Larry Fink on the transformative power of choice in proxy voting

Larry discusses enhancing governance by injecting important new voices into shareholder democracy.

Today, investors can choose from thousands of low-cost, high-quality investment funds across asset classes and markets. BlackRock believes that greater choice should extend to proxy voting and is committed to a future where every investor can participate in the proxy voting process if they so choose.

We launched BlackRock Voting Choice in 2022 to make participation in the proxy voting process easier and more accessible for eligible clients.

BlackRock Voting Choice, an industry first and a proprietary offering, currently enables eligible clients to participate in the proxy voting process where legally and operationally viable.

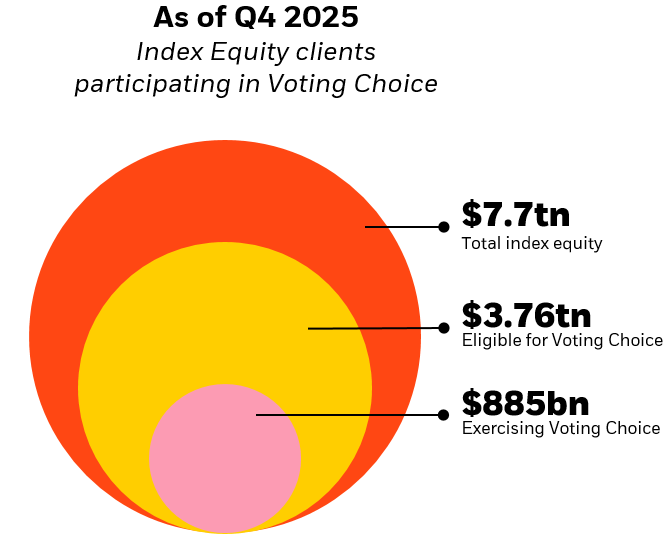

Source: BlackRock. Client funds participating in BlackRock Voting Choice are as of December 31, 2025. Assets include index equity assets held in multi-asset fund of funds strategies. All currency shown in USD.

Eligible clients can choose one of four options:1

Clients in certain institutional pooled vehicles have the ability to apply their preferred voting policy to shares in the pooled fund reflecting the client’s proportional ownership of that fund. Clients either develop their own processes and policies to be implemented by an in-house team or contract directly with a third-party proxy advisor to develop and implement a custom policy. The preferred voting policy, whether designed in-house by the client or a third-party, can be applied in a consistent way across a broader share of their overall portfolio allocation, using the client’s preferred proxy voting service provider and allowing the client to exercise a high degree of control over the decision-making process and the voting implementation.

Separately managed account (SMA) clients have multiple options to direct votes. SMA clients can (i) authorize BlackRock to vote in accordance with BlackRock Investment Stewardship’s Benchmark voting policy, (ii) select a third-party voting policy offered through Voting Choice, (iii) utilize their custom voting policy, (iv) implement a voting policy based on their investment objects with the support of BlackRock Investment Stewardship,2 and/or (v) make specific voting decisions on the topics or at the companies that matter most to them after a voting policy is applied.3

Clients in eligible institutional pooled vehicles and SMAs have the ability to select from a set of voting policies4 from third-party proxy advisers the policy that best aligns with their views and preferences. BlackRock can then use its proxy voting infrastructure to cast votes based on the client’s selected voting policy.

Clients have the choice to rely on BlackRock Investment Stewardship for all of their voting decisions. Electing to rely on BlackRock to exercise voting authority is itself a choice and a deliberate decision by the client to entrust BlackRock Investment Stewardship to vote in the client’s economic interests.

Source: BlackRock. Client funds participating in BlackRock Voting Choice are as of December 31, 2025. Assets include index equity assets held in multi-asset fund of funds strategies.

We offer a wide range of Voting Choice policies through Egan-Jones, Glass Lewis and Institutional Shareholder Services (ISS).

