BLACKROCK INVESTMENT INSTITUTE

Mega forces: An investment opportunity

Mega forces are big, structural changes that affect investing now - and far in the future. This creates major opportunities - and risks - for investors.

BLACKROCK SUSTAINABILITY

Please read this page before proceeding as it explains certain restrictions imposed by law on the distribution of this information and the jurisdictions in which our products and services are authorised to be offered or sold.

By entering this site, you are agreeing that you have reviewed and agreed to the terms contained herein, including any legal or regulatory restrictions, and have consented to the collection, use and disclosure of your personal data as set out in the Privacy section referred to below.

By confirming below, you also acknowledge that you:

(i) have read this important information;

(ii) agree your access to this website is subject to the disclaimer, risk warnings and other information set out herein; and

(iii) are the relevant sophistication level and/or type of audience intended for your respective country or jurisdiction identified below.

The information contained on this website (this “Website”) (including without limitation the information, functions and documents posted herein (together, the “Contents”) is made available for informational purposes only.

No Offer

The Contents have been prepared without regard to the investment objectives, financial situation, or means of any person or entity, and the Website is not soliciting any action based upon them.

This material should not be construed as investment advice or a recommendation or an offer or solicitation to buy or sell securities and does not constitute an offer or solicitation in any jurisdiction where or to any persons to whom it would be unauthorized or unlawful to do so.

Access Subject to Local Restrictions

The Website is intended for the following audiences in each respective country or region: In the U.S.: public distribution. In Canada: public distribution. In the UK and outside the EEA: professional clients (as defined by the Financial Conduct Authority or MiFID Rules) and qualified investors only and should not be relied upon by any other persons. In the EEA, professional clients, qualified clients, and qualified investors. For qualified investors in Switzerland, qualified investors as defined in the Swiss Collective Investment Schemes Act of 23 June 2006, as amended. In DIFC: 'Professional Clients’ and no other person should rely upon the information contained within it. In Singapore, public distribution. In Hong Kong, public distribution. In South Korea, Qualified Professional Investors (as defined in the Financial Investment Services and Capital Market Act and its sub-regulations). In Taiwan, Professional Investors. In Japan, Professional Investors only (Professional Investor is defined in Financial Instruments and Exchange Act). In Australia, public distribution. In China, this may not be distributed to individuals resident in the People's Republic of China ("PRC", for such purposes, excluding Hong Kong, Macau and Taiwan) or entities registered in the PRC unless such parties have received all the required PRC government approvals to participate in any investment or receive any investment advisory or investment management services. For Other APAC Countries, Institutional Investors only (or professional/sophisticated /qualified investors, as such term may apply in local jurisdictions). In Latin America, institutional investors and financial intermediaries only (not for public distribution).In Latin America, no securities regulator within Latin America has confirmed the accuracy of any information contained herein. The provision of investment management and investment advisory services is a regulated activity in Mexico thus is subject to strict rules. For more information on the Investment Advisory Services offered by BlackRock Mexico please refer to the Investment Services Guide available at www.blackrock.com/mx.

This Contents are not intended for, or directed to, persons in any countries or jurisdictions that are not enumerated above, or to an audience other than as specified above.

This Website has not been, and will not be submitted to become, approved/verified by, or registered with, any relevant government authorities under the local laws. This Website is not intended for and should not be accessed by persons located or resident in any jurisdiction where (by reason of that person's nationality, domicile, residence or otherwise) the publication or availability of this Website is prohibited or contrary to local law or regulation or would subject any BlackRock entity to any registration or licensing requirements in such jurisdiction.

It is your responsibility to be aware of, to obtain all relevant regulatory approvals, licenses, verifications and/or registrations under, and to observe all applicable laws and regulations of any relevant jurisdiction in connection with your access. If you are unsure about the meaning of any of the information provided, please consult your financial or other professional adviser.

No Warranty

The Contents are published in good faith but no advice, representation or warranty, express or implied, is made by BlackRock or by any person as to its adequacy, accuracy, completeness, reasonableness or that it is fit for your particular purpose, and it should not be relied on as such. The Contents do not purport to be complete and is subject to change. You acknowledge that certain information contained in this Website supplied by third parties may be incorrect or incomplete, and such information is provided on an "AS IS" basis. We reserve the right to change, modify, add, or delete, any content and the terms of use of this Website without notice. Users are advised to periodically review the contents of this Website to be familiar with any modifications. The Website has not made, and expressly disclaims, any representations with respect to any forward-looking statements. By their nature, forward-looking statements are subject to numerous assumptions, risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future.

