Skip to content

Welcome to the BlackRock site for Qualified Clients and Sophisticated Investors.

Before you proceed, please take a moment to review and accept the following Terms and Conditions.

The information and material on this website, including any offering document, is intended to be used for information purposes only. None of the information constitutes an offer to the public of securities or fund units under any applicable legislation (including but not limited to the Israeli Securities Law, 1968 and the Israeli Joint Investment Trust Law, 1994), or an offer to sell, or a solicitation or an offer to purchase, any financial instruments, including but not limited to the investment products.

The Qualified Client/Sophisticated Investor section of this website and its content is restricted to “Qualified Clients”/Sophisticated Investors” (as defined below) only and is not intended for retail or private investors who are not Qualified Clients or “Sophisticated Investors”.

For the purposes of these terms, references to a "Qualified Client" mean a qualified client pursuant to the First Schedule to the Israeli Regulation of Investment Advice, Investment Marketing and Investment Portfolio Management Law, 1995 (“the Investment Advice Law”), while reference to “Sophisticated Investors” mean a qualified investor pursuant to the Israeli Securities Law, 1968 (the "Securities Law”).

By clicking below, you confirm to meet the definition of Qualified Client/Sophisticated Investor, to have the relevant knowledge and experience to receive the detailed information and documents about BlackRock and iShares products and to fall within one of the following categories:

Qualified Client:

- a joint investment trust fund or a Fund Manager

- a management company or a provident fund as defined in the Control of Provident Funds Law

- a licensed insurance company

- an underwriter qualified in accordance with Section 56 (c) of the Securities Law investing for its own account

- a licensed banking corporation and auxiliary body corporate, as defined by Israeli Banking (Licensing) Law 1981, other than a joint service company

- a licensee under the Investment Advice Law

- a member of the Tel Aviv Stock Exchange

- an entity which is wholly owned by an entity which falls within this list;

- an unlicensed corporation (other than an entity that incorporated in order to obtain services) whose equity capital exceeds NIS 50 million

- A corporation incorporated abroad, with characteristics of activity similar to those of a corporation named in this list

Sophisticated Investor:

- a mutual fund, trust fund or a company that manages a fund

- a licensed provident fund

- a venture capital fund

- a licensed management company that manages a provident fund

- a licensed insurance company

- an underwriter qualified in accordance with Section 56 (c) of the Securities Law investing for its own account

- a licensed banking corporation or auxiliary corporation as defined by Israeli Banking (Licensing) Law 1981 which intends to invest for its own account or for entities which fall within this list

- a portfolio management company licensed to offer investment advice, investment marketing and portfolio management services as defined by Investment Advice Law investing for its own account or for entities which fall within this list

- a licensed investment advising company or investment marketing company as defined in the Investment Advice Law investing for its own account

- a member of the Tel Aviv Stock Exchange investing for its own account or for entities which fall within this list

- an entity which is wholly owned by an entity which falls within this list;

In accessing the website as a Qualified Client or Sophisticated Investor you will be undertaking, warranting and representing to the BlackRock Group that you are a Qualified Client or Sophisticated Investor, as applicable. Please note that BlackRock will be acting in reliance upon your undertaking, warranty and representation.

As a matter of general policy, BlackRock will not conduct regulated investment activities with any person as a result of their receiving information from the website, unless agreed otherwise with a Qualified Client or Sophisticated Investor. Anyone who is not a Qualified Client or a Sophisticated Investor should not access the Website.

You confirm to be aware of the consequences of being classified as a Qualified Client or a Sophisticated Investor and the level of regulatory protection that may not be available to you.

By accessing this website, you consent to receive information on this website in English, unless you inform us otherwise.

Please note that the Privacy Policy includes important information on the use of cookies on our website, to which you agree by clicking above.

Legal Information

None of the material within this website is intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or financial product or to adopt any investment strategy. Any opinions expressed may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. Any investments named within this material may not necessarily be held in any accounts managed by BlackRock. Reliance upon information in this material is at the sole discretion of the reader. Past performance is no guarantee of future.

BlackRock Investment Management (UK) Limited is not licensed as, a portfolio manager, investment adviser or investment manager under the Investment Marketing and Investment Portfolio Management Law- 1995 (the "Advice Law") or any other applicable law, nor does it carry insurance as required thereunder. BlackRock Investment Management (UK) Limited is not, and will not be providing any investment advice, investment marketing or portfolio management services to the Investor.

