Skip to content

Switch your user type.

You're on the BlackRock site for individuals. Do you want to change your user type to individual investor?

Filter list by keyword

Show More

Show Less

to

of

Total

Sorry, no data available.

Please note, that on 03rd June 2024, the benchmark underwent a benchmark enhancement. For more information about this change you can consult the shareholder letter available in the Literature section of this webpage.

Please note, that on 03rd June 2024, the benchmark underwent a benchmark enhancement. For more information about this change you can consult the shareholder letter available in the Literature section of this webpage.

Overview

Important Information: Capital at Risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested.

Important Information: The value of your investment and the income from it will vary and your initial investment amount cannot be guaranteed.All currency hedged share classes of this fund use derivatives to hedge currency risk. The use of derivatives for a share class could pose a potential risk of contagion (also known as spill-over) to other share classes in the fund. The fund’s management company will ensure appropriate procedures are in place to minimise contagion risk to other share class. Using the drop down box directly below the name of the fund, you can view a list of all share classes in the fund – currency hedged share classes are indicated by the word “Hedged” in the name of the share class. In addition, a full list of all currency hedged share classes is available on request from the fund’s management company

Performance

Performance

Chart

Performance chart data not available for display.

Distributions

| Record Date | Ex-Date | Payable Date |

|---|

-

Returns

This chart shows the product's performance as the percentage loss or gain per year over the last 4 years.

During this period performance was achieved under circumstances that no longer apply

*On , the Fund changed its name and/or investment objective and policy.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Total Return (%) EUR | -14.94 | 16.14 | 5.28 | 3.90 | |

| Benchmark (%) EUR | -15.38 | 16.99 | 5.64 | 3.07 |

Missing calendar year returns data

| From 31-Dec-2020 To 31-Dec-2021 |

From 31-Dec-2021 To 31-Dec-2022 |

From 31-Dec-2022 To 31-Dec-2023 |

From 31-Dec-2023 To 31-Dec-2024 |

From 31-Dec-2024 To 31-Dec-2025 |

|

|---|---|---|---|---|---|

|

Total Return (%) EUR

as of 31-Dec-25 |

- | -14.94 | 16.14 | 5.28 | 3.90 |

|

Benchmark (%) EUR

as of 31-Dec-25 |

- | -15.38 | 16.99 | 5.64 | 3.07 |

| 1y | 3y | 5y | 10y | Incept. | |

|---|---|---|---|---|---|

| Total Return (%) EUR | 0.56 | 6.31 | - | - | 3.49 |

| Benchmark (%) EUR | 0.61 | 6.65 | - | - | 3.72 |

Missing average annual returns data

| YTD | 1m | 3m | 6m | 1y | 3y | 5y | 10y | Incept. | |

|---|---|---|---|---|---|---|---|---|---|

| Total Return (%) EUR | 1.53 | 1.53 | 2.45 | 4.65 | 0.56 | 20.17 | - | - | 16.71 |

| Benchmark (%) EUR | 2.10 | 2.10 | 3.01 | 5.13 | 0.61 | 21.32 | - | - | 17.87 |

Missing cumulative returns data

The figures shown relate to past performance. Past performance is not a reliable indicator of future performance. Markets could develop very differently in the future. It can help you to assess how the fund has been managed in the past

Performance is shown on a Net Asset Value (NAV) basis, with gross income reinvested where applicable. Performance data is based on the net asset value (NAV) of the ETF which may not be the same as the market price of the ETF. Individual shareholders may realize returns that are different to the NAV performance.

The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Source: Blackrock

Key Facts

Key Facts

Net Assets

as of 20-Feb-26

EUR 5,268,830

Inception Date

28-Jul-21

Share Class Currency

EUR

Asset Class

Equity

SFDR Classification

Article 8

Total Expense Ratio

0.23%

Distribution Frequency

Quarterly

Domicile

Ireland

Rebalance Frequency

Quarterly

UCITS

Yes

Fund Manager

BlackRock Asset Management Ireland Limited

Custodian

The Bank of New York Mellon SA/NV, Dublin Branch

Bloomberg Ticker

CBUD GY

Net Assets of Fund

as of 20-Feb-26

EUR 3,398,289,345

Fund Launch Date

25-Feb-11

Base Currency

EUR

Benchmark Index

MSCI EUROPE SRI SELECT REDUCED FOSSIL FUEL NET Index (EUR)

