BLACKROCK INVESTMENT INSTITUTE

Mega forces: An investment opportunity

Mega forces are big, structural changes that affect investing now - and far in the future. This creates major opportunities - and risks - for investors.

BLACKROCK SUSTAINABILITY

Please read this page before proceeding as it explains certain restrictions imposed by law on the distribution of this information and the jurisdictions in which our products and services are authorised to be offered or sold.

By entering this site, you are agreeing that you have reviewed and agreed to the terms contained herein, including any legal or regulatory restrictions, and have consented to the collection, use and disclosure of your personal data as set out in the Privacy section referred to below.

By confirming below, you also acknowledge that you:

(i) have read this important information;

(ii) agree your access to this website is subject to the disclaimer, risk warnings and other information set out herein; and

(iii) are the relevant sophistication level and/or type of audience intended for your respective country or jurisdiction identified below.

The information contained on this website (this “Website”) (including without limitation the information, functions and documents posted herein (together, the “Contents”) is made available for informational purposes only.

No Offer

The Contents have been prepared without regard to the investment objectives, financial situation, or means of any person or entity, and the Website is not soliciting any action based upon them.

This material should not be construed as investment advice or a recommendation or an offer or solicitation to buy or sell securities and does not constitute an offer or solicitation in any jurisdiction where or to any persons to whom it would be unauthorized or unlawful to do so.

Access Subject to Local Restrictions

The Website is intended for the following audiences in each respective country or region: In the U.S.: public distribution. In Canada: public distribution. In the UK and outside the EEA: professional clients (as defined by the Financial Conduct Authority or MiFID Rules) and qualified investors only and should not be relied upon by any other persons. In the EEA, professional clients, qualified clients, and qualified investors. For qualified investors in Switzerland, qualified investors as defined in the Swiss Collective Investment Schemes Act of 23 June 2006, as amended. In DIFC: 'Professional Clients’ and no other person should rely upon the information contained within it. In Singapore, public distribution. In Hong Kong, public distribution. In South Korea, Qualified Professional Investors (as defined in the Financial Investment Services and Capital Market Act and its sub-regulations). In Taiwan, Professional Investors. In Japan, Professional Investors only (Professional Investor is defined in Financial Instruments and Exchange Act). In Australia, public distribution. In China, this may not be distributed to individuals resident in the People's Republic of China ("PRC", for such purposes, excluding Hong Kong, Macau and Taiwan) or entities registered in the PRC unless such parties have received all the required PRC government approvals to participate in any investment or receive any investment advisory or investment management services. For Other APAC Countries, Institutional Investors only (or professional/sophisticated /qualified investors, as such term may apply in local jurisdictions). In Latin America, institutional investors and financial intermediaries only (not for public distribution).In Latin America, no securities regulator within Latin America has confirmed the accuracy of any information contained herein. The provision of investment management and investment advisory services is a regulated activity in Mexico thus is subject to strict rules. For more information on the Investment Advisory Services offered by BlackRock Mexico please refer to the Investment Services Guide available at www.blackrock.com/mx.

This Contents are not intended for, or directed to, persons in any countries or jurisdictions that are not enumerated above, or to an audience other than as specified above.

This Website has not been, and will not be submitted to become, approved/verified by, or registered with, any relevant government authorities under the local laws. This Website is not intended for and should not be accessed by persons located or resident in any jurisdiction where (by reason of that person's nationality, domicile, residence or otherwise) the publication or availability of this Website is prohibited or contrary to local law or regulation or would subject any BlackRock entity to any registration or licensing requirements in such jurisdiction.

It is your responsibility to be aware of, to obtain all relevant regulatory approvals, licenses, verifications and/or registrations under, and to observe all applicable laws and regulations of any relevant jurisdiction in connection with your access. If you are unsure about the meaning of any of the information provided, please consult your financial or other professional adviser.

No Warranty

The Contents are published in good faith but no advice, representation or warranty, express or implied, is made by BlackRock or by any person as to its adequacy, accuracy, completeness, reasonableness or that it is fit for your particular purpose, and it should not be relied on as such. The Contents do not purport to be complete and is subject to change. You acknowledge that certain information contained in this Website supplied by third parties may be incorrect or incomplete, and such information is provided on an "AS IS" basis. We reserve the right to change, modify, add, or delete, any content and the terms of use of this Website without notice. Users are advised to periodically review the contents of this Website to be familiar with any modifications. The Website has not made, and expressly disclaims, any representations with respect to any forward-looking statements. By their nature, forward-looking statements are subject to numerous assumptions, risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future.

