iShares ETFs are available on a number of online trading platforms in Australia. Learn more about some of these platforms by clicking on the logos below.

iShares

How to buy ETFs

Learn more about how you can trade ETFs and best practices to follow.

iShares ETFs & BlackRock Funds cover a broad range of asset classes, risk profiles and investment outcomes. To understand the appropriateness of these Funds for your investment objective, please visit our product webpages.

Find out more about iShares ETFs/BlackRock products: https://www.blackrock.com/au/products/investment-funds

iShares ETFs provide access to a wide range of asset classes and markets, making them useful building blocks within investment portfolios. Just like individual shares, they can be bought and sold on exchange. Therefore, just like any investment, it is good to know what to consider when placing an order.

Considerations when trading ETFs

Time

ETFs can be purchased and sold anytime during exchange trading hours.

Markets can be more volatile near open and close. Consider trading after the first, and before the last, 15 minutes of the day. There is also less market making activity during open and close, which can result in wider spreads.

Consider the underlying exposure. If you hold ETFs with underlying exposures on Asian markets, consider trading when those underlying markets are open, as the value of the ETF should be easier to calculate and the bid/offer spread tighter.

Order type

Use an order type which is consistent with your goals:

1. Limit order

The order is executed only if the price specified, or better, can be achieved. This avoids an unexpected outcome at times of higher market volatility or potential wider spreads.

2. Market order

The order executes as soon as possible at the going price at the time. However, all or part of the trade is at risk of being traded at a value different from the last trade price especially in times of market volatility or lower liquidity when values may change quickly.

Due to the execution price risk, limit orders are generally preferable in most circumstances but remember if the limit price isn’t reached, the trade won’t execute.

ETF liquidity

Liquidity is always an important consideration when selecting any investment. The more liquid an investment, the easier and more cost effective it should be to trade. A less liquid investment can take longer to buy or sell and cost more to do so.

ETFs can be bought and sold during the trading day. When evaluating ETF liquidity, it is important to remember that ETFs differ from ordinary shares in one distinct way – ETFs are open-ended investment vehicles. This means that the number of shares in the ETF can actually increase or reduce to meet investor demand.

