Skip to content

Welcome to the BlackRock site for individuals

To reach a different BlackRock site directly, please update your user type.

Filter list by keyword

Show More

Show Less

to

of

Total

Sorry, no data available.

Overview

Important Information: Capital at Risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested.

The value of equities and equity-related securities can be affected by daily stock market movements. Other influential factors include political, economic news, company earnings and significant corporate events. Derivatives are highly sensitive to changes in the value of the asset on which they are based and can increase the size of losses and gains, resulting in greater fluctuations in the value of the Fund. The impact to the Fund can be greater where derivatives are used in an extensive or complex way.

Performance

Performance

Chart

Performance chart data not available for display.

-

Returns

This chart shows the fund's performance as the percentage loss or gain per year over the last 4 years.

During this period performance was achieved under circumstances that no longer apply

*On , the Fund changed its name and/or investment objective and policy..

| 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|

| Total Return (%) | 12.11 | 23.21 | -18.20 | 21.03 | |

| Benchmark (%) | 15.90 | 21.82 | -18.14 | 23.79 |

Missing calendar year returns data

Performance is shown after deduction of ongoing charges. Any entry and exit charges are excluded from the calculation.

| From 31-Mar-2019 To 31-Mar-2020 |

From 31-Mar-2020 To 31-Mar-2021 |

From 31-Mar-2021 To 31-Mar-2022 |

From 31-Mar-2022 To 31-Mar-2023 |

From 31-Mar-2023 To 31-Mar-2024 |

|

|---|---|---|---|---|---|

|

Total Return (%)

as of 31-Mar-24 |

- | 49.16 | 10.55 | -8.11 | 24.44 |

|

Benchmark (%)

as of 31-Mar-24 |

- | 54.03 | 10.12 | -7.02 | 25.11 |

| 1y | 3y | 5y | 10y | Incept. | |

|---|---|---|---|---|---|

| Total Return (%) | 18.53 | 5.56 | - | - | 10.05 |

| Benchmark (%) | 18.39 | 5.63 | - | - | 11.14 |

Missing average annual returns data

| YTD | 1m | 3m | 6m | 1y | 3y | 5y | 10y | Incept. | |

|---|---|---|---|---|---|---|---|---|---|

| Total Return (%) | 6.22 | -3.32 | 4.41 | 19.42 | 18.53 | 17.61 | - | - | 59.57 |

| Benchmark (%) | 4.84 | -3.71 | 3.59 | 20.29 | 18.39 | 17.85 | - | - | 67.43 |

Missing cumulative returns data

The figures shown relate to past performance. Past performance is not a reliable indicator of future performance. Markets could develop very differently in the future. It can help you to assess how the fund has been managed in the past

Share Class and Benchmark performance displayed in EUR, hedged share class benchmark performance is displayed in USD.

Performance is shown on a Net Asset Value (NAV) basis, with gross income reinvested where applicable. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Source: Blackrock

Key Facts

Key Facts

Net Assets

as of 14-May-24

EUR 413,041,784

Net Assets of Fund

as of 14-May-24

USD 21,913,065,095

Inception Date

14-Jun-19

Fund Launch Date

15-Apr-10

Share Class Currency

EUR

Base Currency

USD

Asset Class

Equity

Benchmark Index

MSCI World Net TR Index

Index Ticker

NDDUWI

SFDR Classification

Other

Initial Charge

0.00%

Ongoing Charges Figures

0.18%

ISIN

IE00BJ023R69

Annual Management Fee

0.17%

Performance Fee

0.00%

Minimum Initial Investment

EUR 1,000,000.00

Minimum Subsequent Investment

EUR 10,000.00

Use of Income

Accumulating

Domicile

Ireland

Regulatory Structure

UCITS

Management Company

BlackRock Asset Management Ireland Limited

Morningstar Category

Other Equity

Dealing Settlement

Trade Date + 3 days

Dealing Frequency

Daily, forward pricing basis

Bloomberg Ticker

BGIWEHI

SEDOL

BJ023R6

Portfolio Characteristics

Portfolio Characteristics

Number of Holdings

as of 30-Apr-24

1467

Standard Deviation (3y)

as of 30-Apr-24

15.68%

3y Beta

as of 30-Apr-24

0.913

P/E Ratio

as of 30-Apr-24

21.84

P/B Ratio

as of 30-Apr-24

3.22

Sustainability Characteristics

Sustainability Characteristics

Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund.

