to help clients achieve their investment goals. Clients are turning to BlackRock’s Multi-Asset Strategies and Solutions (MASS) group for:

Our investment platform

Delegated investment management of all or a portion of a client’s portfolio

Investment access through both BlackRock-managed strategies and external managers

Strategies that capitalize on the divergence across global economies and seek to deliver alpha over the long-term

All-in-one target date solutions blending index, factor, and alpha funds

Navigating the market with portfolio expertise.

Our Multi-Asset Strategies and Solutions (MASS) team leverages the expertise of the firm along with our Aladdin® technology platform to help clients reach their goals.

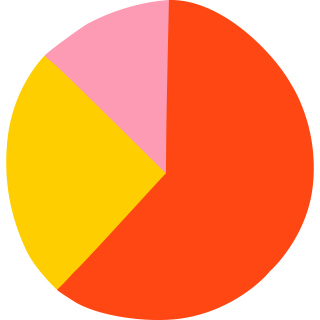

Our multi-asset solutions

Our OCIO business sits at the heart of our firm’s mission to help more people experience financial well-being. Clients come to us to help them deliver better investment outcomes and serve the communities and beneficiaries they represent.

Our GTAA team has a 15-year track record of managing diversified tactical portfolios. Through a top-down, global macro approach, the team seeks to deliver uncorrelated alpha for institutions around the world.

The Multi-Alternatives team (“Multi-Alts”) designs and manages diversified portfolios across liquid and illiquid alternatives by leveraging BlackRock's investment and technology capabilities, plus access to deal flow and external managers.

LifePath® Target Date Funds offer age-based, diversified portfolios that automatically adjust over time to help members achieve retirement income goals.

Leadership

Interested in exploring the role of multi-asset in portfolios?