2836 / 9836

iShares Core SENSEX India ETF

-

Fees as stated in the prospectus

Management Fee: 0.25%

• The ETF aims to provide investment results that, before fees and expenses, closely correspond to the performance of the BSE SENSEX Index. The ETF is subject to concentration risk as a result of investing into a single country, India.

• The ETF is subject to tracking error risk, which is the risk that its performance may not track that of the underlying index exactly.

• The ETF may invest up to 15% of the net asset value (“NAV”) in India Access Products ("IAPs") which are derivative instruments linked to an Indian Security issued by third parties ("IAP issuers"); with a maximum exposure to any single issuer of 10% of the NAV. An IAP represents only an obligation of each IAP issuer to provide the economic performance equivalent to holding the underlying Security. The ETF is subject to counterparty risk associated with each IAP issuer and may suffer losses potentially equal to the full value of the IAPs issued by an IAP issuer if such IAP issuer fails to perform its obligations under the IAPs. In the event of any default by IAP issuers, dealing in the units of the ETF may be suspended and the ETF may ultimately be terminated.

• Investments in emerging markets are generally subject to a greater risk of loss than investments in a developed market.

• The ETF’s Base Currency is in USD but has units traded in HKD (in addition to USD). Investors may be subject to additional costs or losses associated with foreign currency fluctuations between the Base Currency and HKD trading currency when trading units in the secondary market.

• If there is a suspension of the inter-counter transfer of units between the counters and/or any limitation on the level of services provided by brokers and CCASS participants, Unitholders will only be able to trade their units in one counter. The market price of units traded in each counter may deviate significantly.

• The Manager may at its discretion pay dividends out of the capital of the ETF. Payment of dividends out of capital amounts to a return or withdrawal of part of an investor's original investment or from any capital gains attributable to that original investment. Any distributions involving payment of dividends out of the ETF's capital may result in an immediate reduction of the NAV per Unit.

• Trading prices on the SEHK is subject to market forces and may trade at a substantial premium or discount to the NAV.

• The Fund may use derivatives for hedging and for investment purposes. However, usage for investment purposes will not be extensive. The Fund may suffer losses from its derivatives usage.

• The ETF is subject to securities lending transactions risks. In particular, the borrower may fail to return the securities in a timely manner and the value of the collateral may fall below the value of the securities lent out.

Overview

Performance

Performance

Chart

Distributions

| Record Date | Ex-Date | Payable Date |

|---|

-

Returns

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Total Return (%) | -0.05 | 37.12 | -3.22 | 11.55 | 12.15 | 18.48 | -6.10 | 16.70 | 4.11 | 3.11 |

| Benchmark (%) | 0.86 | 37.77 | -1.97 | 13.13 | 14.45 | 21.12 | -4.93 | 19.63 | 6.42 | 5.19 |

If the share class of the fund has been launched for less than 5 years, please refer to the fund factsheet for the performance information calculated from the launch date to the end of launch year.

Performance is calculated based on the calendar year end, NAV-to-NAV with dividend reinvested.

These figures show by how much the Share Class of the Fund increased or decreased in value during the calendar year being shown. Performance is calculated in the relevant Share Class currency, including ongoing charges and taxes and excluding subscription and redemption fees, if applicable.

Where no past performance is shown there was insufficient data available in that calendar year to provide performance.

Please refer to the Key Facts section on the right for the inception date of the Fund and the Share Class.

| 1y | 3y | 5y | 10y | Incept. | |

|---|---|---|---|---|---|

| Total Return (%) | 1.15 | 6.25 | 6.34 | 8.98 | 5.95 |

| Benchmark (%) | 1.14 | 8.50 | 8.41 | 10.69 | 7.47 |

| YTD | 1m | 3m | 6m | 1y | 3y | 5y | 10y | Incept. | |

|---|---|---|---|---|---|---|---|---|---|

| Total Return (%) | -5.17 | -5.17 | -5.15 | -3.63 | 1.15 | 19.96 | 35.99 | 136.34 | 204.35 |

| Benchmark (%) | -5.70 | -5.70 | -5.34 | -3.16 | 1.14 | 27.73 | 49.76 | 176.22 | 300.27 |

Past performance is not a guide to future performance. Investors may not get back the full amount invested.

Performance is calculated based on the period NAV-to-NAV with dividend reinvested.

These figures show by how much the iShares Fund increased or decreased in value during the period being shown. Performance is calculated in the base currency of the iShares Fund, including ongoing charges and taxes, and excluding your trading costs on SEHK.

Please refer to the Key Facts section for the inception date of the iShares Fund.

Where no past performance is shown there was insufficient data available in that period to provide performance.

For purposes of performance comparison, index data disclosed have been converted from the index base currency, INR, into HKD based on the rate per WM/Reuters.

Benchmark performance does not reflect any management fees, transaction costs or expenses.

