关于贝莱德

关于安硕ISHARES

关于防范非法使用贝莱德名义从事金融诈骗活动的风险提示

尊敬的各位投资者:

近期,本集团发现有不法分子以“贝莱德”、 “BlackRock”和 “贝莱德资产管理北亚有限公司”名义,诱导投资者登录仿冒网站、下载仿冒APP、进行注册及认购虚假投资项目等,开展非法诈骗活动。

为保护投资者的合法权益,维护公司品牌及声誉,郑重提醒广大投资者:

一、以BlackRock, Inc.为母公司的贝莱德集团(“贝莱德集团(BlackRock) ”)总部设于美国纽约市,于1999年在纽约证券交易所上市,股票代码为“BLK”。贝莱德资产管理北亚有限公司为贝莱德集团内一家在中国香港地区注册成立的公司,并获香港证券及期货事务监察委员会发牌在中国香港地区进行若干受规管活动,未在中国大陆地区设立分支机构和/或发行产品。

二、通过微信(群)或其他方式诱导投资者登录仿冒网站、下载仿冒APP、进行注册及认购虚假投资项目等行为均系不法分子冒用贝莱德集团名义进行的非法行为,与贝莱德集团及其下属的任何公司(含贝莱德资产管理北亚有限公司)无任何关联。

三、敬请投资者审慎投资,对各类非法使用贝莱德集团名义或谎称与贝莱德集团和/或其下属的任何公司有合作关系的项目推广、证券投资、其它投融资、国内和/或海外基金销售及宣传活动提高警惕及识别判断能力,注意辨别真伪,千万不轻信来源不明的邀约、链接、二维码等,亦不轻易透露个人信息或盲目支付任何可疑费用款项,谨防受骗。如已发生财产损失的,务请尽快向公安机关报案,切实保护自身合法权益。

四、本集团正告所有正在或意图冒用贝莱德集团和/或其下属的任何公司名义注册公司、设立产品、募集资金、从事投融资活动或虚假宣传活动的侵权人士,以及谎称与贝莱德集团和/或其下属的任何公司有合作关系的人士,立即停止一切违法违规、涉嫌构成犯罪的行为。本集团已对此等侵权和/或犯罪行为进行调查并上报有关部门。同时,本集团保留通过一切合法途径追究侵权者法律责任的权利。

特此提示。

贝莱德集团

二〇二三年三月九日

请您在浏览www.blackrock.com/cn (“本网站”)前仔细阅读本网站使用条款,其中包含访问网站的当地法律限制、公开发售限制(包括中国用户合规声明)和其他信息使用及免责条款。如果您继续访问和使用本网站,则表示您已阅读并理解本网站使用条款,并同意受其约束。如果您不同意本网站使用条款,则请勿继续访问和使用本网站。

访问网站的当地法律限制

本网站所载信息或其参考信息可能未向任何当地政府机构(包括中国政府机构)申请、审核或注册。如果本网站的信息发布或访问以及本网站所载信息受到当地法律法规禁止或限制,则本网站不适合位于或居住于该司法管辖区的任何人士(无论因其国籍、住所、居留地或其他原因)使用。您有责任了解和遵守任何相关司法管辖区的所有适用法律法规。

公开发售限制

本网站所载信息仅供参考,从本网站获得的任何资料与任何特定个人或实体的投资目的、财务状况、投资方式或需求等无关。本网站所载信息和文件不会构成根据任何相关法律法规作出的公开发售,或由任何人士在以下任何情况下要约或推介出售基金份额:(1) 任何司法管辖区,法律禁止作出要约、推介或分销本网站所述任何基金份额,(2) 由任何不具备资格作出有关要约或推介的人士要约或推介,或 (3) 向任何法律禁止接受该要约或推介的人士要约或推介。

请特别注意,本网站所述基金不得针对或提供予美国投资者分销或投资。基金份额将不会根据经修订的《1933年美国证券法》("美国证券法")注册。除非交易不会违反美国证券法或任何其他适用的美国证券法例(包括但不限于美国任何州的任何适用法例)的规定,且符合其司法管辖区的规定或美国人士的利益(定义见美国证券法S规则),否则不得直接或间接在美国或其任何领土或属地或地区要约或出售本网站所述基金。

