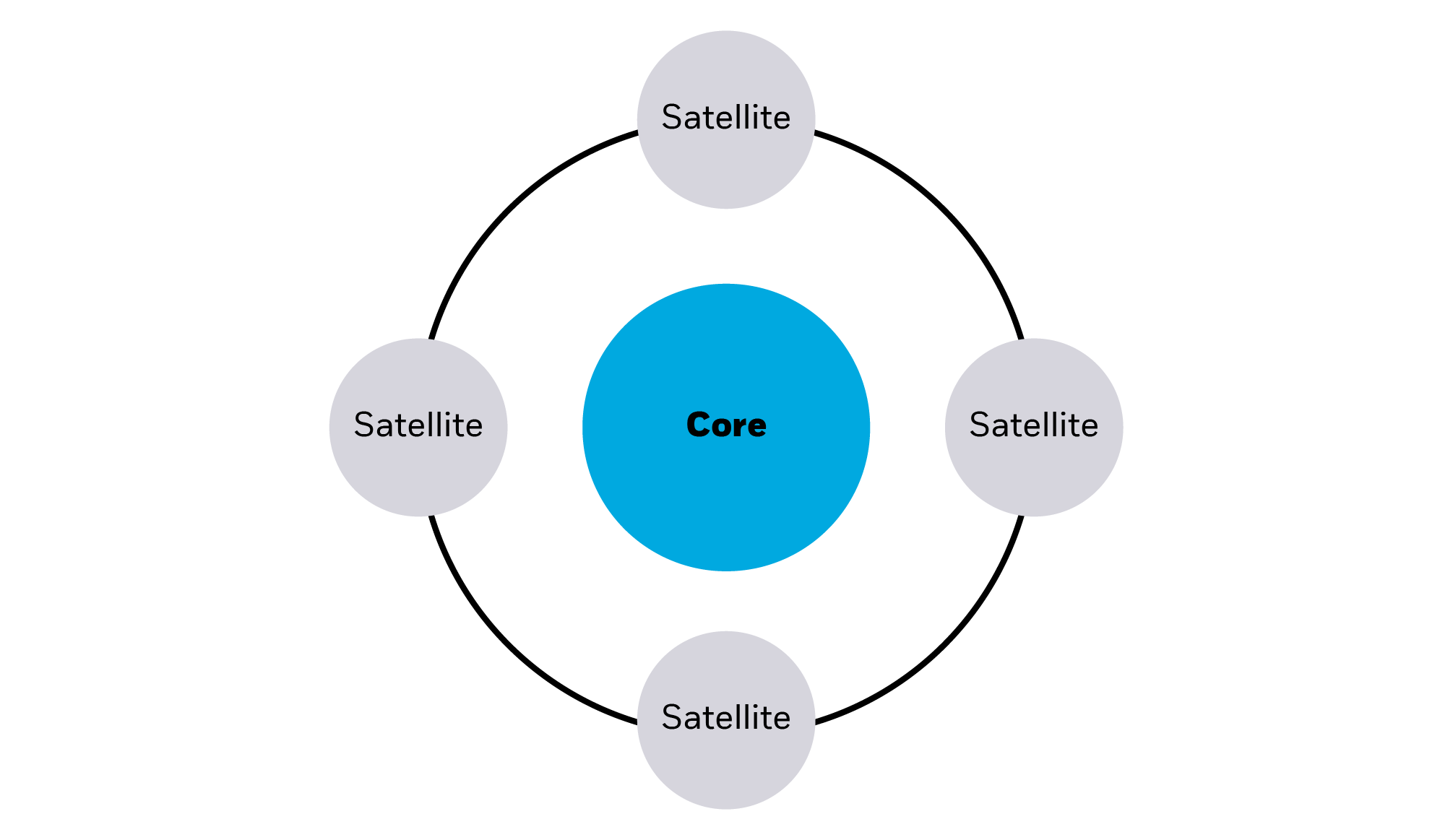

How ETFs give you protection and profit

Diversify1

Build a strong core for your portfolio with ETFs. They provide broad, reliable, and flexible ways to help seek to achieve returns that are in line with the market to ensure your money is always working hard for you

Maintain Income

Cashflow is important; you should have access to the money you need day-to-day. Choosing a fixed-income ETF for example that holds bonds or other fixed-income assets can potentially give you steady returns for a rainy day.

Minimize Volatility

Volatility can drive investors to abandon their investment plans and try to time the markets, which may risk jeopardizing their long-term goals. Some ETFs offer minimum volatility strategies that may appeal to investors seeking to manage risk while also participating in the market.

Maximize Value

If you already have the basics covered, why not push the limits and explore new opportunities? ETFs can give you targeted exposure to different markets and assets with varying degrees of risk and return.

Long-Term Gain

The great thing about ETFs is that they are flexible enough to suit both short-term goals and long-term goals. ETFs being index-tracked means you can pick an index with a track record for long-term growth and sit back let the market run its course.