Alpha reimagined

Key takeaways

-

01

Alpha for a new world

We’re reshaping the way portfolios pursue generating alpha — focused on delivering more predictable, diversified outcomes through adaptive, systematic strategies built for today’s complex markets.

-

02

Tech-driven insights – at scale

Data, tech, and Artificial Intelligence (AI) are central to our approach. Leveraging tools like large language models, we can unlock more in-depth analysis and seek to deliver more precise outcomes for clients.

-

03

Human expertise, always

Having professional investors at every step of the process is essential. We merge human expertise with technology to bring together the art and science of investing.

Redefining investing, alpha reimagined

Systematic strategies leverage data and technology to apply rigorous research and measurement techniques to all aspects of the investment process. For the past four decades, 1 BlackRock Systematic has been at the forefront of data-driven investing, continuously evolving our approach to seek new sources of alpha across asset classes and varying market conditions.

The power of seeking consistent alpha

We believe the most efficient way to seek consistent alpha is investing at scale. That's because we have found that consistently achieving alpha may be more attainable when hundreds of securities are combined: The breadth of holdings can reduce the risk of a single loss dragging down performance.

Though disciplined risk management, however, investors can target a moderate range of alpha without greatly increasing risk in their portfolio - which may make a significant difference over a longer time horizon. In other words, we believe consistently delivering small wins can pay off.

There is no guarantee that a positive investment outcome will be achieved or that research capabilities will contribute to such an outcome. Diversification does not assure a profit and may not protect against loss of principal.

Data is the oxygen of our process. We rigorously test thousands of datasets each year with a constant drive to uncover the next source of insight.

Investing in a data-rich world

Data creation and storage has exploded in recent years, increasing by a factor of 100 over the past 15 years.2 There are limits to how much of this humans by themselves can track.

The numbers help tell the story: at BlackRock, our Systematic team analyzes 15,000 global equities each day, as well as 3,000 global credit issuers – and these are just examples of traditional financial metrics. There are tens of thousands of more inputs beyond these. We believe analyzing, processing and understanding this data is a critical basis for investing at scale.3

We believe that today’s world requires investors to reimagine traditional methods of investing by seeking alpha through continuous and relentless innovation. And for those who want to capture as much information as possible before making decisions systematic strategies are essential, in our view.

Applying our systematic approach to serve clients

Below we focus on how BlackRock Systematic has sought to deliver consistent outcomes for clients for the past 40 years. Our team aims to transform data and insights into alpha, uncovering informational advantages others overlook.

Using AI to seek investment returns

Artificial Intelligence is set to change how many industries work, and asset management is no exception. While we believe that AI will soon be mature enough to assist investors and analysts across different phases of the investment process, investors are already using large language models (LLMs) in their work.

LLMs are known to the general public thanks to tools such as ChatGPT. For systematic investors, LLMs are being used to help inform investment decisions and identify market-relevant themes. For instance, they synthesize information from a variety of text sources, including analyst reports, corporate earnings call transcripts, news articles and social media to help inform investment forecasts and uncover potential alpha opportunities.

Real–world signals

How BlackRock Systematic uses investment signals to help target alpha for clients.

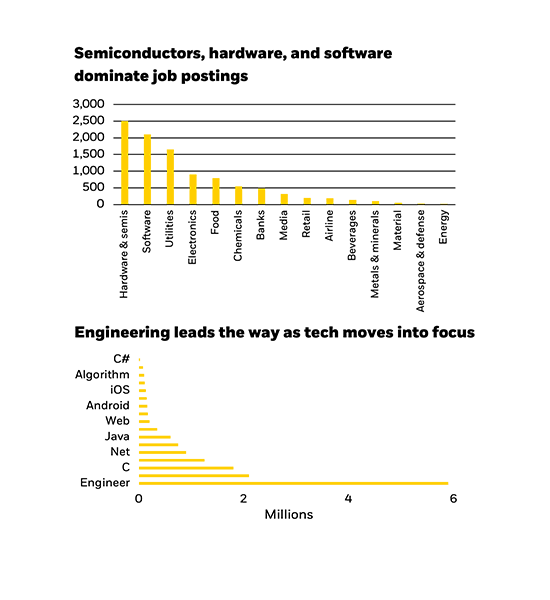

Looking deeper with job postings

We used data from online jobs postings to understand the associated economic impact on businesses.4

