Skip to content

Welcome to the BlackRock Cash site

Before you proceed, please take a moment to review and accept the following Terms and Conditions:

These terms and conditions govern your use of this website (https://www.blackrock.com/cash).

By accessing this website, you agree that you have read and accept these terms and conditions and our Privacy Policy. If you do not wish to be bound by these terms and conditions, please leave this website.

The content of this website is intended for professional investors only, investors of any other description should not rely upon the information contained in this site.

Access to information displayed on this website may be restricted to certain persons in certain countries. Various products shown on this website have been registered or authorised in different countries and as such are authorised for public offering (to retail and professional clients as defined under the Markets in Financial Instruments Directive (as amended) (“MiFID”) and to qualified investors as defined under the Prospectus Regulation (as amended)) in such countries. In countries where one or more products are not registered or authorised for public offering, retail investors may not access information on such products but certain information may be shown to certain types of professional clients and qualified investors, depending on the country concerned.

This site is not for Hong Kong residents' viewing.

Once you have confirmed that you agree to the legal information in this document, and the Privacy Policy, we will place a cookie on your computer to recognise you and prevent this page reappearing should you access this site, or other BlackRock sites, on future occasions. The cookie will expire after six months, or sooner should there be a material change to this important information.

By confirming that you have read this important information, you also: (i) Agree that such information will apply to any subsequent access to the Individual Investors (or Institutions / Intermediaries) section of this website by you, and that all such subsequent access will be subject to the disclaimers, risk warnings and other information set out herein; and (ii) Warrant that no other person will access the Individual Investors section of this website from the same computer and logon as you are currently using.

Prospective investors should consult their own professional advisers as to the possible tax implications of subscribing for, purchasing, holding, switching or disposing of shares in the Institutional Cash Series plc (the “Company”) under the laws of their country of citizenship, residence or domicile. Investors should note that the levels and bases of, and relief from, taxation can change.

BlackRock has not considered the suitability and appropriateness of any investment you may make with us against your personal circumstances. If you are unsure about the meaning of any information provided, please consult your financial or other professional adviser.

Selling Restrictions

The following pages do not constitute an offer or solicitation to sell shares in any of the funds referred to on this site, by anyone in any jurisdiction in which such offer, solicitation or distribution would be unlawful or in which the person making such offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make such offer or solicitation. The website indicates in which countries the funds of the Company is registered for distribution.

Shares in the funds of the Company is not offered or aimed at residents in any country in which (a) the funds of the Company are not authorised or registered for distribution and where to do so is contrary to any country's securities laws, (b) the dissemination of information on the Company and its funds via the Internet is forbidden, and/or BlackRock Investment Management (UK) Limited is not authorised or qualified to make such offer or invitation. This website and the information provided on this website should not be construed as an advertisement, an offer to sell, or a solicitation of an offer to buy any securities in the Institutional Cash Series plc mentioned in this website, nor shall any such securities be offered or sold, in any country in which to do so is contrary to that country's securities laws.

Nothing herein constitutes an offer to invest in the shares of the funds described in the following pages. Any decision to invest must be based solely on the information contained in the Company’s Prospectus, Key Investor Information Document and the latest half-yearly report and unaudited accounts and/or annual report and audited accounts. Investors should read the fund specific risks in the Key Investor Information Document. The distribution of this information in certain jurisdictions may be restricted and, persons into whose possession this information comes are required to inform themselves about and to observe such restrictions. Prospective investors should take their own independent advice prior to making a decision to invest in this fund about the suitability of the fund for their particular circumstances, including in relation to taxation, and should inform themselves as to the legal requirements of applying for an investment. Most of the protections provided by the UK regulatory system, and compensation under the UK's Financial Services Compensation Scheme, will not be available.

The funds of the Company are not offered or aimed at residents in any country in which (a) the funds is not authorised or registered for distribution and where to do so is contrary to any country's securities laws, (b) the dissemination of information of the Company and its funds via the Internet is forbidden, and/or BlackRock Investment Management (UK) Limited or BlackRock Advisors (UK) Limited is not authorised or qualified to make such offer or invitation. This website and the information provided on this website should not be construed as an advertisement, an offer to sell, or a solicitation of an offer to buy any shares in the funds of the Company mentioned in this website, nor shall any such securities be offered or sold, in any country in which to do so is contrary to that country's securities laws.