No information on this Website constitutes business, financial, investment, trading, tax, legal, regulatory, accounting or any other advice. If you are unsure about the meaning of any information provided, please consult your financial or other professional adviser.

No Liability

BlackRock shall have no liability for any loss or damage arising in connection with this Website or out of the use, inability to use or reliance on the Contents by any person, including without limitation, any loss of profit or any other damage, direct or consequential, regardless of whether they arise from contractual or tort (including negligence) or whether BlackRock has foreseen such possibility, except where such exclusion or limitation contravenes the applicable law.

You may leave this Website when you access certain links on this Website. BlackRock has not examined any of these websites and does not assume any responsibility for the contents of such websites nor the services, products or items offered through such websites.

Intellectual Property Rights

Copyright, trademark and other forms of proprietary rights protect the Contents of this Website. All Contents are owned or controlled by BlackRock or the party credited as the provider of the Content. Except as expressly provided herein, nothing in this Website should be considered as granting any licence or right under any copyright, patent or trademark or other intellectual property rights of BlackRock or any third party.

This Website is for your personal use. As a user, you must not sell, copy, publish, distribute, transfer, modify, display, reproduce, and/or create any derivative works from the information or software on this Website. You must not redeliver any of the pages, text, images, or content of this Website using "framing" or similar technology. Systematic retrieval of content from this Website to create or compile, directly or indirectly, a collection, compilation, database or directory (whether through robots, spiders, automatic devices or manual processes) or creating links to this Website is strictly prohibited. You acknowledge that you have no right to use the content of this Website in any other manner.

Additional Information

Investment involves risks. Past performance is not a guide to future performance. The value of investments and the income from them can fall as well as rise and is not guaranteed. You may not get back the amount originally invested. Changes in the rates of exchange between currencies may cause the value of investments to diminish or increase.

Privacy

Your name, email address and other personal details will be processed in accordance with BlackRock’s Privacy Policy for your specific country which you may read by accessing our website at https://www.blackrock.com.

Please note that you are required to read and accept the terms of our Privacy Policy before you are able to access our websites.

Once you have confirmed that you agree to the legal information herein, and the Privacy Policy – by indicating your consent – we will place a cookie on your computer to recognise you and prevent this page from reappearing should you access this site, or other BlackRock sites, on future occasions. The cookie will expire after six months, or sooner should there be a material change to this important information.

From unconventional monetary policy to unprecedented policy coordination.

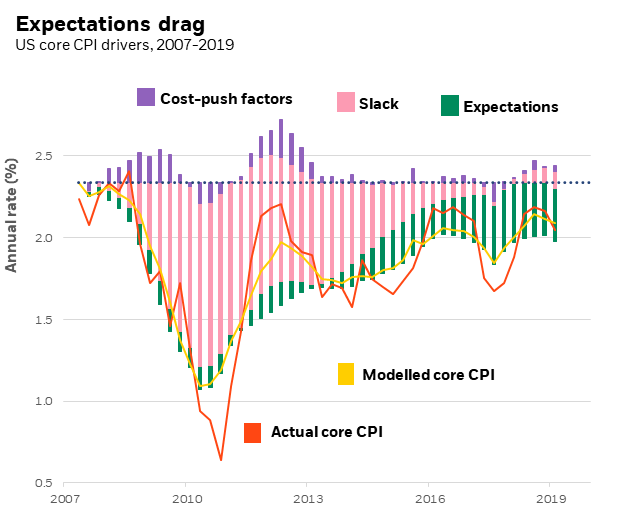

Unprecedented policies will be needed to respond to the next economic downturn. Monetary policy is almost exhausted as global interest rates plunge towards zero or below. Inflation expectations are dragging on actual inflation. See chart below.

Sources: BlackRock Investment Institute, with data from Refinitiv Datastream, August 2019. Notes: This chart shows the actual change in the annual rate of US core Consumer Price Index (CPI) and estimates of the contributions of various economic drivers. We break the drivers of inflation as implied by the Phillips curve into three factors: slack, cost-push factors (mainly via productivity growth and various global input costs) and inflation expectations. The factors are broken down by percentage point of contribution to the overall implied Phillips curve inflation from the starting point in 2007. The implied Phillips curve estimates are partly based off the August 2013 paper The Phillips Curve is Alive and Well. We use a measure of inflation expectations similar to the 2010 paper Modeling Inflation after the Crisis.