Shares Outstanding

as of 20-Feb-26

969,698

ISIN

IE000CR424L6

Use of Income

Distributing

Product Structure

Physical

Methodology

Replicated

Issuing Company

iShares II plc

Administrator

BNY Mellon Fund Services (Ireland) Designated Activity Company

Fiscal Year End

31 October

Portfolio Characteristics

Portfolio Characteristics

Number of Holdings

as of 19-Feb-26

119

Benchmark Ticker

NE727461

Standard Deviation (3y)

as of 31-Jan-26

9.10%

P/E Ratio

as of 19-Feb-26

21.15

Benchmark Level

as of 20-Feb-26

EUR 3,720.41

12 Month Trailing Dividend Distribution Yield

as of 19-Feb-26

2.04

3y Beta

as of 31-Jan-26

0.955

P/B Ratio

as of 19-Feb-26

2.90

Ratings

Registered Locations

Registered Locations

-

Austria

-

Belgium

-

Chile

-

Denmark

-

Finland

-

France

-

Germany

-

Ireland

-

Italy

-

Liechtenstein

-

Luxembourg

-

Netherlands

-

Norway

-

Saudi Arabia

-

Singapore

-

Spain

-

Sweden

-

Switzerland

-

United Kingdom

Holdings

Holdings

| Issuer Ticker | Name | Sector | Asset Class | Market Value | Weight (%) | Notional Value | Nominal | ISIN | Price | Location | Exchange | Market Currency |

|---|

Detailed Holdings and Analytics contains detailed portfolio holdings information and select analytics.

Exposure Breakdowns

Exposure Breakdowns

Geographic exposure relates principally to the domicile of the issuers of the securities held in the product, added together and then expressed as a percentage of the product’s total holdings. However, in some instances it can reflect the location where the issuer of the securities carries out much of their business. Bonds are included in US bond indices when the securities are denominated in U.S. dollars regardless of the domicile of the issuer.

Allocations are subject to change.

Listings

Listings

| Exchange | Ticker | Currency | Listing Date | SEDOL | Bloomberg Ticker | RIC |

|---|---|---|---|---|---|---|

| Xetra | CBUD | EUR | 30-Jul-21 | BNW1JM6 | CBUD GY | CBUD.DE |

PRIIPs Performance Scenarios

PRIIPs Performance Scenarios

The EU Packaged Retail and Insurance-Based Products Regulation (PRIIPs) prescribes the calculation methodology, and publication of the outcomes, of four hypothetical performance scenarios regarding how the product may perform under certain conditions and for such to be published on a monthly basis. The figures shown include all the costs of the product itself, but may not include all the costs that you pay to your advisor or distributor. The figures do not take into account your personal tax situation, which may also affect how much you get back. What you will get from this product depends on future market performance. Market developments in the future are uncertain and cannot be accurately predicted. The unfavourable, moderate, and favourable scenarios shown are illustrations using the worst, average, and best performance of the product, which may include input from benchmark(s) / proxy, over the last ten years.

Recommended holding period : 5 years

Example Investment EUR 10,000

| Scenarios |

If you exit after 1 year

|

If you exit after 5 years

|

|

|---|---|---|---|

|

Minimum

There is no minimum guaranteed return. You could lose some or all of your investment.

|

|||

|

Stress

What you might get back after costs

Average return each year

|

8,210 EUR

-17.9%

|

4,680 EUR

-14.1%

|

|

|

Unfavourable

What you might get back after costs

Average return each year

|

8,360 EUR

-16.4%

|

9,920 EUR

-0.2%

|

|

|

Moderate

What you might get back after costs

Average return each year

|

10,500 EUR

5.0%

|

13,500 EUR

6.2%

|

|

|

Favourable

What you might get back after costs

Average return each year

|

13,900 EUR

39.0%

|

15,950 EUR

9.8%

|

|

The stress scenario shows what you might get back in extreme market circumstances.

Testing missing data

Missing average annual returns data

Sustainability Characteristics

Sustainability Characteristics

Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund.

The metrics are not indicative of how or whether ESG factors will be integrated into a fund. Unless otherwise stated in fund documentation and included within a fund’s investment objective, the metrics do not change a fund’s investment objective or constrain the fund’s investable universe, and there is no indication that an ESG or Impact focused investment strategy or exclusionary screens will be adopted by a fund. For more information regarding a fund's investment strategy, please see the fund's prospectus.

