Skip to content

Welcome to the BlackRock site for wealth managers

Before you proceed, please take a moment to review and accept the following Terms and Conditions.

This section includes investor type descriptions for professional clients and market counterparties.

Professional client

A Professional Client is either: (i) a ‘deemed’ professional client; (ii) serviced-based professional client; or (iii) an assessed professional Client

(i) Deemed Professional Client

A person is a “deemed” professional client if the person is:

- a supranational organisation whose members are either countries, central banks or national monetary authorities

• a government, government agency, central bank or other national monetary authority of any country or jurisdiction

• a public authority or state investment body

• an Authorised Market Institution, Regulated Exchange or regulated clearing house

• a Regulated Financial Institution or the management company of a regulated pension fund;

• a Collective Investment Fund or a regulated pension fund;

• a corporate body whose shares are listed or admitted to trading on any exchange of an IOCSO member country

• trustee of a trust which has, or had during the previous 12 months, assets of at least $10 million;

• a Single Family Office licensed under the Single Family Office Regulations

• a person classified as a ‘large undertaking’ who meetstwoof the following criteria (i) a balance sheet total of at least $20 million; (ii) a net annual turnover of at least $40 million or (iii) own funds or called up capital of at least $2 million

(ii) Service-based Professional Clients

A person is a ‘serviced-based’ professional client if

- the services provided to the client is in relation to the provision of credit including arranging and/or advising on credit

• the services provided to the client relates to corporate structuring and financing such as advice relating to an acquisition, disposal, structuring, restructuring, financing or refinancing of a corporation or other legal entity i.e. takeovers, mergers and capital raising

(iii) Assessed-based Professional Clients

Assessed-based professional clients can be either (i) individuals; or (ii) undertakings

Individuals

An individual (and associated joint account holders) would be classified as an ‘assessed-based professional client’ if:

- the individual (and primary account holder, if relevant) has net assets of at least $1 million; and

• the individual is, or has been, an employee of an authorised firm or a regulated financial institution in the past two years; or

• the individual can provide evidence which demonstrates that they have sufficient knowledge and experience of relevant markets, products and associated risks

Where there is a joint account in place, the secondary account holder must obtain confirmation in writing that investment decisions relating to the joint account are made for or on behalf of the secondary account holder

Undertakings

Undertakings, which are generally not individuals, would be classified as ‘assessed-based’ professional clients if it:

- has own funds or called up capital of at least $1 million; and

• can evidence that they have sufficient knowledge and experience of relevant markets, products and associated risks

Market counterparties

A Market Counterparty is any person who is either:

- authorised firm;

• regulated financial institution; or

• professional client

Filter list by keyword

Show More

Show Less

to

of

Total

Sorry, no data available.

Overview

Important Information: Capital at Risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested.

Important Information:Credit risk, changes to interest rates and/or issuer defaults will have a significant impact on the performance of fixed income securities. Potential or actual credit rating downgrades may increase the level of risk. Investment risk is concentrated in specific sectors, countries, currencies or companies. This means the Fund is more sensitive to any localised economic, market, political or regulatory events. Non-investment grade fixed income securities are more sensitive to changes in interest rates and present greater ‘Credit Risk’ than higher rated fixed income securities. The Fund seeks to exclude companies engaging in certain activities inconsistent with ESG criteria. Investors should therefore make a personal ethical assessment of the Fund’s ESG screening prior to investment. Such ESG screening may adversely affect the value of the Fund’s investments compared to a fund without such screening.All currency hedged share classes of this fund use derivatives to hedge currency risk. The use of derivatives for a share class could pose a potential risk of contagion (also known as spill-over) to other share classes in the fund. The fund’s management company will ensure appropriate procedures are in place to minimise contagion risk to other share class. Using the drop down box directly below the name of the fund, you can view a list of all share classes in the fund – currency hedged share classes are indicated by the word “Hedged” in the name of the share class. In addition, a full list of all currency hedged share classes is available on request from the fund’s management company

Performance

Performance

Chart

Performance chart data not available for display.

