Why BlackRock for credit?

In periods of greater economic uncertainty where risks remain high and markets volatile, achieving superior risk-adjusted results through the credit cycle requires a different kind of relationship. BlackRock’s global credit platform seeks to deliver outperformance with true active engagement.

Fundamental bottom-up investors powered by a global platform

Superior access to quality investment opportunities

Insights amplified with analytics and technology

Global Credit Outlook: 1Q2024

A full suite of credit solutions

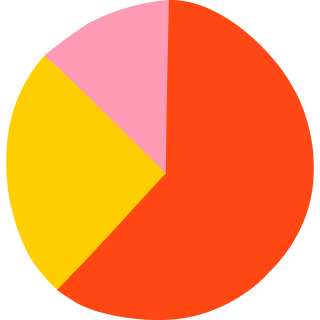

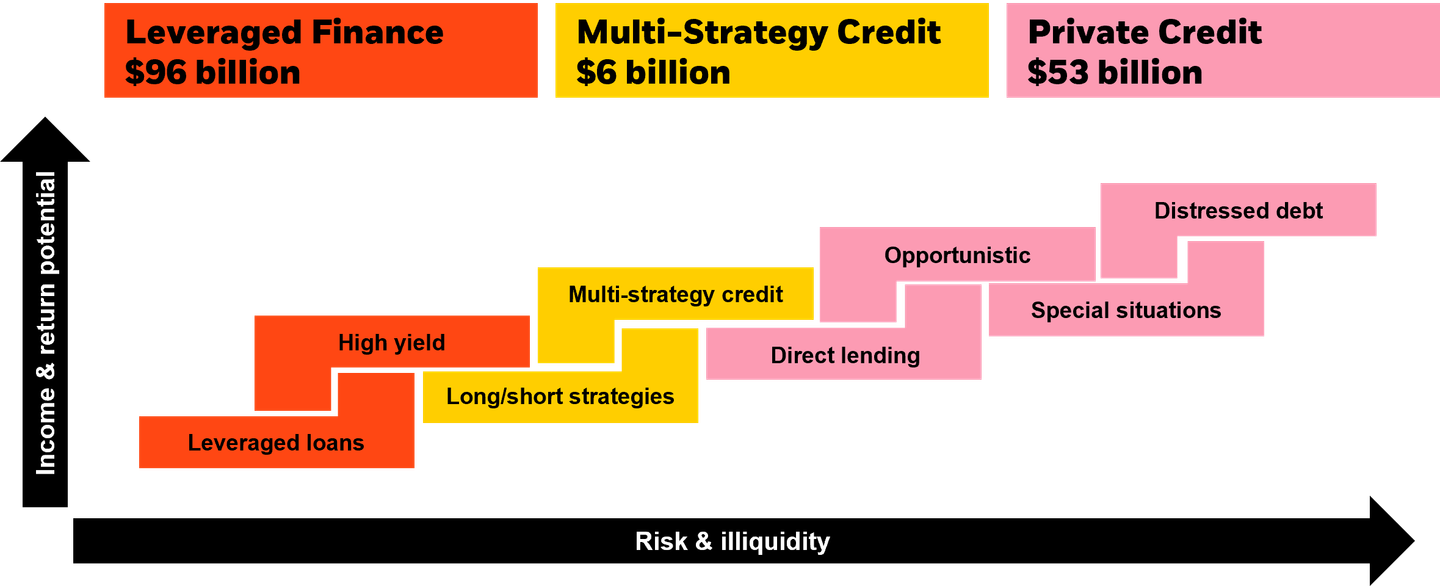

BlackRock offers solutions globally across three investment pillars - leveraged finance, multi-strategy credit and private credit.

A market-leading platform spanning high yield, bank loan and CLO investing.

Multi-strategy creditPublic, public-private blended and long/short strategies that seek flexible opportunities for owning credit throughout the cycle.

Private creditDeep and experienced teams deploying capital in direct lending, opportunistic and event-driven strategies, providing solutions across U.S., European and Asian private markets.

All $ are in USD BlackRock as of 31 December 2023. AUM includes managed assets and dry powder. Note: For illustrative purposes only. This information demonstrates, in part, the firm’s risk/return analysis to organize credit strategies. This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.