Skip to content

Welcome to the BlackRock site for Qualified Clients and Sophisticated Investors.

Before you proceed, please take a moment to review and accept the following Terms and Conditions.

The information and material on this website, including any offering document, is intended to be used for information purposes only. None of the information constitutes an offer to the public of securities or fund units under any applicable legislation (including but not limited to the Israeli Securities Law, 1968 and the Israeli Joint Investment Trust Law, 1994), or an offer to sell, or a solicitation or an offer to purchase, any financial instruments, including but not limited to the investment products.

The Qualified Client/Sophisticated Investor section of this website and its content is restricted to “Qualified Clients”/Sophisticated Investors” (as defined below) only and is not intended for retail or private investors who are not “Qualified Clients” or “Sophisticated Investors”.

For the purposes of these terms, references to a "Qualified Client" mean a qualified client pursuant to the First Schedule to the Israeli Regulation of Investment Advice, Investment Marketing and Investment Portfolio Management Law, 1995 (“the Investment Advice Law”), while reference to “Sophisticated Investors” mean a qualified investor pursuant to the Israeli Securities Law, 1968 (the "Securities Law”).

By clicking below, you confirm and consent to meet the definition of Qualified Client/Sophisticated Investor, to have the relevant knowledge and experience to receive the detailed information and documents about BlackRock and iShares products and to fall within one of the following categories:

Qualified Client:

- a joint investment trust fund or a Fund Manager

- a management company or a provident fund as defined in the Control of Provident Funds Law

- a licensed insurance company

- an underwriter qualified in accordance with Section 56 (c) of the Securities Law investing for its own account

- a licensed banking corporation and auxiliary body corporate, as defined by Israeli Banking (Licensing) Law 1981, other than a joint service company

- a licensee under the Investment Advice Law

- a member of the Tel Aviv Stock Exchange

- an entity which is wholly owned by an entity which falls within this list;

- an unlicensed corporation (other than an entity that incorporated in order to obtain services) whose equity capital exceeds NIS 50 million

- A corporation incorporated abroad, with characteristics of activity similar to those of a corporation named in this list

Sophisticated Investor:

- A mutual fund or a company that manages a fund

- a licensed provident fund

- a venture capital fund1

- a licensed management company that manages a provident fund

- a licensed insurance company

- A corporation with 50 million ILS equity

- an underwriter qualified in accordance with Section 56 (c) of the Securities Law investing for its own account

- a licensed banking corporation or auxiliary corporation as defined by Israeli Banking (Licensing) Law 1981 which intends to invest for its own account or for entities which fall within this list

- a licensed portfolio management company investing for its own account or for entities which fall within this list

- a licensed investment advising company or investment marketing company as defined in the Investment Advice Law investing for its own account

- a member of the Tel Aviv Stock Exchange investing for its own account or for entities which fall within this list

- an entity which is wholly owned by an entity which falls within this list;

In accessing the website as a Qualified Client or Sophisticated Investor you will be undertaking, warranting and representing to the BlackRock Group that you are a Qualified Client or Sophisticated Investor, as applicable. Please note that BlackRock will be acting in reliance upon your undertaking, warranty and representation.

As a matter of general policy, BlackRock will not conduct regulated investment activities with any person as a result of their receiving information from the website, unless agreed otherwise with a Qualified Client or Sophisticated Investor. Anyone who is not a Qualified Client or a Sophisticated Investor should not access the Website.

You understand and consent that due to your classification as a Sophisticated Investor, the protections granted to investors under the Securities Law will not be available for you. For example, you may be offered and sold investments that are not regulated or supervised by the ISA, that are not subject to any disclosure obligations (accordingly, there might be no available information with respect to thereto), and that are not permitted to be publicly offered in Israel) and consent thereto. Furthermore, you understand and consent that even if any information provided by BlackRock was considered "Investment Marketing" (without derogating from the fact that it should not be treated as such), BlackRock would not be required to comply with the following requirements of the Investment Advice Law, due to your classification as a Qualified Clients: (1) ensuring the compatibility of service to the needs of client; (2) engaging in a written agreement with the client, the content of which is as described in section 13 of the Investment Advice Law; (3) providing the client with appropriate disclosure regarding all matters that are material to a proposed transaction or to the advice given; (4) a prohibition on preferring certain Securities or other Financial Assets; (5) providing disclosure about "extraordinary risks" entailed in a transaction (and obtaining the client's approval of such transactions, if applicable); (6) a prohibition on making Portfolio Management fees conditional upon profits or number of transactions; (7) maintaining records of advisory/discretionary actions. Based on all of the above, you confirm that you are aware of the consequences of being classified as a Qualified Client and a Sophisticated Investor, including the consequences listed above, request and consent to be classified as a Qualified Client and a Sophisticated Investor.