Distributions

| Record Date | Ex-Date | Payable Date |

|---|

-

Returns

This chart shows the fund's performance as the percentage loss or gain per year over the last 4 years.

During this period performance was achieved under circumstances that no longer apply

*On , the Fund changed its name and/or investment objective and policy..

| 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|

| Total Return (%) | 6.3 | 4.2 | -12.1 | 12.4 | |

| Benchmark (%) | 7.1 | 4.8 | -12.0 | 12.8 |

Missing calendar year returns data

| From 31-Mar-2019 To 31-Mar-2020 |

From 31-Mar-2020 To 31-Mar-2021 |

From 31-Mar-2021 To 31-Mar-2022 |

From 31-Mar-2022 To 31-Mar-2023 |

From 31-Mar-2023 To 31-Mar-2024 |

|

|---|---|---|---|---|---|

|

Total Return (%)

as of 31-Mar-2024 |

- | 20.75 | -1.30 | -4.48 | 10.15 |

|

Benchmark (%)

as of 31-Mar-2024 |

- | 21.94 | -1.10 | -4.14 | 10.37 |

| 1y | 3y | 5y | 10y | Incept. | |

|---|---|---|---|---|---|

| Total Return (%) | 10.15 | 1.26 | - | - | 2.86 |

| Benchmark (%) | 10.37 | 1.52 | - | - | 3.29 |

Missing average annual returns data

| YTD | 1m | 3m | 6m | 1y | 3y | 5y | 10y | Incept. | |

|---|---|---|---|---|---|---|---|---|---|

| Total Return (%) | 1.08 | 1.11 | 1.08 | 8.67 | 10.15 | 3.84 | - | - | 13.07 |

| Benchmark (%) | 1.03 | 1.09 | 1.03 | 8.69 | 10.37 | 4.64 | - | - | 15.15 |

Missing cumulative returns data

Past performance is not a guide to future performance and should not be the sole factor of consideration

when selecting a product. Performance data is based on the net asset value (NAV) of the ETF which may

not be the same as the market price of the ETF. Individual shareholders may realise returns that are

different to the NAV performance

The figures shown relate to past performance. Past performance is not a reliable indicator of future performance. Markets could develop very differently in the future. It can help you to assess how the fund has been managed in the past

Share Class and Benchmark performance displayed in USD, hedged share class benchmark performance is displayed in USD.

Performance is shown on a Net Asset Value (NAV) basis, with gross income reinvested where applicable. Performance data is based on the net asset value (NAV) of the ETF which may not be the same as the market price of the ETF. Individual shareholders may realize returns that are different to the NAV performance.

The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Source: Blackrock

Key Facts

Key Facts

Net Assets of Share Class

as of 18-Apr-2024

USD 402,855,593

Net Assets of Fund

as of 18-Apr-2024

USD 1,526,088,561

Share Class Launch Date

20-Nov-2019

Fund Launch Date

12-Nov-2019

Share Class Currency

USD

Fund Base Currency

USD

Asset Class

Fixed Income

Benchmark Index

Bloomberg MSCI US Corporate High Yield Sustainable BB+ SRI Bond Index

Shares Outstanding

as of 18-Apr-2024

89,404,366

Total Expense Ratio

0.25%

ISIN

IE00BKF09C98

Distribution Frequency

Semi-Annual

Use of Income

Distributing

Securities Lending Return

as of 31-Dec-2023

0.02%

Domicile

Ireland

Product Structure

Physical

Rebalance Frequency

Monthly

Methodology

Sampled

UCITS Compliant

Yes

Issuing Company

iShares II plc

Fund Manager

BlackRock Asset Management Ireland Limited

Administrator

State Street Fund Services (Ireland) Limited

Custodian

State Street Custodial Services (Ireland) Limited

Fiscal Year End

31 October

Bloomberg Ticker

DHYD NA

Portfolio Characteristics

Portfolio Characteristics

Number of Holdings

as of 18-Apr-2024

1112

Benchmark Level

as of 18-Apr-2024

USD 117.29

Benchmark Ticker

I35047US

12 Month Trailing Dividend Distribution Yield

as of 18-Apr-2024

6.50

Standard Deviation (3y)

