The war in Ukraine has already caused a terrible human toll. We see it extracting a heavy economic price as well, mostly via higher energy costs. This is a major supply shock layered onto an existing one, and we see it resulting in higher inflation and lower growth, especially in the euro area. This puts central banks in a bind: Trying to contain inflation will be more costly, and they can’t cushion the growth shock. We prefer developed equities in this inflationary environment.

Energy shock

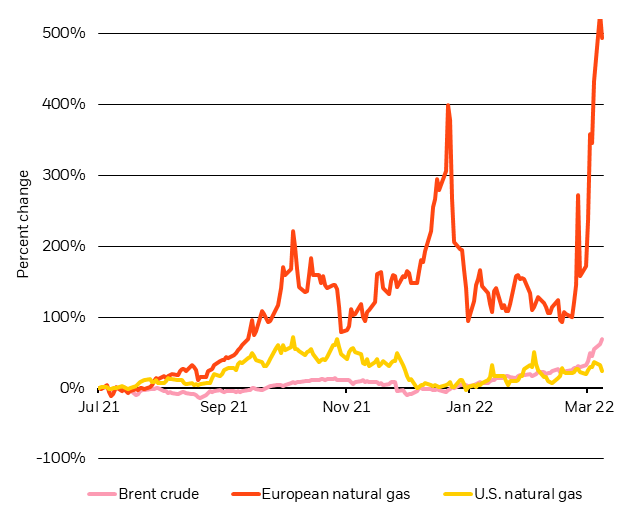

U.S. and European energy prices, 2021-2022

Sources: BlackRock Investment Institute, with data from Refinitiv Datastream, March 2022. The lines show the changes in price of different commodities since July 1, 2021. European natural gas price based on European Energy Derivatives Exchange futures, U.S. based on MYM-Henry Hub Gas futures price. Oil price based on ICE-Brent crude futures.

The Ukraine war has caused a spike in energy prices, putting a damper on growth and exacerbating supply-driven inflation. Europe is most exposed. Natural gas prices have surged beyond 2021 peaks, as the red line in the chart shows, before reversing a bit last week. The big difference with 2021: High energy prices are now the cause of a downdraft in growth, whereas they were the outcome of strong growth then. The culprit is Europe’s reliance on Russian gas in an already tight market. The powerful economic restart from the Covid-19 shock in 2021 had already exposed mismatches in the region’s energy supply and demand. This was aggravated by a mix of geopolitical factors and weather-related supply disruptions just as European inventories were low. The recent surge in European energy prices has pushed the region’s energy burden as a percentage of GDP to above levels reached in the early 1970s, we calculate, whereas the U.S. is still well below it. This is why we think the impact of the current energy shock for Europe could be on par with previous severe episodes such as the 1973 oil embargo.

Higher energy prices are a material, global shock. Europe is facing a large, stagflationary shock, in our view. Analysts are ratcheting down their growth forecasts and upping their inflation projections. This is not over, and we believe the European Central Bank (ECB) growth forecasts understate the shock’s impact on growth. The U.S. is in a better spot, in our view. The shock is less than previous energy crises. The U.S. also has a larger growth cushion thanks to the strong restart’s momentum – even if some of European weakness is bound to spill over.

How will policymakers respond to the poisonous combination of slowing growth and rising inflation? Central banks have to normalize policy as the economy no longer needs stimulus, we believe, so policy rates are headed higher. The ECB last week said it would phase out asset purchases and left the door open for a rate increase this year – the first in more than a decade. The U.S. Federal Reserve this week is expected to announce its first rate hike since the Covid shock, while the Bank of England and a slew of emerging market central banks are set to hold rates or raise them. We still see a historically muted cumulative response to inflation; more aggressive tightening would come at too high a cost to growth and employment. Central banks will be forced to live with inflation. But it’s tough to see central banks coming to the rescue to halt a growth slowdown in this inflationary environment. Our conclusion: central banks are less likely to shape macro outcomes going forward. That leaves fiscal support. The war has raised the prospect of fiscal stimulus to achieve energy security and up defense outlays, but we see this taking time.

