BlackRock Model Portfolios

Hi, I’m Uwe Helmes - lead strategist for the Model Portfolio Solutions business in Australia.

As we approach year-end, I’d like to reflect on how markets have evolved over the past 12 months, share a brief outlook on what lies ahead, and highlight how the portfolios are currently positioned to capture emerging opportunities.

2025 has delivered strong returns for investors, with most asset classes in positive territory driven by strong corporate earnings, resilient economic growth and looser monetary policy.

Most share markets are up over 10% this year and are close to all-time highs.

However, markets did not advance in a straight line and there has been a lot of activity underneath the hood.

We’ve witnesses sharp market swings, record breaking intra-day moves and significant rotations within and across markets.

Tariff announcements, geopolitical tension and news around potential cracks in the financial system have rattled investors and caused many to be too defensively positioned throughout the year.

While uncertainty is uncomfortable for many investors, it also creates opportunities.

We believe our granular, diversified and dynamic approach to portfolio construction is well suited for this environment, and we are proud of the strong returns we have delivered for our clients – not just over one year but over the past decade.

Virtually all risk profiles of the Enhanced Strategic model portfolios achieve 1st or 2nd quartile performance over 1, 3, 5, 7 and 10 years as per the Morningstar Peer rankings.

Our strong relative performance has been driven by several factors:

1. First, we’ve been constructive on the market outlook for most of 2025, despite all the fear-mongering headlines. This was reflected with an equity overweight in the portfolios, which has worked well.

2. Second, an overweight to US equities over domestic equities has added value.

3. Third, adding gold to the portfolio in early 2024 has proven to be very effective – not only in dampening the downside during periods of market stress, but it also amplified returns on the upside as gold rallied over 80% over the past two years.