By accessing this website, you consent to receive information on this website in English, unless you inform us otherwise.

Please note that the Privacy Policy includes important information on the use of cookies on our website, to which you agree by clicking above.

Legal Information

None of the material within this website is intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or financial product or to adopt any investment strategy. Any opinions expressed may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. Any investments named within this material may not necessarily be held in any accounts managed by BlackRock. Reliance upon information in this material is at the sole discretion of the reader. Past performance is no guarantee of future.

BlackRock Investment Management (UK) Limited is not licensed as, a portfolio manager, investment adviser or investment manager under the Investment Marketing and Investment Portfolio Management Law- 1995 (the "Advice Law") or any other applicable law, nor does it carry insurance as required thereunder. BlackRock Investment Management (UK) Limited is not, and will not be providing any investment advice, investment marketing or portfolio management services to the Investor. BlackRock and the Funds managed by BlackRock are not subject to the laws and supervision that apply to mutual funds in Israel.

BlackRock benefits from investments made by investors in Israel in the products mentioned in this website, as well as in other products managed by third parties with whom BlackRock is involved in a business contract. In particular, BlackRock manages the foreign funds mentioned in this website, and therefore benefits from investments of Israeli investors in them (inter alia, by charging a "management fee" as specified in the prospectus and in the Annex to the prospectuses of such funds). Therefore, BlackRock has a "Connection" to such products, a personal interest in their sale, and might prefer such products over other products. Accordingly, any advice BlackRock provides, is considered, for the purpose of the Investment Advice Law, as Investment Marketing (and not Investment Advising). The complete and updated information regarding the names of such asset managers to the products of which BlackRock has a "connection" (and the types of products issued by each one) is available upon request.

Accessibility statement

BlackRock is committed to making its websites accessible following the current Web Content Accessibility Guidelines (WCAG).. These improvements are part of our broader effort to meet legal and regulatory requirements and to ensure an inclusive digital experience for all users.

By accepting these terms and conditions, you consent to communicate with us in English unless you inform us otherwise.

1“Venture Capital Fund” means a corporation primarily engaged in investments in other corporations which are engaged, at the time of the investment, in research and development or in the production of innovative or high technology products or processes, and where the risk of such investment is typically higher than the risk involved in other investments.

BlackRock Investment Management (UK) Limited is not licensed as, a portfolio manager, investment adviser or investment manager under the Investment Marketing and Investment Portfolio Management Law- 1995 (the "Advice Law") or any other applicable law, nor does it carry insurance as required thereunder. BlackRock Investment Management (UK) Limited is not, and will not be providing any investment advice, investment marketing or portfolio management services to the Investor.

I/We confirm that each time I/We log onto to this website, that I/We are Qualified Investors as such term is defined under the Securities Law of 1968 and Qualified Clients under the Advice Law and understand that this website is designated solely for Qualified Investors that are also Qualified Clients, and will not be permitted to view or access the content thereof until I confirm my status as such. I am aware and consent to the implications of being designated as a Qualified Investor and a Qualified Client, including not being entitled to certain protection available under law. Should this status as a Qualified Investor and Qualified Client change, I/We will inform BlackRock Investment Management (UK) Limited which may have the impact of limiting or withdrawing access to the website.

Filter list by keyword

Show More

Show Less

to

of

Total

Sorry, no data available.

Overview

Capital at Risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested.

Credit risk, changes to interest rates and/or issuer defaults will have a significant impact on the performance of fixed income securities. Potential or actual credit rating downgrades may increase the level of risk. The benchmark index only excludes companies engaging in certain activities inconsistent with ESG criteria if such activities exceed the thresholds determined by the index provider. Investors should therefore make a personal ethical assessment of the benchmark index’s ESG screening prior to investing in the Fund. Such ESG screening may adversely affect the value of the Fund’s investments compared to a fund without such screening.All currency hedged share classes of this fund use derivatives to hedge currency risk. The use of derivatives for a share class could pose a potential risk of contagion (also known as spill-over) to other share classes in the fund. The fund’s management company will ensure appropriate procedures are in place to minimise contagion risk to other share class. Using the drop down box directly below the name of the fund, you can view a list of all share classes in the fund – currency hedged share classes are indicated by the word “Hedged” in the name of the share class. In addition, a full list of all currency hedged share classes is available on request from the fund’s management company

Performance

Performance

Chart

Performance chart data not available for display.

