Why BlackRock for global multi-asset portfolios?

BlackRock’s Diversified Strategies team invests in highly diversified portfolios incorporating a global universe of equities, fixed income, alternatives and cash. The team adopts a flexible approach to asset allocation in order to navigate different market environments. The team leverages the considerable in-house global research capabilities of BlackRock in individual asset classes, in addition to formulating its own asset class agnostic perspectives on the team.

Deep macro and thematic insights

Highly innovative implementation

Extensive track record

Investment theory

The Diversified Strategies team focuses on delivering positive returns to clients through active asset allocation decisions. As such, the team focuses on establishing a ’top-down’ macro-economic view of the world and building portfolios that have a diversified set of research-driven investment ideas consistent with that view. The team fundamentally believes that there are better ways to gain exposure to asset markets than simply “buying the market”.

More robust ways of gaining ‘market exposure’ can include:

- Developing more risk-efficient ways of getting the “market” exposure, or capturing the risk premium in market

- Exploiting inefficiencies and mis-pricings within and between asset classes via active asset allocation decisions

- A combination of the above

Our investment theory is based on the following fundamental beliefs:

Macro-economic analysis

Risk awareness

Efficient implementation

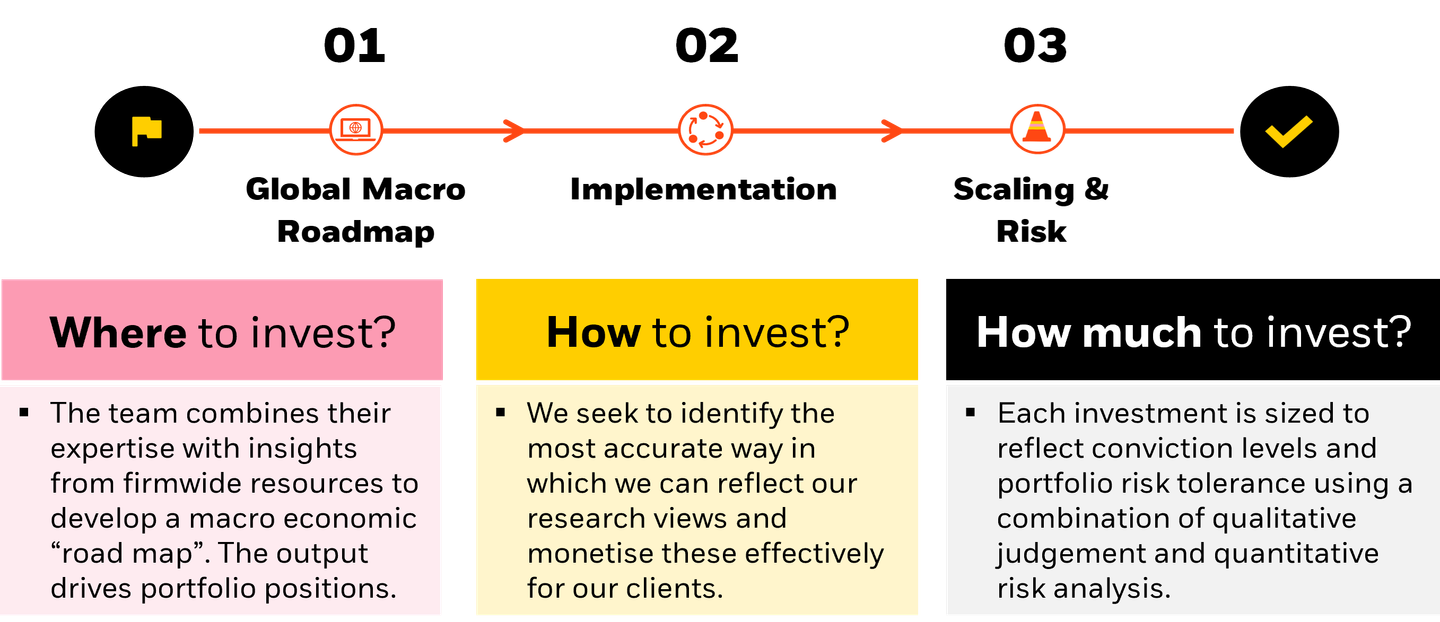

Investment process

The Diversified Strategies team employs a robust and scalable investment process that is underpinned by the team’s expertise across a wide opportunity set in addition to leveraging insights from the breadth of BlackRock’s investment platform. The process has 3 distinct stages:

This information should not be relied upon as research, investment advice, or a recommendation regarding any products, strategies, or any security in particular. This is for illustrative and informational purposes and is subject to change. It has not been approved by any regulatory authority or securities regulator. The environmental, social and governance (“ESG”) considerations discussed herein may affect an investment team’s decision to invest in certain companies or industries from time to time. Results may differ from portfolios that do not apply similar ESG considerations to their investment process.

There is no guarantee that a positive investment outcome will be achieved. There is no guarantee that research capabilities will contribute to a positive investment outcome. Diversification and asset allocation may not fully protect you from market risk. Investment philosophy is subject to change and for illustrative purpose only. Source: BlackRock, as of 01 March 25.

Capabilities

The Diversified Strategies team manages a range of outcome oriented and benchmark / peer group aware strategies and solutions for clients. All strategies feed from the same research inputs in the team’s process but implementation is tailored to meet specific outcomes, risk parameters, sustainable investing requirements and where appropriate, individual client guidelines. The team has a +20-year history managing assets on behalf of a range of clients across the wealth, defined benefit and defined contribution pension funds, charities / endowments, sovereign wealth, and insurance company sectors.