Specifically, the funds described are not available for distribution to or investment by US investors. The shares will not be registered under the US Securities Act of 1933, as amended (the "Securities Act") and, except in a transaction which does not violate the Securities Act or any other applicable US securities laws (including without limitation any applicable law of any of the States of the USA) may not be directly or indirectly offered or sold in the USA or any of its territories or possessions or areas subject to its jurisdiction or to or for the benefit of a US Person.

Shares in the funds of the Company may not, except pursuant to a relevant exemption, be acquired or owned by, or acquired with the assets of an ERISA Plan. An “ERISA Plan” is defined as (i) any retirement plan subject to Title I of the United States Employee Retirement Income Security Act of 1974, as amended (ERISA); or, (ii) any individual retirement account or plan subject to Section 4975 of the United States Internal Revenue code of 1986, as amended.

Additionally, shares in the funds of the Company may not, except pursuant to an exemption from, or in a transaction not subject to the regulatory requirements of, the US Investment Company Act of 1940, as amended (the "1940 Act"), or the US Commodity Exchange Act, as amended (the "CEA"), as the case may be, be acquired by a person who is deemed to be a US Person under the 1940 Act and regulations thereunder or a person who is deemed to be a US Person under the CEA and regulations thereunder.

The funds described have not been, nor will they be, qualified for distribution to the public in Canada as no prospectus for these funds has been filed with any securities commission or regulatory authority in Canada or any province or territory thereof. This website is not, and under no circumstances is to be construed, as an advertisement or any other step in furtherance of a public offering of shares in Canada. No person resident in Canada for the purposes of the Income Tax Act (Canada) may purchase or accept a transfer of shares in the funds described unless he or she is eligible to do so under applicable Canadian or provincial laws.

The Company is an open-ended umbrella investment company with variable capital incorporated with limited liability in Ireland under registration number 298213, and its registered office is at JPMorgan House, International Financial Services Centre, Dublin 1, Ireland. The Company is authorised by the Central Bank of Ireland. BlackRock Investment Management (UK) Limited serves as Principal Distributor of the shares of the funds of the Company.

Users of this website are required to notify BlackRock immediately by email if any information which a user is able to access on this website would cause the user, the Company, BlackRock or any of the Company’s funds to be in breach of applicable laws or regulations. In such event, the user shall (a) stop accessing this website, (b) destroy immediately any such information (and all copies) which has been downloaded or printed by the user from this website, (c) disregard such information, and (d) treat such information as confidential and not disseminate it

Applications to invest in any fund referred to on this site, must only be made on the basis of the offer document relating to the specific investment (e.g. Prospectus or other applicable terms and conditions).

As a result of money laundering regulations, additional documentation for identification purposes may be required when you make your investment. Details are contained in the relevant Prospectus or other constitutional document.

Content and Use of this Website

The information contained on this site is subject to copyright with all rights reserved. It must not be reproduced, copied or redistributed in whole or in part. The information contained on this site is published in good faith but no representation or warranty, express or implied, is made by BlackRock or by any person as to its accuracy or completeness and it should not be relied on as such. BlackRock shall have no liability, save for any liability that BlackRock may have under the UK Financial Services and Markets Act 2000 (or the name of any replacement legislation if the legislation permits such a statement to be made), for any loss or damage arising out of the use or reliance on the information provided including without limitation, any loss of profit or any other damage, direct or consequential. No information on this site constitutes investment, tax, legal or any other advice.

Where a claim is brought against BlackRock by a third party in relation to your use of this website, you hereby agree to fully reimburse Blackrock for all losses, costs, actions, proceedings, claims, damages, expenses (including reasonable legal costs and expenses), or liabilities, whatsoever suffered or incurred directly by BlackRock as a consequence of improper use of this website. Neither party should be liable to the other for any loss or damage which may be suffered by the other party due to any cause beyond the first party's reasonable control including without limitation any power failure.

You acknowledge and agree that it is your responsibility to keep secure and confidential any passwords that we issue to you and your authorised employees and not to let such password(s) become public knowledge. If any password(s) baecome known by someone other than you and your authorised employees, you must change those particular password(s) immediately using the function available for this purpose on the website.

