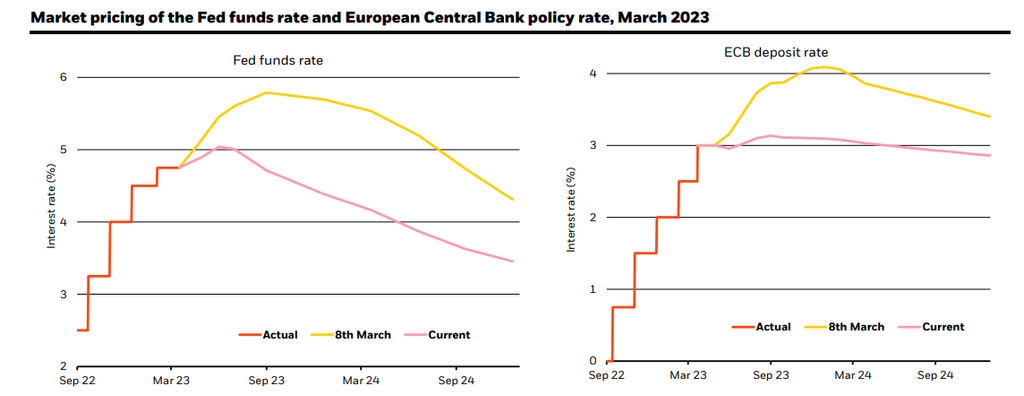

Source: Forward looking estimates may not come to pass. Source: BlackRock Investment Institute, with data from Refinitiv Datastream, March 2023. Notes: The charts show the forward fed funds rate and the European Central Bank deposit rate through December 2024 as implied by futures prices

What to expect

Long-term trends, such as aging workforces and geopolitical fragmentation, will keep inflation persistently above pre-pandemic levels. Meanwhile, central banks continue to hike rates to reign in prices, despite their inability to resolve production constraints. We think that U.S. interests rates will reach around 2.5% in the U.S. by the middle of the year, creating more financial pains.

Persistent inflation

U.S. and Euro area inflation and our expectations, 2006-2026

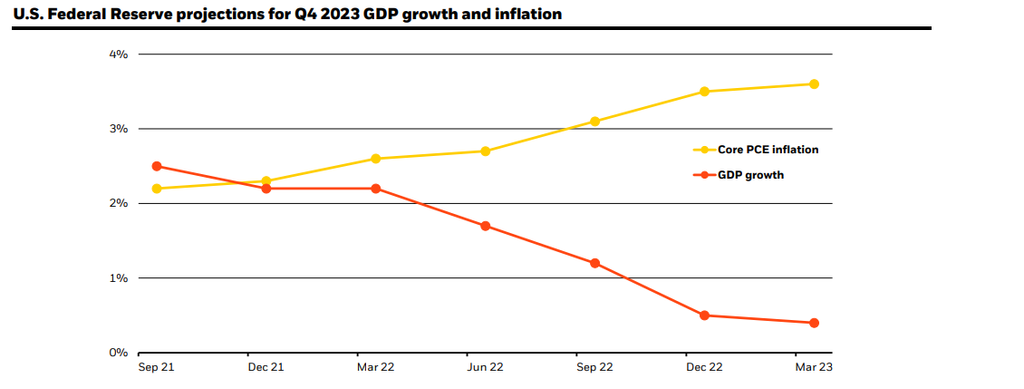

U.S. inflation data at the beginning of 2023 showed that core inflation – which excludes food and energy – is still very high, and core services inflation excluding shelter is running close to 6% on an annual basis. Inflation is nowhere near on track to settle back at the Fed 2% target. Unless the worker shortage can be solved, we think getting inflation down means reducing economic activity to a level that can be more comfortably sustained.