Accessibility statement

BlackRock undertakes to make website and software packages accessible in accordance with Content Accessibility Guidelines (WCAG 2.0) in the near future and incorporate new functionalities specifically designed to enhance accessibility for individuals with disabilities. These enhancements are being implemented to ensure compliance with legal and regulatory requirements and to provide an inclusive online experience for all visitors. Thank you for your patience as we work to improve accessibility on BlackRock platform.

MKTGH0524E/S-3597545

BlackRock Investment Management (UK) Limited is not licensed as, a portfolio manager, investment adviser or investment manager under the Investment Marketing and Investment Portfolio Management Law- 1995 (the "Advice Law") or any other applicable law, nor does it carry insurance as required thereunder. BlackRock Investment Management (UK) Limited is not, and will not be providing any investment advice, investment marketing or portfolio management services to the Investor.

I/We confirm that each time I/We log onto to this website, that I/We are Qualified Investors as such term is defined under the Securities Law of 1968 and Qualified Clients under the Advice Law and understand that this website is designated solely for Qualified Investors that are also Qualified Clients, and will not be permitted to view or access the content thereof until I confirm my status as such. I am aware and consent to the implications of being designated as a Qualified Investor and a Qualified Client, including not being entitled to certain protection available under law. Should this status as a Qualified Investor and Qualified Client change, I/We will inform BlackRock Investment Management (UK) Limited which may have the impact of limiting or withdrawing access to the website.

Filter list by keyword

Show More

Show Less

to

of

Total

Sorry, no data available.

Overview

Capital at Risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested.

Important Information: All financial investments involve an element of risk. Therefore, the value of your investment and the income from it will vary and your initial investment amount cannot be guaranteed. Two main risks related to fixed income investing are interest rate risk and credit risk. Typically, when interest rates rise, there is a corresponding decline in the market value of bonds. Credit risk refers to the possibility that the issuer of the bond will not be able to repay the principal and make interest payments. The Fund’s investments may have low liquidity which often causes the value of these investments to be less predictable. In extreme cases, the Fund may not be able to realise the investment at the latest market price or at a price considered fair. The insolvency of any institutions providing services such as safekeeping of assets or acting as counterparty to derivatives or other instruments, may expose the Fund to financial loss.All currency hedged share classes of this fund use derivatives to hedge currency risk. The use of derivatives for a share class could pose a potential risk of contagion (also known as spill-over) to other share classes in the fund. The fund’s management company will ensure appropriate procedures are in place to minimise contagion risk to other share class. Using the drop down box directly below the name of the fund, you can view a list of all share classes in the fund – currency hedged share classes are indicated by the word “Hedged” in the name of the share class. In addition, a full list of all currency hedged share classes is available on request from the fund’s management company

Performance

Performance

Chart

Performance chart data not available for display.

-

Returns

This chart shows the fund's performance as the percentage loss or gain per year over the last 2 years.

During this period performance was achieved under circumstances that no longer apply

*On , the Fund changed its name and/or investment objective and policy..

| 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|

| Total Return (%) | -4.7 | 1.2 | |||

| Benchmark (%) | -2.1 | 5.5 |

Missing calendar year returns data

| From 30-Sept-2019 To 30-Sept-2020 |

From 30-Sept-2020 To 30-Sept-2021 |

From 30-Sept-2021 To 30-Sept-2022 |

From 30-Sept-2022 To 30-Sept-2023 |

From 30-Sept-2023 To 30-Sept-2024 |

|

|---|---|---|---|---|---|

|

Total Return (%)

as of 30-Sept-2024 |

- | - | -5.56 | -0.25 | 3.11 |

|

Benchmark (%)

as of 30-Sept-2024 |

- | - | -3.76 | 4.03 | 7.62 |

| 1y | 3y | 5y | 10y | Incept. | |

|---|---|---|---|---|---|

| Total Return (%) | 1.78 | -0.92 | - | - | -1.00 |

| Benchmark (%) | 6.20 | 2.74 | - | - | 2.12 |

Missing average annual returns data

| YTD | 1m | 3m | 6m | 1y | 3y | 5y | 10y | Incept. | |

|---|---|---|---|---|---|---|---|---|---|

| Total Return (%) | 1.07 | 0.13 | -0.03 | 1.14 | 1.78 | -2.74 | - | - | -3.72 |

| Benchmark (%) | 5.03 | 0.44 | 1.02 | 3.39 | 6.20 | 8.43 | - | - | 8.24 |

Missing cumulative returns data

The figures shown relate to past performance. Past performance is not a reliable indicator of future performance. Markets could develop very differently in the future. It can help you to assess how the fund has been managed in the past

Share Class and Benchmark performance displayed in CHF, hedged share class benchmark performance is displayed in USD.

