Assumindo o controle: colocando dinheiro para trabalhar

Temas em foco

Gerenciando o risco macroeconômico

O que importa no novo regime: taxas de juros estruturalmente mais altas e condições financeiras mais duras. Os mercados ainda estão se ajustando a esse ambiente – e é por isso que o contexto é fundamental na gestão do risco macroeconômico.

Direcionando os resultados do portfólio

Acreditamos que os investidores precisam assumir o controle dos investimentos e adotar uma abordagem mais dinâmica para suas carteiras, mantendo-se seletivos com alocações.

Aproveitando as mega forças

As mega forças são outra maneira de orientar as carteiras – e pensar em blocos de construção de portfólio que transcendam as classes de ativos tradicionais, em nossa visão.

Leia detalhes das nossas perspectivas para 2024:

Um mundo estruturalmente diferente

Acreditamos que taxas mais altas e a alta volatilidade definem o novo regime. É uma grande mudança em relação a década seguinte à crise financeira global. Os investidores podiam confiar em alocações de classes de ativos amplas e estáticas para obter retornos – e tiveram pouca vantagem com insights diferenciados sobre as perspectivas macroeconômicas.

Hoje, achamos que o inverso é verdadeiro. As restrições de produção são numerosas. Os bancos centrais enfrentam trade-offs mais duros no combate à inflação – e não podem reagir a um crescimento instável como costumavam. Isso leva a um conjunto mais amplo de resultados, criando maior incerteza para os bancos centrais e investidores, em nossa opinião.

Não é um ciclo de negócios típico

Há uma tentação de interpretar o novo regime adotando uma visão clássica do ciclo econômico do ambiente atuais, acreditamos. Isso perde o ponto: a economia está se normalizando desde a pandemia e sendo moldada por fatores estruturais – redução da força de trabalho, fragmentação geopolítica e transição de baixo carbono. Em nossa opinião, a desconexão resultante entre a narrativa cíclica e a realidade estrutural está alimentando ainda mais a volatilidade.

Gerenciando o risco de macroeconômico

O crescimento dos EUA reflete recuperação pós-pandemia, com trajetória fraca, juros persistentemente altos. Mercados ajustando-se ao novo regime, tornando o contexto crucial para a gestão do risco.

Contexto é tudo

O crescimento do emprego desde 2022 superou o que normalmente é visto em uma expansão econômica. Mas o zoom out mostra que a economia está apenas saindo de um buraco profundo da pandemia.

Mudanças na folha de pagamento dos EUA vs. expansão típica

Fonte: BlackRock Investment Institute, U.S. Bureau of Labor Statistics, com dados da Haver Analytics, dezembro de 2023. Notas: Os gráficos mostram as folhas de pagamento não agrícolas dos EUA. As linhas laranjas mostram o nível real do total de empregos não agrícolas na folha de pagamento indexado a duas datas de início diferentes: no gráfico superior, janeiro de 2022=100 e no gráfico inferior fevereiro de 2020=100. As linhas amarelas em ambos os gráficos mostram o emprego hipotético na folha de pagamento, como se a economia tivesse continuado a crescer à taxa média observada durante as expansões dos EUA pós-1945. As barras pretas no gráfico superior mostram ganhos reais mensais na folha de pagamento (em milhões) desde janeiro de 2022.

Direcionando os resultados do portfólio

Acreditamos que os insights macro serão recompensados no novo regime. A maior volatilidade e dispersão dos retornos criam espaço para que a expertise em investimentos se destaque, conforme detalhado em nosso segundo tema – direcionando os resultados da carteira. Isso envolve ser dinâmico com as estratégias de investimento, mantendo-se seletivo e buscando erros de precificação

Aproveitando as mega forças

Uma maneira de impulsionar os resultados do portfólio é aproveitando as mega forças – nosso terceiro tema. Essas são cinco forças estruturais que vemos impulsionando os retornos agora e no futuro. Eles se tornaram importantes blocos de construção de portfólio, em nossa opinião.

