Three takeaways

- Gold and silver prices have darted higher in 2020

- A combination of low and even negative interest rates, a weaker U.S. dollar and rising inflation expectations are bolstering demand

- Exchange traded products (ETPs) give investors simple ways to access exposure to precious metals and potentially build resilience into their portfolios

Gold and silver are having their moment.

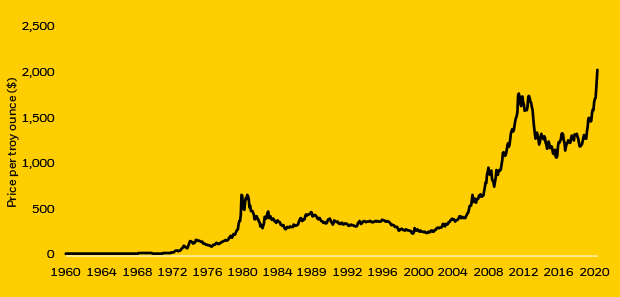

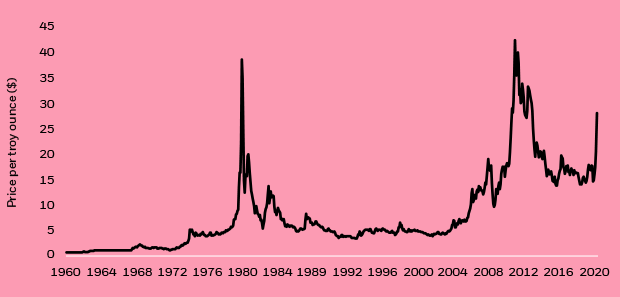

A swell in demand pushed gold above $2,000 an ounce for the first time in history and, in July 2020, silver posted its strongest monthly gain since 1979.1

Precious metals are generally viewed as potential havens in times of market uncertainty—something there has been plenty of in 2020. Three additional investment themes help explain the powerful price moves and may suggest that, should current conditions prevail, there could be persistent future demand for gold and silver. To be sure, precious metals have a history of staging abrupt price moves and changes to the macroeconomic backdrop could buck recent price trends.

Gold prices (monthly since 1960)

Source: World Bank (Jan. 1960 – July 2020); Federal Reserve Bank of St. Louis Economic Research Division (as of Aug. 7, 2020). Past performance is no guarantee of future results.

Silver prices (monthly since 1960)

Source: World Bank (Jan. 1960 – July 2020); Federal Reserve Bank of St. Louis Economic Research Division (as of Aug. 7, 2020). Past performance is no guarantee of future results.

One key support for precious metals: low interest rates globally. Major central banks have anchored policy rates near zero or below and current market pricing shows that interest rates are expected to stay low for some time — helping keep long-term yields pinned lower.2 All things equal, low bond yields can potentially make owning gold or silver more attractive, since investors give up less potential income than they might by owning interest-bearing assets. This point is starker when factoring in inflation because the real yields of many global bonds — including the 10-year U.S. Treasury — are in fact negative.3

A second source of demand for precious metals is a weaker U.S. dollar. One widely followed index that measures the greenback against a basket of foreign currencies has slumped 10% since its March peak as investors assess which economies will rebound most quickly from the COVID-19.4 Since precious metals are priced in U.S. dollars, a stronger home currency can generally benefit overseas gold- and silver-buyers.

Finally, potential for higher inflation down the road is stoking interest in precious metals. In part, this is a result of the weakening dollar, since U.S. consumers have less purchasing power and must pay more for imported goods. Additionally, the global macroeconomic policy in response to the coronavirus shock has been unprecedented in its size and speed.5 The BlackRock Investment Institute continues to monitor the extent to which the policy response might bring about upside inflation risk in the medium term.6

Spotlight on silver

Unlike gold, silver is widely used on the factory floor, including in the production of electronics and solar equipment. Industrial fabrication accounted for 52% of silver demand in 2019, compared with 7.5% of gold demand.7 That means that silver investments are more clearly linked than gold to any pickup in global economic growth.

Investors might consider a valuation comparison between the yellow and white metals. In 2020, buyers have paid more for gold relative to silver than has been typical over the past 50 years, meaning that silver prices would need to rise at a faster pace than gold (or gold would need to fall faster than silver) to restore the pair’s long-run price relationship. As of mid-August, it took 72 ounces silver to purchase one ounce of gold, higher than the average of 69 since 1960.8

Ounces of silver that buy one once of gold

World Bank (Jan. 1960 – July 2020); Federal Reserve Bank of St. Louis Economic Research Division (as of Aug. 7, 2020).

Accessing gold and silver with ETPs

ETPs make it simple for investors to access exposure to the day-to-day movement of the price of gold and silver bullion without the difficulty or expense associated with handling coins and bars. Global investors have taken note: flows into gold and silver ETPs in 2020 have been $53 billion year to date, fully 20% of total gold and silver ETP assets and an annual record with more than three months remaining in the year.9

ETPs also can offer access to a separate but related approach: Targeting diversified exposure to companies that mine gold and silver. Coronavirus-related shutdowns have disrupted global supply chains and higher precious metal prices generally support potential earnings growth in miners. While this industry is historically volatile, exposure to miner stocks offers the potential for growth with performance that has historically been non-correlated to the U.S. stock market.10