People work, and plan, and save because they know that life doesn’t stop in retirement. Yet even with the best preparation, many are still at risk of outliving their savings. Longer lives and economic headwinds have made the path to a secure retirement ever more challenging. And people are looking for help answering the question, how do I make my money last?

Introducing LifePath Paycheck™ funds, the next evolution of Target Date solutions. Providing participants with the option to purchase lifetime income from insurance companies selected by BlackRock, complete with an accompanying digital experience.

Like a traditional target date fund, LifePath Paycheck™ becomes more conservative over time, but it doesn’t stop at just stocks and bonds. It starts allocating to a new asset class called “lifetime income” beginning in the year a participant turns age 55 – which, at retirement, can then be used to purchase the annuities from the selected insurers.

That means, in retirement, participants receive a paycheck they can count on every month, every year, for life.

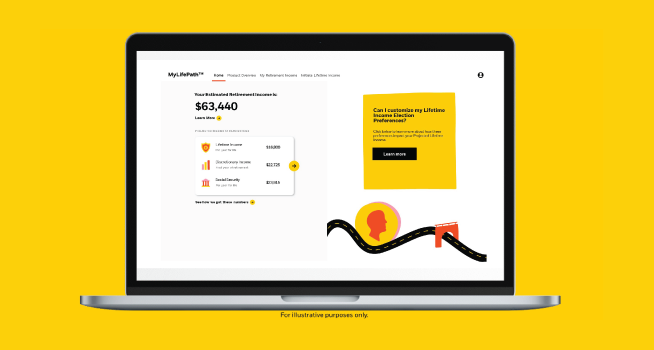

And with the MyLifePath™ digital experience, participants get a clear picture of how today’s contributions can translate to tomorrow’s retirement income, shifting mindsets and encouraging positive savings behaviors to help participants reach their retirement goals.

Managed by BlackRock, LifePath Paycheck™ funds and the MyLifePath™ digital experience.

Driving towards a simpler, more secure path to retirement by providing participants with the option to purchase a lifetime income stream so that you can retire from work, but not a paycheck.