Colocar o dinheiro para trabalhar

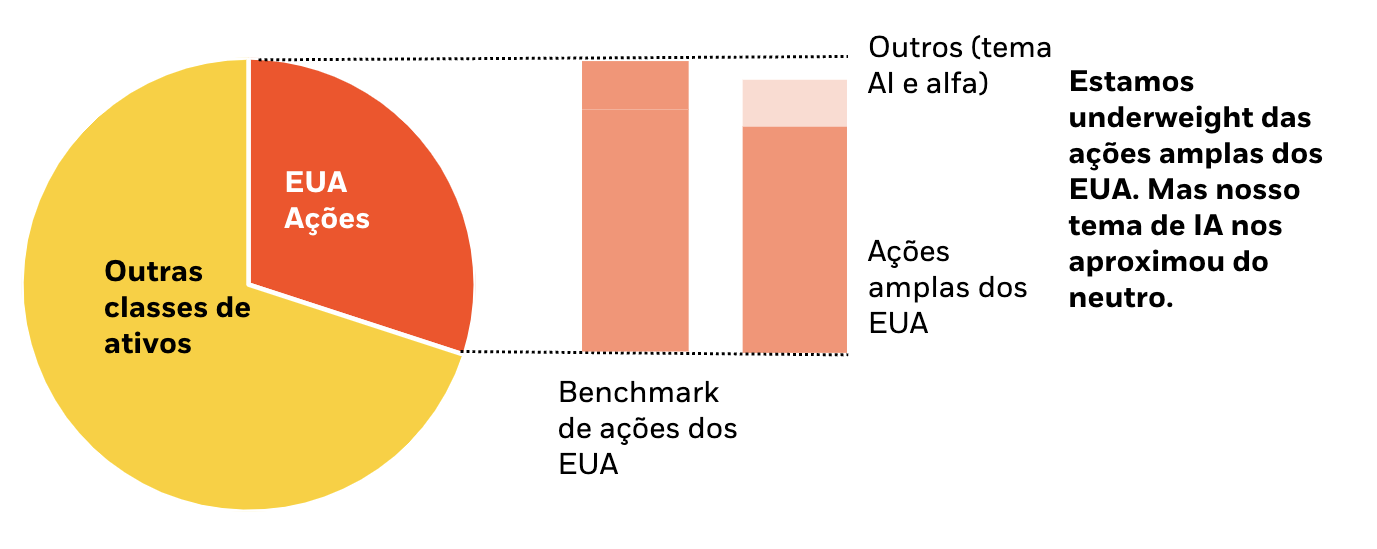

Em um horizonte tático, nossa visão macroeconômica nos manteria underweight das ações de mercados desenvolvidos (MD) como um standalone, porque esperamos que o crescimento permaneça estagnado com a inflação persistente, levando os bancos centrais a manter as taxas de juros mais altas por mais tempo. Mas encontramos maiores oportunidades alfa nas ações dos mercados desenvolvidos. Ao incorporar o tema IA e alfa, nossa visão geral é mais neutra em relação às ações dos EUA. Veja o gráfico abaixo. Continuamos positivos no Japão e continuamos favorecendo o tema IA nas ações de mercados desenvolvidos.

Análise da inclusão de mega força na visão geral de ações dos EUA

Fonte: BlackRock Investment Institute, dezembro de 2023 Nota: As visões são de uma perspectiva do dólar americano, dezembro de 2023. Este material representa uma avaliação do ambiente de mercado em um momento específico e não pretende ser uma previsão de eventos futuros ou uma garantia de resultados futuros. Esta informação não deve ser invocada pelo leitor como pesquisa ou aconselhamento de investimento sobre qualquer fundo, estratégia ou título em particular.

Estrategicamente, é mais uma história de renda fixa. Nossa visão de inflação nos mantém no máximo overweight em títulos atrelados à inflação. Ainda gostamos renda fixa nos mercados privados. Dentro dos títulos públicos dos mercados desenvolvidos, mantemos uma preferência de vencimentos de curto e médio prazo.

