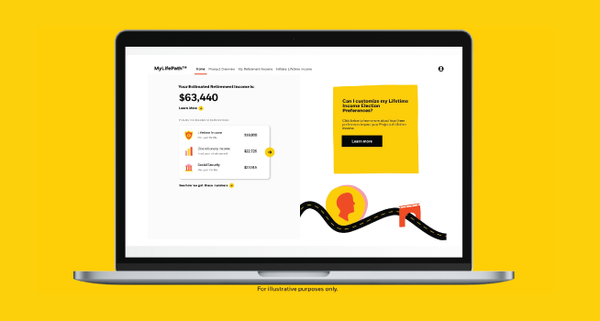

LifePath Paycheck®

People are living longer – and that should be a great thing. But most workers today can’t count on the kind of guaranteed retirement income that previous generations had. We’re changing that with LifePath Paycheck™, a solution designed to give workers access to income streams they can rely on in retirement – for life.

The benefits

01.

Choice

02.

Simplicity

03.

Cost efficiency

Life doesn’t retire™

Insights for better outcomes

10 years of Read on Retirement®

Discover the trends shaping retirement—and the bold steps needed to close the savings gap.

This year’s survey provides insights into the confidence, concerns and behaviors of workplace savers, plan sponsors and retirees to help build a more secure retirement for everyone.

When nest eggs need a safety net

22%. That is the average increase in potential retirement spending that individual savers in defined contribution plan can achieve when they embed guaranteed retirement income solutions into a target date fund. For lower-income workers, it’s a 25% increase.

Anchoring spending in choppy waters: The impact of guaranteed income

New research demonstrates the range of outcomes an investor might expect across market environments with and without guaranteed retirement income.

Our principles of decumulation

Financial advice often focuses on boosting personal savings rates and maximizing return on investment during a worker’s accumulation years. Equally important, however, is the decumulation process, when people spend those savings in the form of income.

Navigating the retirement window: Introduce more certainty to outcomes

The “Retirement Window” is the period between 55-70 when risks are heightened and pivotal decisions shape retirement outcomes.

Solving five key retirement income concerns for plan sponsors

We commissioned a study by Greenwald Research to ask 300 defined contribution decision makers about their biggest concerns around retirement income. Here’s how we’re already addressing them.

The value of annuities

Our most recent Read on Retirement® survey told us workplace savers-and retirees-see value in lifetime income. We wanted to know more about what, exactly, that value was. So, we reached out to the voice of experience: annuity owners. Five key values emerged.

Lights, camera, income…

Check out our latest videos on retirement income – and the impact it can have.

A Retirement Paycheck

BlackRock Bottom Line: Retirement for the ages

Guaranteed retirement income explained

LifePath® target date strategies

With over thirty years of choice built on a foundation of research and experience, our target date strategies have the potential to help participants navigate uncertainty and prepare for retirement.