You may leave the BlackRock website when you access certain links on this website. BlackRock has not examined any of these websites and does not assume any responsibility for the contents of such websites nor the services, products or items offered through such websites.

BlackRock shall have no liability for any data transmission errors such as data loss or damage or alteration of any kind, including, but not limited to, any direct, indirect or consequential damage, arising out of the use of the services provided herein.

Risk Warnings

Investment in the products mentioned in this document may not be suitable for all investors. Past performance is not a guide to current or future performance and should not be the sole factor of consideration when selecting a product. The price of the investments may go up or down and the investor may not get back the amount invested. Your income is not fixed and may fluctuate. Fluctuation may be particularly marked in the case of a higher volatility fund and the value of an investment may fall suddenly and substantially. The value of investments involving exposure to foreign currencies can be affected by exchange rate movements. We remind you that the levels and bases of, and reliefs from, taxation can change.

BlackRock has not considered the suitability of this investment against your individual needs and risk tolerance. The data displayed provides summary information. Investment should be made on the basis of the relevant Prospectus which is available from the manager.

For your protection, telephone calls are usually recorded.

Most of the protections provided by the UK regulatory system do not apply to the operation of the Company. Accordingly, investors entering into investment agreements with such companies will not have the protection afforded by the UK's Financial Services Compensation Scheme.

The views expressed herein do not necessarily reflect the views of the BlackRock Group as a whole or any part thereof, nor do they constitute investment or any other advice.

Any research found on these pages has been procured and may have been acted on by BlackRock for its own purposes.

This site is operated and issued by BlackRock Investment Management (UK) Limited, authorised and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL. Tel: + 44 (0)20 7743 3000. Registered in England and Wales No. 2020394. For your protection telephone calls are usually recorded. BlackRock is a trading name of BlackRock Investment Management (UK) Limited. Please refer to the Financial Conduct Authority website for a list of authorised activities conducted by BlackRock.

In the event where the United Kingdom leaves the European Union without entering into an arrangement with the European Union which permits firms in the United Kingdom to offer and provide financial services into the European Union (“No Deal Brexit Event”), the issuer of this material is:

- BlackRock Investment Management (UK) Limited for all outside of the European Economic Area; and

- BlackRock (Netherlands) B.V. for in the European Economic Area. However, prior to a No Deal Brexit Event and where a No Deal Brexit Event does not occur, BlackRock Investment Management (UK) Limited will be the issuer.

BlackRock (Netherlands) B.V.: Amstelplein 1, 1096 HA, Amsterdam, Tel: 020 – 549 5200, Trade Register No. 17068311. For more information, please see the website: www.blackrock.com. For your protection, telephone calls are usually recorded. BlackRock is a trading name of BlackRock (Netherlands) B.V.

FOR QUALIFIED INVESTORS IN SWITZERLAND

The information contained in the following pages is directed at qualified investors domiciled in Switzerland, which meet the requirements pursuant to Art. 10 para 3 of the Federal Act on Collective Investment Schemes of 23 June 2006, as amended on 1 January 2020 (“CISA”). The content in the following pages is advertising.

The Institutional Cash Series plc is domiciled in Ireland. BlackRock Asset Management Schweiz AG, Bahnhofstrasse 39, CH-8001 Zurich, is the Swiss Representative and State Street Bank International GmbH, Munich, Zurich Branch, Beethovenstrasse 19, CH-8002 Zürich, the Swiss Paying Agent. The Prospectus, Key Investor Information Document, the Articles of Incorporation, the latest and any previous annual and semi-annual reports are available free of charge from the Swiss representative. Investors should read the fund specific risks in the Key Investor Information Document and the Prospectus.

© 2021 BlackRock, Inc. All Rights reserved. BLACKROCK, BLACKROCK SOLUTIONS, iSHARES, BUILD ON BLACKROCK, SO WHAT DO I DO WITH MY MONEY are registered and unregistered trademarks of BlackRock, Inc. or its subsidiaries in the United States and elsewhere. All other trademarks are those of their respective owners.

General enquiries about this website should be sent to webmaster@blackrock.com. This email address should not be used for any enquiries relating to investments.

Central banks recalibrate; activity cools; shocks rise; quality wins

In Q4 2025, policy paths diverged, the ECB stayed on hold as inflation neared target, while the BoE and Fed continued gradual easing, with guidance still firmly data dependent.