The imminent hit to growth has reduced the risk that central banks slam the brakes and aggressively raise rates to contain inflation. So what are the risks? In the short run, escalation of the war and more energy supply shocks are key catalysts for more risk-off market moves. We see a risk of inflation expectations becoming unanchored in the medium term, causing central banks to raise rates sharply. Energy prices are now driving growth, rather than being the result of it. This raises the specter of stagflation–something that was not in play before due to the economy’s strong growth momentum.

What does this mean for investments? We prefer to take risk in DM equities against the inflationary backdrop of negative real bond yields. We expect the global energy shock to hurt corporate earnings, especially in Europe. Recent market declines reflected this, we believe, and the region’s stocks are highly geared toward global growth. We stay underweight government bonds. They are losing their diversification benefits, and we see investors demanding greater compensation for holding them amid higher inflation and larger debt loads. Within the asset class, we prefer short-dated and inflation-linked bonds.

Read our past weekly commentaries here.

Spending shift drives inflation

Assets in review

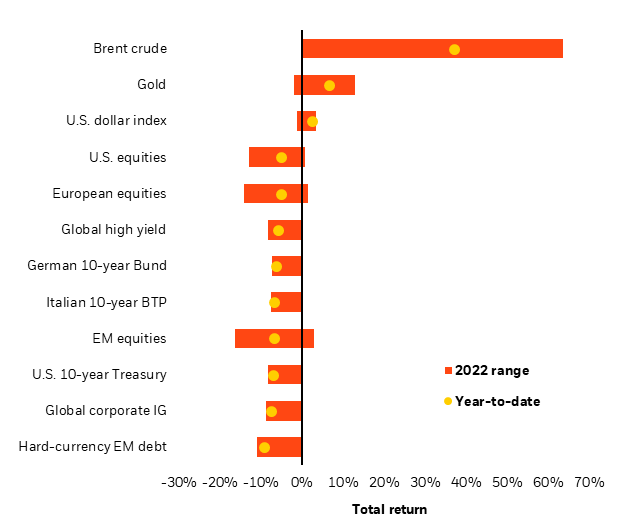

Selected asset performance, 2022 year-to-date return and range

Past performance is not a reliable indicator of current or future results. Indexes are unmanaged and do not account for fees. It is not possible to invest directly in an index. Sources: BlackRock Investment Institute, with data from Refinitiv Datastream as of March 10, 2022. Notes: The two ends of the bars show the lowest and highest returns at any point this year to date, and the dots represent current year-to-date returns. Emerging market (EM), high yield and global corporate investment grade (IG) returns are denominated in U.S. dollars, and the rest in local currencies. Indexes or prices used are: spot Brent crude, ICE U.S. Dollar Index (DXY), spot gold, MSCI Emerging Markets Index, MSCI Europe Index, Refinitiv Datastream 10-year benchmark government bond index (U.S., Germany and Italy), Bank of America Merrill Lynch Global High Yield Index, J.P. Morgan EMBI Index, Bank of America Merrill Lynch Global Broad Corporate Index and MSCI USA Index.

Market backdrop

Crude oil prices shot up to 14-year highs on supply concerns but then suffered their biggest one-day decline in almost two years. Equities followed suit, rebounding from plumbing new 2022 lows earlier in the week. The ECB said it would phase out asset purchases in the third quarter and left the door open for a rate increase this year. Peripheral bond spreads widened.

Week ahead

March 15 – China industrial output and retail sales; UK unemployment data

March 16 – Fed monetary policy meeting; Brazil rate decision

March 17 – UK, Indonesia and Turkey rate decisions

March 18 – Russia rate decision

The U.S. Federal Reserve is expected to raise its policy rate for the first time since the Covid shock. The Bank of England (BoE) is set to announce its third hike, and a slew of emerging market central banks are set to hold rates or raise them. Both the Fed and BoE are keen to normalize policy rates back to pre-Covid settings. We don’t expect them to go beyond that to try to squash high inflation as the costs to growth and employment would be too high. We see central banks living with inflation.

Read our past weekly commentaries here.