as of 31-Mar-2024

8.60%

3y Beta

as of 31-Mar-2024

0.996

Weighted Average YTM

as of 18-Apr-2024

8.17%

Weighted Avg Coupon

as of 18-Apr-2024

5.78

Weighted Avg Maturity

as of 18-Apr-2024

4.84

Effective Duration

as of 18-Apr-2024

3.61

Sustainability Characteristics

Sustainability Characteristics

Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund.

The metrics are not indicative of how or whether ESG factors will be integrated into a fund. Unless otherwise stated in fund documentation and included within a fund’s investment objective, the metrics do not change a fund’s investment objective or constrain the fund’s investable universe, and there is no indication that an ESG or Impact focused investment strategy or exclusionary screens will be adopted by a fund. For more information regarding a fund's investment strategy, please see the fund's prospectus.

Review the MSCI methodologies behind Sustainability Characteristics using the links below.

MSCI ESG Fund Rating (AAA-CCC)

as of 21-Mar-2024

A

MSCI ESG % Coverage

as of 21-Mar-2024

99.65

MSCI ESG Quality Score (0-10)

as of 21-Mar-2024

5.90

MSCI ESG Quality Score - Peer Percentile

as of 21-Mar-2024

92.74

Fund Lipper Global Classification

as of 21-Mar-2024

Bond USD High Yield

Funds in Peer Group

as of 21-Mar-2024

441

MSCI Weighted Average Carbon Intensity (Tons CO2E/$M SALES)

as of 21-Mar-2024

161.22

MSCI Weighted Average Carbon Intensity % Coverage

as of 21-Mar-2024

99.12

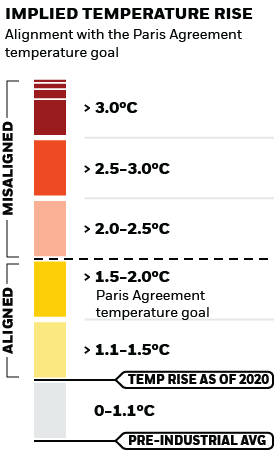

MSCI Implied Temperature Rise (0-3.0+ °C)

as of 21-Mar-2024

> 2.5° - 3.0° C

MSCI Implied Temperature Rise % Coverage

as of 21-Mar-2024

94.52

All data is from MSCI ESG Fund Ratings as of 21-Mar-2024, based on holdings as of 29-Feb-2024. As such, the fund’s sustainable characteristics may differ from MSCI ESG Fund Ratings from time to time.

To be included in MSCI ESG Fund Ratings, 65% (or 50% for bond funds and money market funds) of the fund’s gross weight must come from securities with ESG coverage by MSCI ESG Research (certain cash positions and other asset types deemed not relevant for ESG analysis by MSCI are removed prior to calculating a fund’s gross weight; the absolute values of short positions are included but treated as uncovered), the fund’s holdings date must be less than one year old, and the fund must have at least ten securities.

Business Involvement

Business Involvement

Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments.

Business Involvement metrics are not indicative of a fund’s investment objective, and, unless otherwise stated in fund documentation and included within a fund’s investment objective, do not change a fund’s investment objective or constrain the fund’s investable universe, and there is no indication that an ESG or Impact focused investment strategy or exclusionary screens will be adopted by a fund. For more information regarding a fund's investment strategy, please see the fund's prospectus.

Review the MSCI methodology behind the Business Involvement metrics, using links below.