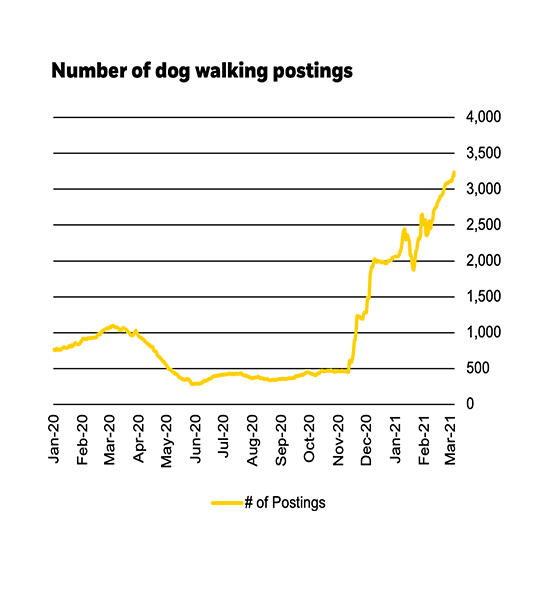

Loosening the leash: Government eases quarantine mandates

We leaned on jobs data to evaluate shifting economic conditions. This time, an uptick in the demand for dog walkers was a significant data point, indicating potential movement toward reopening on a state-by-state level.5

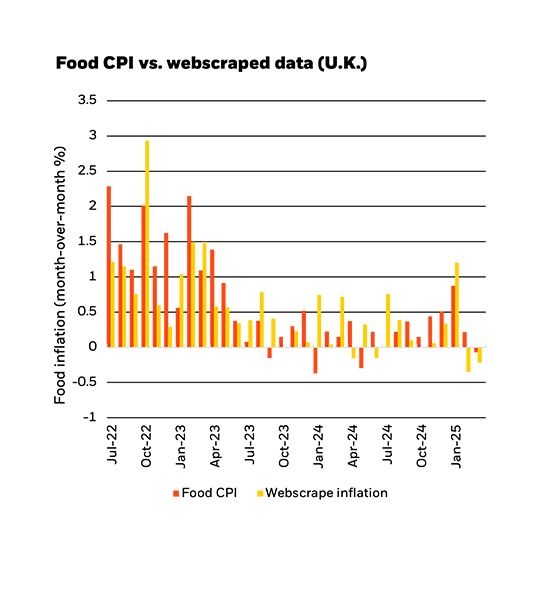

Creating real-time inflation forecasts

We apply web-scraping techniques to gain insights into consumer goods prices well ahead of the monthly CPI print.6

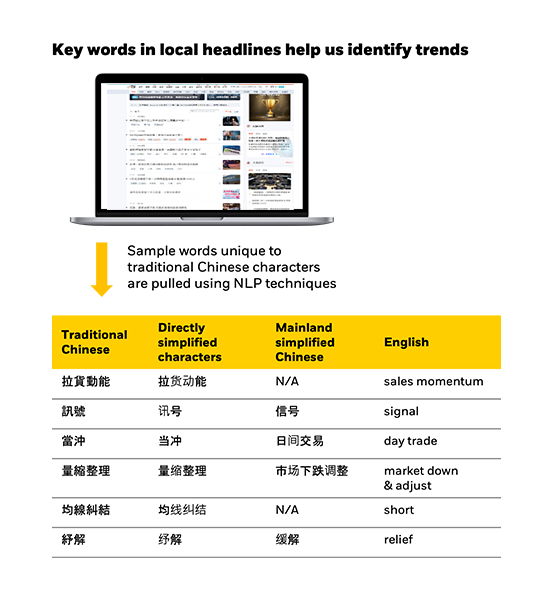

Context clues in local languages

We apply natural language processing (NLP) to parse through local news content. Our models are trained on sample words unique to traditional Chinese characters, which are then translated into English to pick up on local market sentiment.7

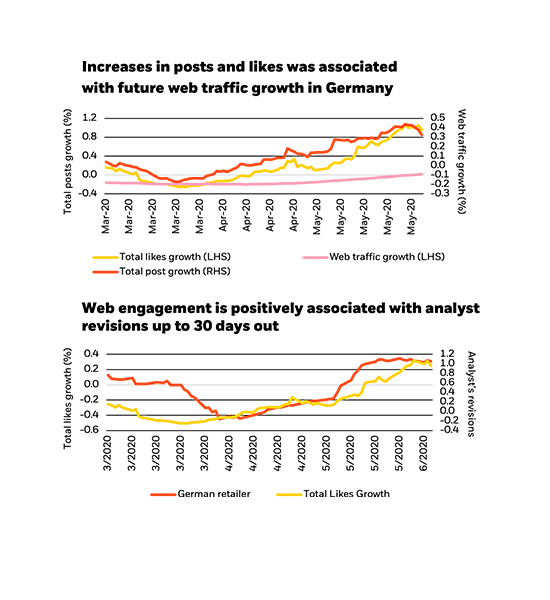

Harnessing the predictive potential of social media

Alternative data generated from influencers and targeted advertising can offer powerful insights into consumer preferences and future brand performance.8

In a study of a German online retailer, we see the number of likes and brand posts increase from March-June 2020. Web traffic also grew with the frequency of posts and likes.