Performance is shown on a Net Asset Value (NAV) basis, with gross income reinvested where applicable. Performance data is based on the net asset value (NAV) of the ETF which may not be the same as the market price of the ETF. Individual shareholders may realize returns that are different to the NAV performance.

The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Source: Blackrock

Key Facts

Key Facts

Net Assets

as of 13-Dec-2024

CHF 14,116,432

Share Class launch date

24-Feb-2021

Share Class Currency

CHF

Asset Class

Fixed Income

SFDR Classification

Article 8

Total Expense Ratio

0.14%

Use of Income

Accumulating

Product Structure

Physical

Methodology

Sampled

Issuing Company

iShares II plc

Administrator

BNY Mellon Fund Services (Ireland) Designated Activity Company

Fiscal Year End

31 October

Net Assets of Fund

as of 13-Dec-2024

USD 1,140,297,074

Fund Launch Date

12-Dec-2018

Fund Base Currency

USD

Benchmark Index

Bloomberg MSCI US Corporate 0-3 Sustainable SRI Index

Shares Outstanding

as of 13-Dec-2024

2,933,722

ISIN

IE00BMH5T376

Domicile

Ireland

Rebalance Frequency

Monthly

UCITS Compliant

Yes

Fund Manager

BlackRock Asset Management Ireland Limited

Custodian

The Bank of New York Mellon SA/NV, Dublin Branch

Bloomberg Ticker

IU0C SE

Portfolio Characteristics

Portfolio Characteristics

Number of Holdings

as of 12-Dec-2024

1645

Benchmark Ticker

BMSRTRUU

3y Beta

as of 30-Nov-2024

0.909

Weighted Avg Coupon

as of 12-Dec-2024

3.61

Effective Duration

as of 12-Dec-2024

1.35

Benchmark Level

as of 13-Dec-2024

USD 130.47

Standard Deviation (3y)

as of 30-Nov-2024

1.92%

Weighted Average YTM

as of 12-Dec-2024

4.71

Weighted Avg Maturity

as of 12-Dec-2024

1.46

Sustainability Characteristics

Sustainability Characteristics

Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund.

The metrics are not indicative of how or whether ESG factors will be integrated into a fund. Unless otherwise stated in fund documentation and included within a fund’s investment objective, the metrics do not change a fund’s investment objective or constrain the fund’s investable universe, and there is no indication that an ESG or Impact focused investment strategy or exclusionary screens will be adopted by a fund. For more information regarding a fund's investment strategy, please see the fund's prospectus.

Review the MSCI methodologies behind Sustainability Characteristics using the links below.

MSCI ESG Fund Rating (AAA-CCC)

as of 21-Nov-2024

A

MSCI ESG Quality Score (0-10)

as of 21-Nov-2024

7.09

Fund Lipper Global Classification

as of 21-Nov-2024

Bond USD Short Term

MSCI Weighted Average Carbon Intensity (Tons CO2E/$M SALES)

as of 21-Nov-2024

49.72

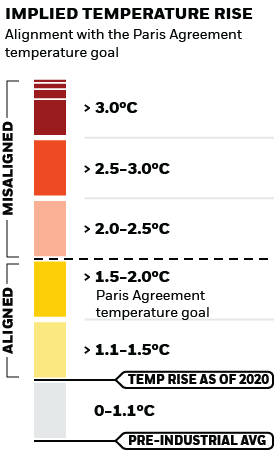

MSCI Implied Temperature Rise (0-3.0+ °C)

as of 21-Nov-2024

> 2.5° - 3.0° C

MSCI ESG % Coverage

as of 21-Nov-2024

99.81

MSCI ESG Quality Score - Peer Percentile

as of 21-Nov-2024

90.34

Funds in Peer Group

as of 21-Nov-2024

207

MSCI Weighted Average Carbon Intensity % Coverage

as of 21-Nov-2024

99.06

MSCI Implied Temperature Rise % Coverage

as of 21-Nov-2024

98.93

All data is from MSCI ESG Fund Ratings as of 21-Nov-2024, based on holdings as of 31-Oct-2024. As such, the fund’s sustainable characteristics may differ from MSCI ESG Fund Ratings from time to time.