-

Returns

This chart shows the product's performance as the percentage loss or gain per year over the last 2 years.

During this period performance was achieved under circumstances that no longer apply

*On , the Fund changed its name and/or investment objective and policy.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Total Return (%) EUR | 4.0 | 3.1 | |||

| Benchmark (%) EUR | 4.1 | 3.2 |

Missing calendar year returns data

| From 31-Dec-2020 To 31-Dec-2021 |

From 31-Dec-2021 To 31-Dec-2022 |

From 31-Dec-2022 To 31-Dec-2023 |

From 31-Dec-2023 To 31-Dec-2024 |

From 31-Dec-2024 To 31-Dec-2025 |

|

|---|---|---|---|---|---|

|

Total Return (%) EUR

as of 31-Dec-2025 |

- | - | - | 4.00 | 3.13 |

|

Benchmark (%) EUR

as of 31-Dec-2025 |

- | - | - | 4.13 | 3.21 |

| 1y | 3y | 5y | 10y | Incept. | |

|---|---|---|---|---|---|

|

Total Return (%) EUR

as of 31-Dec-2025 |

3.13 | - | - | - | 4.95 |

|

Benchmark (%) EUR

as of 31-Dec-2025 |

3.21 | - | - | - | 5.06 |

Missing average annual returns data

| YTD | 1m | 3m | 6m | 1y | 3y | 5y | 10y | Incept. | |

|---|---|---|---|---|---|---|---|---|---|

|

Total Return (%) EUR

as of 31-Dec-2025 |

3.13 | 0.18 | 0.56 | 1.11 | 3.13 | - | - | - | 11.85 |

|

Benchmark (%) EUR

as of 31-Dec-2025 |

3.21 | 0.16 | 0.56 | 1.14 | 3.21 | - | - | - | 12.11 |

Missing cumulative returns data

The figures shown relate to past performance. Past performance is not a reliable indicator of future performance. Markets could develop very differently in the future. It can help you to assess how the fund has been managed in the past

Performance is shown on a Net Asset Value (NAV) basis, with gross income reinvested where applicable. Performance data is based on the net asset value (NAV) of the ETF which may not be the same as the market price of the ETF. Individual shareholders may realize returns that are different to the NAV performance.

The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Source: Blackrock

Key Facts

Key Facts

Net Assets

as of 15-Jan-2026

EUR 814,154,033

Share Class launch date

06-Sept-2023

Share Class Currency

EUR

Asset Class

Fixed Income

SFDR Classification

Article 8

Total Expense Ratio

0.12%

Use of Income

Accumulating

Product Structure

Physical

Methodology

Sampled

Issuing Company

iShares V plc

Administrator

State Street Fund Services (Ireland) Limited

Fiscal Year End

30 November

Net Assets of Fund

as of 15-Jan-2026

EUR 1,176,166,707

Fund Launch Date

06-Sept-2023

Fund Base Currency

EUR

Benchmark Index

BBG MSCI December 2027 Maturity EUR Corporate ESG Screened Index

Shares Outstanding

as of 15-Jan-2026

145,747,314

ISIN

IE000ZOI8OK5

Domicile

Ireland

Rebalance Frequency

Monthly

UCITS Compliant

Yes

Fund Manager

BlackRock Asset Management Ireland Limited

Custodian

State Street Custodial Services (Ireland) Limited

Bloomberg Ticker

IB27 GY

Portfolio Characteristics

Portfolio Characteristics

Number of Holdings

as of 14-Jan-2026

376

Benchmark Ticker

I37980EU

3y Beta

as of -

-

Weighted Avg Coupon

as of 15-Jan-2026

1.95

Effective Duration

as of 15-Jan-2026

1.39

Benchmark Level

as of 15-Jan-2026

EUR 101.07

Standard Deviation (3y)