Egan-Jones Policies

Glass Lewis Policies

ISS Policies

BlackRock believes that greater choice should extend to shareholder proxy voting and is committed to a future where every investor can participate in the proxy voting process. BlackRock Voting Choice (sometimes known as pass-through voting) provides eligible clients with more opportunities to participate in the proxy voting process where legally and operationally viable.

Voting Choice is currently available for eligible clients invested in certain institutional pooled funds in the U.S., UK, Ireland, Canada, and Switzerland that utilize equity index investment strategies, as well as eligible clients in certain institutional pooled funds in the U.S., UK, Canada, and Switzerland that use systematic active equity (SAE) strategies. Currently, this includes over 650 pooled investment funds, including equity index funds and SAE funds. In addition, institutional clients in separately managed accounts (SMAs) continue to be eligible for BlackRock Voting Choice regardless of their investment strategies.

To protect clients’ confidentiality, BlackRock does not disclose names of clients publicly without their consent, including Voting Choice clients.

As part of our commitment to a future where every investor can participate in the shareholder voting process, BlackRock has expanded the Voting Choice program to eligible investors through a U.S Retail Program. The program provides eligible shareholder accounts with more opportunities to participate in the proxy voting process. Three years from the launch of BlackRock Voting Choice for institutional clients, the expansion of the program to individual investors increases eligible Voting Choice assets to $3.76 trillion,5 nearly half of BlackRock’s index equity assets under management.

BlackRock Voting Choice is a proprietary offering launched in January 2022 that provides eligible clients with opportunities to participate in the proxy voting process where legally and operationally viable. This process is sometimes known as pass-through voting. As of December 31, 2025, index equity clients representing ~$885 billion in AUM were exercising BlackRock Voting Choice.6

Under the BlackRock Voting Choice program for the U.S. retail fund, eligible investors can select one of seven third-party proxy voting policies available, in addition to BlackRock Investment Stewardship’s benchmark U.S. voting guidelines. Once a voting policy is selected, it will be applied to the shareholder meetings of companies held in the fund after a reasonable delay (subject to certain exclusions), based on investors’ proportional ownership of the fund.

A proxy voting policy is a document that provides principles-based guidance on how a vote may be cast on certain agenda items at a company’s shareholder meeting. Voting policies are not exhaustive and are applied on a case-by-case basis. As such, they do not indicate how votes will be cast in every instance.

BlackRock offers eligible investors in the participating U.S. retail fund the ability to select one of seven third-party policies, as well as the option to continue to have their shares voted according to the BlackRock Investment Stewardship’s benchmark U.S. voting guidelines, offering eligible investors a greater range of options to reflect their investment goals and preferences in proxy voting.

BlackRock Investment Stewardship Benchmark Policy:

Available Egan-Jones Policy:

Available Glass Lewis Policies:

Available ISS Policies:

Any eligible U.S. fund investor that receives fund proxies through email or mail will receive the proxy voting policy survey. If an advisor receives fund proxies through email or mail on behalf of their client, the advisor will receive the survey and will be able to make the voting policy selection on behalf of their client. End investors of advisors who have voting discretion, as per the advisor agreement (i.e., most non-discretionary accounts) will also receive the survey.

Investors that receive U.S. Fund proxy information through a proxy vendor such as Institutional Shareholder Services (ISS), Glass Lewis, or Broadridge Proxy Edge will not receive the survey and will not be eligible to participate in the U.S. Retail Program. This includes most institutional clients, and certain advisors; or investors who do not have voting discretion (i.e., most advised discretionary accounts).

5Source: BlackRock. As of December 31, 2025. Assets include index equity assets held in multi-asset fund of funds strategies.

6Source: BlackRock Client funds participating in BlackRock Voting Choice are as of December 31, 2025. Assets include index equity assets held in multi-asset fund of funds strategies.

Larry discusses enhancing governance by injecting important new voices into shareholder democracy.