Key points

-

01

Central banks pivot unevenly; caution remains the anchor.

In Q4 2025, policy paths diverged, the ECB stayed on hold as inflation neared target, while the BoE and Fed continued gradual easing, with guidance still firmly data dependent.

-

02

Soft growth, cooling labour, disinflation continues.

Growth stayed soft across the Eurozone, UK, and US, services outperformed manufacturing, labour markets cooled, wage growth eased, and disinflation progressed, supporting further normalisation into 2026 amid lingering downside risks.

-

03

Event risk and information gaps lift the value of liquidity.

Geopolitics, fiscal uncertainty, and trade frictions kept front-end pricing sensitive to event risk, while the US shutdown disrupted key data, increasing reliance on central bank communication and reinforcing the value of liquidity and high-quality diversification.

Read details of our Q4 2025 cash market commentary

Paragraph-1

Paragraph-2

Paragraph-3

Paragraph-4

Market recap

The fourth quarter (Q4) of 2025 reinforced a late-cycle macro regime across the Eurozone, United Kingdom, and United States, disinflation continued, growth remained subdued, and central banks leaned cautious as they balanced improved inflation trends against still fragile domestic demand and policy uncertainty.

In the Eurozone, the European Central Bank (ECB) maintained a steady stance, leaving the deposit facility rate unchanged at 2.00% at its December 18 meeting. Inflation moved back to target, with Eurostat’s flash estimate putting December 2025 euro area inflation at 2.00% year over year. Growth remained soft and uneven, with services outperforming manufacturing, keeping front-end rates anchored and supportive of a carry-focused cash environment, while political and external risks sustained a premium on liquidity and diversification.

In the United Kingdom, the Bank of England (BoE) continued its gradual easing bias, cutting Bank Rate to 3.75% at the meeting, ending December 17 with consumer price index (CPI) inflation noted at 3.20%, still above target but easing. The macro picture remained mixed, activity was modest and confidence uneven, while labour market cooling improved the medium-term inflation outlook, reinforcing expectations for a measured path into 2026.

In the United States, the Federal Reserve (Fed) lowered the target range to 3.50% to 3.75% on December 10, signalling continued normalisation while retaining data dependence. The quarter’s data signal was complicated by a 43-day federal government shutdown that disrupted key releases, including the absence of a full October CPI, and delayed personal consumption expenditures (PCE) inflation reporting, increasing uncertainty around the near-term trajectory even as inflation moderated, with November CPI at 2.70% year over year.

Across EUR, GBP, and USD, money market funds remained a resilient allocation, offering liquidity and attractive income, with Q4 reinforcing the value of maturity discipline.

European market overview:

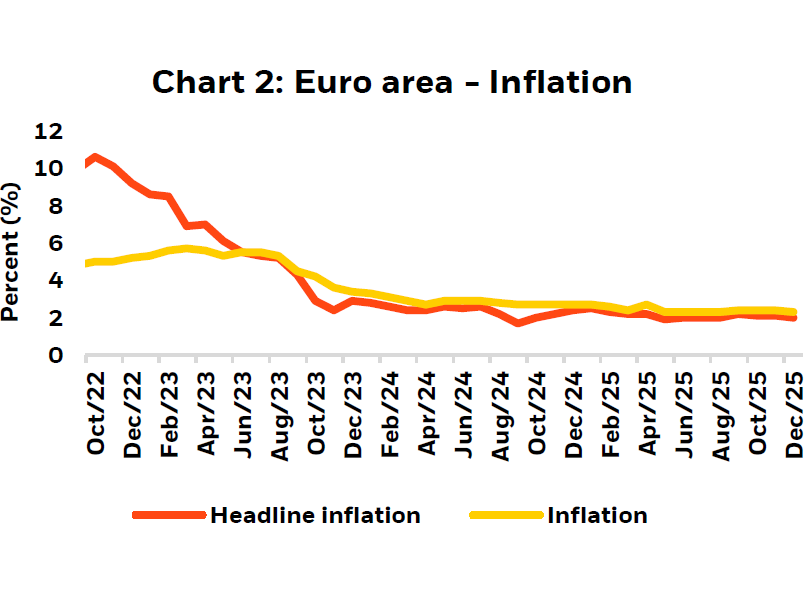

In the fourth quarter of 2025, the Eurozone macro backdrop remained one of cautious stability, with policy, growth, and inflation dynamics largely consistent with a prolonged “pause” environment. Headline inflation stayed broadly close to the European Central Bank’s objective, while core inflation continued to edge lower, albeit gradually, reflecting the slow normalisation of services inflation and wage pass through. As highlighted in Chart 2, inflation printed within a relatively narrow range through the quarter, which helped contain front end volatility and supported a more predictable carry environment.