as of -

-

Weighted Average YTM

as of 15-Jan-2026

2.48

Weighted Avg Maturity

as of 15-Jan-2026

1.42

Ratings

Registered Locations

Registered Locations

-

Austria

-

Czech Republic

-

Denmark

-

Finland

-

France

-

Germany

-

Hungary

-

Ireland

-

Italy

-

Liechtenstein

-

Luxembourg

-

Netherlands

-

Norway

-

Poland

-

Portugal

-

Saudi Arabia

-

Slovak Republic

-

Spain

-

Sweden

-

Switzerland

-

United Kingdom

Holdings

Holdings

as of 14-Jan-2026

| Issuer | Weight (%) |

|---|---|

| SOCIETE GENERALE SA | 2.13 |

| BANQUE FEDERATIVE DU CREDIT MUTUEL SA | 1.98 |

| CREDIT AGRICOLE SA | 1.48 |

| VOLKSWAGEN INTERNATIONAL FINANCE NV | 1.47 |

| BANCO BILBAO VIZCAYA ARGENTARIA SA | 1.29 |

| Issuer | Weight (%) |

|---|---|

| WELLS FARGO & COMPANY | 1.28 |

| MERCEDES-BENZ INTERNATIONAL FINANCE BV | 1.26 |

| NORDEA BANK ABP | 1.17 |

| SKANDINAVISKA ENSKILDA BANKEN AB | 1.10 |

| BPCE SA | 0.98 |

| Issuer Ticker | Name | Sector | Asset Class | Market Value | Weight (%) | Notional Value | Nominal | Par Value | ISIN | Price | Location | Exchange | Duration | Maturity | Coupon (%) | Market Currency | Effective Date |

|---|

Detailed Holdings and Analytics contains detailed portfolio holdings information and select analytics.

Exposure Breakdowns

Exposure Breakdowns

Geographic exposure relates principally to the domicile of the issuers of the securities held in the product, added together and then expressed as a percentage of the product’s total holdings. However, in some instances it can reflect the location where the issuer of the securities carries out much of their business.

Allocations are subject to change.

Estimated Net Acquisition Yield Calculator

Estimated Net Acquisition Yield Calculator

Calculate the Estimated Net Acquisition Yield (ENA Yield) based on the projected market purchase price that you input. This estimate also reflects the deduction of the expense ratio (12 basis points).

The NAV (as of 15-Jan-2026) used in the calculation is EUR 5.59. The value you enter should correspond to your estimated market purchase price as of 15-Jan-2026. Calculation is based on the chosen share class currency and not the chosen trading line currency.

The Average Yield to Maturity shown is the weighted average yield to maturity of the individual bonds. During the final year of the fund's life, the underlying bonds will mature and the proceeds will be held in government debt securities until the liquidation of the fund. The investor's total realised yield to fund maturity will be influenced by the yield earned on these proceeds during the final year. If the future yield on government debt securities is lower than the current Average Yield to Maturity for the portfolio's bonds, the realised yield to fund maturity is also expected to be lower and vice versa.

Please note that the results generated by the Estimated Net Acquisition Yield Calculator are for illustrative purposes only and are not representative of any specific investment outcome.

Please input an amount less than EUR20.000

The ENA Yield metric does not include the impact of cash reinvestment rates (e.g., during the final year prior to maturity), potential losses arising from credit downgrades or defaults, or changes to the portfolio composition over time.

The Estimated Net Acquisition Yield is an annualized number. For periods less than one year, the yield adjustment will be magnified for a given change in price. This effect will increase as the fund approaches maturity.

Listings

Listings

| Exchange | Ticker | Currency | Listing Date | SEDOL | Bloomberg Ticker | RIC |

|---|---|---|---|---|---|---|

| Xetra | IB27 | EUR | 07-Sept-2023 | BR2Q082 | IB27 GY | IB27.DE |

| Borsa Italiana | IB27 | EUR | 14-Sept-2023 | BQV1RT1 | IB27 IM | IB27.MI |

| Nyse Euronext - Euronext Paris | IB27 | EUR | 07-Sept-2023 | BQV1RS0 | IB27 FP | IB27.PA |

| SIX Swiss Exchange | IB27 | EUR | 10-Nov-2023 | BRBXX41 | IB27 SE | IB27.S |

Sustainability Characteristics

Sustainability Characteristics

Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund.

The metrics are not indicative of how or whether ESG factors will be integrated into a fund. Unless otherwise stated in fund documentation and included within a fund’s investment objective, the metrics do not change a fund’s investment objective or constrain the fund’s investable universe, and there is no indication that an ESG or Impact focused investment strategy or exclusionary screens will be adopted by a fund. For more information regarding a fund's investment strategy, please see the fund's prospectus.