Os investidores precisam adotar uma abordagem mais ativa em suas carteiras. Este não é um momento para ligar o piloto automático de investimento; é um momento de assumir o controle. É importante ser deliberado ao assumir o risco da carteira, em nossa visão, e esperamos implantar mais risco ao longo do próximo ano.

Nossas visões de investimento

Nosso novo manual de investimentos – tanto estratégico quanto tático – pede maior nível de detalhes para capturar oportunidades decorrentes de maior dispersão e volatilidade que prevemos para os próximos anos.

Grandes chamadas

Visões de maior convicção de horizontes tático e estratégicos, abril de 2024

| Razões | ||

|---|---|---|

| Tático | ||

| Ações dos EUA | Nossa visão macro nos coloca neutros no nível de referência. Mas o tema da IA e seu potencial para gerar retornos alfa – ou acima do benchmark – nos impulsionam a ser overweight geral. | |

| Renda em renda fixa | O amortecimento de renda proporcionado pelos títulos aumentou em todos os setores em um ambiente de taxas mais altas. Gostamos de títulos de curto prazo e agora estamos neutros em relação aos títulos do Tesouro dos EUA de longo prazo, pois vemos riscos bidirecionais à frente. | |

| Granularidade geográfica | Somos a favor de obter granularidade geográfica (ver página 11) e gostamos de ações do Japão em mercados desenvolvidos. Dentro de mercados emergente (ME), gostamos da Índia e do México como beneficiários de mega forças, mesmo quando as avaliações relativas parecem ricas. | |

| Estratégico | ||

| Crédito privado | Acreditamos o crédito privado vai ganhar participação nos empréstimos à medida que os bancos recuarem – e com retornos atraentes em relação ao risco de crédito público. | |

| Títulos atrelados à inflação | Vemos a inflação ficar mais próxima de 3% no novo regime em um horizonte estratégico. | |

| Obrigações de curto e médio prazo | No geral, preferimos títulos de curto prazo ao longo prazo. Isso se deve à inflação mais incerta e volátil, a maior volatilidade do mercado de títulos e a demanda mais fraca dos investidores. | |

Nota: As visões são de uma perspectiva do dólar dos EUA, abril de 2024. Este material representa uma avaliação do ambiente de mercado em um momento específico e não pretende ser uma previsão de eventos futuros ou uma garantia de resultados futuros. Esta informação não deve ser invocada pelo leitor como pesquisa ou aconselhamento de investimento sobre qualquer fundo, estratégia ou título em particular.

Visões granulares táticas

Perspectivas táticas de 6 a 12 meses sobre ativos selecionados em relação a classes abrangentes de ativos globais por nível de convicção, abril de 2024.

| Ativo | Visão tático | Comentário | ||||

|---|---|---|---|---|---|---|

| Equities | ||||||

| Unido Estados | Ponto de referência |  |

Somos neutros em nossa maior alocação de portfólio. A queda da inflação e os próximos cortes de juros do Fed podem sustentar o ímpeto do rali. Estamos prontos para girar assim que a narrativa do mercado mudar. | |||

| Geral |  |

Estamos overweight geral ao incorporar nossa visão positiva centrada nos EUA sobre inteligência artificial (IA). Acreditamos os beneficiários de IA ainda podem ganhar, enquanto o crescimento dos lucros parece robusto. | ||||

| Europa |  |

Estamos underweight. O BCE está mantendo a política apertada em uma desaceleração. As avaliações são atraentes, mas não vemos um catalisador para melhorar o sentimento. | ||||

| Reino Unido |  |

Somos neutros. Achamos que as avaliações atraentes refletem melhor as baixas perspectivas de crescimento e os aumentos acentuados dos juros do Banco da Inglaterra para combater a inflação persistente. | ||||

| Japão |  |

Estamos overweight. Inflação moderada, forte crescimento dos lucros e reformas favoráveis aos acionistas são todos positivos. Vemos a mudança de política do BC como uma normalização, não uma mudança para o aperto. | ||||