中国用户合规声明

就中华人民共和国(就此目的而言不适用于香港和澳门特别行政区或台湾)(“中国”)用户而言,本网站所述基金的资料仅提供给已获得合格境内机构投资者(QDII)资格并获得批准投资本网站所述基金的金融机构,并非为其他任何中国个人或实体所设置。其他中国个人或实体不能仅依赖本网站信息或文件作出投资决定,在投资之前应向其专业顾问或QDII咨询意见。本网站所述基金未在中国注册或经过有关监管部门批准,因此贝莱德不构成依照《中华人民共和国证券法》、《中华人民共和国证券投资基金法》或其他有关法律法规在中国境内向中国用户投资者发出认购所述基金的要约或要约邀请。同时,本网站所包含的信息和文件亦不构成证券投资顾问服务或提供投资意见服务,不得被视为投资任何所述基金或产品的招揽或建议。中国用户系基于自己的主观意愿浏览或使用本网站及其所述信息和文件。贝莱德未指示或要求任何中国用户向其名下投资人或其他QDII推广本网站。如果中国用户决定投资本网站所述基金,其应承诺遵守中国法律法规并获得相应的投资资格或批准。任何中国用户均无权就使用或依赖本网站及其所述信息或文件而向贝莱德提出任何权利主张或索赔。

中国用户一经同意接受本合规说明即视为向贝莱德作出以下声明:

“本人作为本公司的正当合法授权代表登陆贝莱德网站和查阅网站上的信息和文件,并将遵守QDII法律法规及其他相关法律法规使用这些信息和文件。”

对于本网站所述任何基金的投资申请,必须根据适用的基金发售文件(例如基金说明书或其他适用条款和条件)为基础做出。贵公司在做出投资决定前,应仔细阅读适用的基金发售文件。

根据反洗钱相关法律法规的规定,贵公司在作出投资时可能须提交其他文件,以识别身份。详情载于适用的基金说明书或其他章程文件。

不对任何信息做出保证

贝莱德或任何相关人士基于诚信在本网站刊载信息,但对其准确性、完整性或适用性,并未作出任何明示或暗示的声明或保证,有关信息也不应被视为准确、完整或适用而加以依赖。本网站所述任何信息(包括基金份额价格和可认购基金份额数量等) 为“现有”或“现存”信息,可能随时修改或更新,无须另行通知任何用户。本网站所包含的价格信息仅是指导性的,不代表贝莱德的最终或确定报价。

过往业绩并不代表将来的表现。投资价值与收入可涨可跌,贝莱德未对此做出任何保证或承诺。汇率、指数、利率、票息率、剩余投资期、股息收益和发行人信用评级都可能导致投资价值增加或减少。投资者可能无法取回投资本金。波幅较高的基金表现可能尤为反复,投资价值可能突然大幅下跌。

本网站所载信息不会构成投资、税务、会计、法律或任何其他意见。如果您对本网站提供的任何信息有疑问,请咨询您的财务或其他专业顾问。

免责

在法律允许的最大范围内,贝莱德或其董事、员工及关联方不向用户承担任何因使用或依赖本网站提供的信息而导致的直接或间接损失(包括但不限于利润或商业机会等)、债务、费用、要求、开支或损害等,无论这些是因合同、侵权(包括疏忽)或因使用所有或部分这些网页引起的或与之相关的,即使贝莱德事先已获知其可能性。

使用本网站所提供的服务时,网络软件或传输问题可能会产生不准确或不完整的信息和材料副本并可能被下载和显示于您的电脑中。贝莱德对任何于信息和材料传输过程中出现的任何直接或间接损害、改变、遗漏或任何其他形式的变动均不承担责任。

本网站可能含有第三方内容或与第三方网站的链接。这些内容与链接仅为您提供方便,并供您参考。对于第三方的任何内容和网站,包括但不限于其准确性、主题、质量或及时性,贝莱德既无法控制,也不为其承担任何责任,并不作任何保证或陈述。贝莱德对第三方的内容或网站或与本网站链接或配合的网站一律免责。

如第三人因您对于本网站之使用而对贝莱德主张任何权利时,您同意完全补偿因不当使用本网站而直接或间接导致贝莱德承受的所有损失、成本、诉讼、法律程序、请求、损害、费用(包括合理之法律成本及费用)或责任。任一方当事人均无须对他方当事人因超出其合理控制范围的因素(包括但不限于停电)所造成的损失或损害负责。

知识产权

贝莱德或相关第三方所有权人保留对本网站所有信息和内容(包括所有文章、数据、图解、标识)的各项权利、所有权和权益(包括版权、商标权、专利权以及其他知识产权或其他权利)。您不得为任何商业或公共的目的改动、复印、传播、散发、展示、施行、再制、出版、许可、制定、在其基础上创造衍生内容、转让或以任何其他形式使用本网站上获得的所有或部分信息、文章、图解、图像、视频剪辑、姓名地址录、数据库、列表或软件。此外,您不得系统性检索本网站的内容(不论是通过远程遥控、网上蜘蛛、自动设备或人工制程等技术手段)以直接或间接创作和汇编收藏、编辑、数据库或姓名地址录,或建立与本网站的链接。

