It’s time. Consider a dynamic approach to portfolios.

New regime, new playbook

Stable inflation and economic growth in the Great Moderation supported an investment approach that relied on static, set-and-forget allocations to equities and bonds. We’re now in a supply-driven world that’s fuelling volatility and inflation, forcing central banks into a structurally tighter policy era – which doesn’t bode well for a hands-off approach. We think outperforming market returns in this new regime requires a new playbook, with more dynamic and nimble asset allocation. See New regime, new approach.

Staying nimble

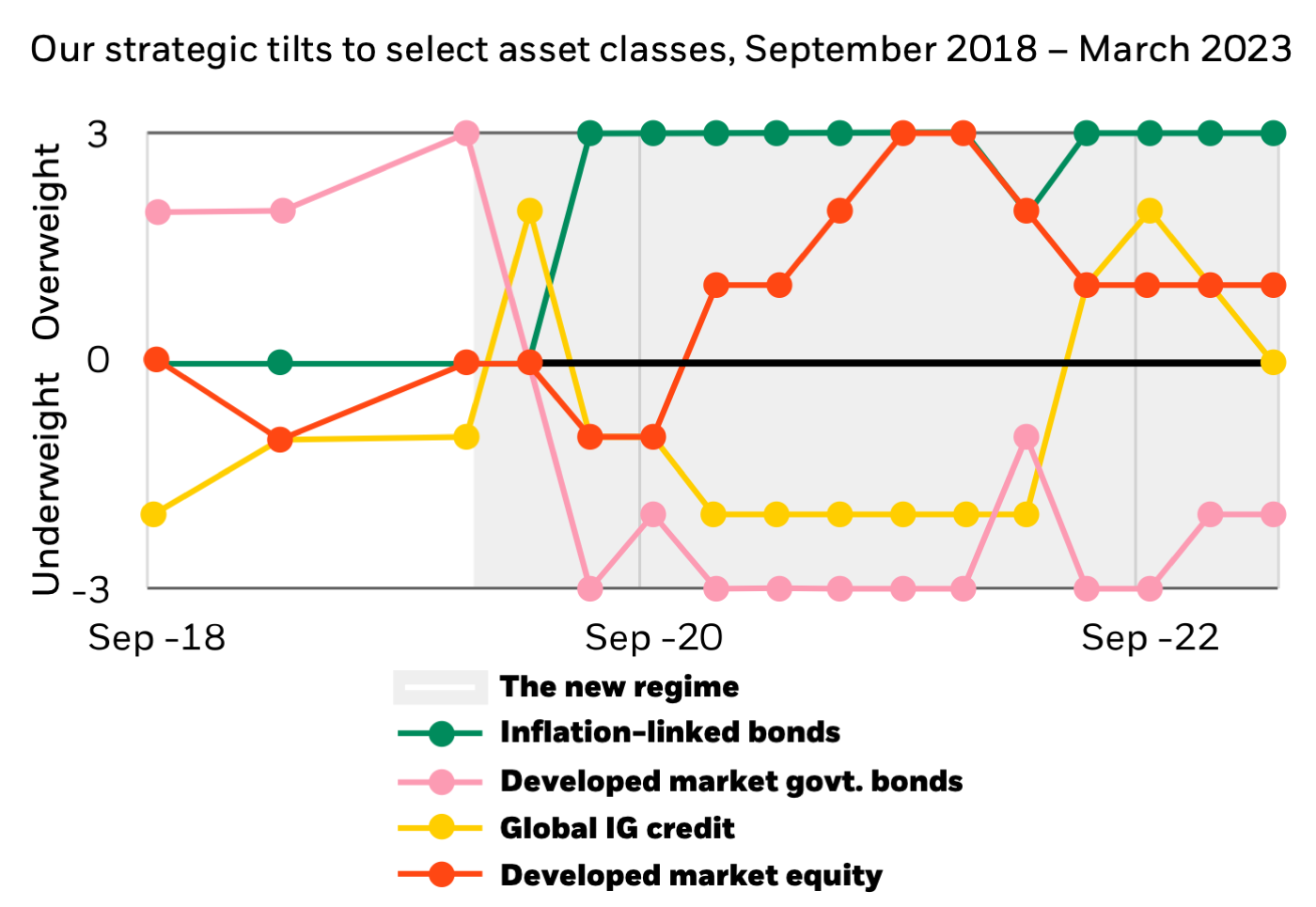

This information is not intended as a recommendation to invest in any particular asset class or strategy or as a promise - or even estimate - of future performance. Notes: The chart shows how our strategic views for selected asset classes have changed over time. The allocation shown is hypothetical, may differ by jurisdiction and does not represent a real portfolio. It is intended for information purposes only and does not constitute investment advice. Source: BlackRock Investment Institute, data as of 31 March 2023. Index proxies: Bloomberg Barclays US Government Inflation-Linked Bond Index, MSCI World US$, Bloomberg Barclays Global Credit Index, Bloomberg Barclays U.S. Credit index, Bloomberg Barclays Global Aggregate Treasury index. We use BlackRock proxies for selected private markets due to lack of sufficient data. These proxies represent the risk factor exposure mix we believe represents the economic sensitivity of the given asset class.