MSCI - Controversial Weapons

as of 18-Apr-2024

0.00%

MSCI - UN Global Compact Violators

as of 18-Apr-2024

0.00%

MSCI - Nuclear Weapons

as of 18-Apr-2024

0.00%

MSCI - Thermal Coal

as of 18-Apr-2024

0.00%

MSCI - Civilian Firearms

as of 18-Apr-2024

0.00%

MSCI - Oil Sands

as of 18-Apr-2024

0.00%

MSCI - Tobacco

as of 18-Apr-2024

0.00%

Business Involvement Coverage

as of 18-Apr-2024

51.16%

Percentage of Fund not covered

as of 18-Apr-2024

48.84%

BlackRock business involvement exposures as shown above for Thermal Coal and Oil Sands are calculated and reported for companies that generate more than 5% of revenue from thermal coal or oil sands as defined by MSCI ESG Research. For the exposure to companies that generate any revenue from thermal coal or oil sands (at a 0% revenue threshold), as defined by MSCI ESG Research, it is as follows: Thermal Coal 0.00% and for Oil Sands 0.00%.

Business Involvement metrics are calculated by BlackRock using data from MSCI ESG Research which provides a profile of each company’s specific business involvement. BlackRock leverages this data to provide a summed up view across holdings and translates it to a fund's market value exposure to the listed Business Involvement areas above.

Business Involvement metrics are designed only to identify companies where MSCI has conducted research and identified as having involvement in the covered activity. As a result, it is possible there is additional involvement in these covered activities where MSCI does not have coverage. This information should not be used to produce comprehensive lists of companies without involvement. Business Involvement metrics are only displayed if at least 1% of the fund’s gross weight includes securities covered by MSCI ESG Research.

Ratings

Registered Locations

Registered Locations

-

Austria

-

Belgium

-

Denmark

-

Finland

-

France

-

Germany

-

Ireland

-

Italy

-

Luxembourg

-

Netherlands

-

Norway

-

Spain

-

Sweden

-

Switzerland

-

United Kingdom

Holdings

Holdings

as of 18-Apr-2024

| Issuer | Weight (%) |

|---|---|

| CCO HOLDINGS LLC | 3.02 |

| TRANSDIGM INC | 1.99 |

| TENET HEALTHCARE CORPORATION | 1.69 |

| CSC HOLDINGS LLC | 1.61 |

| CHS/COMMUNITY HEALTH SYSTEMS INC | 1.32 |

| Issuer | Weight (%) |

|---|---|

| BAUSCH HEALTH COMPANIES INC | 1.06 |

| SIRIUS XM RADIO INC | 1.06 |

| ROYAL CARIBBEAN CRUISES LTD | 1.05 |

| IRON MOUNTAIN INC | 0.95 |

| FRONTIER COMMUNICATIONS HOLDINGS LLC | 0.95 |

| Issuer Ticker | Name | Sector | Asset Class | Market Value | Weight (%) | Notional Value | Nominal | Par Value | ISIN | Price | Location | Exchange | Duration | Maturity | Coupon (%) | Market Currency | Effective Date |

|---|

Detailed Holdings and Analytics contains detailed portfolio holdings information and select analytics.

Exposure Breakdowns

Securities Lending

Securities Lending

Securities lending is an established and well regulated activity in the investment management industry. It involves the transfer of securities (such as shares or bonds) from a Lender (in this case, the iShares fund) to a third-party (the Borrower). The Borrower will give the Lender collateral (the Borrower’s pledge) in the form of shares, bonds or cash, and will also pay the Lender a fee. This fee provides additional income for the fund and thus can help to reduce the total cost of ownership of an ETF.

At BlackRock, securities lending is a core investment management function with dedicated trading, research and technology capabilities. The lending programme is designed to deliver superior absolute returns to clients, whilst maintaining a low risk profile. Funds participating in securities lending retain 62.5% of the income, while BlackRock receives 37.5% of the income and covers all the operational costs resulting from securities lending transactions.

| From 31-Dec-2018 To 31-Dec-2019 |

From 31-Dec-2019 To 31-Dec-2020 |

From 31-Dec-2020 To 31-Dec-2021 |

From 31-Dec-2021 To 31-Dec-2022 |

From 31-Dec-2022 To 31-Dec-2023 |

|

|---|---|---|---|---|---|

| Securities Lending Return (%) | 0.02 | ||||

| Average on-loan (% of AUM) | 1.70 | ||||

| Maximum on-loan (% of AUM) | 3.95 | ||||

| Collateralisation (% of Loan) | 107.04 |

The above table summarises the lending data available for the fund.