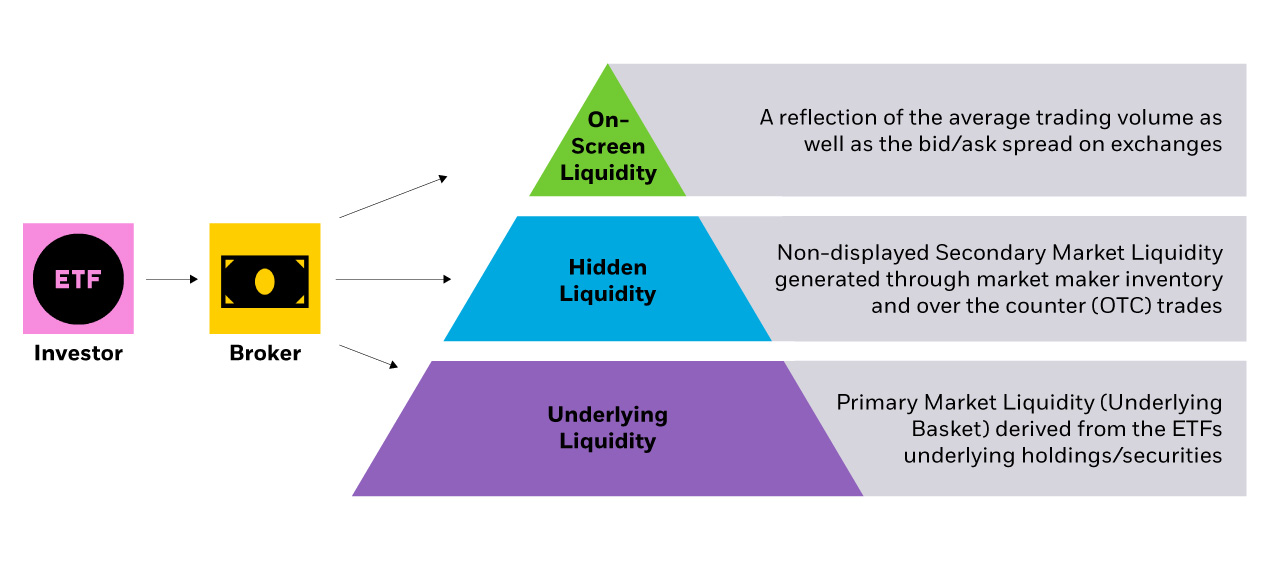

Although ETFs trade like shares, the liquidity of an ETF works very differently to the liquidity of a share. With an ordinary share, trading reflects the buyers and sellers interacting on an exchange at a price that represents the economic value of a company and investor supply and demand. The trading of the ETF also depends on the investor supply and demand of the ETF, but this only partially accounts for the liquidity of an ETF (on-screen liquidity). There are in fact multiple layers that make up the entire liquidity of an ETF:

If you’re familiar with exchanged traded funds, or ETFs, you may have heard the phrase Creation and Redemption. But let’s dig deeper into what it means and why it’s important?

ETFs are low-cost ways to access both broad and precise market exposures. They trade like stocks, can provide deep liquidity, and their prices are closely tied to the value of their underlying securities. But how is this possible? It’s all thanks to the processes of creation and redemption.

To better understand how it works, think of an individual stock or bond as a flower. Just like companies come in different sectors and sizes, flowers come in all kinds of varieties and shapes. Now take a variety of flowers and bundle them into a bouquet, and you’ve got yourself an ETF. The price of an ETF is based on the price of the stocks or bonds that make up the ETF. So when the prices of individual flowers increase, so does the price of the bouquet.

Now let’s say an investor wants to buy a bouquet, what does she do? She goes to a flower shop, which we can imagine as a brokerage firm. Here, the investor browses bouquets and finds the emerging markets bouquet, the clean energy bouquet, and the S&P 500 bouquet. She decides to buy one S&P 500 bouquet. Like a florist, the broker dealer takes this order and sends the market maker out to the market to fill it. The market maker finds the S&P 500 bouquet and brings it back to the shop. The investor pays the broker and gets the ETF she wants. Easy!

But what happens if the investor wants one hundred bouquets? Just as before, the broker dealer sends the market maker to get one hundred bouquets. But there are only five bouquets available. So what’s the poor market maker to do? Thanks to the unique process of ETF creation, more bouquets can be made to fill the large order. The creation process kicks in as soon as the investor places the order. It begins with the authorized participant, or AP for short. The AP watches the market in order to manage the supply of flowers and bouquets. When the market maker can’t fill an order, he asks the AP to make extra bouquets. The AP checks the S&P 500 Index to find out exactly which individual flowers make up the S&P 500 bouquet. Once the AP has everything he needs, he gives the flowers to iShares. Similar to a bouquet designer, iShares assembles brand-new S&P 500 bouquets. Once they bundle the individual flowers, iShares gives the new bouquets back to the AP; the AP gives the bouquets to the market maker; and the market maker brings them back to the broker dealer,

who in turn sells them to the investor at market price. Despite the size of the order, the price of the bouquets stays approximately the same due to the increased supply.

Now let’s flip things around for redemption.

The investor wants to return one hundred bouquets, so the florist buys them back. He then gets the market maker to take the bouquets to the market to see who wants them. But there’s already an adequate supply of bouquets. So what does the market maker do now? Well, he turns to the AP again. The market maker gives the AP the bouquets, who then brings them to the iShares workshop where they are disassembled into individual flowers. And just like that, the number of bouquets decreases to meet market needs and keep bouquet prices stable. Creation and redemption occur to keep ETF supply in line with demand. This generally keeps ETF values closely tied to their underlying assets. And it allows you to easily trade ETFs throughout the day due to their deep liquidity. Visit iShares to learn more about ETFs today.

The ETF creation & redemption process

Understand ETF liquidity and the creation and redemption process that lets ETFs trade even when volume is low.

Where to trade ETFs

A broker is a professional who buys and sells securities such as ETFs on a stock exchange on behalf of clients. You can buy iShares ETFs through a broker during daily trading hours. Please note that brokerage and other fees may apply.

The ASX has a tool to help you locate a stockbroker which you can access here.