| Mercados desenvolidos AI mega força |  |

Estamos overweight. Vemos um ciclo de investimento centrado em IA multi-país e multi-setor se desenrolando, provavelmente apoiando receitas e margens. | ||||

| Mercados emergentes |  |

Somos neutros. Vemos o crescimento em uma trajetória mais fraca e vemos apenas estímulos políticos limitados da China. Preferimos a dívida de mercados emergentes ao capital próprio. | ||||

| China |  |

Somos neutros. Estímulos políticos modestos podem ajudar a estabilizar a atividade, e as avaliações caíram. Desafios estruturais, como o envelhecimento da população e os riscos geopolíticos, persistem. | ||||

| Renda fixa | ||||||

| Títulos de curto prazo do Tesouro dos EUA |  |

Estamos overweight. Preferimos títulos públicos de curto prazo para obter renda, já que as taxas de juros permanecem mais altas por mais tempo | ||||

| Títulos longos do Tesouro dos EUA |  |

Somos neutros. O aumento do rendimento impulsionado pelas taxas de juros esperadas provavelmente atingiu o pico. Agora vemos chances iguais de que os rendimentos de longo prazo oscilem em qualquer direção. | ||||

| Bonds atrelados à inflação dos EUA |  |

Somos overweight e preferimos os EUA à zona euro. Vemos preços de mercado subestimando a inflação pegajosa | ||||

| Bonds index. à inflação da área do euro |  |

Somos neutros. As expectativas do mercado para a inflação persistente na área do euro diminuíram. | ||||

| Bonds do tesouro da área do euro |  |

Somos neutros. A precificação de mercado reflete as taxas de juros em linha com nossas expectativas e os rendimentos de 10 anos estão fora de suas máximas. O alargamento dos spreads das obrigações periféricas continua a ser um risco. | ||||

| Títulos de dívida do Reino Unido |  |

Somos neutros. Os rendimentos se comprimiram em relação aos títulos do Tesouro dos EUA. Os mercados estão precificando as taxas de juros do Banco da Inglaterra mais próximas de nossas expectativas. | ||||

| Bonds do governo japonês |  |

Estamos abaixo do peso. Encontramos retornos mais atrativos em ações. Vemos alguns dos retornos menos atraentes nos títulos do governo japonês, por isso os usamos como fonte de financiamento. | ||||

| Bonds do governo da China |  |

Somos neutros. Os títulos são sustentados por uma política mais frouxa. No entanto, achamos os rendimentos mais atraentes em papéis de DM de curto prazo. | ||||

| Agência norte-americana MBS |  |

Somos neutros. Vemos a agência MBS como uma exposição de alta qualidade em uma alocação diversificada de títulos e a preferimos à IG. | ||||

| Crédito de grau de investimento global |  |

Estamos underweight. Os spreads apertados não compensam o impacto esperado nos balanços corporativos dos aumentos de juros, em nossa visão. Preferimos a Europa aos EUA. | ||||

| High Yeld global |  |

Somos neutros. Os spreads estão apertados, mas gostamos de seu alto rendimento total e potenciais rali de curto prazo. Preferimos a Europa. | ||||

| Crédito na Ásia |  |

Somos neutros. Não achamos as avaliações convincentes o suficiente para se tornarem mais positivas. | ||||

| Moeda forte de mercados emergentes |  |

Estamos overweight. Preferimos a dívida em moeda forte EM devido ao seu valor relativo e qualidade. Também é amortecido pelo enfraquecimento das moedas locais, à medida que os bancos centrais cortam as taxas de juros. | ||||

| Moeda local de mercados emergentes |  |

Estamos neutros. Os rendimentos caíram para mais perto dos rendimentos do Tesouro dos EUA. Os cortes nas taxas dos bancos centrais podem prejudicar as moedas de mercados emergentes, prejudicando os retornos potenciais. | ||||

O desempenho passado não é um indicador confiável de resultados atuais ou futuros. Não é possível investir diretamente em um índice. Nota: As visualizações são de uma perspectiva do dólar americano. Este material representa uma avaliação do ambiente de mercado em um momento específico e não pretende ser uma previsão ou garantia de resultados futuros. Estas informações não devem ser consideradas como aconselhamento de investimento relativamente a qualquer fundo, estratégia ou valor mobiliário em particular.

