Building global infrastructure and property into your core

Real asset ETFs can give investors access to assets that have historically had high barriers to entry. They also offer the added liquidity and transparency associated with publicly traded stocks.

iShares ETFs cover a broad range of asset classes, risk profiles and investment outcomes. To understand the appropriateness of this fund for your investment objective, please visit our product webpage.

Find out more about iShares Core FTSE Global Infrastructure (AUD Hedged) ETF:

https://www.blackrock.com/au/products/331650/

This product is likely to be appropriate for a consumer:

• who is seeking capital growth and/or income distribution

• using the product for a core component of their portfolio or less

• with a minimum investment timeframe of 5 years, and

• with a medium to high risk/return profile

Find out more about iShares Core FTSE Global Property Ex Australia (AUD Hedged) ETF:

https://www.blackrock.com/au/products/331647/

This product is likely to be appropriate for a consumer:

• who is seeking capital growth and/or income distribution

• using the product for a core component of their portfolio or less

• with a minimum investment timeframe of 5 years, and

• with a medium to high risk/return profile

For many investors, infrastructure and real estate are no longer considered alternative investments but, in fact, have become a core component of the modern investment portfolio. Recent data indicates almost half of institutional investors globally plan to increase their allocations to infrastructure in the next 12 months.1 This increasing interest has also been demonstrated across iShares’ Australian ETF range, where infrastructure and real estate exposures have seen over $400 million combined inflows in the first half of 2025.2

Why now?

-

01

The new market regime is in action

We are in a new regime characterised by greater macroeconomic and market volatility. The four decades of steady growth and inflation known as the Great Moderation are over, and we expect central banks to be restricted in how much they can cut rates amid structurally ‘higher for longer’ inflation.

-

02

Getting granular

The old “set and forget” 60/40 portfolio construction approach is unlikely to deliver results as it did in the past. This stresses the need to construct more granular core portfolios, which will allow investors to be more nimble and quickly respond to market changes.

-

03

Now is the time

Against the current market backdrop now is the time for investors to reposition and build greater resilience in their core portfolios. With inflation and supply chain disruption top-of-mind for investors, global infrastructure and property can help investors navigate today’s turbulence, whilst capturing structural growth opportunities.

Infrastructure

Infrastructure refers to the physical and organisational structures that underpins the structure of any country’s economy and society. It covers sectors such as energy (power generation), transportation (toll roads and airports), communication networks, utilities (gas, water and waste), and social infrastructure (schools and hospitals) that are critical to everyday living.

It is important to distinguish between two broad types of infrastructure: core and value-added. Core infrastructure refers to the stable and consistent income-producing end of the spectrum, whereas value-added infrastructure performance is based on capital appreciation realised on the sale of the asset and is generally characterised as riskier in nature.

Core infrastructure, as defined by FTSE Russell, focuses on activities in transportation, energy and telecommunication, that act as the foundation of developed market economies.

Transportation

Roads, bridges, tunnels, ports, airports, railways, terminals, depots and inland waterways

Energy

Electricity generation, distribution and transmission, water supply projects and pipelines

Telecommunications

Fixed line, telephone, data networks, transmission lines, towers, wireless transmission, towers and transmission satellites

Source: FTSE Russell, August 2024.

Property

Listed real estate represents companies engaged in real estate investment, development, and other real estate related services. Real Estate Investments Trusts (REITs) are a company that owns, operates or finances income-producing real estate such as apartments, shopping centres, offices, hotels and warehouses, allowing investors to invest in the property sector without the risk of purchasing properties directly.

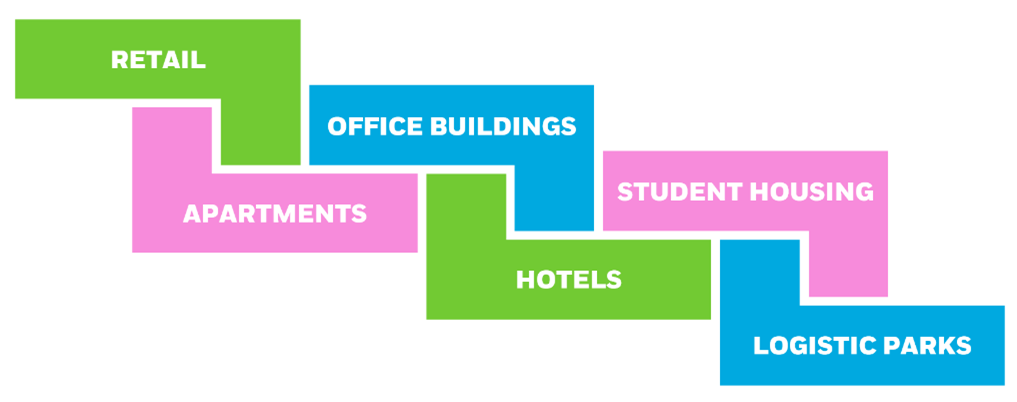

The most common real estate sectors include office, residential, industrial & logistics and retail. There are numerous other secondary sectors including hospitality, self-storage, student accommodation, retirement, and other special purpose buildings.