No information on this Website constitutes business, financial, investment, trading, tax, legal, regulatory, accounting or any other advice. If you are unsure about the meaning of any information provided, please consult your financial or other professional adviser.

No Liability

BlackRock shall have no liability for any loss or damage arising in connection with this Website or out of the use, inability to use or reliance on the Contents by any person, including without limitation, any loss of profit or any other damage, direct or consequential, regardless of whether they arise from contractual or tort (including negligence) or whether BlackRock has foreseen such possibility, except where such exclusion or limitation contravenes the applicable law.

You may leave this Website when you access certain links on this Website. BlackRock has not examined any of these websites and does not assume any responsibility for the contents of such websites nor the services, products or items offered through such websites.

Intellectual Property Rights

Copyright, trademark and other forms of proprietary rights protect the Contents of this Website. All Contents are owned or controlled by BlackRock or the party credited as the provider of the Content. Except as expressly provided herein, nothing in this Website should be considered as granting any licence or right under any copyright, patent or trademark or other intellectual property rights of BlackRock or any third party.

This Website is for your personal use. As a user, you must not sell, copy, publish, distribute, transfer, modify, display, reproduce, and/or create any derivative works from the information or software on this Website. You must not redeliver any of the pages, text, images, or content of this Website using "framing" or similar technology. Systematic retrieval of content from this Website to create or compile, directly or indirectly, a collection, compilation, database or directory (whether through robots, spiders, automatic devices or manual processes) or creating links to this Website is strictly prohibited. You acknowledge that you have no right to use the content of this Website in any other manner.

Additional Information

Investment involves risks. Past performance is not a guide to future performance. The value of investments and the income from them can fall as well as rise and is not guaranteed. You may not get back the amount originally invested. Changes in the rates of exchange between currencies may cause the value of investments to diminish or increase.

Privacy

Your name, email address and other personal details will be processed in accordance with BlackRock’s Privacy Policy for your specific country which you may read by accessing our website at https://www.blackrock.com.

Please note that you are required to read and accept the terms of our Privacy Policy before you are able to access our websites.

Once you have confirmed that you agree to the legal information herein, and the Privacy Policy – by indicating your consent – we will place a cookie on your computer to recognise you and prevent this page from reappearing should you access this site, or other BlackRock sites, on future occasions. The cookie will expire after six months, or sooner should there be a material change to this important information.

The world is transitioning to a low-carbon economy.

Technological innovation is spreading.

Carolyn Weinberg: Wow, so this is the nerve center?

Dickon Pinner: Each one of those is one of these automated trucks?

Alvin Foo: Automated guided vehicles.

Climate and transition policy initiatives are driving transformation.

Chris Kaminker: Recent shifts in U.S. policy have sparked a global clean energy race that is creating investment opportunities on both sides of the Atlantic.

Companies are transforming and supply chains are evolving

Martin Lundstedt: This is the beauty.

Mark Wiedman: Fully electric!

Martin Lundstedt: Fully electric.

Mark Wiedman: I am driving a proper truck.

Martin Lundstedt: Yeah, yeah, absolutely.

The shape of the global economy is changing.

And new investment risks and opportunities are emerging.

Anne Valentine Andrews: The low-carbon transition is a once-in-a-lifetime opportunity for our clients and BlackRock has the breadth, expertise and whole portfolio solutions to meet our clients needs.

CONCLUSION

VO: The transition to a lower-carbon world is happening.

VO: And at BlackRock…

VO: We’re ready.

Corporate site Disclosures

This material is intended for information purposes only, and does not constitute investment advice, a recommendation or an offer or solicitation to purchase or sell any securities, funds or strategies to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. The opinions expressed are subject to change without notice. Reliance upon information in this material is at the sole discretion of the reader. Investing involves risks. BlackRock does and may seek to do business with companies covered in this video content. As a result, viewers should be aware that the firm may have a conflict of interest that could affect the objectivity of this video.

