Systematic Active Equity

Seeking an information edge – in pursuit of an alpha edge

In an age where new information is constantly being created, the ability to process vast amounts of raw data can create a significant advantage for active managers.

BlackRock’s Systematic Active Equity (SAE) team uses cutting-edge technology and sophisticated analytics techniques to uncover investment insights faster, at greater scale, and with more granularity than traditional methods.

On-screen question: How do you maintain an alpha edge in markets?

Simply put, deep human expertise and cutting-edge technology.

We live in an increasingly digital world. When you look at all the data available, 90% of it has been generated over the last two years. [Source: Dihuni, data as of April 10 2020]

This is everything from wi-fi beacons to credit card purchases, to online activities.

While a single data point might not be interesting, in aggregate, it starts to tell a story.

We utilize diverse market expertise and data-driven investment process to separate potentially valuable signals from the noise. This leads to potentially innovative insights that seek to forecast trends and help make active moves ahead of the pack.

We believe that better and more differentiated investment insights from new data and new techniques are becoming necessary conditions for investment success.

Co-Chief Investment Officer

Co-Head of Systematic Active Equity

Benefits of a systematic approach in equities

Data seeks to provide an investment edge

Alternative data goes beyond information included in company financial statements. Examples include text from corporate call transcripts and online job postings. These unstructured datasets have the potential to uncover investment opportunities before they’re priced into markets, seeking to provide a unique investment edge.

Designed to effectively balance risk and return objectives

In our view, robust risk management is essential to generating consistent returns. Enabled by sophisticated risk management capabilities, our investment experts use proprietary systematic tools and analysis to continuously manage and navigate evolving risks.

Investment process engineered for scale

A systematic approach is key to transforming a sea of raw data into actionable insights that can be implemented at the portfolio level. We use cutting-edge technology to scale detailed analysis and implementation techniques across thousands of securities, creating a consistent process across a broad opportunity set.

Solutions with potential to improve portfolio outcomes

Designed to deliver differentiated return potential and diversification, systematic equity strategies may complement existing index and factor solutions—enhancing portfolio outcomes.

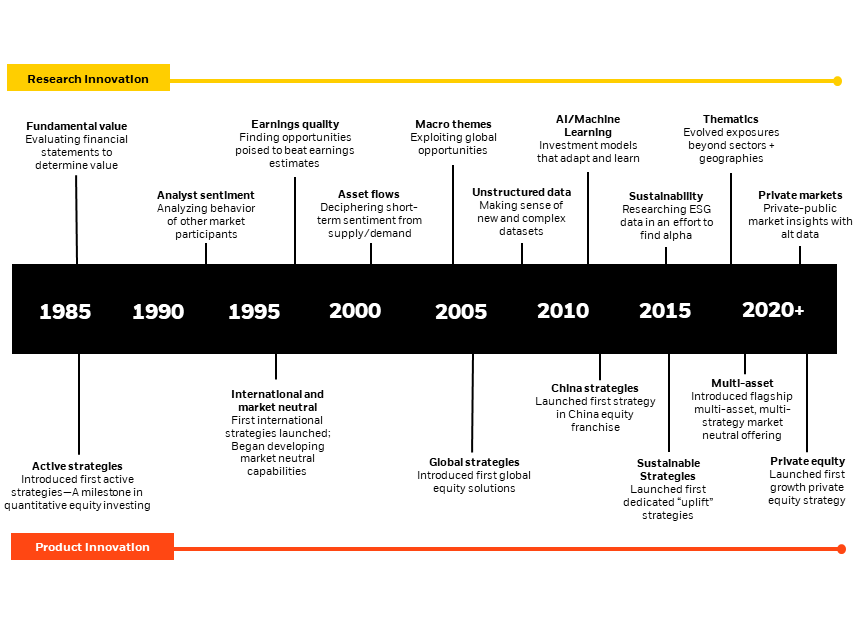

History of innovation

Source: BlackRock, as of 12/31/2023. Investment process is subject to change and provided here for illustrative purposes. Timeline reflects predecessor firms. *Investment strategies do not have a sustainable investment mandate unless it is specifically referenced in the prospectus. On this page, the only fund with a sustainable mandate is the BlackRock Sustainable Advantage Large Cap Core Fund (BIRIX).