Chart takeaway: Strategic views need to change more frequently to reflect the new, more volatile regime. Investors could "set-and-forget" strategic allocations before. But we think being static risks missing out on the opportunities that could emerge.

A whole portfolio approach

This move towards more dynamic asset allocation and more frequent evaluation of strategic portfolio weights makes a holistic multi-asset portfolio approach even more critical than it already was. Getting the asset mix right in the new regime will be more difficult, but in our view it will also be more important for maximising returns. The impact of getting the asset mix wrong – calculated as the ratio of the relative returns for each illustrative asset mix – could be up to three times as much in the new regime, we find. See the chart below.

For illustrative purposes only. These do not represent actual portfolios and do not constitute investment advice Source: BlackRock Investment Institute with data from Refinitiv Datastreamand Morningstar. Returns data as of December 2022. Notes: The chart illustrates the contrast between estimated average annualrelative performance of two hypothetical portfolios against a 60-40 global equity-global bond portfolio over the coming decade where we see a regime of higher macro and market volatility and estimated performance over the Great Moderation era (Jan 1990-Dec 2019) of stable growth and inflation. We show hypothetical performance of portfolios comprising a 40%-global equity-60% global bond split and an 80% global equity-20% global bond mix. Index proxies: MSCI AC World for equities and the Bloomberg Global Aggregate Index for bonds. We use the actual returns for both indexes using Refinitiv data to estimate portfolio returns during the Great Moderation and use our capital market assumptions (CMAs) as of 31 December 2022 to estimate portfolio returns over the coming decade. Professional investors can see https://www.blackrock.com/institutions/en-zz/insights/charts/capital-market-assumptionsfor more details on our return assumptions. The chart illustrates that for both sets of asset mixes the overall relative return impact against a 60-40 portfolio is three times greater under the new regime. An inherent limitation of hypothetical results is that allocation decisions reflected in the performance record were not made under actual market conditions. They cannot completely account for the impact of financial risk in actual portfolio management. We also assume no transaction costs in our estimates. Indexes are unmanaged and do not account for fees. It is not possible to invest directly in an index.

Unearthing granular opportunities

We lean into selectivity and a nimble whole-portfolio approach to capture the different but abundant investment opportunities emerging in the new regime. This means getting granular across asset classes and harnessing mega forces: identifying assets that price in the economic damage, and that look well-positioned today for long-term tailwinds.

We think portfolios built for the new regime will need to account for higher inflation, get more granular with regional, sector and factor exposures, and allocate to private markets – all while being more dynamic.

Below, we look at potential opportunities within equities, fixed income and alternatives that we think are suited to the current environment.

Equities: taking a more selective approach

The new, more volatile economic regime provides different yet abundant investment opportunities. Persistent supply constraints are compelling major central banks to hold policy rates high. We seek to find opportunities by getting granular within asset classes and harnessing mega forces.

Moving up in quality

Adding quality exposure may help to boost portfolio resilience in the face of macro volatility and still-high inflation. Quality’s tilt towards companies with high profitability, low debt and strong balance sheets could help provide capital protection in volatile markets, in our view, while remaining invested for potential capital growth.

Pivoting to new opportunities

In a more volatile macro and market environment, investors may find opportunities by getting more granular, tilting portfolios to areas where the damage is priced in. We look to emerging market (EM) equities and opportunity in selective sectors such as healthcare.

Emerging market investments are usually associated with higher investment risk than developed market investments. Therefore, the value of these investments may be unpredictable and subject to greater variation.

Harnessing mega forces

In the new regime, we believe we need new portfolio building blocks that blend themes with traditional stock and bond asset classes. We look to mega forces, such as artificial intelligence (AI), where we’ve seen tactical opportunities open this year, as well as those – like the transition to a low-carbon economy – where entry points look attractive.

