iShares

An all-in-one wealth solution

iShares ETFs cover a broad range of asset classes, risk profiles and investment outcomes. To understand the appropriateness of this fund for your investment objective, please visit our product webpage.

Find out more about iShares High Growth ESG ETF (IGRO)

https://www.blackrock.com/au/products/327642/

This product is likely to be appropriate for a consumer:

• who is seeking capital growth and/or income distribution

• using the product for a whole portfolio solution or less

• with a minimum investment timeframe of 5 years, and

• with a medium to high risk/return profile

Find out more about iShares Balanced ESG ETF (IBAL)

https://www.blackrock.com/au/products/327628/

This product is likely to be appropriate for a consumer:

• who is seeking capital growth, capital preservation and/or income distribution

• using the product for a whole portfolio solution or less

• with a minimum investment timeframe of 5 years, and

• with a medium to high risk/return profile

Why iShares multi-asset ETFs

Whole Portfolio Solution

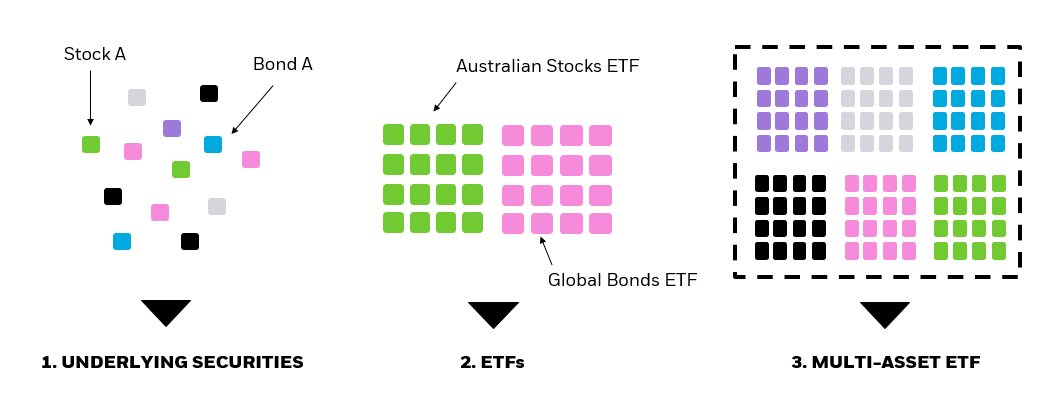

A single and simple investing solution in one trade, accessing global equity and bond markets with over 7,000 stocks and bonds in one portfolio.

Convenience for your Clients

Choose from balanced or growth portfolios that are fully diversified, professionally managed and sustainably integrated – all for a lower cost than comparable ETFs.1

Powered by BlackRock

Benefit from BlackRock’s 30+ years’ experience managing multi-asset portfolios, leveraging our global insight, risk management and portfolio analytics platform.2

A simple solution to build future wealth

Did you know that Australians aged over 60 are expected to transfer around $3.5 trillion to younger generations by 2034?3

At the same time, many young people may struggle to build up this same level of wealth without help. Australians currently take more than a decade to save a 20% deposit for a home4, and if current policy settings stay the same, Sydney home prices will not be affordable for those relying on a full-time wage alone by 2031.5

So what can older generations do to put aside wealth for their children and grandchildren until they’re ready to receive full financial advice? One option is a multi-asset ETF – an all-in-one diversified portfolio that is professionally managed, can be easily purchased on the ASX and held alongside existing client assets.

The low-cost and convenience of multi-asset ETFs means they’re greatly in demand among financial advisers and their clients - almost a quarter of advisers in large practices say they would like ETF providers to offer more of these types of products.6

Benefits of diversification with iShares multi-asset ETFs

Most investors would generally agree that the primary goal of investing is to generate the highest possible return for the lowest risk. Diversification can help you obtain this balance.

By spreading investments across asset classes, geographies and sectors, investors lower their risks as the poor performance of one investment can be offset by stronger performance in another, and vice versa. This may help you to build wealth faster over time compared to less diversified investments, such as a more concentrated portfolio of individual shares.

How multi-asset ETFs work

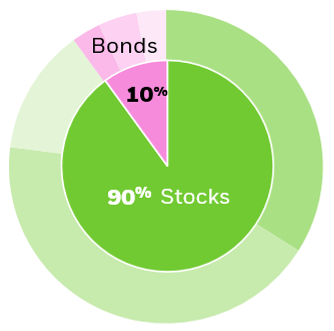

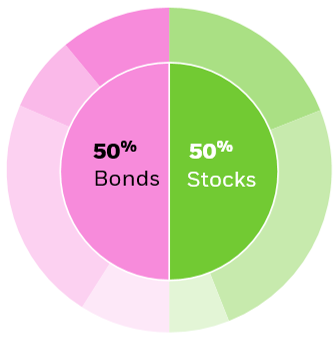

Our multi-asset ETF options

iShares offers two diversified portfolio options for investors depending on the asset allocation they are comfortable with. Both are suitable for investors with a medium to high-risk return profile and a minimum investment time frame of five years.

Explore our multi-asset ETFs

Better together