Visões tácticas granulares denominadas em euros

Visões táticas de seis a 12 meses sobre ativos selecionados versus amplas classes de ativos globais por nível de convicção, dezembro de 2023

| Asset | Tactical view | Commentary | ||

|---|---|---|---|---|

| Equities | ||||

| Europa menos Reino Unido |  |

Estamos underweight. O BCE continua a apertar num abrandamento e o apoio ao crescimento dos preços mais baixos da energia está a desaparecer. | ||

| Alemanha |  |

Estamos underweight. As avaliações são moderadamente favoráveis em relação aos pares, mas vemos ganhos sob pressão de taxas de juros mais altas, crescimento global mais lento e incerteza de médio prazo sobre o fornecimento de energia. A longo prazo, acreditamos que a transição para o net zero pode trazer oportunidades. | ||

| França |  |

Estamos underweight. Avaliações relativamente mais ricas e um potencial arrasto para ganhos de consumo mais fraco em meio a taxas de juros mais altas compensaram o impacto positivo de reformas passadas de aumento da produtividade, mix energético favorável e impulso ao setor de luxo da reabertura da China. | ||

| Itália |  |

Estamos underweight. Os fundamentos de crédito relativamente fracos da economia em meio a um aperto financeiro global nos mantêm cautelosos, embora as avaliações e as tendências de revisão de lucros pareçam atraentes em relação aos pares. | ||

| Espanha |  |

Estamos underweight. As avaliações e o ímpeto dos lucros são moderadamente favoráveis em relação aos pares, mas a maior inclinação do mercado para as finanças pode obscurecer a perspectiva de lucros em meio a problemas do setor bancário. | ||

| Holanda |  |

Estamos underweight. O mercado bolsista holandês está a negociar a uma avaliação comparável à do mercado europeu, mas oferece um rendimento de dividendos relativamente baixo. | ||

| Suíça |  |

Estamos overweight. Temos uma preferência relativa. Os altos pesos do índice para setores defensivos, como saúde e bens de consumo não discricionários, fornecem um colchão em meio à alta incerteza macro global. As avaliações permanecem elevadas em relação aos pares e uma moeda forte é um obstáculo à competitividade das exportações. | ||

| Reino Unido |  |

Estamos underweight. O Banco da Inglaterra está subindo acentuadamente para lidar com a inflação pegajosa. Enquanto as ações precificam mais risco de baixa, aguardamos clareza da política. | ||

| Renda fixa | ||||

| Obrigações do tesouro da área do euro |  |

Somos neutros. A precificação de mercado reflete melhor as taxas de juros que permanecem mais altas por mais tempo. Vemos um risco de spreads de títulos periféricos mais amplos devido a condições financeiras mais apertadas. | ||

| Títulos alemães |  |

Somos neutros. A precificação de mercado reflete melhor as taxas de juros que permanecem mais altas por mais tempo. Preferimos papéis públicos de curto prazo para renda. | ||

| OATs franceses |  |

Somos neutros. As avaliações parecem atraentes em comparação com os títulos periféricos, com os spreads franceses para os títulos alemães pairando acima das médias históricas. A elevada dívida pública francesa e um ritmo mais lento das reformas estruturais continuam a ser ventos contrários. | ||

| BTPs italianos |  |

Estamos underweight. O spread BTP-Bund está muito apertado em meio a um cenário macro deteriorado, pensamos. Revisões recentes de dados mostraram um déficit/PIB maior do que o relatado originalmente para o período 2020-2022. No entanto, isso é compensado, em certa medida, pela postura fiscal relativamente prudente do novo governo e rendimentos relativamente atraentes. | ||

| Títulos de dívida do Reino Unido |  |

Somos neutros. Achamos que os rendimentos do ouro refletem melhor nossas expectativas para as perspectivas macro e a política do Banco da Inglaterra. | ||