BlackRock’s Systematic Active Equity (SAE) platform has a 35+ year history of active management across global markets. Discovering new market inefficiencies as they emerge is key to success, as they can disappear as quickly as they’re found. We believe that an investment process underpinned by continual innovation is vital to our goal of delivering consistent alpha to our clients.

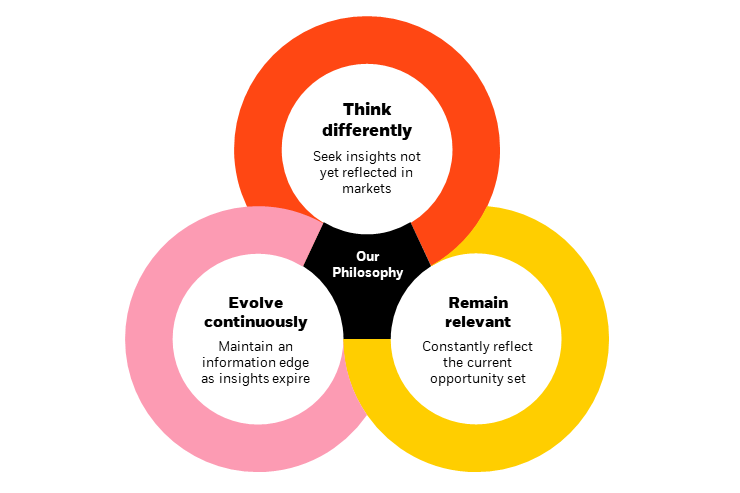

Investment Philosophy

BlackRock, as of 12/31/2023.

Sourcing alpha opportunities has always required an investment edge–which is becoming more difficult to achieve and maintain in a hyper-informed world. We believe staying ahead requires three key characteristics: thinking differently, evolving continuously, and remaining relevant as conditions change.

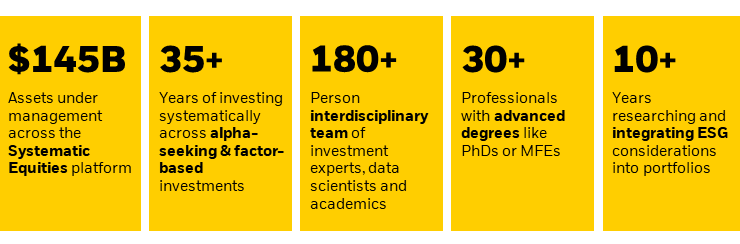

Robust human expertise

Source: BlackRock, as of 12/31/2023. Investment process is subject to change and provided here for illustrative purposes. Timeline reflects predecessor firms. Investment strategies do not have a sustainable investment mandate unless it is specifically referenced in the prospectus. On this page, the only fund with a sustainable mandate is the BlackRock Sustainable Advantage Large Cap Core Fund (BIRIX).

Our approach to systematic investing goes beyond data and technology. Human intellect is central to investment decision-making. Just as our process has evolved over time, so has the human expertise involved in these efforts. This multi-disciplinary foundation is seen as a key source of strength and differentiation.

To obtain more information on the funds, including the Morningstar time period ratings and standardized average annual total returns as of the most recent calendar quarter and current month-end, please visit:

Sustainable Advantage Large Cap Core Fund

Global Equity Market Neutral Fund

The Morningstar RatingTM for funds, or "star rating," is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and 10-year (if applicable) Morningstar Rating metrics. The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods.

Performance data quoted represents past performance and is no guarantee of future results. Investment returns and principal values may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. All returns assume reinvestment of dividends and capital gains. Current performance may be lower or higher than that shown. Refer to blackrock.com for most recent month-end performance.

Dig deeper into our insights

BlackRock’s equity market experts reveal what is driving their 2024 outlook.

Explore the origins of systematic investing, from first identifying the trade-off between risk and return to construct optimal investment portfolios, to the pure systematic alpha strategies of today that rely on an explosion of new and unstructured data.

Explore how we use AI in our investment process to identify security selection insights and target precise portfolio outcomes.

Read our latest blog posts

Our investment experts take on some of the most talked about investment themes today and decode what is happening in the markets.