Fiscal policy on its own will struggle to provide major stimulus in a timely fashion given high debt levels and the typical lags with implementation. Without a clear framework in place, policymakers will inevitably find themselves blurring the boundaries between fiscal and monetary policies. This threatens the hard-won credibility of policy institutions and could open the door to uncontrolled fiscal spending. This paper outlines the contours of a framework to mitigate this risk so as to enable an unprecedented coordination through a monetary-financed fiscal facility. Activated, funded and closed by the central bank to achieve an explicit inflation objective, the facility would be deployed by the fiscal authority.

After a decade of unprecedented monetary stimulus around the world, actual inflation and inflation expectations still remain stubbornly low in most major economies. Inflation is falling persistently short of central bank targets even in economies operating beyond full employment – notably the US. It is even more unusual to see a drop in inflation expectations in the late-cycle stage when concerns would typically focus on overheating.

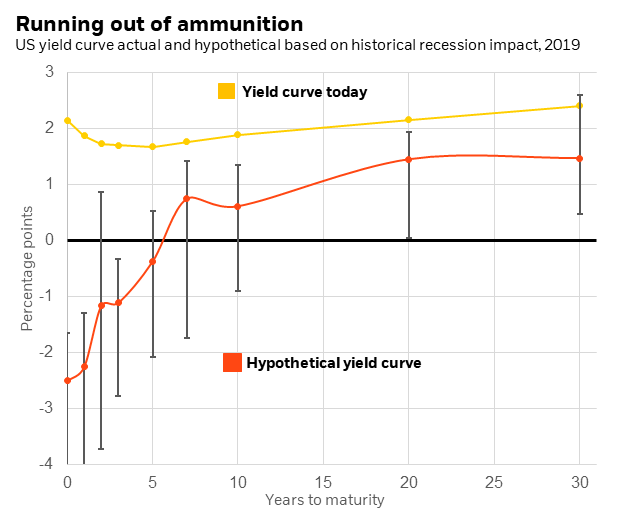

Sources: BlackRock Investment Institute, with data from Refinitiv Datastream, August 2019. Notes: The chart shows the current US Treasury yield curve and hypothetical yield curve. The hypothetical curve shows what the yield curve would look like based on its median move during the past five recessions. The bars show the range of moves during those recessions. To account for the changing interest rate environment of the past few decades, the curve moves are adjusted based on the structural decline in neutral rates discussed in our report. Forward looking estimates may not come to pass.

Monetary policy – both conventional and unconventional – works through lower interest rates. Lowering rates across the yield curve helps stimulate demand by lowering the cost of financing consumption or investment. It also gives investors incentives to rebalance into riskier assets, in principle reducing the cost of capital for companies. If policy rates are near their effective lower bound (ELB) and the scope for longer term rates to fall is limited, monetary policy cannot provide much more stimulus through this channel – a liquidity trap situation.

We detailed the factors that have been driving the decline in interest rates in our November 2017 paper The safety premium driving low rates.

The secular decline in neutral interest rates (r-star) – the estimate of rates that neither stimulates nor hinders economic growth – has reduced the distance from the effective lower bound (ELB) and thereby how much the central bank can cut in a downturn. Lower potential growth is one factor, but our r-star estimate, based on a Fed model, has fallen by more than growth since the mid-2000s – especially after the crisis. We believe this wedge reflects the role played by an increase in global risk aversion, initially stoked after the late-1990s Asia financial crisis and later magnified by the GFC. These severe shocks motivated persistently higher precautionary savings by both the public and private sectors, dragging down the neutral rate. Our estimates suggest that greater risk aversion and lower potential growth each account equally for the roughly 150 basis point decline in the US r-star since the GFC.

Rising risk aversion also makes perceived safe assets more alluring and compresses their yields relative to other assets. This is why investors are pushing interest rates ever lower and flattening out yield curves. Nominal yields on long-term government bonds are at new record lows – the entire German bund yield curve is now negative – or back near historic ones in the US. The term premium – the compensation that investors typically demand for bearing the greater risk of long-term bonds – is negative again. Interest rates in Europe and Japan may already be near their ultimate floor as long as there is still physical cash.

