Key Takeaways

- A one-two punch threatening income investors: rising inflation and low interest rates.

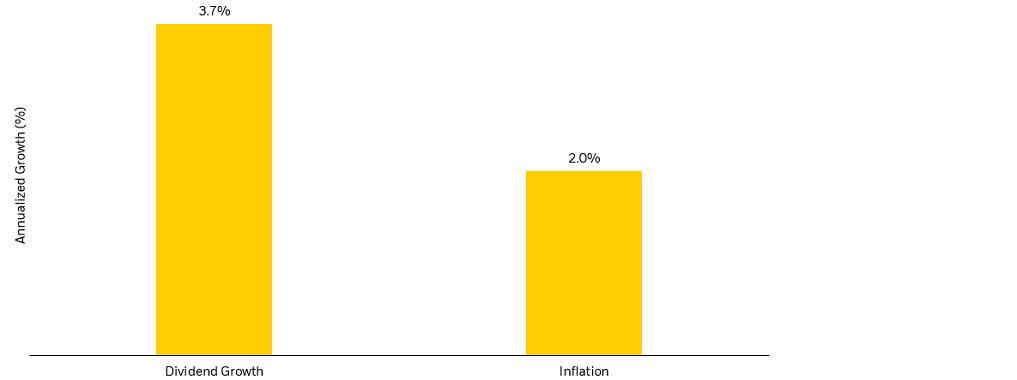

- Dividends have historically grown faster than inflation and can help investors outpace inflation.

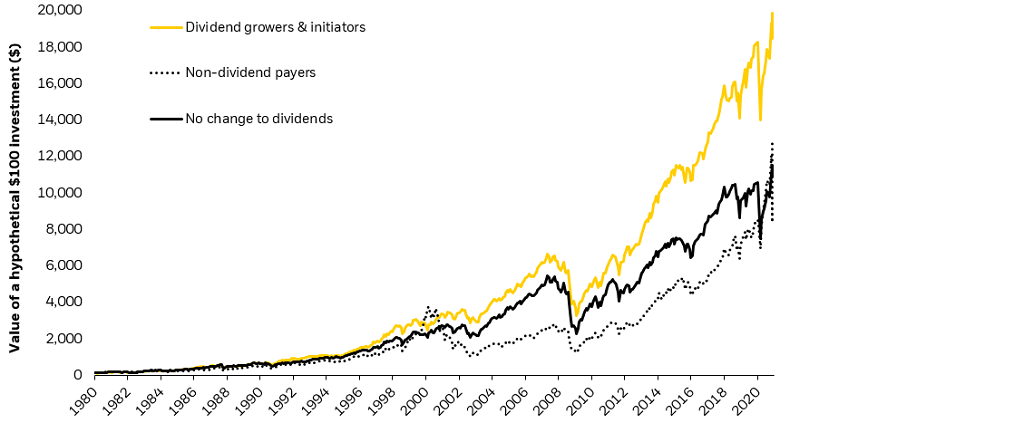

- ETFs focused on dividend-growth stocks can help income-seeking investors diversify sources of income and seek long-term returns.

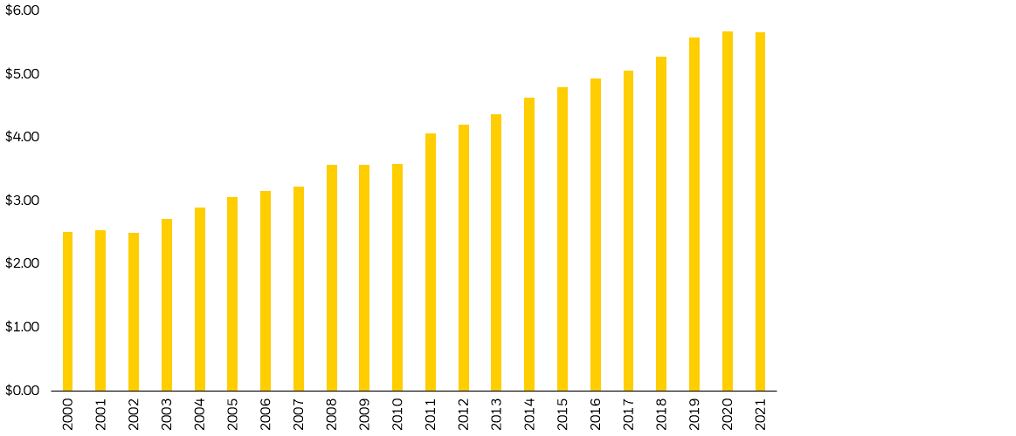

The first Big Mac cost 45 cents. Today the classic burger with special sauce costs nearly $6 in the United States.1

The long-term effects of inflation erode how far you can stretch a dollar, and not just at the drive-thru. For income investors, fast-rising inflation tends to shrink the buying power of bond interest payments, an especially vexing challenge given that interest rates are currently near historic lows.

Bonds of course play an essential role for investors, but ETFs targeting stocks that are poised to grow their dividends can help diversify income and enhance returns over the long term.

Super size me

U.S. Big Mac prices