Source: BlackRock, Asia Index Private Limited, WM/Reuters

Key Facts

Key Facts

For more information regarding the index, please visit here.

Portfolio Characteristics

Portfolio Characteristics

Ratings

Holdings

Holdings

| Ticker | Name | Sector | Asset Class | Market Value | Weight (%) | Notional Value | Shares | CUSIP | ISIN | SEDOL | Price | Location | Exchange | Currency | FX Rate | Market Currency |

|---|

Total allocation percentages shown in the All Holdings tables may not equal 100% due to rounding.

Note: The base currency of the fund changed from HKD to USD on 1 January 2018. Distribution amounts before and after 1 January 2018 are displayed in USD. Click here for historical Holdings, NAV, Performance and Distributions information prior to 1 January 2018 displayed in HKD.

There is no IAP Issuers for this fund.

Exposure Breakdowns

Exposure Breakdowns

% of Weight

Participating Dealers

Participating Dealers

Exchange

Exchange

| Ticker | Exchange | Currency | Listing Date | Premium Discount | Premium Discount As Of | NAV | NAV $ Change | NAV % Change | Price As Of | NAV As Of | Closing Price | Closing Price $ Change | Closing Price % Change | FX to Base Ccy | 20d Avg Volume | Exchange Volume | Bloomberg Ticker | Bloomberg IOPV | Bloomberg INAV | Bloomberg Shares Out. | SEDOL | ISIN | RIC | Trading Board Lot |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2836 | XHKG | Hong Kong Dollar | 02-Nov-2006 | -0.80 | 16-Feb-2026 | 39.45 | 0.24 | 0.62 | 20-Feb-2026 | 16-Feb-2026 | 39.20 | 0.06 | 0.15 | 7.81540 | 63,523.00 | 14,400.00 | 2836 HK | 2836NAV | 2836IV | 2836SHO | B1GDNZ5 | HK2836036130 | 2836.HK | 200.00 |

| 9836 | XHKG | U.S. Dollar | 14-Oct-2016 | -0.56 | 16-Feb-2026 | 5.05 | 0.03 | 0.65 | 20-Feb-2026 | 16-Feb-2026 | 5.02 | 0.00 | 0.00 | - | 905.00 | - | 9836 HK | 9836NAV | 9836IV | 9836SHO | BVK1DW2 | HK2836036130 | 9836.HK | 200.00 |

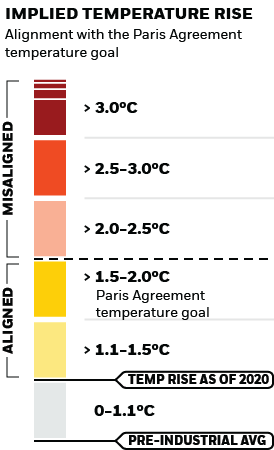

Sustainability Characteristics

Sustainability Characteristics

Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund.

The metrics are not indicative of how or whether ESG factors will be integrated into a fund. Unless otherwise stated in fund documentation and included within a fund’s investment objective, the metrics do not change a fund’s investment objective or constrain the fund’s investable universe, and there is no indication that an ESG or Impact focused investment strategy or exclusionary screens will be adopted by a fund. For more information regarding a fund's investment strategy, please see the fund's prospectus.

Review the MSCI methodologies behind Sustainability Characteristics using the links below.

To be included in MSCI ESG Fund Ratings, 65% (or 50% for bond funds and money market funds) of the fund’s gross weight must come from securities with ESG coverage by MSCI ESG Research (certain cash positions and other asset types deemed not relevant for ESG analysis by MSCI are removed prior to calculating a fund’s gross weight; the absolute values of short positions are included but treated as uncovered), the fund’s holdings date must be less than one year old, and the fund must have at least ten securities.

Business Involvement

Business Involvement

Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments.

Business Involvement metrics are not indicative of a fund’s investment objective, and, unless otherwise stated in fund documentation and included within a fund’s investment objective, do not change a fund’s investment objective or constrain the fund’s investable universe, and there is no indication that an ESG or Impact focused investment strategy or exclusionary screens will be adopted by a fund. For more information regarding a fund's investment strategy, please see the fund's prospectus.

Review the MSCI methodology behind the Business Involvement metrics, using links below.

Business Involvement metrics are calculated by BlackRock using data from MSCI ESG Research which provides a profile of each company’s specific business involvement. BlackRock leverages this data to provide a summed up view across holdings and translates it to a fund's market value exposure to the listed Business Involvement areas above.

Business Involvement metrics are designed only to identify companies where MSCI has conducted research and identified as having involvement in the covered activity. As a result, it is possible there is additional involvement in these covered activities where MSCI does not have coverage. This information should not be used to produce comprehensive lists of companies without involvement. Business Involvement metrics are only displayed if at least 1% of the fund’s gross weight includes securities covered by MSCI ESG Research.