Against this backdrop, the ECB maintained policy settings and reiterated a data-dependent approach, keeping a close watch on services inflation, wage dynamics, and the evolving external environment. The front end remained anchored by the ECB’s steady stance, while market pricing continued to oscillate around the timing and scale of any eventual easing in 2026. Directionally, the balance of risk was shaped by three familiar themes, global trade frictions, energy price sensitivity, and domestic political developments across key member states. This combination reinforced a regime where the market’s “terminal” policy debate mattered less than the question of how long restrictive settings would be maintained.

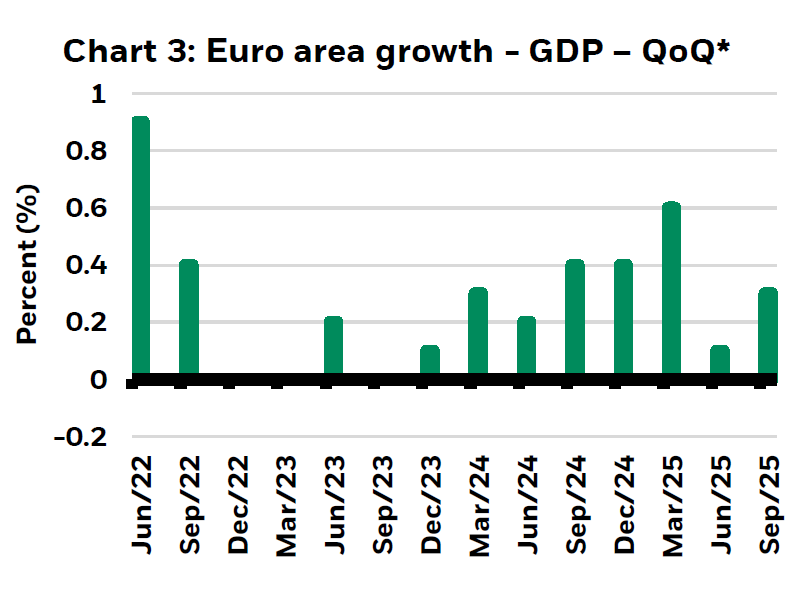

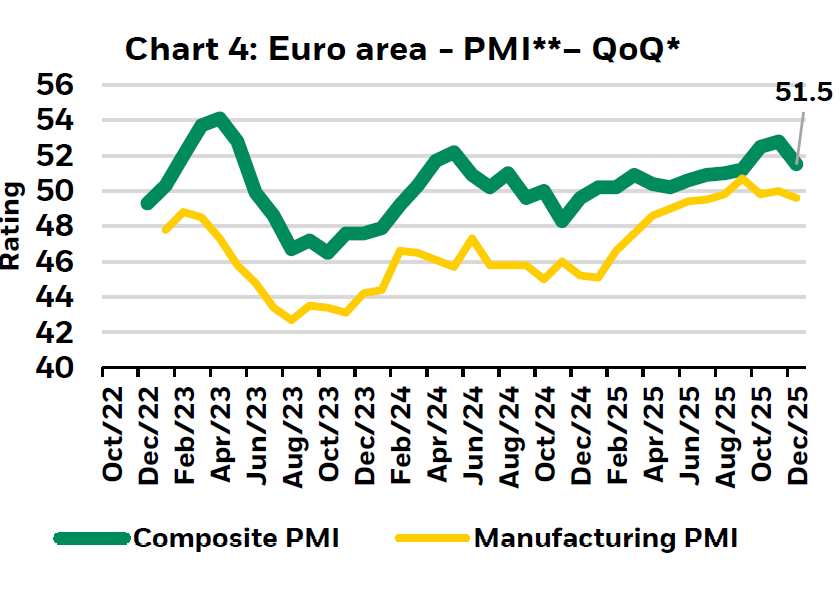

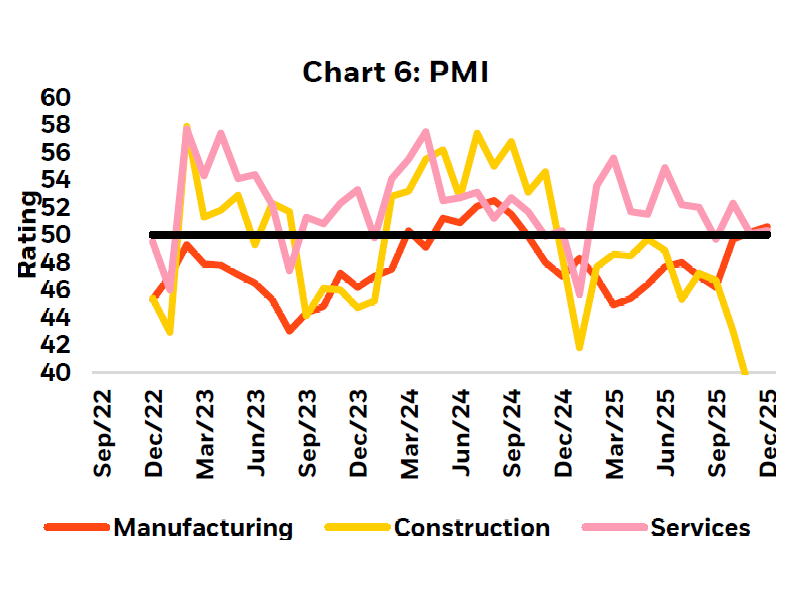

Activity remained soft but did not materially deteriorate. Incoming data suggested modest expansion, supported by improved real income dynamics and easing financial conditions relative to earlier in the year, but constrained by weak manufacturing momentum and uneven external demand. Survey indicators remained consistent with near-trend growth, with services continuing to outperform manufacturing, as indicated in Chart 3 and Chart 4. The result was a growth profile that felt stable but uninspiring, sufficient to sustain risk appetite intermittently, but not strong enough to force a hawkish repricing at the front end.