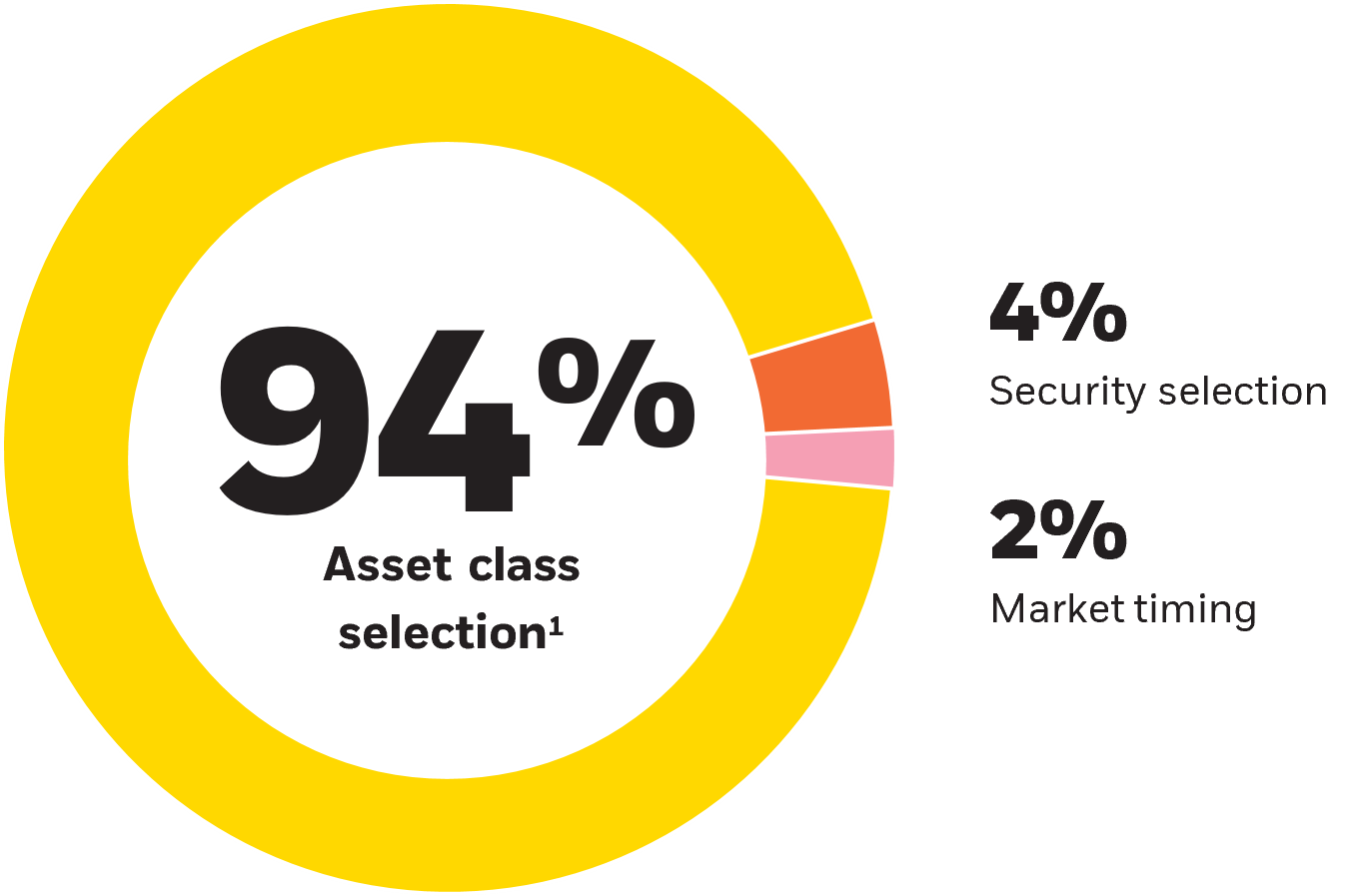

4. Finally, our granular and dynamic approach to asset allocation has added value. For example, a tactical overweight to European equities in the first half of the year worked well, while a more recent shift to Emerging Market equities was additive during the second half of the year.

Looking ahead into 2026, we believe the key question remains whether policymakers can keep economies growing while maintaining inflation at or close to target.

New and old challenges, including geopolitical tension, stretched valuations and increasing government debt levels, continue to require a disciplined and robust investment approach.

On that note, we conducted a portfolio rebalance on the 17th of November to reflect our latest tactical views.

Here are some of the key highlights of this rebalance:

First, we maintain a modest equity overweight. Robust corporate earnings, fiscal support and ongoing economic resilience lead us to remain constructive on the outlook.

Second, we re-calibrate the portfolio’s regional exposures. We maintain a preference for US and Emerging market equities over Australian and European equities, largely driven by differentials in corporate earnings.

Meanwhile, we neutralise our underweight to Japanese equities driven by improving macro data and a more favourable view on the Japanese currency – the yen.

Within Australian equities, we introduce a modest tilt to small caps, driven by more favourable valuations relative to large caps and improving sentiment indicators for small caps.

Within fixed income, we maintain a granular and active approach to selecting the desired exposures.

We reduce Australian fixed income, as we believe sticky inflation could put upwards pressure on Australian yields.

We take profits on Emerging market debt which has performed well this year. Similarly, we take profits on gold and allocate the freed-up capital to cash – as a buffer in the portfolio.

Thanks for watching.

Model Portfolios rebalance - 17 November

The Enhanced Strategic Model Portfolios traded a scheduled rebalance on the 17th of November. Lead Strategist, Uwe Helmes, provides an update on recent market developments and our updated asset allocations.

Helping you achieve your goals

BlackRock’s range of Model Portfolios are designed to help you reach financial wellbeing. We work with your financial adviser so they can help you invest in a portfolio that aligns with what you want to achieve. Whether you are looking to grow your portfolio, maximise income or protect your nest egg for you and your loved ones. BlackRock's model portfolios can help you achieve your goals.

The right team can help you stay on track

The importance of diversification

Managed by a team of professionals

Guided by a team of experienced investment experts, our sole focus is to deliver well-built and cost-effective managed portfolios in a diversified, defined, and streamlined manner.