The chart above shows the current US Treasury yield curve compared with a hypothetical one based on the median curve moves during the recessions of recent decades, adjusted for structural changes to neutral rates. We do this to get a sense of how the curve might need to shift lower from current levels if it were to react in a similar fashion as during past recessions. To get a similar move now, short-term rates would need to drop to around -2%. We believe such a move is highly unlikely if not impossible – the ELB where central banks stop cutting rates, and investors stop chasing negative yields, is almost certainly higher than this.

Conventional and unconventional monetary policy space is therefore limited and rapidly being used up even before central banks respond to the next downturn, let alone a full-blown recession.

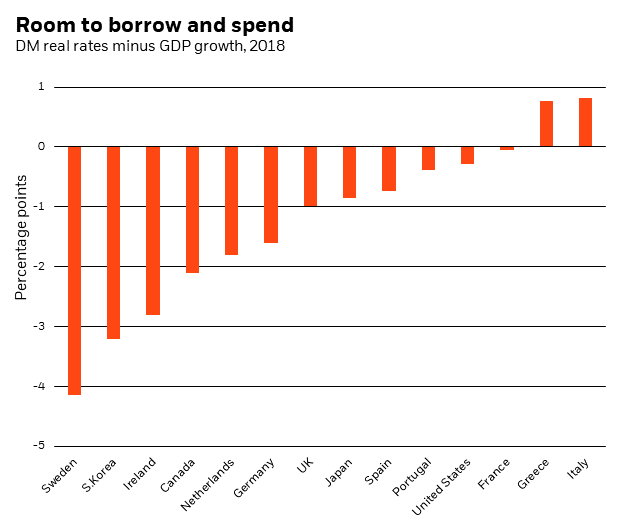

Fiscal policy can do more heavy lifting when monetary policy alone is no longer enough. Even without any coordination, governments have room to borrow and invest more – especially in a low interest rate environment – to effectively stir activity. We have argued that there has not been enough government spending globally on infrastructure, education, renewable energy or other technologies to lift total factor productivity growth back to its pre-crisis trends and boost potential growth.

Sources: BlackRock Investment Institute, with data from the Organisation of Economic Cooperation and Development, August 2019. Notes: The chart shows real interest rates minus GDP growth based on the OECD’s May 2019 economic outlook. The interest rate is the effective rate paid on debt and thus adjusted by the maturity of the overall debt.

The low interest rate environment increases fiscal space not only by making it cheaper to borrow, but also makes it possible for some governments to grow out of the increased debt. The ratio of interest expense to revenue for developed market (DM) governments is lower on average now than it was before the crisis, even though debt levels are considerably higher. So as long as risk free rates stay below the return on capital and trend growth, it is possible to increase deficits and still see debt-to-GDP ratios fall (Blanchard 2019, Furman and Summers 2019). The chart below shows how this is true for many DM countries.

There are good reasons to expect an environment favourable to fiscal policy to persist: the deep-rooted forces underlying the global saving glut will not change quickly on their own or will need material changes to be affected. That appears to be the market’s belief.

Yet there is no guarantee this favourable wedge between interest rates and trend growth would persist in the face of a major fiscal expansion. The strength and persistence of global precautionary saving pushed real interest rates below growth, driven by the decline in both neutral rates and the term premium, according to our estimates. But a significant increase in borrowing by governments globally could absorb part or all of this saving glut, pushing real interest rates towards or even above growth.

Furthermore, with debt/GDP ratios reaching new record highs, it would not take much of a shock to growth or interest rates for the debt ratio to balloon and spark concerns about debt sustainability. Hence high existing debt levels mean fiscal policy is vulnerable to even transitory interest rate spikes. Such a surge in rates could damage the fiscal policy space. This could arise from a so-called sudden stop: a temporary drying up of liquidity due to concerns about debt sustainability or losing reserve currency status.

Typically countries that issue debt in their own currency can sustain higher debt levels and have more flexibility than countries that cannot. Yet countries borrowing in their own currency cannot completely avoid a surge in rates. If debt is on an unsustainable trajectory, the central bank can intervene by either increasing the monetary base by printing money or restarting QE. In the first case, runaway inflation would likely result at some point. In the second, it is important to realise that QE does not improve the government’s solvency: as the central bank issues reserves to buy bonds, the consolidated balance sheet of the government sector – including the central bank – is unchanged.