Labour market conditions stayed resilient, though the pace of job creation softened. Wage growth showed early signs of cooling, which supported confidence that domestic inflation pressures would continue to moderate into 2026. From a front-end perspective, this reduced the probability of renewed tightening, while still leaving the ECB with justification to remain cautious until disinflation was clearly entrenched.

The fourth quarter of 2025 was defined by a continued balancing act for the Bank of England, as the UK economy navigated a mixed growth picture and an inflation profile that remained sensitive to domestic cost drivers. Policy communications stayed cautious, with the Monetary Policy Committee emphasising gradualism and data dependence, reflecting the need to confirm that services inflation and wage growth were cooling sustainably before moving decisively toward easing.

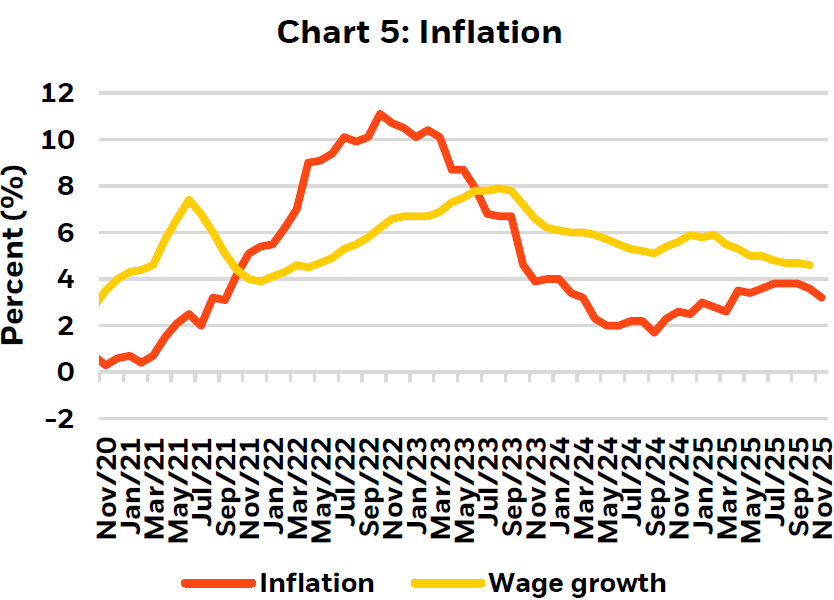

Inflation moderated from earlier peaks but remained uneven through the quarter, at times holding above target and keeping the market focused on labour costs, services pricing, and regulated price adjustments. As shown in Chart 5, the inflation path supported a cautious policy stance, limiting the extent to which investors could bring forward expectations of rapid rate cuts.