| Títulos do governo suíço |  |

Somos neutros. Não vemos o SNB subindo as taxas tanto quanto o BCE, dada a inflação relativamente moderada e uma moeda forte. Uma maior pressão ascendente sobre os rendimentos parece limitada, dada a incerteza macro global. | ||

| Obrigações europeias ligadas à inflação |  |

Estamos underweight. Preferimos os EUA à zona euro. Os mercados estão precificando uma inflação mais alta do que nos EUA, mesmo com o Banco Central Europeu sinalizando mais aumentos de juros à frente. | ||

| Crédito europeu de grau de investimento |  |

Estamos modestamente overweight para crédito europeu de grau de investimento para obter rendimentos decentes. Preferimos o grau de investimento europeu em detrimento dos EUA, dadas as avaliações mais atrativas. Monitoramos condições financeiras e de crédito mais apertadas. | ||

| High Yeld europeu |  |

Somos neutros. Achamos o potencial de renda atraente, mas preferimos exposições de crédito de alta qualidade em meio a um cenário macro de piora. | ||

O desempenho passado não é um indicador confiável de resultados atuais ou futuros. Não é possível investir diretamente em um índice. Nota: As opiniões são de uma perspetiva do euro, junho de 2023. Este material representa uma avaliação do ambiente de mercado em um momento específico e não pretende ser uma previsão ou garantia de resultados futuros. Estas informações não devem ser consideradas como aconselhamento de investimento relativamente a qualquer fundo, estratégia ou valor mobiliário em particular.

Adaptação ao novo regime

Durante a Grande Moderação, as visões dos analistas sobre os lucros esperados da empresa foram muito mais agrupadas fora dos grandes choques. Agora, eles estão mais dispersos, mostrando que um ambiente de inflação e juros mais altos torna as perspectivas mais difíceis de ler. Veja o gráfico abaixo.

Dispersão das estimativas de lucros dos analistas dos EUA, 1995-2023

Fonte: BlackRock Investment Institute, LSEG Datastream, dezembro de 2023. Notas: O gráfico mostra o desvio padrão agregado das estimativas de lucros dos analistas para empresas de S&P. A linha verde mostra a mediana de 1995 até o final de janeiro de 2020, a linha laranja mostra a mediana desde fevereiro de 2020.

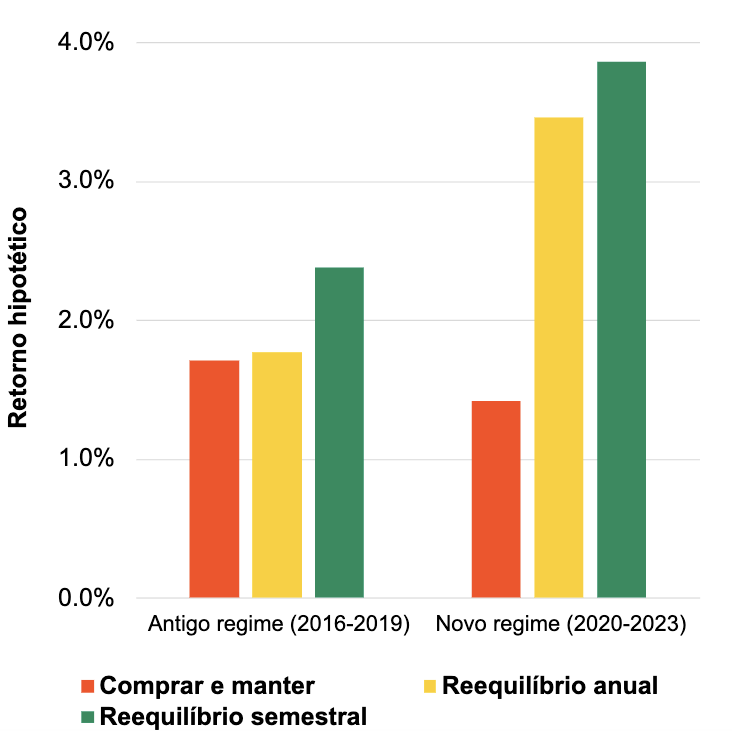

Uma abordagem mais dinâmica

Acreditamos que o novo regime, mais volátil, recompensa uma abordagem mais dinâmica das carteiras. Vemos alocações de ativos individuais se tornando menos eficazes.