The information in the Lending Summary table will not be displayed for the funds that have participated in securities lending for less than 12 months. The figures shown relate to past performance. Past performance is not a reliable indication of current or future results.

BlackRock’s policy is to disclose performance information quarterly subject to a one-month delay. This means that returns from 01/01/2019 to 31/12/2019 can be publicly disclosed from 01/02/2020.

Maximum on-loan figure may increase or decrease over time.

With securities lending there is a risk of loss should the borrower default before the securities are returned, and due to market movements, the value of collateral held has fallen and/or the value of the securities on loan has risen.

The information in the Lending Summary table will not be displayed for the funds that have participated in securities lending for less than 12 months. The figures shown relate to past performance. Past performance is not a reliable indication of current or future results.

BlackRock’s policy is to disclose performance information quarterly subject to a one-month delay. This means that returns from 01/01/2019 to 31/12/2019 can be publicly disclosed from 01/02/2020.

Maximum on-loan figure may increase or decrease over time.

With securities lending there is a risk of loss should the borrower default before the securities are returned, and due to market movements, the value of collateral held has fallen and/or the value of the securities on loan has risen.

as of 18-Apr-2024

| Ticker | Name | Asset Class | Weight % | ISIN | SEDOL | Exchange | Location |

|---|

Collateral Holdings shown on this page are provided on days where the fund participating in securities lending had an open loan.

The information in the Collateral Holdings table relates to securities obtained in the collateral basket under the securities lending programme for the fund in question. The information contained in this material is derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, is not necessarily all inclusive and is not guaranteed as to accuracy. Reliance upon information in this material is at the sole discretion of the reader. The primary risk in securities lending is that a borrower will default on their commitment to return lent securities while the value of the liquidated collateral does not exceed the cost of repurchasing the securities and the fund suffers a loss in respect of the short-fall.

The information in the Collateral Holdings table relates to securities obtained in the collateral basket under the securities lending programme for the fund in question. The information contained in this material is derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, is not necessarily all inclusive and is not guaranteed as to accuracy. Reliance upon information in this material is at the sole discretion of the reader. The primary risk in securities lending is that a borrower will default on their commitment to return lent securities while the value of the liquidated collateral does not exceed the cost of repurchasing the securities and the fund suffers a loss in respect of the short-fall.

The below table shows the Loan/Collateral Combinations and Collateral Levels for our European Lending funds.

| Collateral Types | ||||

|---|---|---|---|---|

| Loan Type | Equities | Government, Supranational and Agency Bonds | Cash (Not for Reinvestment) | |

| Equities | 105%-112% | 105%-106% | 105%-108% | |

| Government Bonds | 110%-112% | 102.5%-106% | 102.5%-105% | |

| Corporate Bonds | 110%-112% | 104%-106% | 103.5%-105% | |

We also accept selected physically replicating Equity, Government Bond, Credit and Commodity ETFs as collateral.

Collateral parameters depend on the collateral and the loan combination, and the over collateralisation level may range from 102.5% to 112%. In this context, “Over Collateralisation” means that the aggregate market value of collateral

taken will exceed the overall on-loan value. Collateral parameters are reviewed on an ongoing bases and are subject to change.

With securities lending there is a risk of loss should the borrower default before the securities are returned, and due to market movements, the value of collateral held has fallen and/or the value of the securities on loan has risen.

Listings

Listings

| Exchange | Ticker | Currency | Listing Date | SEDOL | Bloomberg Ticker | RIC |

|---|---|---|---|---|---|---|

| Euronext Amsterdam | DHYD | USD | 22-Nov-2019 | BK6NCY0 | DHYD NA | DHYD.AS |