BEFORE YOU BUY: LEARN HOW TO SELECT ETFs

New to ETFs? Explore our guide to ETF selection when placing an order.

Learn how you can select, compare, and trade ETFs with our comprehensive guide.

New to ETFs? Explore our guide to ETF selection when placing an order.

iShares ETFs are available on a number of brokerages1 in Singapore. Learn more about some of these platforms listed below:

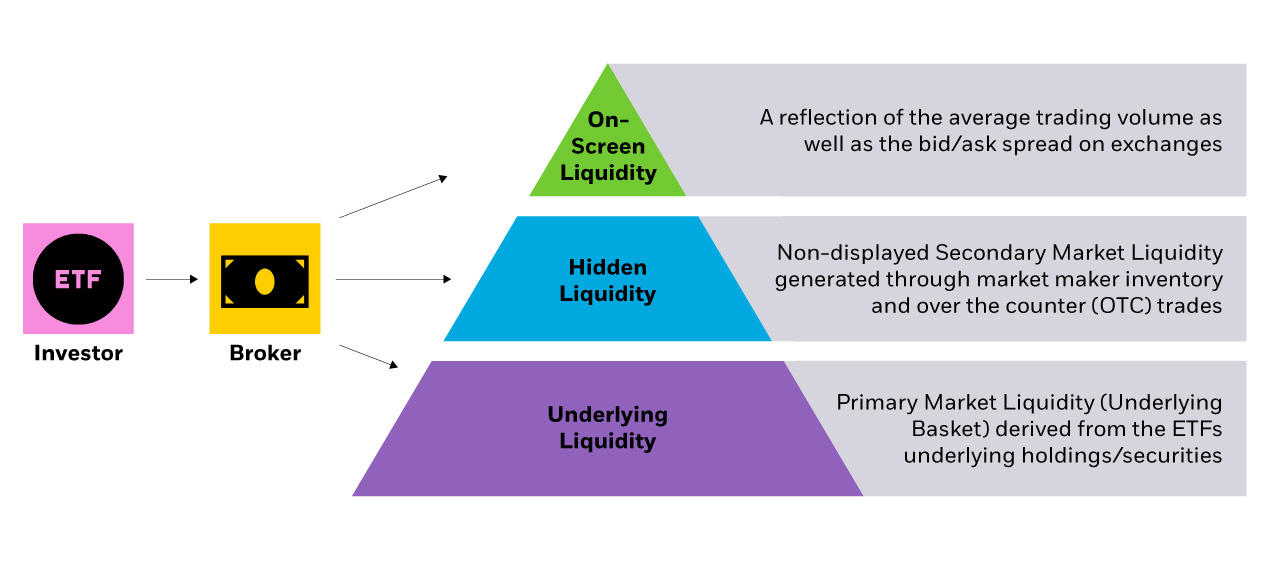

Liquidity is always an important consideration when selecting any investment. The more liquid an investment, the easier and more cost effective it should be to trade. A less liquid investment can take longer to buy or sell and cost more to do so.

ETFs can be bought and sold during the trading day. When evaluating ETF liquidity, it is important to remember that ETFs differ from ordinary shares in one distinct way – ETFs are open-ended investment vehicles. This means that the number of shares in the ETF can actually increase or reduce to meet investor demand.

Although ETFs trade like shares, the liquidity of an ETF works very differently to the liquidity of a share. With an ordinary share, trading reflects the buyers and sellers interacting on an exchange at a price that represents the economic value of a company and investor supply and demand. The trading of the ETF also depends on the investor supply and demand of the ETF, but this only partially accounts for the liquidity of an ETF (on-screen liquidity). There are in fact multiple layers that make up the entire liquidity of an ETF:

Self-directed investors can open a brokerage account to invest in ETFs. Refer to the list of online trading platforms above to get started.

There are two common order types available on trading platforms:

Yes, the Supplementary Retirement Scheme (SRS) can be used to invest in ETFs listed on the SGX. The SRS is a government-led initiative that helps Singaporeans invest for retirement and is separate from the Central Provident Fund (CPF). There are personal income tax benefits from SRS contributions. Learn more here.