To be included in MSCI ESG Fund Ratings, 65% (or 50% for bond funds and money market funds) of the fund’s gross weight must come from securities with ESG coverage by MSCI ESG Research (certain cash positions and other asset types deemed not relevant for ESG analysis by MSCI are removed prior to calculating a fund’s gross weight; the absolute values of short positions are included but treated as uncovered), the fund’s holdings date must be less than one year old, and the fund must have at least ten securities.

Business Involvement

Business Involvement

Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments.

Business Involvement metrics are not indicative of a fund’s investment objective, and, unless otherwise stated in fund documentation and included within a fund’s investment objective, do not change a fund’s investment objective or constrain the fund’s investable universe, and there is no indication that an ESG or Impact focused investment strategy or exclusionary screens will be adopted by a fund. For more information regarding a fund's investment strategy, please see the fund's prospectus.

Review the MSCI methodology behind the Business Involvement metrics, using links below.

MSCI - Controversial Weapons

as of 12-Dec-2024

0.00%

MSCI - Nuclear Weapons

as of 12-Dec-2024

0.00%

MSCI - Civilian Firearms

as of 12-Dec-2024

0.00%

MSCI - Tobacco

as of 12-Dec-2024

0.00%

MSCI - UN Global Compact Violators

as of 12-Dec-2024

0.00%

MSCI - Thermal Coal

as of 12-Dec-2024

0.00%

MSCI - Oil Sands

as of 12-Dec-2024

0.00%

Business Involvement Coverage

as of 12-Dec-2024

92.83%

Percentage of Fund not covered

as of 12-Dec-2024

7.17%

BlackRock business involvement exposures as shown above for Thermal Coal and Oil Sands are calculated and reported for companies that generate more than 5% of revenue from thermal coal or oil sands as defined by MSCI ESG Research. For the exposure to companies that generate any revenue from thermal coal or oil sands (at a 0% revenue threshold), as defined by MSCI ESG Research, it is as follows: Thermal Coal 0.00% and for Oil Sands 0.00%.

Business Involvement metrics are calculated by BlackRock using data from MSCI ESG Research which provides a profile of each company’s specific business involvement. BlackRock leverages this data to provide a summed up view across holdings and translates it to a fund's market value exposure to the listed Business Involvement areas above.

Business Involvement metrics are designed only to identify companies where MSCI has conducted research and identified as having involvement in the covered activity. As a result, it is possible there is additional involvement in these covered activities where MSCI does not have coverage. This information should not be used to produce comprehensive lists of companies without involvement. Business Involvement metrics are only displayed if at least 1% of the fund’s gross weight includes securities covered by MSCI ESG Research.

Ratings

Registered Locations

Registered Locations

-

Ireland

-

Liechtenstein

-

Saudi Arabia

-

Switzerland

Holdings

Holdings

as of 12-Dec-2024

| Issuer | Weight (%) |

|---|---|

| JPMORGAN CHASE & CO | 3.99 |

| BANK OF AMERICA CORP | 3.66 |

| CITIGROUP INC | 2.75 |

| MORGAN STANLEY | 2.72 |

| GOLDMAN SACHS GROUP INC/THE | 2.69 |

| Issuer | Weight (%) |

|---|---|

| HSBC HOLDINGS PLC | 1.83 |

| APPLE INC | 1.42 |

| BARCLAYS PLC | 1.35 |

| TOYOTA MOTOR CREDIT CORP | 1.34 |

| ROYAL BANK OF CANADA | 1.30 |

| Issuer Ticker | Name | Sector | Asset Class | Market Value | Weight (%) | Notional Value | Nominal | Par Value | ISIN | Price | Location | Exchange | Duration | Maturity | Coupon (%) | Market Currency | Effective Date |

|---|

Detailed Holdings and Analytics contains detailed portfolio holdings information and select analytics.

Exposure Breakdowns

Exposure Breakdowns

Geographic exposure relates principally to the domicile of the issuers of the securities held in the product, added together and then expressed as a percentage of the product’s total holdings. However, in some instances it can reflect the location where the issuer of the securities carries out much of their business.

Allocations are subject to change.

Listings

Listings

| Exchange | Ticker | Currency | Listing Date | SEDOL | Bloomberg Ticker | RIC |

|---|---|---|---|---|---|---|

| SIX Swiss Exchange | IU0C | CHF | 26-Feb-2021 | BMH5T37 | IU0C SE | IU0C.S |