Skip to content

Switch your user type.

You're on the BlackRock site for advisors. Do you want to change your user type to advisor?

COLLEGE SAVINGS & MORE

529 Savings Plans

Tax-advantaged, flexible, and convenient. Learn about BlackRock’s 529 plans, navigate your investment strategy, and access benefits for advisors like you and your clients. It’s never too early or late to start investing for education.

Facts on 529 plans

-

01

Use any state's plan

Invest in ANY 529 plan and use plan assets at ANY eligible school around the country or abroad.1

-

02

529s are for more than college tuition

529 plans are flexible. Account assets can be used to pay for many qualified education expenses.

-

03

Easily transfer plan benefits.

Unlike other education savings and investment options, a 529 account owner controls the account. That means the account owner can change the beneficiary to another eligible member of the family.

Why 529 plans?

Next to retirement, saving for education is the second most important goal for many investors. 529 plans serve as a way to invest and save for education while providing additional tax benefits.

Explore the potential advisor and client benefits, and how BlackRock 529s can support education savings needs.

Look out for tuition increases

Sources: BlackRock; College Board, “Trends in College Pricing and Student Aid 2022.” Figures include tuition, fees, room and board. Figures for age 18 based on costs for 2022-2023 academic year. Assumes a 5% price increase accounting for inflation and is for illustrative purposes only. As of 09/07/2023.

Between academic years 1991-92 and 2021-23, average tuition fees rose at public and private nonprofit four year institutions, after adjusting for inflation.

As tuition rates continue to increase, 529 plans provide a way for families to save for the cost of education while enjoying tax benefits.

The contributions made to the account grow tax free, and withdrawals used for qualified education expenses are also tax free. Additionally, some states offer tax deductions or credits for contributions made to 529 plans. Costs are projected to escalate by 8% each year and have exceeded annual inflation rates. Early and consistent investing in a 529 plan helps prepare clients for the rising cost of education and provide resources for the long term.

What 529 plans cover

529 plans can be used for:

- Saving for a child, grandchild, or other student’s education

- Tuition expenses up to $10,000 annually for K-12 public, private, or parochial schools2

- Graduate school, continuing education courses, apprenticeship programs3

- Student loan repayments4

- Tuition, room and board, fees, books, and supplies5

- Computer equipment and technology5

529 plan benefits for advisors

Consider the benefits for your practice when making 529s an everyday part of your client conversations

- Develop relationships with the next generation of clients

- Apply a strategic estate planning lens

- Pave the way to a whole portfolio conversation

- Prepare clients for education and retirement

- Provide “tax-alpha” to your clients

Take advantage of state tax benefits

Tax parity states

These states offer a tax deduction for contributing to any 529 plan, including out of state plans, which may be more attractive than the in-state option.

Tax neutral states

These states offer no 529 state income deductions or income tax credits for 529 plan contributions.

In-state tax benefits

These states offer potential tax breaks on contributions made only to in-state 529 plans

529 Insights and articles

Explore expert strategies to maximize the value of 529 plans and create meaningful value for your clients.

BlackRock 529 plans

Learn about the 529 plans BlackRock has to offer.

Video Player-1,Image Cta-2,Navigation List-1,Multi Column Teaser-2,Paragraph-2,Related Content-1

Video Player-2,Navigation List-2,Related Materials-1

Well, good morning.

I picked my own outfit.

I love it.

Mommy, guess what?

What, baby?

I picked a college. And it's really far away.

When did you grow up?

Yep, I'm a grown-up.

Someday, she really is going to college. So start saving with Ohio's tax-free 529 plan. We make it simple to get your plan on track to meet any savings goal. Someday starts at BlackRock.com/CollegeAdvantage.

An investor should consider the investment objectives, risk, charges, and expenses associated with the municipal fund based securities before investing. More information about municipal fund securities is available in the issuers program description. You may obtain a program description by visiting www.BlackRock.co m/CollegeAdvantage, calling 866-529-8582, or by contacting your financial advisor. The program description should be read carefully before investing.

CollegeAdvantage® 529 Plan

Cost: One of the lowest cost advisor-sold 529 plans.8

Choice: Match investment strategies with your clients' goals.

Flexibility: Use any iShares® ETF or BlackRock mutual fund.

BlackRock CollegeAdvantage is 1 of 3 advisor-sold plans awarded a medal rating by Morningstar, out of 30+ advisor-sold 529 plans.9

CollegeAdvantage® 529 ranked ‘top of the class’ advisor-sold plan

Saving for College has again recognized the BlackRock CollegeAdvantage plan with its “Top of the Class” designation for both 2024 and 2025. This achievement makes the plan a two-time honoree, outperforming more than 90% of its category peers and standing out as only 1 of 3 advisor-sold plans to earn this distinction.10

Hi, my name is Paul Colasante In my over 20 years as a financial representative, I’ve had the opportunity to meet with many different people who are at different stages of their lives.

Recently, I had a meeting with a young family. While we were discussing their financial situation and goals, the conversation turned to if they were planning to save for their children’s education.

We discussed the pros and cons of several options like regular savings, UTMAs, UGMAs, Roth IRAs, and 529s.

My clients liked the 529 plan for the ability to use it for a wide range of qualified education expenses, the tax benefits and the ability to change the beneficiary and maintain control of the account—just to name a few.

We reviewed which investments were best for their situation and then I walked them through the account opening process.

The clients were happy we were able to help them with the funding of their children’s education and that they had someone they could contact through the process. And it was pretty special for me to be part of this investment in their child’s bright future.

So, how can you get started? To learn more about a section 529 plan or NextGen 529, contact your financial professional.

To learn more about NextGen 529, its investment objectives, risks and costs, read the program description available at NextGen for ME dot com. Check if your home state has a 529 plan that offers tax or other benefits.

USRRMH0624U/S-3651419

NextGen 529

NextGen 529 is designed specifically with the needs of investing for education in mind.

High contribution limit: Contribute a maximum of $545,000 per beneficiary.

Convenient investing: Make automated bank transfers or payroll deductions.

Flexibility: Choose from the largest number of investment options in any advisor-sold 529 plan.

529 Savings tools

Explore our useful tools to help you plan for future savings costs.

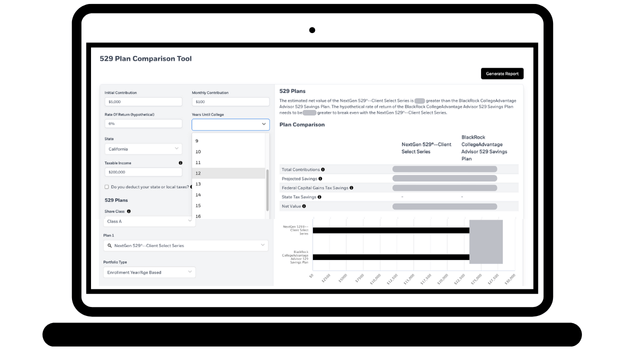

529 Comparison Tool

Easily compare 529 plans to find the best fit for education savings, estate planning, or retirement flexibility. Try the 529 Comparison Tool today to streamline decision-making and discover enhanced strategies.