The metrics are not indicative of how or whether ESG factors will be integrated into a fund. Unless otherwise stated in fund documentation and included within a fund’s investment objective, the metrics do not change a fund’s investment objective or constrain the fund’s investable universe, and there is no indication that an ESG or Impact focused investment strategy or exclusionary screens will be adopted by a fund. For more information regarding a fund's investment strategy, please see the fund's prospectus.

Review the MSCI methodologies behind Sustainability Characteristics using the links below.

MSCI ESG Fund Rating (AAA-CCC)

as of 21-Apr-24

A

MSCI ESG % Coverage

as of 21-Apr-24

98.60

MSCI ESG Quality Score (0-10)

as of 21-Apr-24

6.88

MSCI ESG Quality Score - Peer Percentile

as of 21-Apr-24

37.85

Fund Lipper Global Classification

as of 21-Apr-24

Equity Global

Funds in Peer Group

as of 21-Apr-24

5,545

MSCI Weighted Average Carbon Intensity (Tons CO2E/$M SALES)

as of 21-Apr-24

97.68

MSCI Weighted Average Carbon Intensity % Coverage

as of 21-Apr-24

98.50

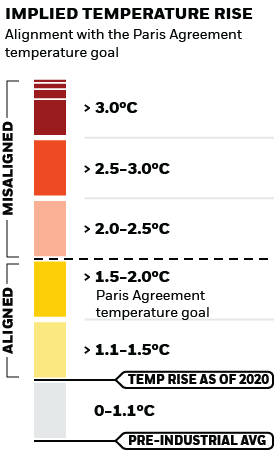

MSCI Implied Temperature Rise (0-3.0+ °C)

as of 21-Apr-24

> 2.5° - 3.0° C

MSCI Implied Temperature Rise % Coverage

as of 21-Apr-24

98.47

All data is from MSCI ESG Fund Ratings as of 21-Apr-24, based on holdings as of 31-Dec-23. As such, the fund’s sustainable characteristics may differ from MSCI ESG Fund Ratings from time to time.

To be included in MSCI ESG Fund Ratings, 65% (or 50% for bond funds and money market funds) of the fund’s gross weight must come from securities with ESG coverage by MSCI ESG Research (certain cash positions and other asset types deemed not relevant for ESG analysis by MSCI are removed prior to calculating a fund’s gross weight; the absolute values of short positions are included but treated as uncovered), the fund’s holdings date must be less than one year old, and the fund must have at least ten securities.

Business Involvement

Business Involvement

Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments.

Business Involvement metrics are not indicative of a fund’s investment objective, and, unless otherwise stated in fund documentation and included within a fund’s investment objective, do not change a fund’s investment objective or constrain the fund’s investable universe, and there is no indication that an ESG or Impact focused investment strategy or exclusionary screens will be adopted by a fund. For more information regarding a fund's investment strategy, please see the fund's prospectus.

Review the MSCI methodology behind the Business Involvement metrics, using links below.