Review the MSCI methodologies behind Sustainability Characteristics using the links below.

MSCI ESG Fund Rating (AAA-CCC)

as of 23-Jan-26

AAA

MSCI ESG Quality Score (0-10)

as of 23-Jan-26

9.10

Fund Lipper Global Classification

as of 23-Jan-26

Equity Europe

MSCI Weighted Average Carbon Intensity (Tons CO2E/$M SALES)

as of 23-Jan-26

21.67

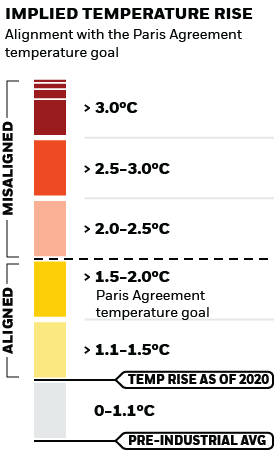

MSCI Implied Temperature Rise (0-3.0+ °C)

as of 23-Jan-26

> 1.5° - 2.0° C

MSCI ESG % Coverage

as of 23-Jan-26

99.99

MSCI ESG Quality Score - Peer Percentile

as of 23-Jan-26

99.85

Funds in Peer Group

as of 23-Jan-26

1,313

MSCI Weighted Average Carbon Intensity % Coverage

as of 18-Jul-25

99.17

MSCI Implied Temperature Rise % Coverage

as of 23-Jan-26

99.44

All data is from MSCI ESG Fund Ratings as of 23-Jan-26, based on holdings as of 31-Dec-25. As such, the fund’s sustainable characteristics may differ from MSCI ESG Fund Ratings from time to time.

To be included in MSCI ESG Fund Ratings, 65% (or 50% for bond funds and money market funds) of the fund’s gross weight must come from securities with ESG coverage by MSCI ESG Research (certain cash positions and other asset types deemed not relevant for ESG analysis by MSCI are removed prior to calculating a fund’s gross weight; the absolute values of short positions are included but treated as uncovered), the fund’s holdings date must be less than one year old, and the fund must have at least ten securities.

Business Involvement

Business Involvement

Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments.

Business Involvement metrics are not indicative of a fund’s investment objective, and, unless otherwise stated in fund documentation and included within a fund’s investment objective, do not change a fund’s investment objective or constrain the fund’s investable universe, and there is no indication that an ESG or Impact focused investment strategy or exclusionary screens will be adopted by a fund. For more information regarding a fund's investment strategy, please see the fund's prospectus.

Review the MSCI methodology behind the Business Involvement metrics, using links below.

MSCI - Controversial Weapons

as of 19-Feb-26

0.00%

MSCI - Nuclear Weapons

as of 19-Feb-26

0.00%

MSCI - Civilian Firearms

as of 19-Feb-26

0.00%

MSCI - Tobacco

as of 19-Feb-26

0.00%

MSCI - UN Global Compact Violators

as of 19-Feb-26

0.00%

MSCI - Thermal Coal

as of 19-Feb-26

0.00%

MSCI - Oil Sands

as of 19-Feb-26

0.00%

Business Involvement Coverage

as of 19-Feb-26

99.99%

Percentage of Fund not covered

as of 19-Feb-26

0.01%

BlackRock business involvement exposures as shown above for Thermal Coal and Oil Sands are calculated and reported for companies that generate more than 5% of revenue from thermal coal or oil sands as defined by MSCI ESG Research. For the exposure to companies that generate any revenue from thermal coal or oil sands (at a 0% revenue threshold), as defined by MSCI ESG Research, it is as follows: Thermal Coal 0.00% and for Oil Sands 0.00%.

Business Involvement metrics are calculated by BlackRock using data from MSCI ESG Research which provides a profile of each company’s specific business involvement. BlackRock leverages this data to provide a summed up view across holdings and translates it to a fund's market value exposure to the listed Business Involvement areas above.

Business Involvement metrics are designed only to identify companies where MSCI has conducted research and identified as having involvement in the covered activity. As a result, it is possible there is additional involvement in these covered activities where MSCI does not have coverage. This information should not be used to produce comprehensive lists of companies without involvement. Business Involvement metrics are only displayed if at least 1% of the fund’s gross weight includes securities covered by MSCI ESG Research.