Directional views

Strategic (long-term) and tactical (6-12 month) views on broad asset classes, September 2020

| Asset | Strategic view | Tactical view | |

| Equities |  |

|

|

| We have turned neutral on equities on a strategic horizon given increased valuations and a challenging backdrop for earnings and dividend payouts. We move to a modest underweight in DM equities and tilt toward EM equities. Tactically, we are also neutral on equities overall . We like the quality factor for its resilience and favor Europe among cyclical exposures. | |||

| Credit |  |

|

||

| We have turned neutral on credit on a strategic basis because we see investment grade (IG) spreads offering less compensation for any increase in default risks. We still like high yield for income. On a tactical horizon, we strongly prefer high yield for its income and more room for spread tightening. We are neutral on IG and underweight emerging market debt. | ||||

| Govt Bonds |  |

|

|

| The strategic case for holding nominal government bonds has materially diminished with yields closer to perceived lower bounds. Such low rates reduce the asset class’s ability to act as ballast against equity market selloffs. We prefer inflation-linked bonds as we see risks of higher inflation in the medium term. On a tactical basis, we keep duration at neutral as unprecedented policy accommodation suppresses yields. | |||

| Cash |  |

|

||

| We are neutral on cash. Holding some cash makes sense as a buffer against supply shocks that could drive both stocks and bonds lower. | ||||

| Private markets |  |

|

|

| Non-traditional return streams, including private credit, have the potential to add value and diversification. Many institutional investors remain underinvested in private markets as they overestimate liquidity risks, in our view. Private assets reflect a diverse array of exposures but valuations and inherent uncertainties of some private assets keep us neutral overall. | |||

Note: Views are from a U.S. dollar perspective, September 2020. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding any particular funds, strategy or security.

Our granular views indicate how we think individual assets will perform against broad asset classes. We indicate different levels of conviction.

Tactical granular views

Six to 12-month tactical views on selected assets vs. broad global asset classes by level of conviction, September 2020

Equities

| Asset | Tactical view | ||

| United States |  |

|

|

| We are neutral on U.S. equities. Risks of fading fiscal stimulus and an extended epidemic are threatening to derail the market’s strong run. Renewed U.S.-China tensions and a divisive election also weigh. | |||

| Europe |

|

|

|

| We are overweight European equities. The region is exposed to a cyclical upside as the economy restarts, against a backdrop of solid public health measures and a galvanizing policy response. | |||

| Japan |

|

|

|

| We keep Japanese equities at neutral. We see strong fiscal policy and public health measures allowing for rapid normalization. | |||

| Emerging markets |  |

|

|

| We are underweight emerging market equities. We are concerned about the pandemic’s spread and see less room or willingness for policy measures to cushion the impact in many – but not all – countries. | |||

| Asia ex-Japan |  |

|

|

| We hold Asia ex-Japan equities at neutral. Renewed U.S.-China tension is a risk. China’s goal to balance growth with financial stability has led to relatively muted policy measures to cushion the virus fallout. | |||

| Momentum |  |

|

|

| We keep momentum at neutral. The sectoral composition of the factor provides exposure to both growth (tech) and defensive stocks (pharma). Yet momentum’s high concentration poses risks as recovery takes hold. | |||

| Value |

|

|

|

| We are neutral on value. We see the ongoing restart of economies likely benefiting cyclical assets and potentially helping value stage a rebound after a long stretch of underperformance. | |||

| Minimum volatility |  |

|

|

| We hold min vol at neutral. The restart of economies is likely to benefit cyclical assets and reduce the need for defensive exposures. | |||

| Quality |

|

|

|

| We keep our strong overweight on quality. We see it as the most resilient exposure against a range of outcomes in terms of developments in the pandemic and economy. | |||