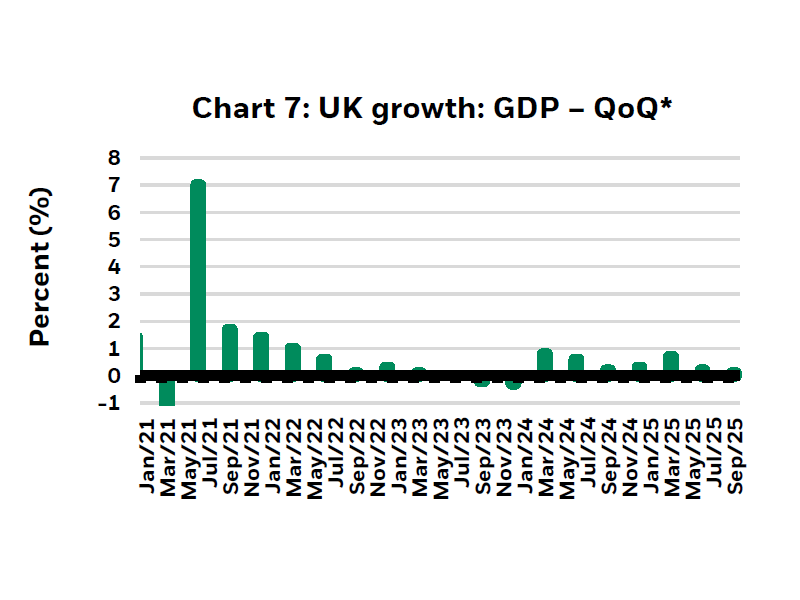

Activity data suggested a modest and uneven expansion. GDP growth remained subdued, and business sentiment oscillated around neutral levels, consistent with a private sector that was neither contracting sharply nor accelerating meaningfully, as indicated in Chart 6 and Chart 7. This “low growth, improving inflation” mix kept the front end highly sensitive to incremental data, especially labour market prints and measures of services inflation momentum.

Labour market conditions softened at the margin. Hiring intentions eased, vacancy trends continued to normalise, and wage growth showed signs of deceleration. For the rates market, this was important because wage moderation acts as the bridge between restrictive policy and lower services inflation, strengthening the case that inflation pressures could fade further into 2026.

Fiscal developments remained a key input for sterling markets. Policy announcements late in the year influenced expectations for gilt supply and the broader growth outlook, with knock-on effects for front end term premia and liquidity conditions. For cash investors, the interaction between fiscal signalling, issuance expectations, and policy pricing remained a recurring driver of short dated yield dispersion.

In the fourth quarter of 2025, the U.S. policy narrative shifted further toward normalisation as evidence accumulated that labour market conditions were cooling and inflation was trending lower, albeit unevenly.