MSCI - Controversial Weapons

as of 30-Apr-24

0.48%

MSCI - UN Global Compact Violators

as of 30-Apr-24

0.06%

MSCI - Nuclear Weapons

as of 30-Apr-24

0.48%

MSCI - Thermal Coal

as of 30-Apr-24

0.35%

MSCI - Civilian Firearms

as of 30-Apr-24

0.12%

MSCI - Oil Sands

as of 30-Apr-24

0.30%

MSCI - Tobacco

as of 30-Apr-24

0.54%

Business Involvement Coverage

as of 30-Apr-24

99.86%

Percentage of Fund not covered

as of 30-Apr-24

0.14%

BlackRock business involvement exposures as shown above for Thermal Coal and Oil Sands are calculated and reported for companies that generate more than 5% of revenue from thermal coal or oil sands as defined by MSCI ESG Research. For the exposure to companies that generate any revenue from thermal coal or oil sands (at a 0% revenue threshold), as defined by MSCI ESG Research, it is as follows: Thermal Coal 0.74% and for Oil Sands 2.63%.

Business Involvement metrics are calculated by BlackRock using data from MSCI ESG Research which provides a profile of each company’s specific business involvement. BlackRock leverages this data to provide a summed up view across holdings and translates it to a fund's market value exposure to the listed Business Involvement areas above.

Business Involvement metrics are designed only to identify companies where MSCI has conducted research and identified as having involvement in the covered activity. As a result, it is possible there is additional involvement in these covered activities where MSCI does not have coverage. This information should not be used to produce comprehensive lists of companies without involvement. Business Involvement metrics are only displayed if at least 1% of the fund’s gross weight includes securities covered by MSCI ESG Research.

Risk Indicator

Risk Indicator

1

2

3

4

5

6

7

Low Risk

High Risk

Typically low rewards

Typically high rewards

Ratings

Holdings

Holdings

as of 30-Apr-24

| Name | Weight (%) |

|---|---|

| MICROSOFT CORP | 4.40 |

| APPLE INC | 4.01 |

| NVIDIA CORP | 3.42 |

| AMAZON COM INC | 2.61 |

| ALPHABET INC CLASS A | 1.54 |

| Name | Weight (%) |

|---|---|

| META PLATFORMS INC CLASS A | 1.53 |

| ALPHABET INC CLASS C | 1.36 |

| ELI LILLY | 1.01 |

| BROADCOM INC | 0.93 |

| JPMORGAN CHASE & CO | 0.89 |

Holdings subject to change

Exposure Breakdowns

Exposure Breakdowns

Negative weightings may result from specific circumstances (including timing differences between trade and settle dates of securities purchased by the funds) and/or the use of certain financial instruments, including derivatives, which may be used to gain or reduce market exposure and/or risk management. Allocations are subject to change.

Pricing & Exchange

Pricing & Exchange

| Investor Class | Currency | NAV | NAV Amount Change | NAV % Change | NAV As Of | 52wk High | 52wk Low | ISIN |

|---|---|---|---|---|---|---|---|---|

| Inst Hedged | EUR | 16.55 | 0.06 | 0.39 | 14-May-24 | 16.55 | 13.17 | IE00BJ023R69 |

| Flex Hedged | SGD | 15.35 | 0.06 | 0.40 | 14-May-24 | 15.35 | 12.20 | IE00BN782T03 |

| Flex Hedged | EUR | 17.36 | 0.07 | 0.39 | 14-May-24 | 17.36 | 13.80 | IE00BFZPRS19 |

| Flex | EUR | 47.70 | 0.10 | 0.22 | 14-May-24 | 47.75 | 38.14 | IE00B61D1398 |

| Class D Hedged | GBP | 17.15 | 0.07 | 0.40 | 14-May-24 | 17.15 | 13.64 | IE00BGL88775 |

| Flex | GBP | 43.30 | 0.09 | 0.21 | 14-May-24 | 43.37 | 35.01 | IE00B61BMR49 |

| Class D Hedged | EUR | 11.78 | 0.05 | 0.39 | 14-May-24 | 11.78 | 9.38 | IE000M0KK797 |

| Flex | GBP | 36.08 | 0.07 | 0.21 | 14-May-24 | 36.15 | 29.66 | IE00B6385520 |

| Inst | EUR | 36.19 | 0.08 | 0.22 | 14-May-24 | 36.23 | 29.37 | IE00B62NV726 |

| Class D | SGD | 13.97 | 0.05 | 0.35 | 14-May-24 | 13.97 | 11.12 | IE000NNYZMJ7 |

