Navigator: The road ahead

Markets are moving fast, and volatility is reshaping how we think about growth.

The U.S. is a powerful growth engine, with AI its big driver. It’s fueling demand for chips, cloud infrastructure and next-generation software and this is why being selective matters. Targeted exposure in these areas may capture long-term growth potential.

But the AI story goes beyond the U.S.

Asia is emerging as a key player in the AI value chain. From advanced chipmaking in Taiwan to data centers in Southeast Asia, these markets fresh growth opportunities and diversification benefits.

Opportunities for income are broadening out.

Within fixed income, looking beyond traditional benchmarks can help provide ballast and resilience.

That’s why we go further and look at areas such as bank loans, securitized credit, and local currency debt to diversify income potential.

Lean into multi-asset strategies that can combine bonds and stocks to dynamically deliver income potential through cycles.

And consider equity dividend strategies with option layers, offering another way to stay invested while generating cash flow potential.

Think beyond the traditional and make your income work harder for you.

In today’s changing markets we need to rethink our approach to diversification.

Consider using liquid alternatives such as market-neutral and systematic total alpha strategies, that seek to deliver returns that don’t move in step with markets.

Combining these strategies with a whole-portfolio view helps ensure diversification works when it should.

Important Information

This material is prepared by BlackRock and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date shown above and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader. This material is intended for information purposes only and does not constitute investment advice or an offer or solicitation to purchase or sell in any securities, BlackRock funds or any investment strategy nor shall any securities be offered or sold to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. Investment involves risks. Past performance is not an indication for the future performance.

In Hong Kong, this material is issued by BlackRock Asset Management North Asia Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

In Singapore, this is issued by BlackRock (Singapore) Limited (Co. registration no. 200010143N). This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

No part of this material may be reproduced, stored in retrieval system or transmitted in any form or by any means, electronic, mechanical, recording or distributed without the prior written consent of BlackRock.

©2025 BlackRock, Inc. or its affiliates. All Rights Reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

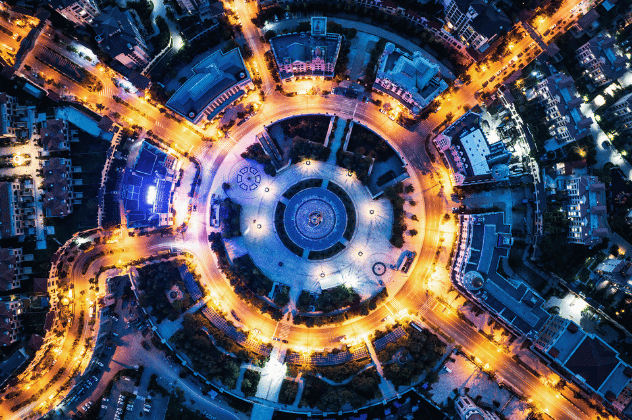

Your roadmap for 2026 starts here. Pursue income, unlock growth, stay diversified and build resilient portfolios with ideas built for today’s markets.

The way forward

-

01

Roads to income

Expand your universe. Look to Asia. Diversify with high-income equity.

Capture differentiated income streams through global bonds, Asian credit, and equity strategies designed for resilience and yield. -

02

Roads to growth

Keep the U.S. in focus. Be precise in AI exposures. Seek global opportunities.

Position for innovation and resilience by balancing U.S. leadership with emerging market potential and targeted AI strategies. -

03

Roads to diversification

Build resilience. Blend liquid alternatives.

Go beyond the traditional with liquid alternatives and gold to strengthen portfolios against volatility and enhance risk-adjusted returns.

Roads to income

Relying on traditional fixed income could limit returns this year. Look for ways to diversify income sources and improve resilience without sacrificing quality.

High yield, emerging market and non-agency securitized bonds offer the potential to spread risk and open more ways to earn.

Asian USD bonds offer ~70 basis points more yield than U.S. IG corporates1, with 85% investment-grade quality and moderate duration2.

Dividend equities and option overlays can enhance income potential while cushioning downside risk.

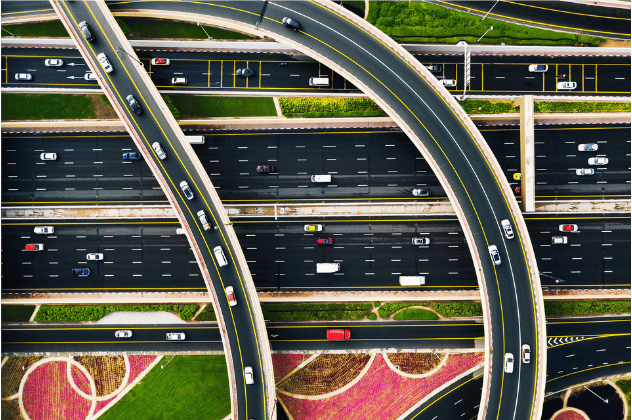

Roads to growth

U.S. assets continue to dominate. Massive capital spending on AI is reshaping the economy, creating opportunities along with concentration risks. Active management and precision will be key.

AI now spans semiconductors, infrastructure, software, and industrial applications. Active management helps identify where monetization is strong and avoid where expectations outpace fundamentals.

Asia plays a critical role in the AI buildout – from rare earths to foundry capacity – while offering structural growth and portfolio diversification.

Tap into resilience and strength beyond AI. Dynamic strategies can rotate across styles and sectors as conditions evolve. Innovation bodes well for healthcare. Financials could see market tailwinds.

Roads to diversification

Traditional diversifiers do not provide the ballast they once did. Stocks and bonds today often move together, leaving portfolios exposed when volatility spikes. Look to alternatives to bolster portfolios.

Market-neutral and absolute return strategies offer flexibility, liquidity, and low correlation to traditional assets, helping cushion downside risks and enhance portfolio efficiency.

Gold remains a proven hedge against inflation, geopolitical risk, and market shocks, while gold miners add alpha potential through disciplined capital management.