Review the MSCI methodologies behind Sustainability Characteristics using the links below.

MSCI ESG Fund Rating (AAA-CCC)

as of 19-Dec-2025

AA

MSCI ESG Quality Score (0-10)

as of 19-Dec-2025

7.27

Fund Lipper Global Classification

as of 19-Dec-2025

Target Maturity Bond EUR 2020+

MSCI Weighted Average Carbon Intensity (Tons CO2E/$M SALES)

as of 19-Dec-2025

84.20

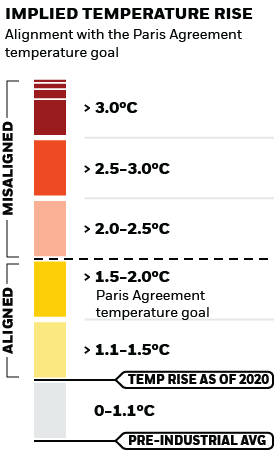

MSCI Implied Temperature Rise (0-3.0+ °C)

as of 19-Dec-2025

> 2.0° - 2.5° C

MSCI ESG % Coverage

as of 19-Dec-2025

97.59

MSCI ESG Quality Score - Peer Percentile

as of 19-Dec-2025

81.98

Funds in Peer Group

as of 19-Dec-2025

516

MSCI Weighted Average Carbon Intensity % Coverage

as of 18-Jul-2025

99.31

MSCI Implied Temperature Rise % Coverage

as of 19-Dec-2025

99.21

All data is from MSCI ESG Fund Ratings as of 19-Dec-2025, based on holdings as of 30-Nov-2025. As such, the fund’s sustainable characteristics may differ from MSCI ESG Fund Ratings from time to time.

To be included in MSCI ESG Fund Ratings, 65% (or 50% for bond funds and money market funds) of the fund’s gross weight must come from securities with ESG coverage by MSCI ESG Research (certain cash positions and other asset types deemed not relevant for ESG analysis by MSCI are removed prior to calculating a fund’s gross weight; the absolute values of short positions are included but treated as uncovered), the fund’s holdings date must be less than one year old, and the fund must have at least ten securities.

Business Involvement

Business Involvement

Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments.

Business Involvement metrics are not indicative of a fund’s investment objective, and, unless otherwise stated in fund documentation and included within a fund’s investment objective, do not change a fund’s investment objective or constrain the fund’s investable universe, and there is no indication that an ESG or Impact focused investment strategy or exclusionary screens will be adopted by a fund. For more information regarding a fund's investment strategy, please see the fund's prospectus.

Review the MSCI methodology behind the Business Involvement metrics, using links below.

MSCI - Controversial Weapons

as of 14-Jan-2026

0.00%

MSCI - Nuclear Weapons

as of 14-Jan-2026

0.00%

MSCI - Civilian Firearms

as of 14-Jan-2026

0.00%

MSCI - Tobacco

as of 14-Jan-2026

0.00%

MSCI - UN Global Compact Violators

as of 14-Jan-2026

0.00%

MSCI - Thermal Coal

as of 14-Jan-2026

0.00%

MSCI - Oil Sands

as of 14-Jan-2026

0.00%

Business Involvement Coverage

as of 14-Jan-2026

89.74%

Percentage of Fund not covered

as of 14-Jan-2026

10.26%

BlackRock business involvement exposures as shown above for Thermal Coal and Oil Sands are calculated and reported for companies that generate more than 5% of revenue from thermal coal or oil sands as defined by MSCI ESG Research. For the exposure to companies that generate any revenue from thermal coal or oil sands (at a 0% revenue threshold), as defined by MSCI ESG Research, it is as follows: Thermal Coal 0.45% and for Oil Sands 0.81%.

Business Involvement metrics are calculated by BlackRock using data from MSCI ESG Research which provides a profile of each company’s specific business involvement. BlackRock leverages this data to provide a summed up view across holdings and translates it to a fund's market value exposure to the listed Business Involvement areas above.

Business Involvement metrics are designed only to identify companies where MSCI has conducted research and identified as having involvement in the covered activity. As a result, it is possible there is additional involvement in these covered activities where MSCI does not have coverage. This information should not be used to produce comprehensive lists of companies without involvement. Business Involvement metrics are only displayed if at least 1% of the fund’s gross weight includes securities covered by MSCI ESG Research.