| Flex | USD | 41.49 | 0.17 | 0.42 | 14-May-24 | 41.49 | 32.68 | IE00B616R411 |

| Flex | USD | 11.87 | 0.01 | 0.09 | 16-Oct-17 | 11.87 | 9.96 | IE00B630W685 |

| Class D Hedged | SGD | 11.33 | 0.04 | 0.39 | 14-May-24 | 11.33 | 9.02 | IE000XUK0R09 |

| Class D | USD | 20.47 | 0.09 | 0.42 | 14-May-24 | 20.47 | 16.14 | IE00BD0NCN62 |

| Inst | GBP | 28.62 | 0.06 | 0.21 | 14-May-24 | 28.67 | 23.53 | IE00B62HNT07 |

| Class D | EUR | 20.57 | 0.05 | 0.22 | 14-May-24 | 20.59 | 16.46 | IE00BD0NCM55 |

| Flex | EUR | 22.71 | 0.05 | 0.22 | 14-May-24 | 22.73 | 18.42 | IE00B61MGS68 |

| Inst | USD | 33.24 | 0.14 | 0.42 | 14-May-24 | 33.24 | 26.21 | IE00B62WG306 |

| Flex Hedged | GBP | 18.04 | 0.07 | 0.40 | 14-May-24 | 18.04 | 14.25 | IE00BFZPRR02 |

| Inst | GBP | 41.97 | 0.09 | 0.21 | 14-May-24 | 42.04 | 33.99 | IE00B62C5H76 |

| Inst | USD | 26.54 | 0.11 | 0.42 | 14-May-24 | 26.54 | 21.04 | IE00B62NX656 |

| Inst | EUR | 43.56 | 0.10 | 0.22 | 14-May-24 | 43.60 | 34.88 | IE00B62WCL09 |

| Class D | GBP | 20.93 | 0.04 | 0.21 | 14-May-24 | 20.97 | 16.95 | IE00BD0NCL49 |

Portfolio Managers

Portfolio Managers

Kieran Doyle

Group Index Equity PM Core DM EMEA

PRIIPs Performance Scenarios

PRIIPs Performance Scenarios

The EU Packaged Retail and Insurance-Based Products Regulation (PRIIPs) prescribes the calculation methodology, and publication of the outcomes, of four hypothetical performance scenarios regarding how the product may perform under certain conditions and for such to be published on a monthly basis. The figures shown include all the costs of the product itself, but may not include all the costs that you pay to your advisor or distributor. The figures do not take into account your personal tax situation, which may also affect how much you get back. What you will get from this product depends on future market performance. Market developments in the future are uncertain and cannot be accurately predicted. The unfavourable, moderate, and favourable scenarios shown are illustrations using the worst, average, and best performance of the product, which may include input from benchmark(s) / proxy, over the last ten years.

Recommended holding period : 5 years

Example Investment EUR 10,000

| Scenario |

If you exit after 1 year

|

If you exit after 5 years

|

|

|---|---|---|---|

|

Minimum

There is no minimum guaranteed return. You could lose some or all of your investment.

|

|||

|

Stress

What you might get back after costs

Average return each year

|

6,830 EUR

-31.7%

|

3,540 EUR

-18.8%

|

|

|

Unfavourable

What you might get back after costs

Average return each year

|

8,180 EUR

-18.2%

|

10,880 EUR

1.7%

|

|

|

Moderate

What you might get back after costs

Average return each year

|

10,730 EUR

7.3%

|

14,750 EUR

8.1%

|

|

|

Favourable

What you might get back after costs

Average return each year

|

14,920 EUR

49.2%

|

19,730 EUR

14.6%

|

|

The stress scenario shows what you might get back in extreme market circumstances.

Testing missing data

Missing average annual returns data