Fixed Income: rethinking the role of bonds

As the global economy has moved away from a period of steady growth, stable inflation, and supportive central bank policies, investors are now facing a new market regime. We’re in a period of heightened market volatility, stubbornly high inflation in some regions and tighter monetary policies. Against this backdrop, we see a key but evolving role for fixed income in portfolios. As investors rethink the role of bonds, we expect more dynamic decision-making in asset allocation and product implementation.

Get granular

Pivots to more granular new opportunities to help diversify and seek returns beyond broad exposures. We maintain our high conviction towards local currency emerging market debt, for several reasons, among them most EM central banks having paused or being very close to pausing their hiking cycles, as well as less prevalent inflationary pressures in EM, especially in Asia.

Tilting towards quality

Quality is also in demand in the fixed income space: weak growth and even weaker earnings as well as central bank policy paths keep us positive on investment grade (IG) credit over high yield (HY). IG credit is offering decade-high yields while default risks remain low and balance sheets are in good health.

Time for income

Still-stubborn inflation suggests investors will demand higher term premia to own the long end of the curve, in our view. We see pockets of potential opportunity for income in other parts of the US Treasury yield curve. Flexible duration management can also help protect total returns of fixed income assets and add sources of potential income. A relative value strategy, aims to deliver returns less dependent on market beta.

Karim:

Welcome to Around the World, where today, we shine the spotlight on fixed income. Of course, ‘bonds are back’ has been one of the biggest investment stories of the year, with the higher rate environment creating income opportunities not seen in over a decade. As a result, we’ve seen a significant rise in allocations to fixed income, across both rates and credit, as investors recalibrate portfolios to take advantage of the yields that are now on offer. Despite this pickup, we still see plenty of room to run. I’m delighted to be joined by Brett Pybus, Global Co-Head of iShares Fixed Income ETFs for BlackRock. He will tell us about some of the catalysts that could cause fixed income allocations to rise further from here.

Brett:

Thanks Karim. As you mentioned, fixed income really has returned to the fore in 2023, and investors have taken note, but we think this reallocation trend still has a long way to go. Why? Well firstly, rate volatility this year has deterred many investors from allocating in size to fixed income. With developed market central banks at or close to a peak in their rate hiking cycles, we see this volatility subsiding, creating a more supportive backdrop for fixed income exposures. Secondly, the increase in fixed income flows this year has largely been a tactical asset allocation story. As rate hiking cycles peak, we think this will spur more investors to raise their strategic allocations to fixed income. In fact, our analysis of EMEA portfolios shows that while average allocations to fixed income have increased over the last year, they still lag what we see as the optimal strategic level based on BlackRock's 10-year Capital Market Assumptions [Source: BlackRock Portfolio Consulting, October 2023]. Specifically, we look to fixed maturity ETFs, such as the iShares iBonds range, to lock in higher yields – even if, as we expect, central banks keep rates higher for longer than markets are currently pricing. While we tilt towards the front end of the curve in the US, we are starting to see opportunities to add to duration, particularly in Europe, where ETP flows suggest that investors have been moving back into long-term bonds. Thank you for joining us.

Spotlight on fixed income

Hear from Karim Chedid, Head of EMEA iShares Investment Strategy and Brett Pybus, Global Co-Head of iShares Fixed Income ETFs for BlackRock, as they discuss some of the catalysts that could cause fixed income allocations to rise further from here.

Alternatives: long term diversifiers

One fixture of the old approach to portfolio construction that we think must evolve is the broad allocation blocks to listed equities and bonds. The increasing correlation of public stocks and bonds means investors are struggling to find reliable diversification and sources of returns. To help make portfolios more resilient for the new regime, investors are increasingly considering exposure to alternatives investments.

Alternatives investments are assets that don’t fall into traditional categories such as stocks, bonds, or cash. There are two main types of alternatives investments. Private markets, such as Private Equity, Private Credit, Real Estate and Infrastructure. They are more complex and less frequently traded than public stocks and bonds. Liquid alternatives such as Hedge funds are the second type.

Alternatives investments can help investors broaden their opportunity set, increase return potential, and enhance portfolio diversification. In some cases, it can also add a healthy dose of inflation mitigation.

A continuum of portfolio solutions based around you

The new regime of increased macro and market volatility is here to stay, in our view. This will require a new approach to portfolio construction. We are here to partner with you in whatever way suits your objectives, to help implement the dynamic and nimble portfolios you will need in this new environment.

Whether you want to keep control of your asset allocation and are looking for implementation ideas and vehicles, would like to insource some multi-asset or model portfolio capabilities to free up capacity elsewhere, or are looking for a consultation to review and help shape your redesigned portfolio ideas, we can partner with you to find the right solution.