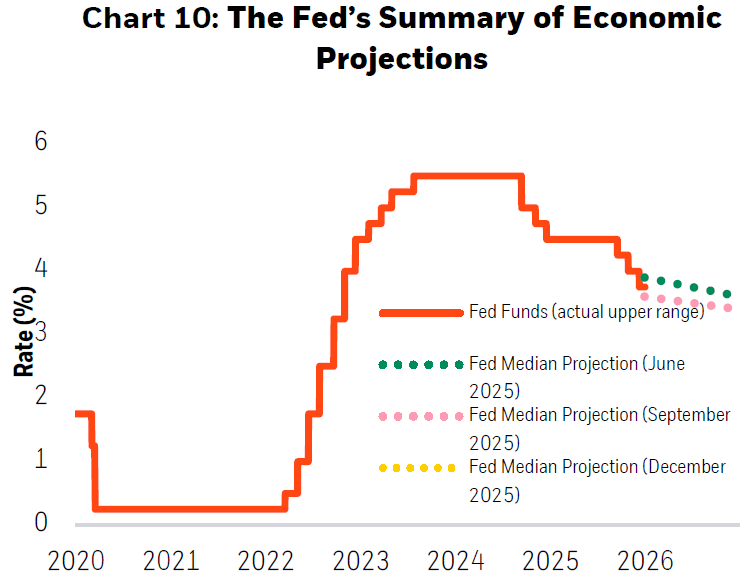

Following the initial easing step in September, the Federal Reserve delivered additional accommodation through year-end, bringing the target range to 3.50% to 3.75% as of 31 December 2025, as reflected in Chart 10.

A 43-day federal government shutdown ran from October 1, 2025, through November 12, 2025, forcing broad suspensions of data collection and publication across agencies.

Disinflation progressed, but the data signal became more difficult to interpret because the federal statistical system suffered a material disruption during the quarter.

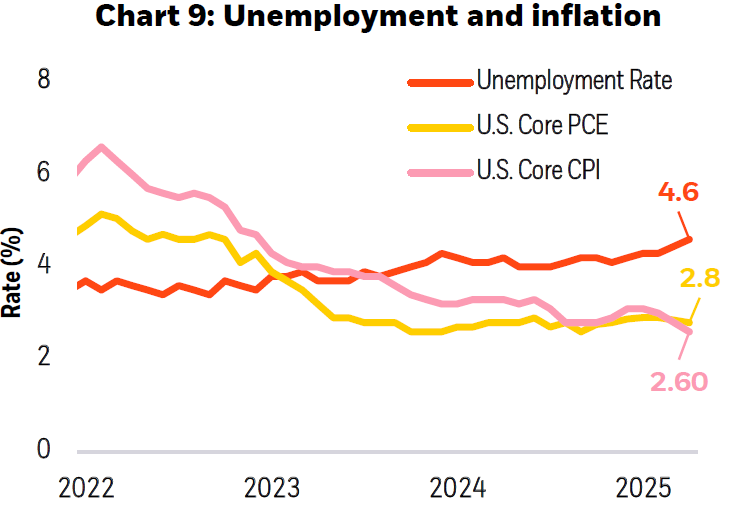

Inflation, directionally lower, but with an important gap. Annual CPI inflation printed at 2.70% year over year in November, down from 3.00% in September, reinforcing the narrative of easing price pressures. Data continuity was impaired. The Bureau of Labor Statistics (BLS) cancelled the October CPI report because the shutdown halted CPI data collection, making a full October print infeasible.

PCE inflation was also affected. With the October CPI missing, the Bureau of Economic Analysis (BEA) indicated it would use an average of September and November CPI data to estimate October inflation inputs for PCE, and it delayed the October and November PCE inflation data release to January 22, 2026.

Labour market readings were incomplete. The shutdown led to the cancellation of the October employment report, with BLS indicating October payrolls would be released alongside November employment data, while the October unemployment rate, derived from the household survey, would remain unknown.

The key market question was not whether the Fed had started to ease, but rather how quickly it would proceed in 2026, and how long policy would remain restrictive in real terms.

Source: Refinitiv Datastream and Bloomberg. Chart by BlackRock Investment Institute as of December 31st, 2025. CPI , Unemployment Rate and PCE as of November 2025. This chart does not reflect back-dated data revisions from the Bureau of Labor Statistics. For abbreviated terms and definitions, please refer to the pages titled “Definitions.”

Policy communications remained centred on risk management. The FOMC highlighted that labour market conditions had loosened compared with earlier in the year, while reiterating that inflation was still somewhat elevated and progress back to 2.00% was not assured. Incoming inflation and employment data, shown in Chart 9, kept markets sensitive to each incremental data release and to shifts in the Fed’s confidence about the disinflation trajectory.

Source: Refinitiv Datastream, Bloomberg. Chart by BlackRock Investment Institute as of December 31, 2025, and depicts the latest Summary of Economic Projections by the Federal Reserve dated December 10, 2025. There is no guarantee projections will be realized. Actual upper range line represents the upper limit to the Federal Funds Target ranges. As of December 31, 2025, the target range was 3.50% to 3.75%. The upper range would be 3.75%.