In the UK and inside the EEA: Until 31 December 2020, issued by BlackRock Investment Management (UK) Limited, authorised and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL. Tel: + 44 (0)20 7743 3000. Registered in England and Wales No. 02020394. For your protection telephone calls are usually recorded. Please refer to the Financial Conduct Authority website for a list of authorised activities conducted by BlackRock. From 1 January 2021, in the event the United Kingdom and the European Union do not enter into an arrangement which permits United Kingdom firms to offer and provide financial services into the European Economic Area, the issuer of this material is: BlackRock Investment Management (UK) Limited for all outside of the European Economic Area; and (ii) BlackRock (Netherlands) B.V. for in the European Economic Area, BlackRock (Netherlands) B.V. is authorised and regulated by the Netherlands Authority for the Financial Markets. Registered office Amstelplein 1, 1096 HA, Amsterdam, Tel: 020 – 549 5200, Tel: 31-20-549-5200. Trade Register No. 17068311 For your protection telephone calls are usually recorded.

In Switzerland: This document is marketing material. Issued by BlackRock Investment Management (UK) Limited, authorised and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL. Tel: + 44 (0)20 7743 3000. Registered in England and Wales No. 02020394. For your protection telephone calls are usually recorded.

In the U.S. and Canada, this material is intended for public distribution.

In Latin America: No securities regulator has confirmed the accuracy of any information contained herein. The provision of investment management and investment advisory services is a regulated activity in Mexico thus is subject to strict rules. For more information on the Investment Advisory Services offered by BlackRock Mexico please refer to the Investment Services Guide available at www.blackrock.com/mx

In Singapore, this is issued by BlackRock (Singapore) Limited (Co. registration no. 200010143N). This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

In Hong Kong, this material is issued by BlackRock Asset Management North Asia Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

In South Korea, this is issued by BlackRock Investment Management (Korea) Limited. For information or educational purposes only, not for reuse, redistribution, or any commercial activity, and does not constitute investment advice or an offer or solicitation to purchase or sells in any securities or any investment strategies.

In Taiwan, independently operated by BlackRock Investment Management (Taiwan) Limited. Address: 28F., No. 100, Songren Rd., Xinyi Dist., Taipei City 110, Taiwan. Tel: (02)23261600.

In Australia, issued by BlackRock Investment Management (Australia) Limited ABN 13 006 165 975 AFSL 230 523 (BIMAL). The material provides general information only and does not take into account your individual objectives, financial situation, needs or circumstances.

In China, this material is provided for informational or educational purposes in People’s Republic of China (“PRC”, for such purposes, excluding Hong Kong, Macau and Taiwan) only and does not constitute a solicitation of any securities or BlackRock funds.

This material is provided for informational or educational purposes in People’s Republic of China (“PRC”, for such purposes, excluding Hong Kong, Macau and Taiwan) only and does not constitute a solicitation of any securities or BlackRock funds or any financial services in any jurisdiction in which such solicitation is unlawful or to any person to whom it is unlawful.

©2023 BlackRock, Inc. All Rights Reserved. BLACKROCK is a trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other trademarks are those of their respective owners.

The investment landscape is being shaped by big structural changes, or mega forces, that we think could create both investment risks and opportunities across public and private markets.

We see the transition to a low-carbon economy having implications for macroeconomic trends and portfolios. We are providing clients with the solutions and tools to help them achieve their investment objectives.

To serve our clients, we have 700+ global sustainable and transition specialists focused on providing customized insights, data and a choice of investment solutions and technology tailored to our clients' needs.

We approach this work solely in service of our clients' best financial interests. That is the foundation upon which we built BlackRock into the most trusted asset manager in the world1 – a total focus on our clients, underpinned by our respect for their diverse preferences and uniqueness.

