Record-breaking declines in Canadian economic activity failed to interfere with gains in risk assets last week. Kurt and Daniel put all the events of the past week in context and provide some thoughts on the outlook from here.

Statistics Canada reported a 9.0% monthly decline in GDP for the February to March period – the worst reading since the series began in 1961. This was the reporting agency’s first attempt at a flash estimate for GDP and, given the unprecedented nature of the economic shutdown, this estimate will likely face substantial revisions over coming weeks. April readings for the Canadian economy are likely to be even bleaker, as the economic lockdown deepens and front-month U.S. crude prices decline back below U.S. $20/barrel.

Given the massive shock to the economy, the Bank of Canada chose to suspend its economic forecasts and described the outlook instead in terms of scenarios. The shock to Canada’s economy today is much worse than during the financial crisis when well-capitalized banks, limited exposure to subprime lending and an upswing in industrial commodity demand helped to cushion the blow from a period of weak global demand. This time is different: although banks are well capitalized, energy is in structural decline and household debt is high. These factors could lead to larger cumulative economic losses and a longer recovery than during the financial crisis even if the initial recovery reverses much of the coronavirus demand shock. This explains the steady rollout of unconventional policy steps.

Policymakers to the rescue

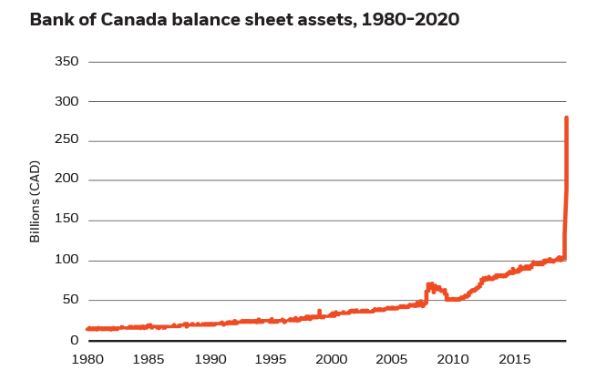

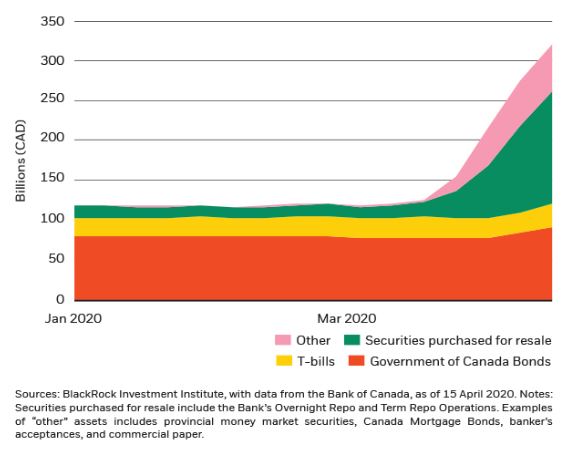

The Bank of Canada (BoC) is just beginning its foray into large-scale asset purchases. At its April monetary policy meeting, the Bank of Canada announced facilities to purchase investment grade corporate and provincial bonds in the secondary market to reduce spreads and provide liquidity to credit markets. This comes in addition to previously announced purchases of Government of Canada (GoC) bonds and mortgage-backed securities, which already began to register on the BoC’s balance sheet this week (see chart below). At its current pace, the BoC could end up owning GoC’s bonds to the tune of 10% of GDP by early next year.

The BoC will therefore buy much of the new GoC supply in coming months, but newly announced programs will only add to the deficits. Last week, the Canadian federal government extended support to small and medium-sized businesses through updates to two programs last week: 1. a new Emergency Commercial Rent Assistance program to help businesses cover May-June rents and provide partially forgivable loans to commercial landlords who offer rent discounts or rent holidays to their tenants, and 2. relaxed qualification thresholds for the previously announced Canada Emergency Business Account, which provides businesses with a $40K interest-free loan where $10K is eligible for forgiveness. And in a bid to assist the beleaguered energy sector, Prime Minister Trudeau announced C$2.5 billion in aid to clean up Alberta oil wells, achieve emissions reductions and provide loans to cash-strapped businesses.

Stocks climb in the face of bleak and uncertain earnings

All told, public officials are attempting to build a bridge across the incoming weak economic and earnings data to lessen the long-term damage to the labor market and the capital stock from the coronavirus outbreak. Financial market gains in recent weeks reflect optimism about the policy response: since the mid-March lows, the S&P/TSX Composite Index (TSX) has advanced 28%, led by gains in cyclical sectors and information technology. Despite these recent gains, cyclicals are more than 25% below their peak levels in February, whereas tech is only 5% off its highs. Consequently, information technology has grown to become the sixth largest sector in the TSX as measured by market capitalization, whereas energy has rapidly diminished in size alongside its structural underperformance.

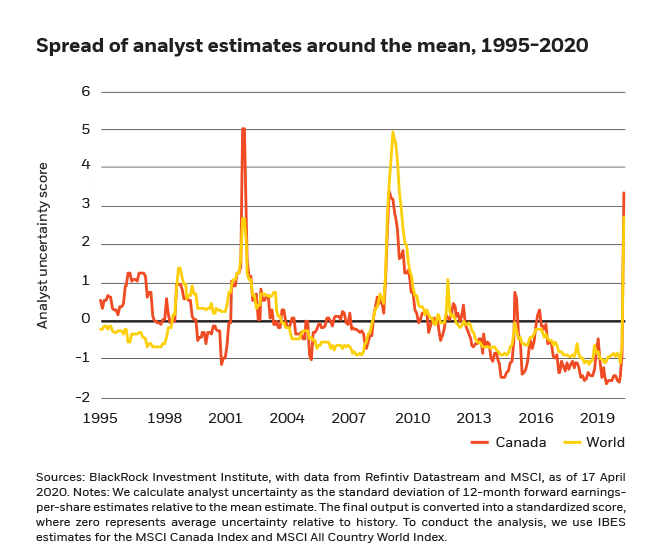

First-quarter earnings will soon dominate the headlines, as will dividend announcements and forward guidance. Refinitiv Datastream shows an anticipated 15% earnings decline during the first quarter from the previous year, and annual 2020 earnings for the TSX are likewise projected to fall 12% from 2019. Yet the dispersion of analyst estimates is historically wide, which suggests a low level of conviction in forecasting the near-term earnings outlook (see chart below). Various companies have temporarily withdrawn forward guidance until there’s more visibility into the duration of lockdowns and how quickly consumer and business activity can resume to normal. Aggressive stimulus measures will help the market navigate during what’s likely to be a tough period of economic and earnings releases. However, cyclical sectors that have recently bounced remain vulnerable to sharp disappointments to already lowered expectations. Further, elevated uncertainty should keep market volatility and risk premiums elevated in the near term.