Supply chain constraints

Supply chain disruptions are at historical highs

The surge in inflation over the past year has been driven by economy-wide and sector-specific supply constraints, a profound change from the decades-long dominance of demand drivers. The pandemic resulted in a huge switch in consumer spending in the U.S., away from services and towards goods. This pushed up goods prices, resulting in higher overall inflation, despite activity not being back to its pre-COVID path. We were in a world shaped by supply and expected the supply side to adjust over time – but the nature of the activity restart meant we were far from 1970s stagflation. We are now seeing a textbook energy supply shock, more like the 1970s, layered on top of the restart.

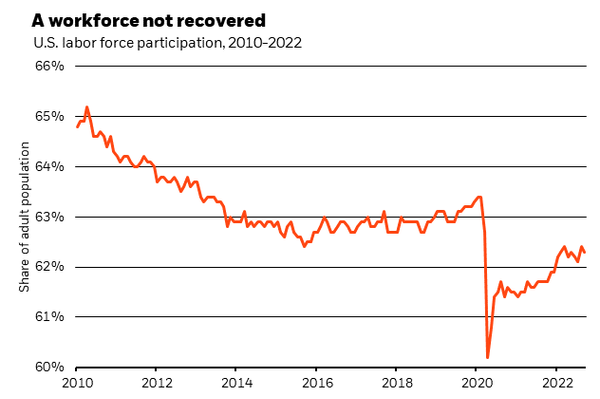

A workforce not recovered

Even though U.S. unemployment is at a 50-year low, workforce participation rates still significantly lag pre-2020 levels. Aging demographics were already going to add pressures to labor markets, but then the forced break from work during the pandemic likely pushed many older workers into early retirements.

U.S. GDP and potential supply capacity, February 2023

A world shaped by supply constraints will bring more macroeconomic volatility. Central banks have to either accept higher inflation or destroy demand to squeeze wages and prices to rein in inflation.

Central bank frameworks

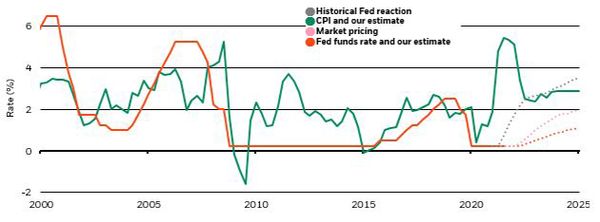

U.S. CPI inflation, Fed Funds Rate and expectations, 2000-2025

Major central banks’ much more muted policy reaction shows that they will likely live with supply-driven inflation rather than destroy demand and economic activity – provided that inflation expectations remain anchored. We see a steeper yield curve than the market currently expects as inflation rises due to accommodative central bank policy, continued fiscal spending in developed economies, and a revival of the term premia.

Portfolio positioning

The Great Moderation, the multi-decade long period of low inflation and low volatility, is over. Focused on taming inflation, central banks are poised to overtighten and are unlikely to come to the rescue if a recession takes hold. This fundamentally different regime requires a new investment playbook.

A new investment playbook

Put dispersion to work in your portfolioHigher levels of dispersion can create opportunities that can be captured with granular asset allocation decisions and active insights.

Make dynamic portfolio choicesRe-examine asset class assumptions and consider more frequent portfolio adjustments to navigate an uncertain road ahead.

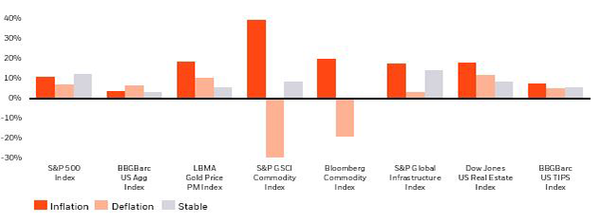

Ways to address inflation within your portfolio

Key points

01.

Inflation stabilizes higher

02.

A new frontier for yield

03.

Diversification is key

I don’t think we’re going into a recession, but I think it's becoming more prominent in the thought process of a lot of people out there. So, what do you do with that?

Rick RiederChief Investment Officer of Global Fixed Income at BlackRock