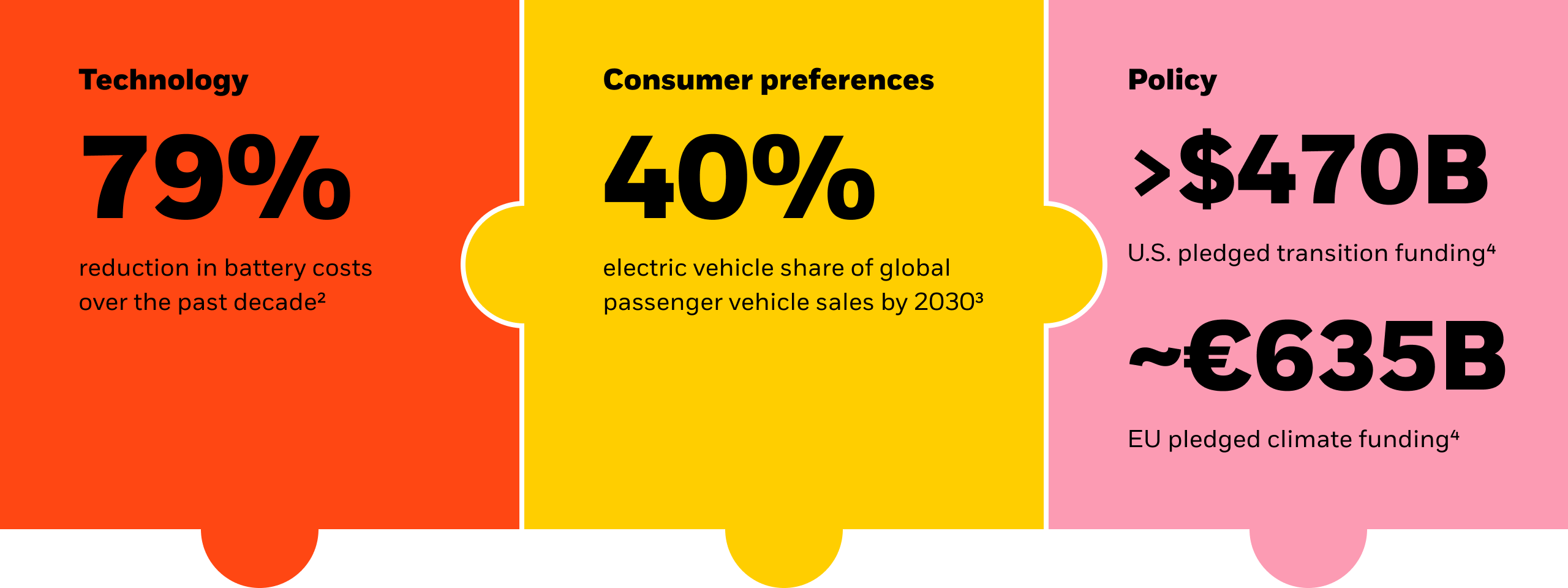

Structural shifts associated with the low-carbon transition – technological innovation, consumer and investor preferences for lower-carbon products, and shifts in government policies – are reshaping production and consumption and spurring capital investment.

Our global team of investment and sector specialists, climate scientists, data analysts, and engineers research macroeconomic and investment trends related to the transition, in order to evaluate risks and opportunities and deliver unique insights to clients.

1. BlackRock is trusted to manage more assets than any other global asset manager, with an AUM of $9.1 trillion as of September 30, 2023.

2. BloombergNEF, Top 10 Energy Storage Trends in 2023.

3. BloombergNEF, Electric Vehicle Outlook, June 2022. This figure reflects the report’s Economic Transition Scenario.

4. BII, Rocky Mountain Institute, and European Commission, December 2022. $ figures are shown in USD.

BlackRock speaks to thought leaders and industry experts from around the globe about the biggest trends moving markets. Listen to companies, business leaders and investors at the forefront of the transition to a low-carbon economy.

The transition to a low-carbon economy has emerged as a key player in the five mega forces that the BlackRock Investment Institute has outlined in recent episodes. But what exactly does it mean to "invest in the transition to a low-carbon economy"?

Charlie Lilford, portfolio manager from BlackRock’s Fundamental Equities business joins host Oscar Pulido to talk about the rate of adoption of electric vehicles across the world and where he sees the most exciting investment opportunities.

According to a 2021 UN-backed report, the world’s food systems account for approximately one-third of human-caused emissions.

Mark Schneider, CEO of Nestle, the world’s largest food and beverage company, joins The Bid to discuss how food – from the farm to the fork to the compost bin – plays a role in the transition to a low-carbon economy.

We visit a range of portfolio companies that are developing innovative solutions that could transform their industries.