Record debt levels might also stoke expectations that taxes will be raised, or benefits reduced, in the future. Such expectations could reduce current private sector spending and reduce the effectiveness of any public spending increase, a phenomenon known as Ricardian equivalence.

We believe a practical approach would be to stipulate a contingency where monetary and fiscal policy would become jointly responsible for achieving the inflation target.

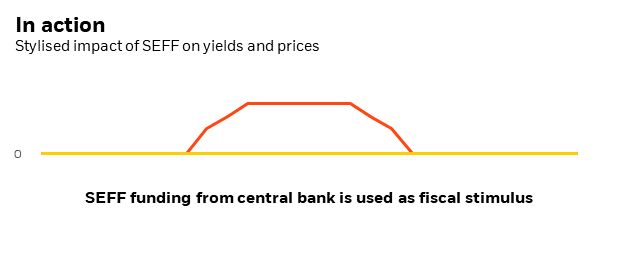

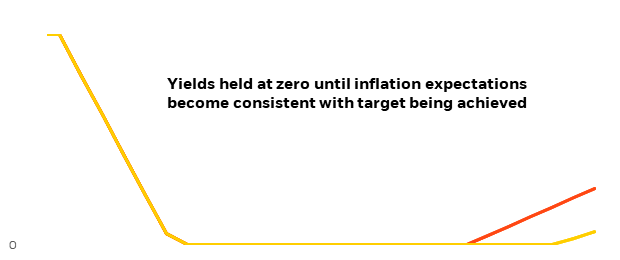

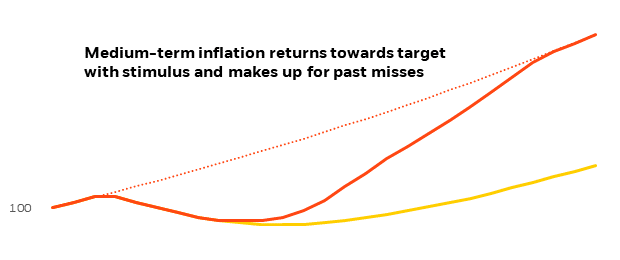

Sources: BlackRock Investment Institute, August 2019. Notes: These stylised charts show the hypothetical impact of a temporary increase in fiscal stimulus financed by the central bank, as reflected in the SEFF funding (red line). The other red lines show the impact on the inflation trend relative to the inflation target (dotted line) and on the long-term sovereign bond yield. The yellow lines show the hypothetical outcome if there is no stimulus in this scenario. For illustrative purposes only. There is no guarantee that any forecasts made will come to pass.

To be sure, agreeing on the proper governance for such cooperation would be politically difficult and take time. That said, here are the contours of a framework:

This proposed framework could include Bernanke’s temporary price-level target where the central bank commits to not only reach its inflation target but make up for past shortfalls (see Bernanke 2017 and our June 2019 work on inflation make-up strategies). Importantly, it complements it by specifying the mechanism – the SEFF – to push inflation higher. This is inspired by Bernanke’s 2016 proposal for a money-financed fiscal programme.

This approach improves on other fiscal approaches to providing stimulus when rates are at the ELB, we believe. Similar to Furman and Summers (2019) and Blanchard (2019), it argues for the use of fiscal policy – yet it does not rely on rates staying below growth for the entire time needed to stimulate the economy.

Our proposal stands in sharp contrast to the prescription from MMT proponents. They advocate the use of monetary financing in most circumstances and downplay any impact on inflation. Our proposal is for an unusual coordination of fiscal and monetary policy that is limited to an unusual situation – a liquidity trap – with a pre-defined exit point and an explicit inflation objective. Quasi-fiscal credit easing, such as central bank purchases of private assets, could be operated by the SEFF rather than the central bank alone to separate monetary and fiscal decisions.

A credible stimulus strategy would help investors understand what will happen once the monetary policy space is exhausted and provides a clear gauge to evaluate the systematic fiscal policy response. Spelling out a contingency plan in advance would increase its effectiveness and might also reduce the amount of stimulus ultimately needed. As former US Treasury Secretary Henry Paulson famously said during the financial crisis: “If you've got a bazooka, and people know you've got it, you may not have to take it out.”

This is one way to implement a credible coordination framework. In the next downturn, the loss of central bank independence and uncontrolled fiscal spending are risks. Any framework will need to put boundaries around such policy coordination to mitigate these risks.