除非有明确说明,本网站的任何内容不应被视为授予任何人由贝莱德或任何第三方享有的任何版权、专利、商标或其他知识产权的许可或权利。

保密

您理解并同意您有责任对贝莱德发给您和/或贵公司的其他授权员工的任何密码予以保护和保密,不得向公众披露。如任何密码由您或贵公司的其他授权员工以外的人士知悉,您需立即使用本网站的密码保护机制变更该密码。

其他重要信息

另请注意,部分贝莱德基金为分离责任状态的基金,也有部分为连带责任状态的基金。针对连带责任状态的贝莱德基金,当单一贝莱德基金无法偿付因可归责于该贝莱德基金资产所造成的责任时,超过部分应由同一公司下其他贝莱德基金的资产偿付。我们建议您参考各子基金的公开说明书中规定的与此有关的详细信息。

隐私声明

贝莱德重视您的隐私,您访问本网站将适用贝莱德得隐私声明。 [请点击此链接阅读隐私声明。]

(以下为影片字幕)

TEXT:世界正朝向低碳经济转型。

TEXT:科技创新持续进行

Carolyn Weinberg:哇,这是控制中心吗?

Dickon Pinner:每辆自动驾驶卡车都安装这个设备?

Alvin Foo:无人搬运车。

TEXT:气候和转型政策措施正在推动市场变化。

Chris Kaminker:近期美国政策的转向引发一场全球洁净能源竞赛,并为大西洋两岸创造投资机会。

TEXT:公司转型的同时,供应链也正在演变

Martin Lundstedt:这真好看。

Mark Wiedman::全电动!

Martin Lundstedt:没错,全电动。

Mark Wiedman:我正在开一辆潜力无穷的卡车。

Martin Lundstedt:没错,确实如此。

TEXT:全球经济的形态正在改变。

TEXT:新的投资风险和机会正在崛起。

Anne Valentine Andrews:低碳转型对我们的客户来说是难得一见的机会,贝莱德凭借着广泛的专业知识和完整的投资组合解决方案来满足我们客户的需求。

结论

VO:朝向低碳世界的转型正在发生。

VO: 而在贝莱德…

VO:我们已经准备好了。

贝莱德的客户日渐关注如何能够降低投资组合风险,并捕捉与可持续发展及向低碳经济转型相关的投资机遇。作为托管人,我们代表客户进行投资并协助他们实现投资目标。

贝莱德在可持续发展投资(只供英文)与向低碳经济转型的投资策略源于我们作为客户资产托管人的职责。我们首先着重了解客户的投资目标,并提供切合他们需要的投资选择,旨在在客户授权范畴内寻求更丰厚的风险调整后回报;以研究、数据及分析作为管理工作的依据。