Impacto hipotético do rebalanceamento nos retornos das ações dos EUA

O desempenho passado não é um indicador confiável do desempenho futuro. Os retornos de índice não contabilizam taxas. Não é possível investir diretamente em um índice. Fonte: BlackRock Investment Institute, MSCI com dados da Bloomberg, dezembro de 2023. Notas: O gráfico mostra os retornos mensais das ações dos EUA – com base no MSCI USA – no antigo e no novo regime sob três cenários: manutenção das participações inalteradas (buy-and-hold), reequilíbrios anuais e reequilíbrios semestrais. Os reequilíbrios otimizam a carteira para retornos, diversificação e risco com perfeita previsão dos retornos do setor de ações no índice MSCI USA. Essa análise utiliza retornos históricos e foi conduzida com o benefício da retrospectiva. Os retornos futuros podem variar e esses resultados podem não ser os mesmos de outras classes de ativos. Não considera potenciais custos de transação que possam prejudicar os retornos. Ele também não representa um portfólio real e é mostrado apenas para fins ilustrativos.

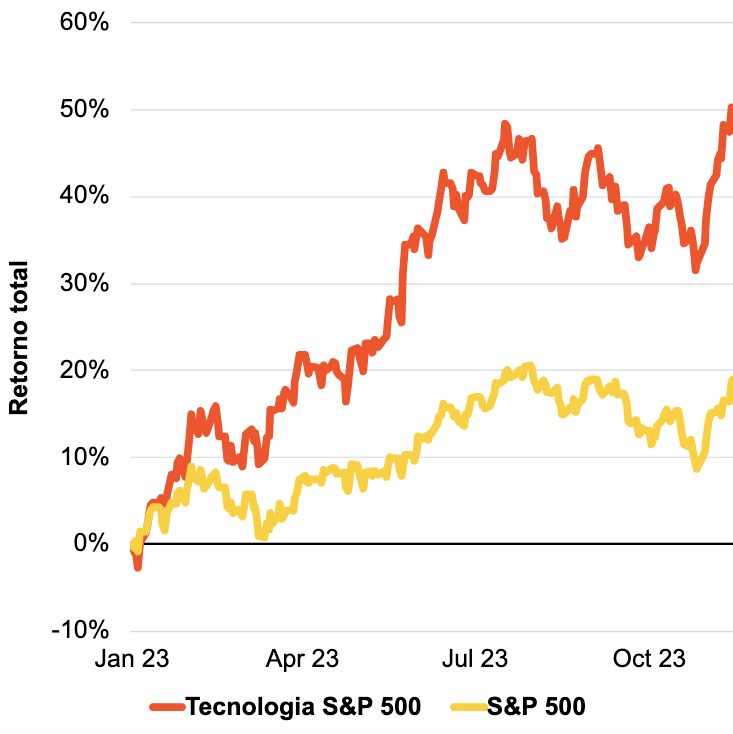

A mega força da IA em ação

O entusiasmo dos investidores por IA e tecnologia digital compensou o impacto do aumento dos rendimentos. Isso levou as ações de tecnologia dos EUA a superar facilmente o mercado mais amplo em 2023. Vemos o impacto potencial da IA se espalhando para outros setores também.

Setor de tecnologia S&P vs desempenho do S&P 500, 23 acumulado do ano

O desempenho passado não é um indicador confiável de resultados futuros. Os retornos de índice não contabilizam taxas. Não é possível investir diretamente em um índice. Fonte: BlackRock Investment Institute, com dados do LSEG Datastream, dezembro de 2023. Notas: O gráfico mostra os retornos totais no acumulado do ano em termos de dólar dos EUA para o setor de Tecnologia do S&P 500 (linha laranja) e o índice S&P 500 (linha amarela).