Resilience amid high inflation

Infrastructure has proven resilient amid times of high inflation. Many infrastructure assets are contractually linked to inflation through regulations, contracts or concession agreement that often include price adjustment mechanisms to pass inflationary prices through to the end consumer.3 While inflation is gradually cooling versus the immediate post-pandemic period, we expect inflation to settle at a structurally higher level due to persistently large government deficits, meaning adding infrastructure to your portfolio long-term could provide useful protection.

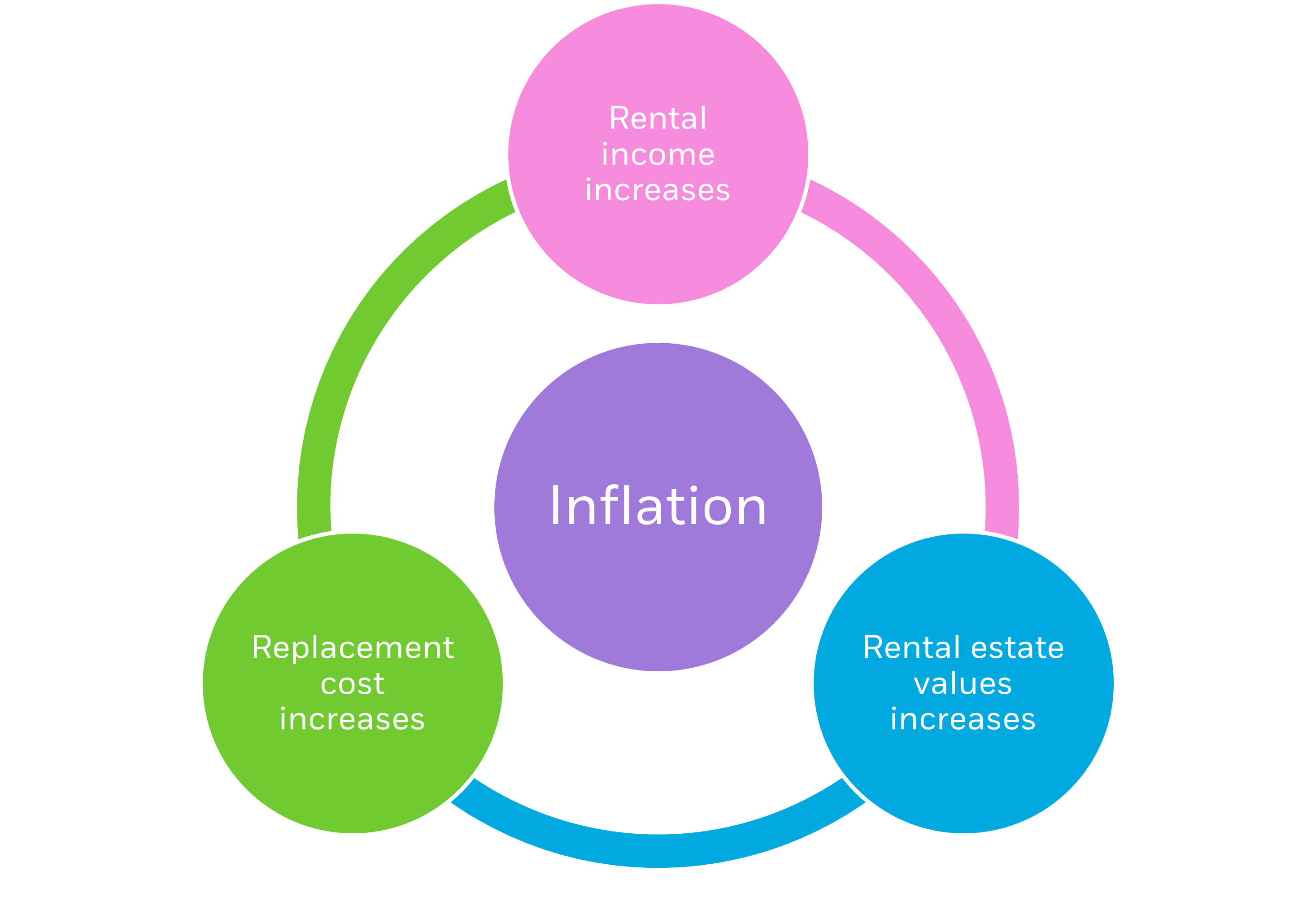

Natural inflation-hedge and protection

Real estate rental cashflows offer a natural inflation-hedge and there is protection through the replacement cost mechanism. With many leases being tied to inflation, rental income and the value of real estate tends to increase in response to rising inflation. The increase in the cost of replacing existing assets in the market, as higher construction costs tend also to increase with inflation, limits new supply further and contributes to elevated rents and housing prices.

Source: BlackRock, August 2024. For illustrative purposes only.

Stable cash flows

Infrastructure and property can provide stable cash flows. During market downturns, such as the 2020 Covid-19 pandemic, dividend yields on infrastructure and real estate stocks rose substantially higher than that of the broader market due to falling asset prices.4

Building resilient core portfolios

Infrastructure and property exhibit relatively lower correlation with other asset classes, allowing portfolio constructors to diversify sources of return and risk in their portfolios. Over the past two decades, infrastructure has generated an average 3% outperformance versus global equities during quarters where equity performance was negative.5