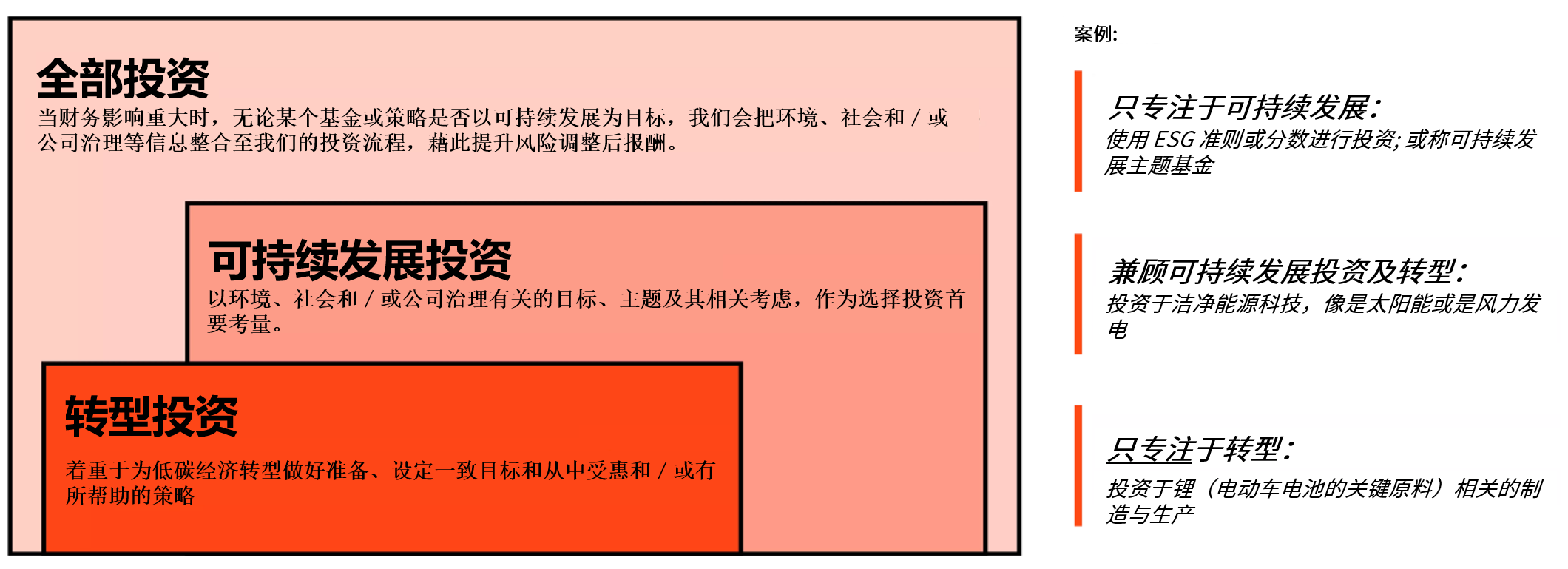

可持续发展投资利用环境、社会及╱或公司治理(ESG)目标、主题及相关因素作为挑选投资的重要元素。

贝莱德于可持续发展投资平台内的产品采取不同的策略,来帮助投资者实现投资回报。

请浏览BlackRock.com及 iShares.com的产品网页,以了解特定基金的可持续发展特质及各基金采用的具体筛选方针。

转型至低碳经济是少数有可能重塑经济、产业和企业的重大结构性转变之一。

目前并非全部可持续发展投资策略均涉及转型投资,反之亦然。了解这两类投资策略的关系,有助投资者识别能够满足其目标的产品及解决方案。

贝莱德将转型投资定义为专注投资于做好准备及配合向低碳经济转型,并能够从中受惠及╱或发挥推动作用的资产。

数据源:贝莱德,2023年9月。仅供说明。此图根据当前资产管理规模展示可持续发展投资及转型投资的关系,可能未按比例呈现。欲了解更多信息,请参阅我们的Firmwide ESG Integration Statement(贝莱德ESG整合手册)。

与低碳转型相关的结构性转变(科技创新、消费者及投资者偏好低碳产品及政府政策变化)正在重塑生产及消费,并促进资本投资。

推动经济转型的三大趋势:1

转型正在创造投资机遇。举例而言,预计到2050年能源体系平均年度支出将由过去十年的每年2.2万亿美元增至每年4万亿美元。2,3

我们擅长协助投资者了解气候及可持续发展风险对投资组合的影响。我们的内部专家团队(包括行业专家及气候科学家)着力发掘独特观点以捕捉当中机遇。

ESG代表环境、社会及公司治理,指纳入投资决策的特定考虑因素。

ESG信息例子如下:

贝莱德把ESG整合界定为将具重大财务影响的ESG数据或信息纳入全公司投资流程的做法,其旨在提升我们客户投资组合的风险调整后回报。无论基金或策略是否以可持续发展为目标,均会采用此做法。

贝莱德的ESG整合框架允许不同投资团队、策略及特定客户授权采用多元方法。

欲了解更多信息,请参阅我们的ESG Integration Statement(贝莱德ESG整合手册)。

改变能源格局的原材料革命

我们认为各国寻求能源安全保障最终会加快向更低成本、更洁净的新型能源来源转型。

可持续发展及转型解决方案团队为我们的公司及客户就可持续发展议题、风险及长期财务表现之间的关系提供明确指引。

投资督导是贝莱德对客户履行受托责任,以提升其长期经济利益的重要环节。我们会与客户所投资公司保持沟通、代表授权予我们的客户行使投票权、并作为参与管理的知情投资者倡导稳健的企业公司治理及业务实践,以达致此目标。

根据我们的经验,能够有效管理业务模式涉及的重大风险及机遇(包括可持续发展相关)的公司,更有机会取得稳健持久的长期财务表现。高标准企业公司治理以及强而有力的董事会及管理层能令公司在面临可能影响其财务表现的宏观经济及社会挑战时具备更高的抗跌及应变能力。