Fixed income

| Asset | Tactical view | ||

| U.S. Treasuries |

|

|

|

| We still like U.S. Treasuries. Long-term yields are likely to fall further than other developed market peers, even as low rates reduce their ability to cushion against risk asset selloffs. | |||

| Treasury Inflation-Protected Securities |  |

|

|

| We are neutral on TIPS. A huge decline in rates makes the entry point less attractive. We still see potential for higher inflation over time and like TIPS in strategic allocations. | |||

| German bunds |

|

|

|

| We remain underweight bunds as current yield levels provide little cushion against major risk events. Also, potential issuance related to the proposed EU recovery fund could compete with bunds for investment. | |||

| Euro area peripherals |  |

|

|

| We are overweight euro area peripheral government bonds despite recent outperformance. We see further rate compression due to stepped-up quantitative easing by the European Central Bank and other policy actions. | |||

| Global investment grade |  |

|

|

| We downgrade investment grade credit to neutral. We see little room for further yield spread compression, as we see deeper rate cuts and more asset purchases as unlikely as policy response. Central bank asset purchases and a broadly stable rates backdrop still are supportive. | |||

| Global high yield |

|

|

|

| We increase our overweight on high yield. We see the very high implied default rates as overly pessimistic, and high yield remains an attractive source of income in a yield-starved world. | |||

| Emerging market - hard currency |  |

|

|

| We are underweight hard-currency EM debt due to the pandemic’s spread, heavy exposure to energy exporters and limited policy space in some emerging economies. Default risks may be underpriced. | |||

| Emerging market - local currency |  |

|

|

| We have downgraded local-currency EM debt to underweight. We see many EM countries as having insufficient capacity to rein in the virus spread and limited policy space to cushion the shock from the pandemic. | |||

| Asia fixed income |

|

|

|

| We are neutral on Asia fixed income. The pandemic’s containment in many countries and low energy exposure are positives. Renewed U.S.-China tensions and China’s relatively muted policy fallout are risks. | |||

Past performance is not a reliable indicator of current or future results. It is not possible to invest directly in an index. Note: Views are from a U.S. dollar perspective. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast or guarantee of future results. This information should not be relied upon as investment advice regarding any particular fund, strategy or security.

Read our past weekly commentaries here.

Read details about our investment themes and more in our 2022 Global outlook.

We expect central banks to carry on with normalizing policy. We see a reduced risk of them slamming on the brakes to deal with supply-driven inflation. Politically, it’s easier to blame inflation on the Ukraine war and argue that monetary policy can do little about it, in our view.

-

- This means central banks are unlikely to come to the rescue to halt a growth slowdown by cutting rates. In addition, the risk of inflation expectations becoming unanchored has increased as inflation becomes more persistent.

- We believe the cumulative response to rising inflation will be historically muted. DM central banks have already demonstrated they are more tolerant of inflation.

- The Fed is poised to start hiking rates this week for the first time since the pandemic hit. The European Central Bank last week struck a hawkish tone, leaving the door open for a rate increase later this year. We expect it to adopt a flexible stance in practice, given the material hit to growth from higher energy prices.

- Investment implication: We prefer equities over fixed income and remain overweight inflation-linked bonds.

We had thought the unique mix of events – the restart of economic activity, virus strains, supply-driven inflation and new central bank frameworks – could cause markets and policymakers to misread the current surge in inflation.

-

- We saw the confusion play out with the aggressively hawkish repricing in markets at start the year.

- The Russia-Ukraine conflict has compounded the inflation picture. Yet we still think the response to inflation will be historically muted as central banks focus on getting policy rates closer to neutral.

- So far the sum total of expected rate hikes hasn’t changed, even as markets have cooled expectations of higher rates in the near term.

- Investment implication: We have tweaked our risk exposure to favor equities at the expense of credit.

Climate risk is investment risk, and the narrowing window for governments to reach net-zero goals means that investors need to start adapting their portfolios today. The net-zero journey is not just a 2050 story, it's a now story.

-

- Sustainability cuts across multiple dimensions: the outlook for inflation, geopolitics and policy. The green transition comes with costs and higher inflation, yet the economic outlook is unambiguously brighter than a scenario of no climate action or a disorderly transition. Both would generate lower growth and higher inflation, in our view.

- Risks around a disorderly transition are high – particularly if execution fails to match governments’ ambitions to cut emissions.

- We favor sectors with clear transition plans. Over a strategic horizon, we like sectors that stand to benefit more from the transition, such as tech and healthcare, because of their relatively low carbon emissions.

- Investment implication: We favor DM equities over EM as we see them as better positioned in the green transition.

Read our past weekly commentaries here.