Skip to content

Welcome to the BlackRock site for wealth managers

Before you proceed, please take a moment to review and accept the following Terms and Conditions.

This site is designed for Professional Investors resident in South Africa. We define "Professional Investors" as those who have the appropriate expertise and knowledge e.g. asset managers, distributors and financial intermediaries. You should not use this site if you do not fall within this category.

A New Continuum

Private Markets Outlook

In 2026, private markets are set to transform how societies build infrastructure, how businesses finance growth, and how investors achieve diversification in their portfolios.

Key takeaways

-

01

The evolution of private markets

As the world’s capital seeks resilience in a changing global economy, private markets hold the key to many pressing challenges and opportunities, with the potential to redefine the ways that states and corporations build infrastructure, how businesses finance their growth and how investors build diversified portfolios.

-

02

Evolving liquidity

With IPO and M&A activity slowing in recent years, many companies are staying private for longer, elevating the role of private credit and secondary strategies.

-

03

A broader investor base

Newer client segments, such as wealth investors, are increasing their allocations to private markets largely via evergreen fund structures, such as ELTIFs, LTAFs and model portfolios, which can offer greater liquidity.

A step change in private markets

As the world’s capital seeks resilience in a changing global economy, private markets hold the key to many pressing challenges and opportunities.

With fewer public companies and slower IPO activity, private credit and secondaries are becoming core to accessing growth and liquidity.

An expanding investor base including wealth and retirement investors is entering through evergreen, semi liquid structures, aided by regulatory shifts that improve access and liquidity.

Investors are increasingly adopting a whole portfolio approach, blending public and private assets to capture opportunities in areas such as AI, infrastructure, and real estate.

As data transparency and accessibility grow, private markets are evolving - placing them in a less binary relationship with public markets into something more like a continuum: a more liquid, integrated ecosystem within whole portfolios.

Image-1

Image-2

Image-3

Image-4

Image-5

Private credit: a change in mindset

Episodes of high volatility are leading private credit to take on a larger percentage of overall lending activity, with expanding opportunities in asset based financing and high grade corporate credit.

• Such periods, as we saw in 2025, historically have the long term effect of acclimating more borrowers to private credit.

• Asset based financing is one area of private credit where we expect to see a profound increase in opportunities in 2026.

• Driven by heightened demand, private high grade credit has been expanding, and we expect that to continue in the year ahead.

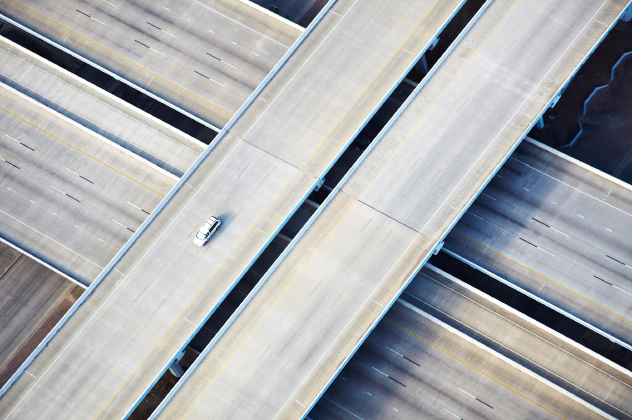

Infrastructure: A generational investment opportunity

Mega forces, such as digitalization and AI, the transition to a low-carbon economy, and demographic change are increasing the global opportunity set for private infrastructure investment.

• A rapid expansion of digitalization, data migration to the cloud and artificial intelligence is driving an unprecedented demand for infrastructure such as data centers.

• The global energy transition and an added emphasis on energy security will require substantial investments in power generation.

• Global demographic changes – such as rising global populations, especially in cities - is increasing the need for infrastructure investment.

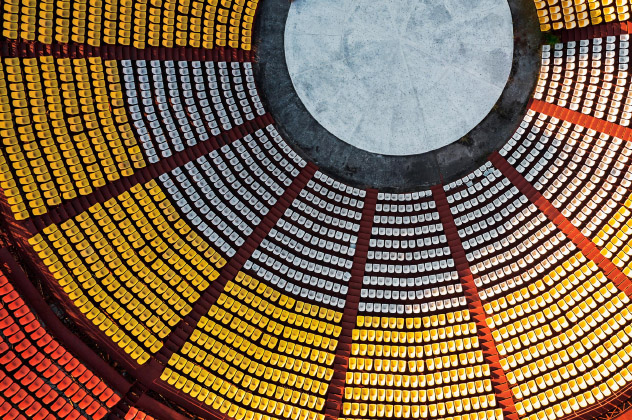

Private equity: A focus on liquidity

In private equity, more investors are using secondaries for liquidity and portfolio management, and we’re seeing attractive opportunities in both growth equity and co-investments.

• The secondaries market is both expanding and maturing, with more investors using it as a liquidity source and a tool for regular portfolio management.

• We see more opportunities in growth equity as companies seek fresh funding on more attractive terms, while managers benefit from an increase in available data.

• Co-investments are becoming a cornerstone of portfolios as overall deal sizes rise, while investors seek more control, transparency and cost efficiency.

Real estate: Reimagining an asset class

The global real estate market has undergone a reset, with residential, industrial and specialized property types, such as data centers, taking the lead.

• As we enter 2026 and the real estate market enters a new cycle, it does so in a fundamentally different form than it had just a few years before.

• Apartments and industrial properties like warehouses – propelled by global macro forces - are among the biggest opportunities we see in the year ahead.

• Specialized properties such as data centers, life-sciences facilities, daycares and self-storage are becoming a bigger part of the investible universe within real estate.

Portfolio perspectives

More wealth and retirement investors are entering private markets, supported by new fund structures that improve accessibility and liquidity, and by technology that enhances transparency.

• Once the domain of large institutions, private markets now serve a broader base aiming for differentiated return streams, income stability and portfolio resilience.

• This expansion creates opportunity—and raises practical questions around sizing, structuring, liquidity and whole-portfolio integration.

• Not all private assets behave alike. Understanding the distinct risk/return of buyouts, private credit and infrastructure can inform allocations that seek higher median returns with lower volatility.

The BlackRock Take

Private assets are becoming a key component of a whole portfolio strategy for more clients. This is happening at a time when private markets themselves are becoming more transparent, more holistic, and more accessible.

Building a successful private markets program is both an art and a science. The art lies in navigating liquidity pacing, governance and practical constraints. The science lies in understanding skewed distributions, correlations and diversification benefits across asset classes. Private markets, when thoughtfully harnessed, can deliver the elusive combination of higher potential returns with managed risk.